Australia LED Bulb Market Size, Share, Trends and Forecast by Application and Region, 2025-2033

Australia LED Bulb Market Overview:

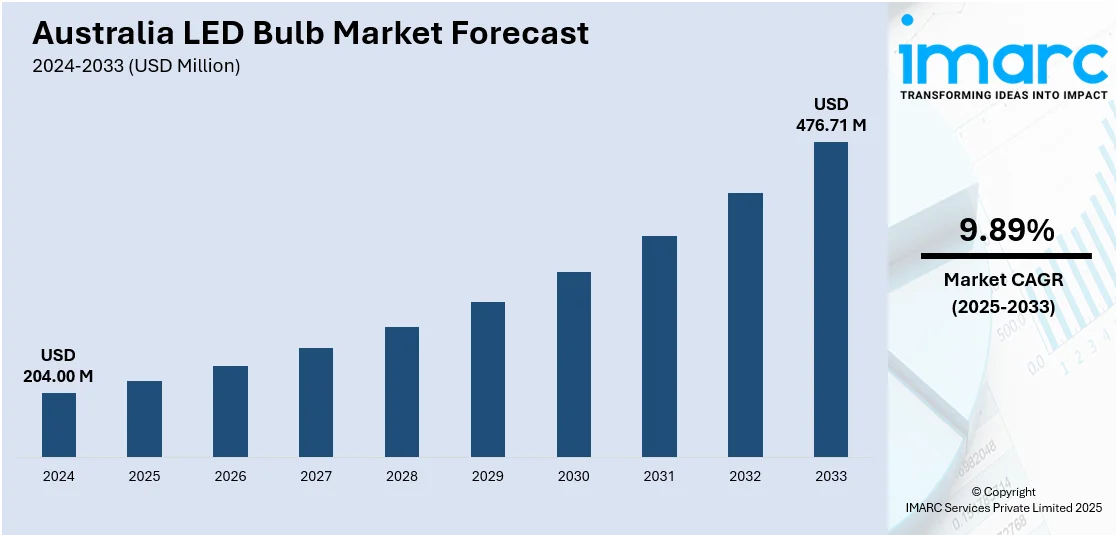

The Australia LED bulb market size reached USD 204.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 476.71 Million by 2033, exhibiting a growth rate (CAGR) of 9.89% during 2025-2033. The market is driven by regulatory mandates promoting energy-efficient lighting through building codes and national standards. Rising adoption of smart home devices and demand for automation-enabled bulbs support growth in the residential and commercial segments, thereby fueling the market. Industrial, mining, and agricultural applications are leveraging LED benefits for durability and energy savings, further augmenting the Australia LED bulb market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 204.00 Million |

| Market Forecast in 2033 | USD 476.71 Million |

| Market Growth Rate 2025-2033 | 9.89% |

Australia LED Bulb Market Trends:

Nationwide Energy Efficiency Regulations and Building Codes

Australia’s stringent energy efficiency policies have accelerated the adoption of LED lighting across residential, commercial, and public infrastructure sectors. The government’s Minimum Energy Performance Standards (MEPS) and phase-out of inefficient lighting products, such as incandescent and halogen bulbs, have made LEDs the default solution for compliance. These regulatory measures are reinforced by state-level building codes that mandate energy-efficient lighting in both new constructions and major renovations. Furthermore, the Nationwide House Energy Rating Scheme (NatHERS) and the National Construction Code (NCC) promote sustainable building practices, with lighting efficiency as a key metric. On July 22, 2024, the Australian Government announced updates to the Greenhouse and Energy Minimum Standards (GEMS) scheme to phase out inefficient halogen lamps in favor of LED alternatives. The reforms are projected to save households up to AUD 229 (USD 155) annually by switching 10 halogen lamps to LEDs, while nationwide savings from the GEMS Act have reached between AUD 12–18 Billion (USD 8.1–12.2 Billion) over the past decade. Public procurement policies now prioritize LED-based solutions in transport hubs, street lighting, and government buildings. In the commercial sector, energy performance certifications, such as NABERS and Green Star, drive businesses to retrofit traditional lighting with LEDs to meet emission benchmarks and reduce operating costs. Utility-led rebate programs and peak demand reduction incentives further encourage early replacement cycles. As LED bulbs offer significantly higher lumen-per-watt performance and reduced thermal output, their use is expanding in retail, education, and healthcare environments. With lighting efficiency being a central feature of Australia’s net-zero goals, these institutional mechanisms continue to fuel Australia LED bulb market growth as industry and consumers shift toward sustainable lighting alternatives.

To get more information on this market, Request Sample

Expanding Smart Lighting Ecosystem and Consumer Preferences

The proliferation of smart home technologies in Australia has elevated consumer demand for connected LED lighting systems that support automation, remote control, and energy monitoring. Households are increasingly adopting app-controlled LED bulbs with features such as dimming, color temperature adjustment, and integration with smart assistants like Google Home and Amazon Alexa. This preference aligns with broader trends in residential energy optimization and convenience-driven design. Additionally, commercial spaces are transitioning to smart LED lighting networks that use sensors and data analytics to reduce energy waste and enhance occupancy comfort. LED lights consume approximately 75% less energy in comparison to halogen bulbs and have a lifespan that is 5 to 10 times longer, substantially lowering both replacement expenses and landfill waste. Typically, the initial investment in LED lighting pays for itself in under one year. The convergence of LED technology with IoT platforms has led to modular, interoperable lighting systems that can be managed through centralized dashboards, particularly in office buildings, warehouses, and retail chains. This evolution supports Australia's ongoing digital transformation strategy across multiple sectors. Meanwhile, lighting designers and architects are emphasizing LED-based ambient and accent lighting for customized interiors, promoting LED usage in aesthetic and experiential applications. These integrated systems also contribute to energy reporting and ESG compliance for large enterprises. As affordability improves and smart device adoption broadens, demand for intelligent, user-configurable LED lighting continues to grow beyond traditional use cases.

Australia LED Bulb Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on application.

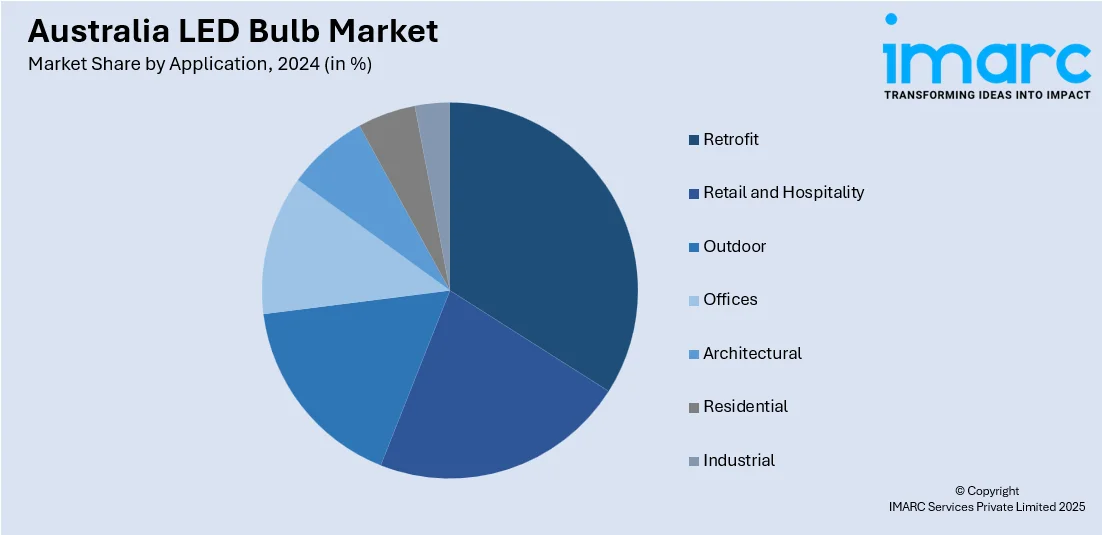

Application Insights:

- Retrofit

- Retail and Hospitality

- Outdoor

- Offices

- Architectural

- Residential

- Industrial

The report has provided a detailed breakup and analysis of the market based on the application. This includes retrofit, retail and hospitality, outdoor, offices, architectural, residential, and industrial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all major regional markets. This includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia LED Bulb Market News:

- On July 4, 2024, VAILO, a South Australia-based manufacturer, launched two new ultra-high-performance LED lighting products: Zenith Gen-V PC Amber and Zenith Gen-V Zero Tilt, that are designed to reduce light pollution and environmental impact. These advancements support biodiversity conservation and energy efficiency in community and professional sports venues across Australia.

Australia LED Bulb Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Retrofit, Retail and Hospitality, Outdoor, Offices, Architectural, Residential, Industrial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia LED bulb market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia LED bulb market on the basis of application?

- What is the breakup of the Australia LED bulb market on the basis of region?

- What are the various stages in the value chain of the Australia LED bulb market?

- What are the key driving factors and challenges in the Australia LED bulb market?

- What is the structure of the Australia LED bulb market and who are the key players?

- What is the degree of competition in the Australia LED bulb market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia LED bulb market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia LED bulb market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia LED bulb industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)