Australia IT Services Market Report by Service Type (Professional Services (System Integration and Consulting), Managed Services), Enterprise Size (Small and Medium-sized Enterprises, Large Enterprises), Deployment Mode (On-premises, Cloud-based), End Use Industry (BFSI, Telecommunication, Healthcare, Retail, Manufacturing, Government, and Others), and Region 2026-2034

Australia IT Services Market Overview:

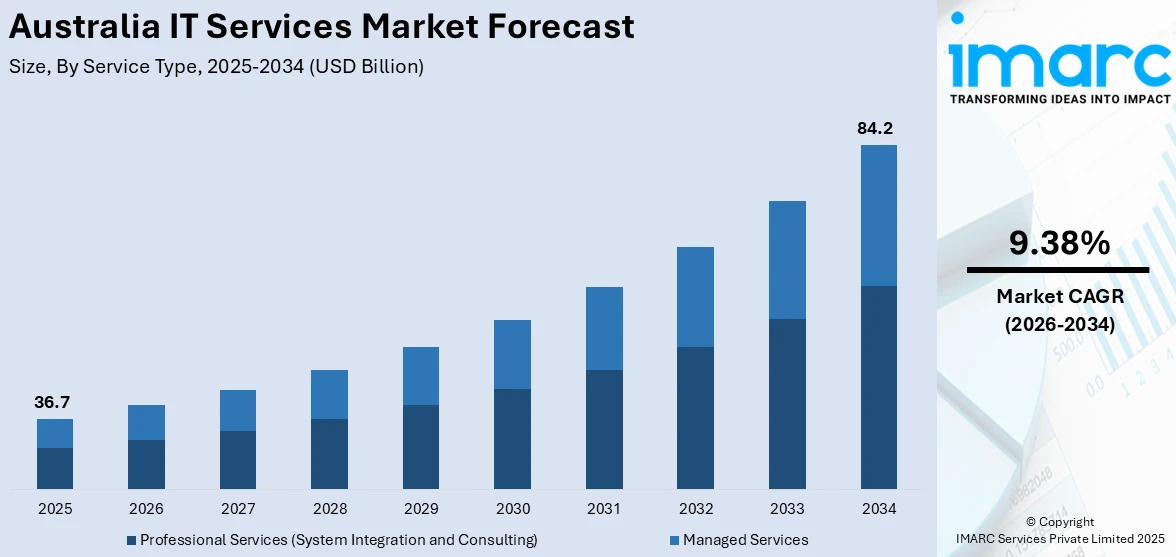

The Australia IT services market size reached USD 36.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 84.2 Billion by 2034, exhibiting a growth rate (CAGR) of 9.38% during 2026-2034. The increasing digital transformation initiatives, growing adoption of cloud computing, surging demand for cybersecurity solutions, expansion of data analytics capabilities, rising focus on information technology (IT) outsourcing, and the rapid proliferation of artificial intelligence (AI) and machine learning (ML) technologies across industries are some of the key factors strengthening the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 36.7 Billion |

| Market Forecast in 2034 | USD 84.2 Billion |

| Market Growth Rate 2026-2034 | 9.38% |

Australia IT Services Market Trends:

Cloud migration and adoption have become central to IT strategies

An increasing number of Australian companies are moving their applications and infrastructure to cloud platforms, especially those in the mid-market and enterprise segments. The need for scalable, adaptable, and affordable solutions that improve competitiveness is driving this migration. Leading cloud service providers like AWS, Microsoft Azure, and Google Cloud have made significant investments in Australian data centers, creating a strong local cloud ecosystem. Additionally, the adoption of hybrid cloud models combining public and private cloud environments has gained traction as companies prioritize balancing data security with operational agility. As companies increasingly leverage cloud technology to optimize resources, boost efficiency, and ensure security, this trend is fueling market growth in the rapidly evolving digital landscape.

To get more information on this market Request Sample

Cybersecurity and data protection are increasingly critical considerations

The rise in high-profile data breaches and cyberattacks alongside digital transformation are necessitating for strong cybersecurity frameworks. Regulatory initiatives, such as the Notifiable Data Breaches (NDB) scheme and the Australian Cyber Security Centre’s guidelines are prompting organizations to invest in advanced cybersecurity services. This is creating a surging demand for managed security services (MSS), identity and access management (IAM) solutions, and threat detection technologies. Moreover, businesses are increasingly outsourcing their cybersecurity needs to specialized IT service providers, which is further providing an impetus to the market growth.

The rise of artificial intelligence (AI) and automation is reshaping the IT services landscape

Australian enterprises are increasingly leveraging AI technologies to enhance operational efficiency, streamline processes, and improve customer experiences. AI is being integrated into various sectors, such as healthcare, finance, and retail, for tasks like predictive analytics, customer service chatbots, and robotic process automation (RPA). IT service providers are responding by offering tailored AI-driven solutions to meet the specific needs of different industries. Furthermore, the increasing adoption of machine learning (ML) and data analytics services as businesses seek to unlock insights from vast amounts of data is supporting market growth. As AI and automation technologies continue to advance, their adoption is anticipated to expand significantly. This growth will drive increased demand for IT services that facilitate AI integration, maintenance, and innovation, thereby aiding in market expansion.

Australia IT Services Market News:

- In July 2024, Data#3 inaugurated a new state-of-the-art Security Operations Centre (SOC) at its Brisbane headquarters, powered by global cybersecurity provider SecurityHQ. This advanced SOC aims to enhance data protection and sovereignty, addressing the growing cybersecurity needs of businesses.

- In May 2024, Tech Data, a TD SYNNEX Company, launched Tech Data Capital in Singapore, Australia, and India, extending flexible financing solutions to partners and end-customers. This expansion follows successful launches in North America and Europe, aiming to support the IT channel ecosystem with enhanced payment options.

Australia IT Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on service type, enterprise size, deployment mode, and end use industry.

Service Type Insights:

- Professional Services (System Integration and Consulting)

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the service type. This includes professional services (system integration and consulting) and managed services.

Enterprise Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes small and medium-sized enterprises and large enterprises.

Deployment Mode Insights:

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

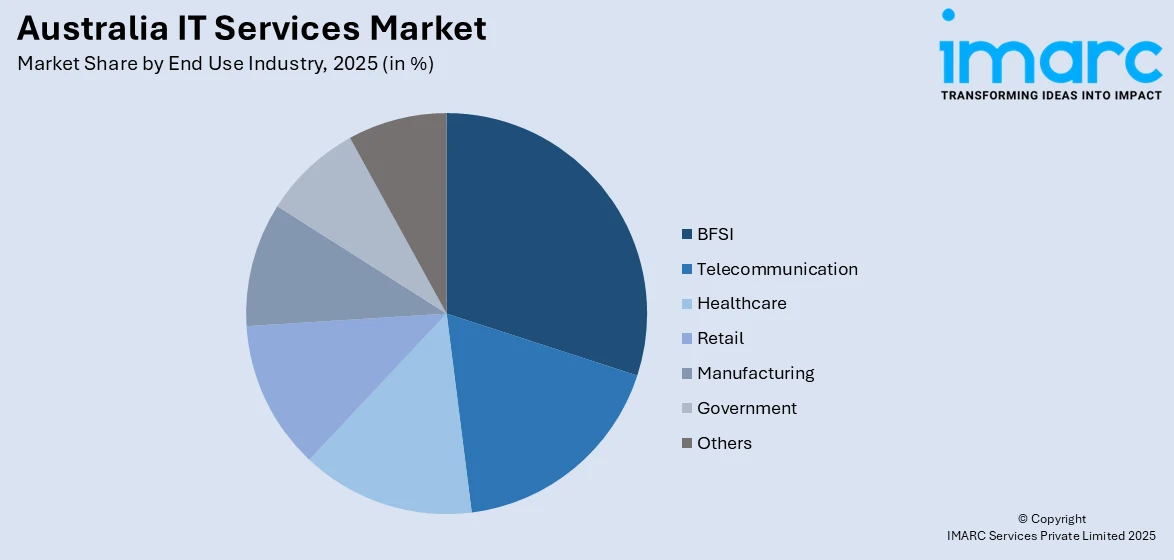

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- Telecommunication

- Healthcare

- Retail

- Manufacturing

- Government

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes BFSI, telecommunication, healthcare, retail, manufacturing, government, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia IT Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Professional Services (System Integration, Consulting), Managed Services |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Deployment Modes Covered | On-premises, Cloud-based |

| End Use Industries Covered | BFSI, Telecommunication, Healthcare, Retail, Manufacturing, Government, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia IT services market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia IT services market on the basis of service type?

- What is the breakup of the Australia IT services market on the basis of enterprise size?

- What is the breakup of the Australia IT services market on the basis of deployment mode?

- What is the breakup of the Australia IT services market on the basis of end use industry?

- What are the various stages in the value chain of the Australia IT services market?

- What are the key driving factors and challenges in the Australia IT services?

- What is the structure of the Australia IT services market and who are the key players?

- What is the degree of competition in the Australia IT services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia IT services market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia IT services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia IT services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)