Australia Leak Detection Market Size, Share, Trends and Forecast by Technology, End User, and Region, 2025-2033

Australia Leak Detection Market Overview:

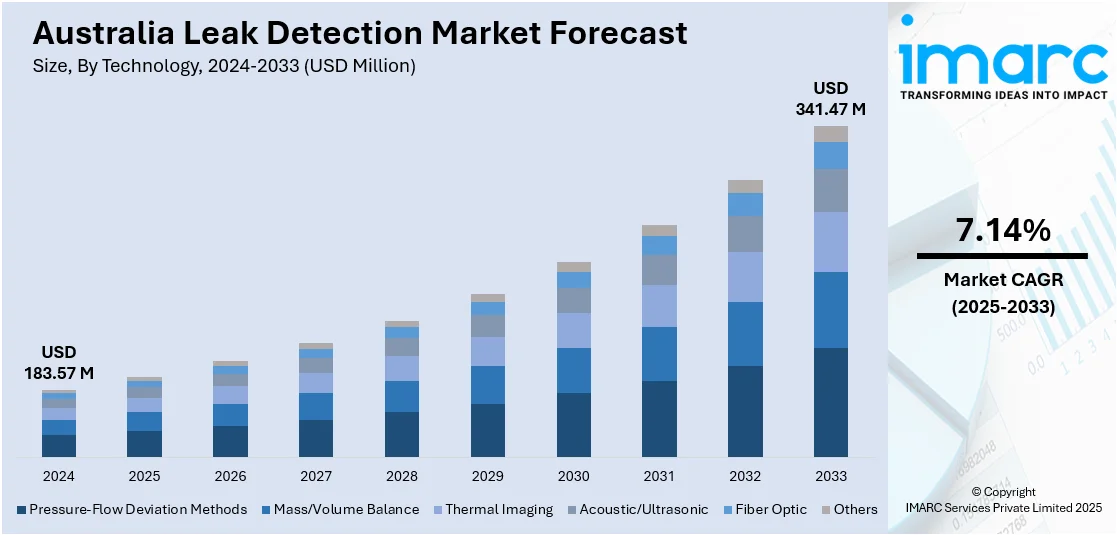

The Australia leak detection market size reached USD 183.57 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 341.47 Million by 2033, exhibiting a growth rate (CAGR) of 7.14% during 2025-2033. The market is driven by the shift toward advanced technologies, such as IoT-enabled sensors and AI-powered analytics, enhancing real-time leak detection and operational efficiency. Stringent environmental regulations and water conservation initiatives are compelling industries to adopt automated, non-invasive solutions. Additionally, rising demand for sustainable methods, aligns with Australia’s decarbonization goals, further augmenting the Australia leak detection market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 183.57 Million |

| Market Forecast in 2033 | USD 341.47 Million |

| Market Growth Rate 2025-2033 | 7.14% |

Australia Leak Detection Market Trends:

Increasing Adoption of Advanced Leak Detection Technologies

The industry is gradually moving towards more sophisticated technologies and solutions due to their speed and efficiency. Traditional methods, including basic pressure testing and visual inspection, are being surpassed by intelligent leak detection solutions that utilize IoT sensors, AI, and acoustic monitoring. They support the identification of leaks in real time and enable the minimization of water loss and damage to infrastructure. There are strong government initiatives towards water conservation, such as the National Water Initiative, which are also helping to bring about this change. The Australian government's measures to encourage water conservation are geared towards reducing water waste, with programs such as the Water Efficiency program targeting a savings of 38 GL by 2030. These measures will encompass active leak detection, customer interaction, and the application of innovative technologies, such as smart meters, to encourage ongoing efficiency improvements. In addition, combined initiative with DCCEEW and more research into water-wise habits are expected to enhance the long-term water management plan. Additionally, industries such as oil and gas, mining, and utilities are investing in automated leak detection to comply with stringent environmental regulations. The growing demand for non-invasive and predictive maintenance solutions is also fueling Australia leak detection market growth. As a result, companies offering AI-driven and cloud-based leak detection systems are gaining traction, positioning Australia as a leader in adopting innovative water management solutions.

To get more information on this market, Request Sample

Rising Demand for Sustainable and Eco-Friendly Leak Detection Solutions

Sustainability is becoming a key driver in the market, with businesses and consumers prioritizing eco-friendly solutions. Water scarcity concerns and stricter environmental policies are pushing industries to adopt leak detection systems that minimize resource wastage. Australia is facing a significant water shortage, with overall water use crossing 76,000 gigalitres, of which agriculture accounted for 68%. Climate change has exacerbated water availability problems, leading to reduced runoff, higher rates of evaporation, and severe droughts. In an effort to counter such challenges, government programs have been implemented, ranging from improved leak detection and water recycling to infrastructure improvements. Groundwater supplies, including the Great Artesian Basin, account for about 3,200 gigalitres annually. Advanced technologies, such as satellite-based leak detection and drone inspection, are gaining popularity for their efficiency and sustainability. Municipalities and water authorities are increasingly partnering with technology companies to create efficient, sustainable leak detection programs that reduce water loss within urban areas and further help reduce carbon emissions by using renewable energy-powered sensors, which are typically acceptable in Australia. Green technologies and the circular economy are fast becoming popular, in part because CSR, or corporate social responsibility, has become an integral part of decision-making processes for procurement in many industries. This is expected to continue as Australia is moving towards emphasizing sustainable infrastructure development.

Australia Leak Detection Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology and end user.

Technology Insights:

- Pressure-Flow Deviation Methods

- Mass/Volume Balance

- Thermal Imaging

- Acoustic/Ultrasonic

- Fiber Optic

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes pressure-flow deviation methods, mass/volume balance, thermal imaging, acoustic/ultrasonic, fiber optic, and others.

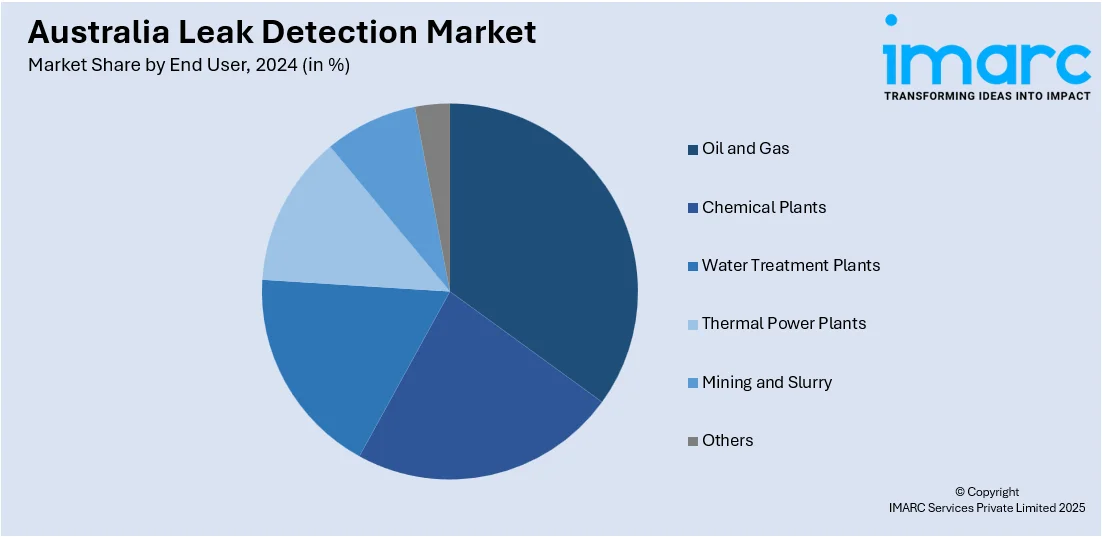

End User Insights:

- Oil and Gas

- Chemical Plants

- Water Treatment Plants

- Thermal Power Plants

- Mining and Slurry

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes oil and gas, chemical plants, water treatment plants, thermal power plants, mining and slurry, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Leak Detection Market News:

- November 25, 2024: Phyn collaborated with Iplex Pipelines Australia to provide innovative leak detection technology to the Western Australian (WA) Industry Response, offering residents a complimentary Phyn Plus leak detector with automatic shutoff. The AI-driven technology continually monitors plumbing by evaluating water pressure 240 times per second to detect leaks in real time. The scheme is designed to protect Western Australian homes against plumbing failures and water damage, thereby ensuring effective preventive leak management.

- October 15, 2024: Metis Engineering released its cutting-edge hydrogen leak detection sensor, the Cell Guard with Hydrogen, specifically designed for hydrogen storage and energy solutions. The sensor provides precise detection of hydrogen leaks from 0% to 20% H₂ and operates reliably over a wide temperature range of -40°C to +85°C. This innovative technology will enhance safety in Australia's growing hydrogen economy, delivering critical leak detection capabilities through low power consumption and fast measurements.

Australia Leak Detection Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Pressure-Flow Deviation Methods, Mass/Volume Balance, Thermal Imaging, Acoustic/Ultrasonic, Fiber Optic, Others |

| End Users Covered | Oil and Gas, Chemical Plants, Water Treatment Plants, Thermal Power Plants, Mining and Slurry, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia leak detection market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia leak detection market on the basis of technology?

- What is the breakup of the Australia leak detection market on the basis of end user?

- What is the breakup of the Australia leak detection market on the basis of region?

- What are the various stages in the value chain of the Australia leak detection market?

- What are the key driving factors and challenges in the Australia leak detection market?

- What is the structure of the Australia leak detection market and who are the key players?

- What is the degree of competition in the Australia leak detection market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia leak detection market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia leak detection market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia leak detection industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)