Australia Kombucha Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2025-2033

Australia Kombucha Market Overview:

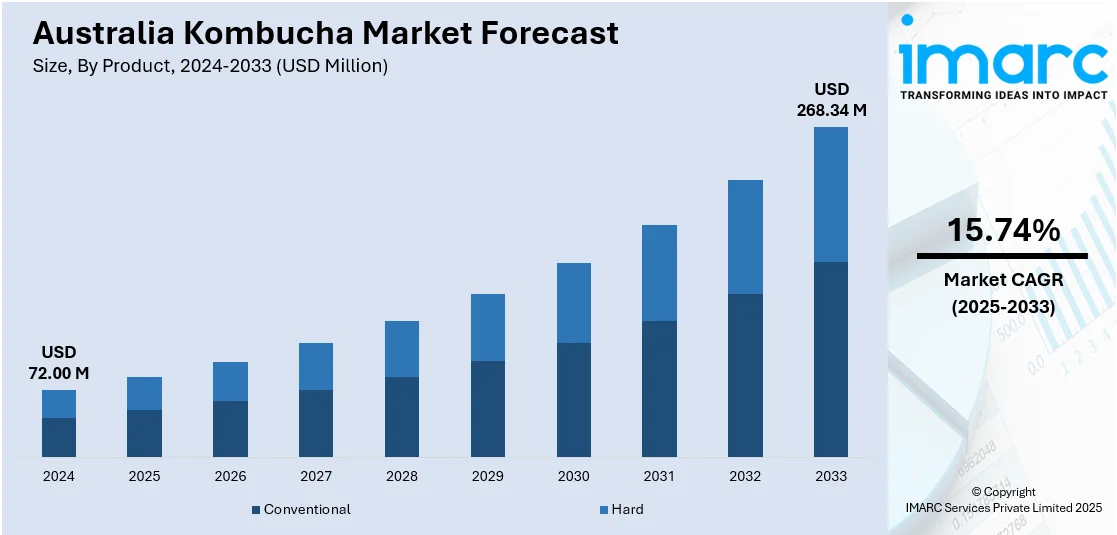

The Australia kombucha market size reached USD 72.00 Million in 2024. Looking forward, the market is expected to reach USD 268.34 Million by 2033, exhibiting a growth rate (CAGR) of 15.74% during 2025-2033. The market is experiencing significant growth as consumers increasingly shift toward health-conscious beverages. The rising demand for natural, low-sugar, and probiotic-rich drinks is also driving growth, particularly among millennials and health-conscious individuals. Kombucha’s popularity in cafes, supermarkets, and health food stores is on the rise, and this increase, along with new flavors and formulations entering the market, is intensifying competition and contributing to the growing Australia kombucha market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 72.00 Million |

| Market Forecast in 2033 | USD 268.34 Million |

| Market Growth Rate 2025-2033 | 15.74% |

Key Trends of Australia Kombucha Market:

Expansion of Flavor Varieties

The Australian kombucha market is experiencing significant growth in flavor range, as companies work to attract a diverse range of consumer tastes. Classic kombucha flavors such as ginger and lemon are being supplemented by more unusual offerings such as turmeric, hibiscus, and berry combinations. These new flavors are elevating the flavor experience while also responding to increasing consumer demand for functional beverages with extra health value. Turmeric-flavored kombuchas, for instance, are for those who want anti-inflammatory benefits, while berry flavors are for consumers searching for fresher, fruitier options. As the market becomes increasingly competitive, flavor variety assists brands in differentiating and appealing to a larger customer base, from newcomers to kombucha to those who seek more than the traditional taste. For instance, in August 2024, Remedy Drinks unveiled a new kombucha flavor, Strawberries & Cream, in collaboration with chef Ben Shewry of Attica. This limited release offers the sweetness of ripe strawberries and vanilla cream. This trend contributes to the overall growth and popularity of kombucha in Australia, particularly among younger, adventurous drinkers.

To get more information on this market, Request Sample

Celebrity Endorsements and Influencer Promotions

Celebrity endorsements and influencer promotions are playing a crucial role in raising awareness and driving popularity for kombucha among younger demographics in Australia. For instance, in July 2023, Australian cricket captain Pat Cummins joined sugar-free kombucha brand Nexba as an ambassador and shareholder. The multi-year partnership aims to promote healthier beverage alternatives and support the expansion of Goodness Group Global. Cummins emphasizes the importance of health and wellness, aligning with the brand's mission to reduce sugar and artificial ingredients. Social media influencers and celebrities with large followings are increasingly promoting kombucha as a health-conscious, trendy beverage. These influencers showcase kombucha’s benefits, such as its probiotic properties and digestive health support, and highlight its alignment with a wellness-focused lifestyle. By featuring kombucha in their daily routines, they make it more relatable and aspirational for their audience, particularly millennials and Gen Z. As these endorsements grow, more consumers are discovering kombucha and viewing it as an alternative to sugary soft drinks or energy beverages. This trend is contributing significantly to the overall Australia kombucha market growth, as it helps increase brand visibility, attract new customers, and shift purchasing habits toward healthier beverage options.

Growth Drivers of Australia Kombucha Market:

Health-Driven Consumer Demand and Functional Interest

One of the significant drivers accelerating the growth of Australia's kombucha market arises from an intense and accelerating consumer focus on wellness and functional nutrition. Australian consumers are becoming more focused on foods and beverages that promote digestive health, strengthen immunity, and resonate with holistic wellness philosophies that prevail in the country. Kombucha's natural probiotic nature, based on fermented production, is appealing to the Australian desire for wellness-enhancing products, particularly among urban health enthusiasts and lifestyle-driven consumers. This attractiveness is also increased through the knowledge of kombucha as a healthier replacement for sweetened beverages and liquor, further solidifying its reputation as a refined but healthy option. Several local kombucha breweries focus on clean-label features like prioritizing low processing and natural ingredients, to appeal to a clientele interested in transparency and integrity in product development. This trend lies firmly within the region’s shifting food culture, which increasingly prizes what can be characterized as an understated synergy between taste, functionality, and well-being, and further supports the Australia kombucha market demand.

Innovation, Product Variety, and Local Brand Leadership

Another strong growth driver in the Australian kombucha market is the dynamic innovation both in product forms and consumer experience. Indigenous brands are regularly introducing complex flavors that leverage Australia's bountiful botanical history. There is also packaging innovation, with innovative containers designed for premium appeal and alternate shelf visibility. In addition, Australia has emerged as a key hub for the development of "hard kombucha," an alternative in the form of low-alcohol functionality that aligns with both the craft beverage trend and changing drinking behaviors among younger generations. Local businesses and fermentation artists are piloting brewing methods and formats that are pushing kombucha's presence beyond conventional areas of health-oriented spaces into hip bars, wellness cafes, and craft beverage events. By such experimentation, kombucha is moving beyond its health-focused beginnings to become a lifestyle drink that is innovative and profoundly entrenched in Australia's native flavors and food culture that is oriented globally.

Regulation, Accessibility, and Market Ecosystem Support

According to the Australia kombucha market analysis, concerns the changing frameworks and distribution channels are placing quality kombucha within easier reach and greater trust. Australian regulatory agencies and food safety organizations increasingly create frameworks to benefit producers, particularly smaller and regional breweries, with open guidelines for labeling, alcohol levels, and fermentation methods. Such support infrastructure enhances consumer confidence and supports investment in product innovation. Concurrently, the multifaceted retail landscape of Australia, ranging from health food stores and boutique grocery stores to mass-market supermarkets and online shopping platforms, is broadening kombucha's reach and visibility. Consumers are able to explore and sample a broad range of brands and flavors, which reinforces their buying behaviors and generates repeat interaction. Furthermore, there is an emerging appetite among Australian producers for building collaborative networks, for instance, using regional agrifood ingredients or collaborating with fermentation research programs, to constantly enhance quality and consistency. Together, such regulatory clarity and matured retail system make kombucha seen and credible while also harmoniously becoming a part of the changing Australian beverage market ecosystem.

Australia Kombucha Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product and distribution channel.

Product Insights:

- Conventional

- Hard

The report has provided a detailed breakup and analysis of the market based on the product. This includes conventional and hard.

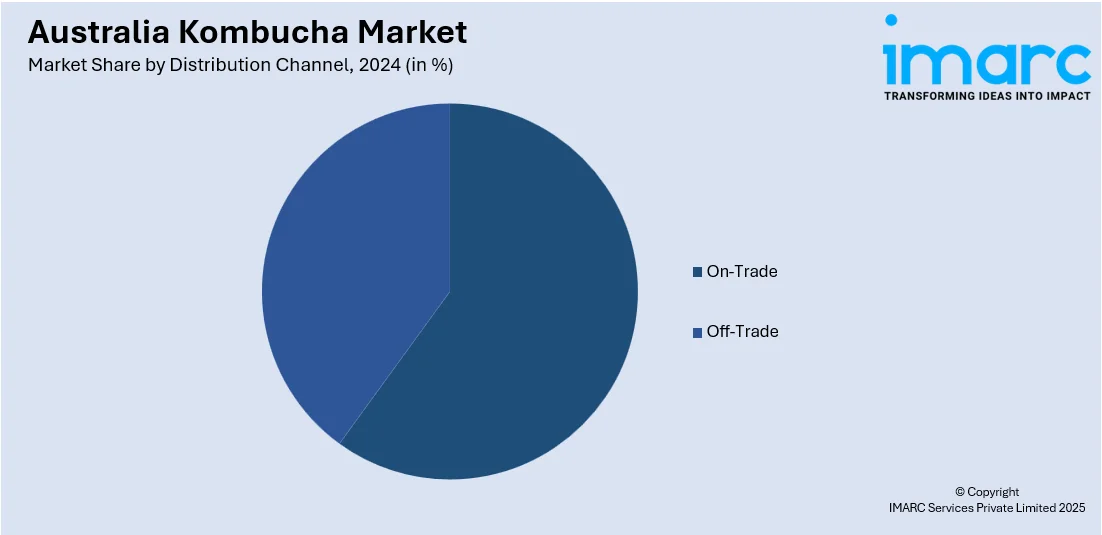

Distribution Channel Insights:

- On-Trade

- Off-Trade

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes on-trade and off-trade.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Buchi Kombucha

- JIVA Kombucha

- Kombucha Me Pty Ltd

- Live Kombucha Brewing Company

- Lo Bros Living Drinks

- SCULL kombucha

- Tea Gardens Kombucha

- The Good Brew Company

- Wicked Kombucha

Australia Kombucha Market News:

- In August, Goodness Group Global invited investors to support its expansion of Nexba, a functional drink brand known for its sugar-free products and kombucha. Following a successful crowdfunding round, they aim to raise AUD 2 million to support international growth and product innovation.

Australia Kombucha Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Conventional, Hard |

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Buchi Kombucha, JIVA Kombucha, Kombucha Me Pty Ltd, Live Kombucha Brewing Company, Lo Bros Living Drinks, SCULL kombucha, Tea Gardens Kombucha, The Good Brew Company, Wicked Kombucha, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia kombucha market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia kombucha market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia kombucha industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia kombucha market was valued at USD 72.00 Million in 2024.

The Australia kombucha market is projected to exhibit a CAGR of 15.74% during 2025-2033.

The Australia kombucha market is expected to reach a value of USD 268.34 Million by 2033.

The Australia kombucha market trends include growing demand for functional health drinks, innovative native ingredient blends, and the emergence of hard kombucha. Consumers seek low-sugar, gut-friendly alternatives, while local brands emphasize sustainability and clean labels. Distribution is also expanding through supermarkets, cafes, and online channels, supporting broader market penetration and lifestyle integration.

The Australia kombucha market is driven by rising health consciousness, demand for functional beverages, and a shift away from sugary drinks. Local innovation, including native ingredients and low-alcohol options, fuels interest. Supportive regulation and broad retail availability further enhance accessibility, making kombucha a mainstream wellness choice across diverse consumer segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)