Australia LED Lighting Market Report by Application (Retrofit, Retail and Hospitality, Outdoor, Offices, Architectural, Homes, Industrial), and Region 2025-2033

Australia LED Lighting Market Overview:

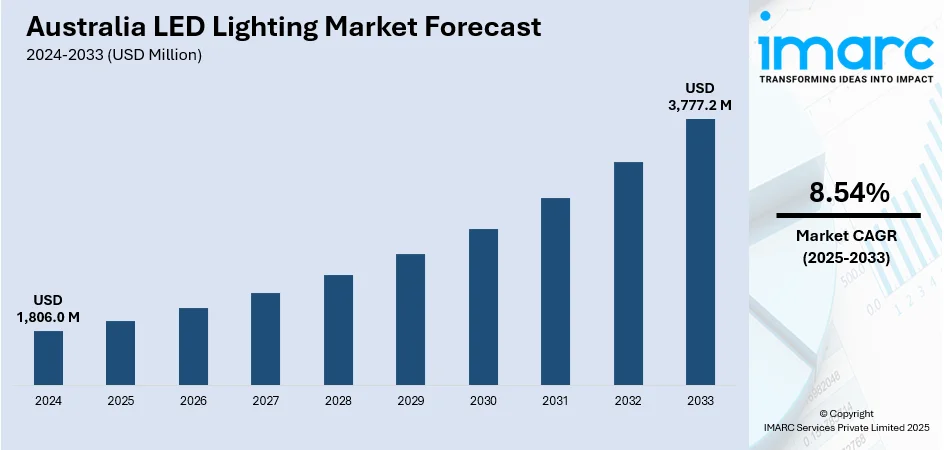

Australia LED lighting market size reached USD 1,806.0 Million in 2024. Looking forward, the market is expected to reach USD 3,777.2 Million by 2033, exhibiting a growth rate (CAGR) of 8.54% during 2025-2033. The integration of LEDs with smart lighting systems and IoT, which has opened up new possibilities for control, automation, and customization of lighting environments, is primarily driving the regional market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,806.0 Million |

| Market Forecast in 2033 | USD 3,777.2 Million |

| Market Growth Rate (2025-2033) | 8.54% |

LED lighting, or light-emitting diode lighting, is an energy-efficient and versatile lighting technology that has revolutionized the illumination industry. Unlike traditional incandescent bulbs, LEDs produce light by passing an electric current through a semiconductor, emitting photons and generating illumination. This process is more efficient, as LEDs waste less energy in the form of heat. LED lighting offers numerous advantages, including lower energy consumption, longer lifespan, and a range of color options. It is widely used in various applications, from residential and commercial lighting to automotive and outdoor lighting. The compact size, durability, and the ability to dim LEDs make them a popular choice for modern lighting solutions. As the demand for sustainable and energy-saving lighting options grows, LED lighting continues to play a crucial role in shaping the future of illumination.

To get more information on this market, Request Sample

Australia LED Lighting Market Trends:

Shift Toward Human-Centric Lighting Design

One of the most notable trends in the Australian LED lighting market is the growing adoption of human-centric lighting systems. These systems are designed to align with the natural human circadian rhythm by adjusting brightness and color temperature throughout the day. Educational institutions, healthcare facilities, and office environments are increasingly integrating tunable white and dynamic LED lighting to improve focus, mood, and sleep quality. As awareness of the impact of lighting on health and productivity grows, lighting designers and architects are prioritizing wellness-centric lighting solutions in building plans. This trend reflects a broader movement toward creating more responsive and adaptive interior environments that support mental and physical well-being, pushing the demand for advanced, programmable LED solutions across multiple sectors.

Integration of LED Lighting in Smart City Infrastructure

The expansion of smart city projects across Australian cities is significantly influencing the LED lighting market. Governments and municipalities are deploying smart LED street lighting systems equipped with IoT sensors, real-time monitoring, and adaptive brightness control. These systems not only reduce energy consumption but also improve public safety, enable traffic monitoring, and reduce maintenance costs through predictive analytics. Integration with centralized control platforms allows cities to remotely manage lighting networks, contributing to environmental sustainability and operational efficiency. As cities aim to meet carbon neutrality goals and digitize infrastructure, smart LED lighting is becoming a fundamental element of urban planning, making it one of the most transformative trends in the country’s lighting landscape.

Growing Demand for Aesthetic and Architectural LED Lighting

The demand for visually appealing and architecturally integrated LED lighting solutions is on the rise in Australia’s commercial and high-end residential sectors. Designers are leveraging LED technology not just for illumination but as a central element of interior and exterior aesthetics. Features such as flexible strip lights, RGB color options, and customizable luminaires are being used to enhance ambiance, highlight architectural features, and support branding in retail and hospitality spaces. This trend reflects an increasing appreciation for lighting as an artistic and experiential medium. As building owners and developers prioritize design and ambiance, manufacturers are responding with innovative, modular LED products that offer both visual impact and energy performance, contributing to a more dynamic lighting market.

Growth Drivers of Australia LED Lighting Market:

Rise in Commercial Renovation and Retrofit Projects

Australia is experiencing an uptick in commercial renovation projects, with building owners increasingly replacing outdated lighting systems to meet energy efficiency goals. LEDs are the preferred choice for retrofits due to their lower energy consumption, longer lifespan, and minimal maintenance requirements. Markets including the retail industry, hospitality industry, and office spaces are at the forefront of this change, with an interest in lighting systems and technology that increase aesthetics, cut expenditure, and help achieve sustainability goals. This trend is further reinforced by incentives made by the government (upgrading inefficient lighting). With the crisis adoption of modern energy standards in commercial real estate, the increased interest in retrofitting initiatives will quite literally fast-track the uptake of innovative LED technologies in the suburban and urban commercial regions.

Advancement in LED Manufacturing and Product Innovation

Technological progress in LED production, such as miniaturization, higher luminous efficacy, and heat dissipation control, has led to a new generation of lighting products that are more reliable and adaptable. These innovations are enabling the development of LEDs for specific applications, such as healthcare-grade lighting, UV-C disinfection systems, and customizable lighting for education and industrial environments. Improved production methods are also reducing manufacturing costs, making high-quality LED products more accessible to a wider market. This continual innovation enhances product performance, expands functional use cases, and helps manufacturers differentiate in a competitive landscape, thereby driving Australia LED lighting market demand.

Electrification of Transport and Public Infrastructure Projects

Australia’s increasing investment in electric vehicle infrastructure, public transit upgrades, and smart city initiatives is fueling the adoption of energy-efficient LED lighting systems. Applications include LED streetlights, tunnel lighting, EV charging station illumination, and transport hub lighting. These infrastructure projects require durable, low-maintenance, and energy-saving lighting solutions, positioning LEDs as the go-to option. Moreover, the integration of LED systems with sensors and IoT platforms enhances energy monitoring and safety, further aligning with government goals for sustainable urban development. As large-scale electrification projects continue nationwide, they create significant demand for tailored LED solutions across diverse public sector applications.

Opportunities of Australia LED Lighting Market:

Expansion in Outdoor and Sports Lighting Installations

With rising investment in urban planning and recreational facilities, there is a growing opportunity in the outdoor and sports lighting segment. LEDs offer precise beam control, low glare, and high illumination efficiency, ideal for stadiums, parks, and sports complexes. Local councils and event organizers are adopting LED floodlights to reduce operational costs and meet green building requirements. The rise of community sports infrastructure in suburban and regional areas further widens the addressable market. Advanced control systems also allow for event-based lighting schedules and real-time adjustments, offering enhanced user experience and lower energy consumption. This segment provides a scalable and visible growth avenue for LED manufacturers and installers.

Integration with Renewable Energy Systems

The combination of solar panels and LED lighting presents a significant opportunity, especially in remote and off-grid regions of Australia, which is fueling the Australia LED lighting market share. Solar-powered LEDs require minimal maintenance and offer sustainable lighting solutions for streets, farms, and rural businesses. As Australia accelerates its shift toward renewables, integrated lighting systems can be deployed where grid connectivity is limited or unstable. These systems are also gaining traction in emergency response planning and disaster-prone areas. Solar-LED hybrids help reduce electricity costs while supporting national carbon reduction targets. The scalability and adaptability of these integrated systems open new markets and create lasting value for both suppliers and end users.

Growing Demand in the Horticulture and Agritech Sectors

The rise of controlled-environment agriculture (CEA), including greenhouses and vertical farming, is creating demand for specialized horticultural LED lighting. These LEDs are engineered to enhance photosynthesis and optimize plant growth cycles, improving crop yields and quality. Australia's agritech sector is increasingly embracing smart farming techniques, where LED systems play a crucial role in resource-efficient production. High energy efficiency and wavelength customization make LEDs ideal for year-round indoor farming, even in areas with challenging climates. As food security and sustainable agriculture gain national priority, LED technology tailored for agribusiness presents a promising growth opportunity with long-term environmental and economic benefits.

Challenges of Australia LED Lighting Market:

Market Saturation and Price Competition

As the LED lighting market in Australia matures, increased competition among manufacturers and suppliers is driving down prices. While this benefits consumers, it poses challenges for businesses trying to maintain profitability. The abundance of low-cost imports, particularly from Asia, puts additional pressure on domestic players to reduce margins or differentiate through value-added services. This intense competition can lead to oversupply, reduced innovation incentives, and limited investment in product quality. Smaller companies may struggle to compete or scale, potentially leading to market consolidation. Maintaining profitability while offering competitive pricing and high-quality products has become a critical challenge in sustaining long-term growth.

Consumer Reluctance Toward Upfront Costs

Despite long-term energy and maintenance savings, many residential and small business users hesitate to switch to LED lighting due to higher initial costs. Budget-conscious consumers often prioritize short-term expenses over long-term benefits, especially when traditional lighting options are still available at lower prices. According to the Australia LED lighting market analysis, this price sensitivity slows widespread adoption in lower-income households and small-scale commercial environments. Lack of awareness regarding lifetime savings and performance advantages also contributes to resistance. Bridging this perception gap through educational campaigns, incentives, and flexible financing options is essential to overcoming this barrier and expanding the reach of LED technologies across diverse consumer segments.

Recycling and End-of-Life Disposal Concerns

As LED adoption grows, so does the concern around the proper disposal and recycling of used products. LEDs contain materials such as semiconductors, plastics, and metals, which require responsible handling at the end of their lifecycle. Australia's recycling infrastructure for electronic waste, including lighting, is still developing, leading to uncertainty around compliance and environmental responsibility. The absence of standardized take-back programs or clear disposal guidelines can result in environmental risks or regulatory challenges for manufacturers and retailers. Addressing this issue requires industry collaboration, government regulation, and increased investment in circular economy practices to ensure sustainable end-of-life management for LED products.

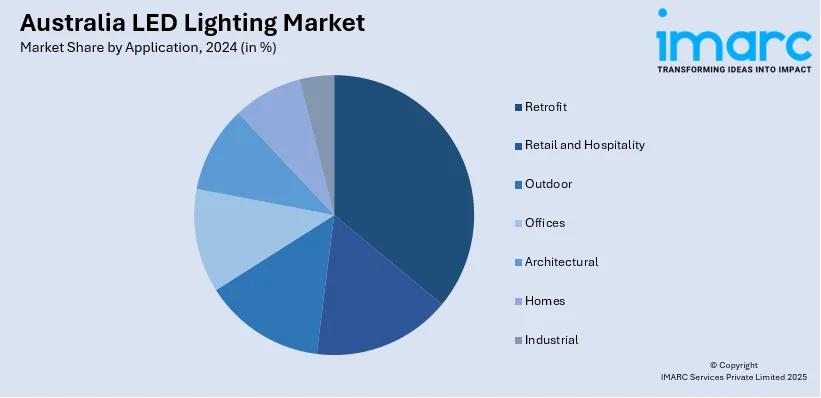

Australia LED Lighting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on application.

Application Insights:

- Retrofit

- Retail and Hospitality

- Outdoor

- Offices

- Architectural

- Homes

- Industrial

The report has provided a detailed breakup and analysis of the market based on the application. This includes retrofit, retail and hospitality, outdoor, offices, architectural, homes, and industrial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia LED Lighting Market News:

- In April 2025, Lazer Lamps Ltd, a prominent UK-based producer of high-performance LED lighting systems, introduced its latest innovation, the AIR LED light bar, across the Australian and New Zealand markets. Engineered specifically for heavy trucks and commercial vehicles, the AIR combines advanced technology, robust durability, and contemporary styling in a streamlined, high-impact design.

- In August 2024, Haneco Specialised Solutions (HSS) was delighted to hold its exclusive launch event at the impressive new Adelaide Marriott Hotel. As the chosen supplier of lighting and control systems for this landmark project, HSS had the honor of presenting its latest range of professional luminaires and control solutions to guests ahead of the hotel’s official debut.

- In June 2023, Inlite announced its newly formed partnership with renowned Italian lighting leader, Artemide, under new ownership and with a revitalized commitment to delivering innovative and eco-conscious lighting solutions to Australia's architectural, design, and engineering sectors.

Australia LED Lighting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Retrofit, Retail and Hospitality, Outdoor, Offices, Architectural, Homes, Industrial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia LED lighting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia LED lighting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia LED lighting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The LED lighting market in Australia was valued at USD 1,806.0 Million in 2024.

The Australia LED lighting market is projected to exhibit a CAGR of 8.54% during 2025-2033.

The Australia LED lighting market is projected to reach a value of USD 3,777.2 Million by 2033.

Smart lighting systems with automation features, human-centric and tunable LEDs and growing interest in energy-efficient, aesthetically flexible solutions for architectural, commercial, and outdoor use, driven by sustainability goals and modern design preferences, are some of the major growth drivers of the Australia LED lighting market.

Australia is witnessing a steady growth due to the rising shift toward smart LED lighting integrated with automation systems. Increasing demsand for human-centric lighting that supports health and productivity, and customizable LED designs for architectural and outdoor applications are gaining popularity, emphasizing aesthetics, efficiency, and control.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)