Australia IoT Security Market Size, Share, Trends and Forecast by Component, Security Type, Vertical, and Region, 2025-2033

Australia IoT Security Market Overview:

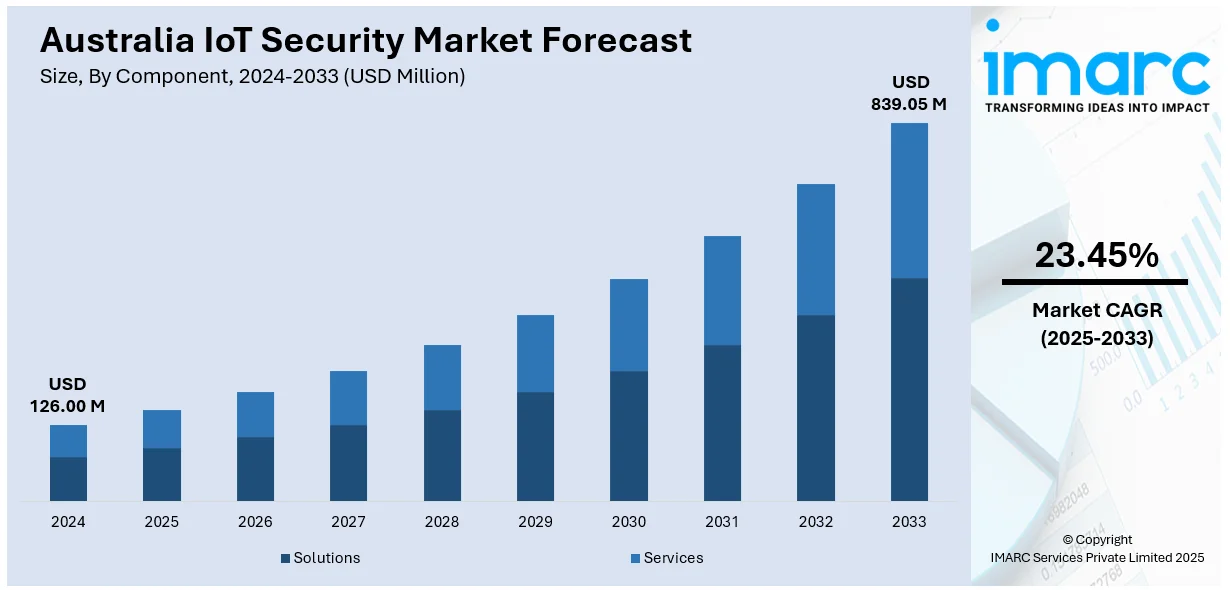

The Australia IoT security market size reached USD 126.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 839.05 Million by 2033, exhibiting a growth rate (CAGR) of 23.45% during 2025-2033. The increasing frequency of cyber threats targeting the Internet of Things (IoT) devices, government enforcement through frameworks, and the digitalization of the healthcare sector are supporting the market growth. Additionally, deployment of smart infrastructure by city councils, rollout of fifth generation (5G) networks, and increasing the demand for robust IoT security solutions are other growth-inducing factors. Furthermore, the use of Artificial Intelligence (AI) for threat detection, adoption of zero-trust architecture in enterprises, and growing requirements for device interoperability are also contributing to Australia IoT security market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 126.00 Million |

| Market Forecast in 2033 | USD 839.05 Million |

| Market Growth Rate 2025-2033 | 23.45% |

Australia IoT Security Market Trends:

Rising Frequency of IoT-Targeted Cyberattacks

The growing number of cyberattacks aimed at IoT devices is driving the Australia IoT security market growth. As more businesses and households adopt connected technologies, the risk of data breaches and system interference has increased. IoT devices, especially older or low-cost models, lack built-in security features, making them easy targets for attackers. Once compromised, these devices can be used to access broader networks or collect sensitive information without detection. This is a serious concern in sectors like healthcare and energy, where any disruption could have major consequences. Organizations are beginning to realize that traditional cybersecurity tools are not enough to protect IoT environments, which has surged the demand for solutions that offer real-time monitoring, secure communication, and regular software updates, further propelling the market growth. According to a report by Zayo Group, Distributed Denial of Service (DDoS) attacks in Australia surged by 82% from 2023 to 2024, increasing from 90,000 to over 165,000 incidents. This escalation is attributed to cybercriminals leveraging artificial intelligence and the proliferation of IoT devices to execute faster, more persistent, and sophisticated attacks. The financial impact is substantial, with each incident costing businesses nearly USD 234,000 on average.

To get more information on this market, Request Sample

Government Cybersecurity Regulations and Mandates

Australian government regulations are playing a critical role in shaping the IoT security market. Laws, such as the Security of Critical Infrastructure Act and other cybersecurity guidelines, are placing clear responsibilities on companies that use connected technologies. These rules are especially important for sectors like utilities, transportation, and communication, where system failures can have wide-reaching effects. Additionally, the government is focusing on data privacy, pushing organizations to tighten security around devices that gather user data. Businesses now need to show compliance by conducting audits, adopting certified tools, and maintaining up-to-date security systems. Moreover, vendors are adjusting their offerings to meet local compliance needs, which is opening up the market for specialized services.

Smart Infrastructure Investments by State and City Agencies

Australia’s push toward smart infrastructure is creating steady demand for IoT security. State and local governments are using connected systems to improve city services, ranging from public transport to waste management. These projects rely on IoT sensors and devices that gather large volumes of real-time data. While these upgrades improve efficiency, they also increase the potential entry points for cyberattacks. If one part of the system is compromised, it can affect services across the board. To avoid these risks, public agencies are placing greater focus on security during the design and rollout of smart infrastructure. They are setting clear security benchmarks in tenders and working closely with tech providers to ensure compliance. There’s also a shift toward unified platforms that allow secure management of various smart functions from a central point.

Australia IoT Security Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, security type, and vertical.

Component Insights:

- Solutions

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions and services.

Security Type Insights:

- Network Security

- Endpoint Security

- Application Security

- Cloud Security

- Others

A detailed breakup and analysis of the market based on the security type have also been provided in the report. This includes network security, endpoint security, application security, cloud security, and others.

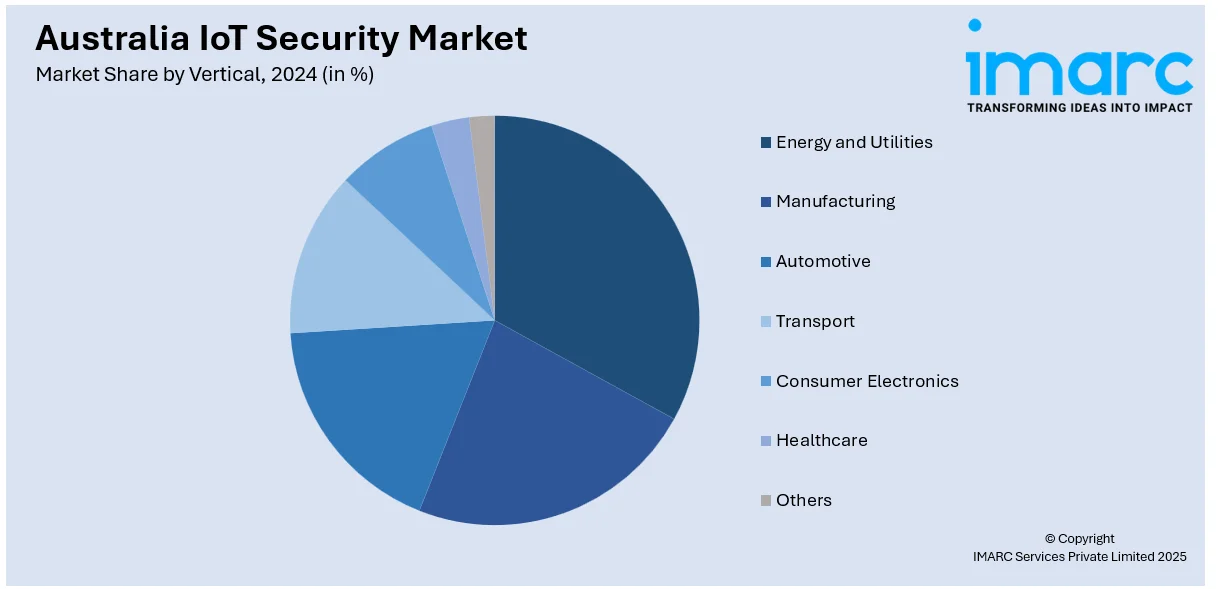

Vertical Insights:

- Energy and Utilities

- Manufacturing

- Automotive

- Transport

- Consumer Electronics

- Healthcare

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes energy and utilities, manufacturing, automotive, transport, consumer electronics, healthcare, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia IoT Security Market News:

- In 2025, Australia introduced the Cyber Security (Security Standards for Smart Devices) Rules 2025, mandating security requirements for smart devices sold domestically. The standards, effective from March 2026, prohibit default passwords and require vulnerability reporting programs.

- In 2024, Adelaide-based Myriota secured a USD 50 million investment to scale its satellite-based IoT platform, which enables secure, low-power communication between remote sensors and nanosatellites. This innovation supports real-time data collection in hard-to-reach areas, benefiting sectors like agriculture, defense, mining, and logistics by enhancing asset monitoring, environmental tracking, and critical infrastructure management.

Australia IoT Security Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solutions, Services |

| Security Types Covered | Network Security, Endpoint Security, Application Security, Cloud Security, Others |

| Verticals Covered | Energy and Utilities, Manufacturing, Automotive, Transport, Consumer Electronics, Healthcare, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia IoT security market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia IoT security market on the basis of component?

- What is the breakup of the Australia IoT security market on the basis of security type?

- What is the breakup of the Australia IoT security market on the basis of vertical?

- What is the breakup of the Australia IoT security market on the basis of region?

- What are the various stages in the value chain of the Australia IoT security market?

- What are the key driving factors and challenges in the Australia IoT security market?

- What is the structure of the Australia IoT security market and who are the key players?

- What is the degree of competition in the Australia IoT security market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia IoT security market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia IoT security market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia IoT security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)