Australia Leather Chemicals Market Size, Share, Trends and Forecast by Product, Process, Application, and Region, 2025-2033

Australia Leather Chemicals Market Overview:

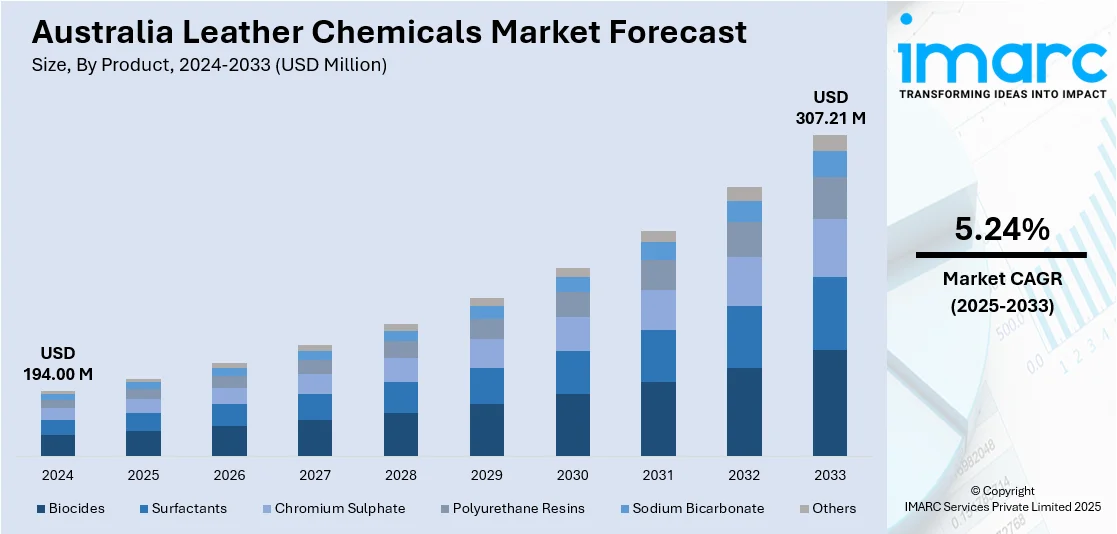

The Australia leather chemicals market size reached USD 194.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 307.21 Million by 2033, exhibiting a growth rate (CAGR) of 5.24% during 2025-2033. The market is driven by increasing leather production for footwear, automotive upholstery, and furniture, prompting higher demand for processing chemicals. Strict environmental regulations in Australia are pushing tanneries to adopt eco-friendly chemical alternatives, further influencing market dynamics. In addition to this, growth in exports of finished leather goods also supports chemical usage across tanning and finishing stages, which is significantly augmenting the Australia leather chemicals market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 194.00 Million |

| Market Forecast in 2033 | USD 307.21 Million |

| Market Growth Rate 2025-2033 | 5.24% |

Australia Leather Chemicals Market Trends:

Shift Towards Sustainable and Eco-Friendly Leather Processing

The market is experiencing a clear shift toward sustainability, driven by regulatory pressure and global consumer preferences. According to industry reports, over 90% of leather products are processed using chromium-based tanning agents, primarily basic chromium sulfate. Moreover, a research study analyzed 105 leather samples for chromium content and found high levels of total Cr (32–45,800 mg/kg) and CrVI (0.5–64.3 mg/kg), with 82% exceeding the EU CrVI limit of 3 mg/kg. These toxic solvents are phased out in favor of bio-based or less hazardous alternatives. Moreover, stringent government regulations such as the Industrial Chemicals Environmental Management Standard (IChEMS) are enforcing tighter controls on chemical use and disposal. As a result, manufacturers are investing in research to develop (R&D) activities for plant-based tanning agents, biodegradable degreasers, and low-impact dyes that comply with both domestic and international standards. This transition is not only regulatory-driven but also commercially motivated. Australian tanners and exporters aiming to access markets in Europe, North America, and parts of Asia must meet stringent environmental and safety certifications. Along with this, the adoption of sustainable chemicals can serve as a market differentiator and allow local producers to charge premium prices for their leather goods. This trend is encouraging chemical suppliers to realign their product portfolios and develop new application technologies tailored to eco-friendly processing without compromising performance, which is positively impacting the Australia leather chemicals market growth.

To get more information on this market, Request Sample

Increased Demand from Automotive and Upholstery Segments

The expansion of automotive and interior design industries in the country is increasing the demand for specialty leather chemicals, particularly for finishing and surface treatment. According to a recent survey, about 90,614 new vehicles were delivered across Australia in April 2025 alone, reflecting continued growth in the automotive sector. This growth directly supports increased consumption of leather treated with high-performance chemicals. Automotive manufacturers and aftermarket suppliers require leather with specific properties such as UV resistance, abrasion durability, and long-term color stability. As a result, chemical suppliers in Australia are responding by developing advanced formulations that enhance leather performance while also complying with evolving safety and environmental regulations. Similarly, in-home and commercial upholstery, leather must exhibit resistance to wear and staining, which leads to a higher requirement for protective topcoats and water-repellent treatments. Apart from this, the market also benefits from regional production of high-quality hides, especially bovine leather, which is preferred for car seats and furniture due to its strength and texture. Local processors rely on chemical technologies that enhance yield, uniformity, and finishing quality. As the furniture and automotive sectors grow through new builds and consumer refurbishments, chemical suppliers are expanding their offerings in high-performance additives and process aids that meet evolving technical and aesthetic standards.

Australia Leather Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, process, and application.

Product Insights:

- Biocides

- Surfactants

- Chromium Sulphate

- Polyurethane Resins

- Sodium Bicarbonate

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes biocides, surfactants, chromium sulphate, polyurethane resins, sodium bicarbonate, and others.

Process Insights:

- Tanning and Dyeing

- Beamhouse Chemicals

- Finishing Chemicals

A detailed breakup and analysis of the market based on the process have also been provided in the report. This includes tanning and dyeing, beamhouse chemicals, and finishing chemicals.

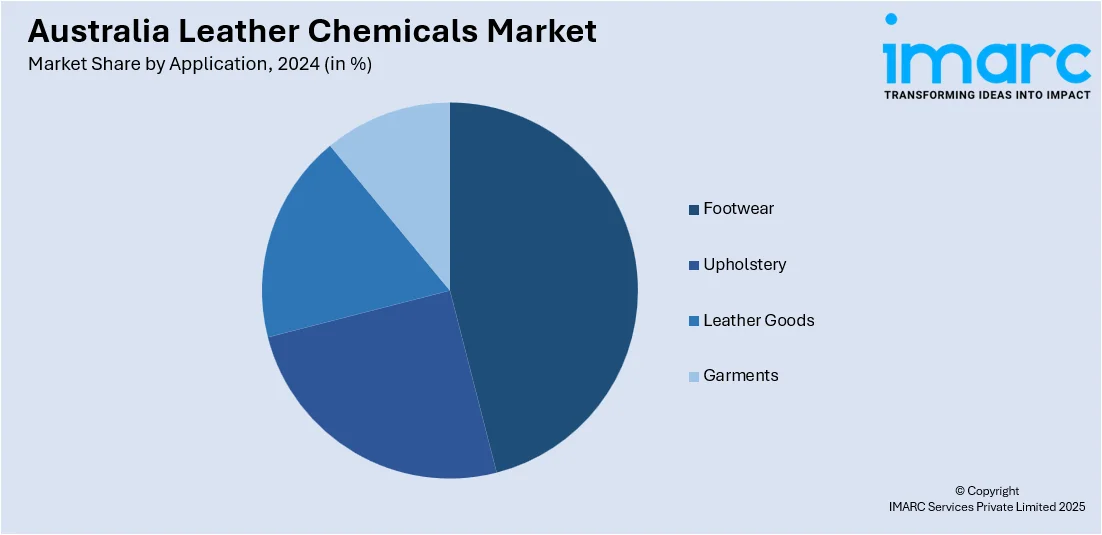

Application Insights:

- Footwear

- Upholstery

- Leather Goods

- Garments

The report has provided a detailed breakup and analysis of the market based on the application. This includes footwear, upholstery, leather goods, and garments.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Leather Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Biocides, Surfactants, Chromium Sulphate, Polyurethane Resins, Sodium Bicarbonate, Others |

| Processes Covered | Tanning and Dyeing, Beamhouse Chemicals, Finishing Chemicals |

| Applications Covered | Footwear, Upholstery, Leather Goods, Garments |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia leather chemicals market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia leather chemicals market on the basis of product?

- What is the breakup of the Australia leather chemicals market on the basis of process?

- What is the breakup of the Australia leather chemicals market on the basis of application?

- What is the breakup of the Australia leather chemicals market on the basis of region?

- What are the various stages in the value chain of the Australia leather chemicals market?

- What are the key driving factors and challenges in the Australia leather chemicals market?

- What is the structure of the Australia leather chemicals market and who are the key players?

- What is the degree of competition in the Australia leather chemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia leather chemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia leather chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia leather chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)