Australia Leisure Battery Market by Fuel Type (AGM, Lead Acid, Lithium Iron Phosphate (LFP), Lithium Nickel Cobalt Aluminium Oxide (NCA), Lithium Nickel Manganese Cobalt (LI NMC), Lithium Cobalt Oxide (LCO), Lithium Manganese Oxide (LMO), Lithium Titanate Oxide (LTO), and Others), Voltage Range (12 V, Less than 12 V, More than 12V but less than 48V, 48V and More than 48V), Distribution Channel (Brick and Mortar, E-commerce Channel), and Region 2025-2033

Australia Leisure Battery Market Size:

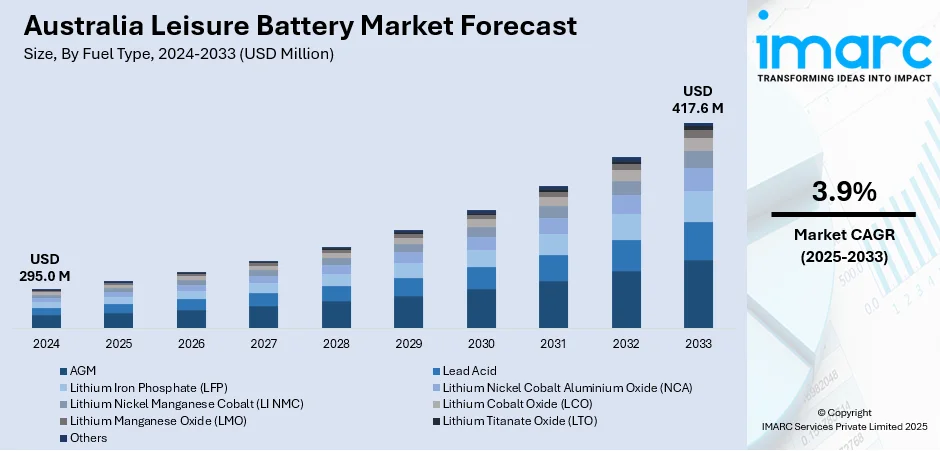

The Australia leisure battery market size reached USD 295.0 Million in 2024. Looking forward, the market is projected to reach USD 417.6 Million by 2033, exhibiting a growth rate (CAGR) of 3.9% during 2025-2033. The market is driven by the increased adoption of renewable energy across numerous end-use sectors, considerable rise in outdoor recreational activities among the masses, and technological advancements that enhance battery performance and connectivity, and an enhanced focus on sustainable development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 295.0 Million |

|

Market Forecast in 2033

|

USD 417.6 Million |

| Market Growth Rate 2025-2033 | 3.9% |

Australia Leisure Battery Market Analysis:

- Major Market Drivers: The primary drivers of the Australia leisure battery market include the increasing adoption of renewable energy sources like solar power, which necessitates reliable energy storage solutions.

- Key Market Trends: Technological advancements are a significant trend, with companies focusing on lithium-ion batteries for their efficiency and durability, alongside innovations in smart battery technology that offer enhanced connectivity and user control.

- Competitive Landscape: Some of the major market players in the Australia leisure battery industry include ACDelco Australia (General Motors), ALLion Lithium Batteries, Century Batteries (GS Yuasa Corporation), Deka Intimidator, Delkor Co. Ltd, Enerdrive, Full River Battery, Lifeline Batteries Inc, Optima Batteries, Power Sonic Corporation (The Blackbird Group), RELiON Batteries (Brunswick Corporation), Renogy, Redarc Electronics, 4WD Supacentre, SuperCharge Batteries (Ramcar Batteries Inc.), U.S. Battery, Victron Energy, Yuasa Battery (GS Yuasa Corporation), Outbax., etc, among many others.

- Challenges and Opportunities: While the market faces challenges like the high initial cost of advanced battery technologies and competition from traditional energy sources, opportunities arise from the growing consumer shift towards eco-friendly products and the increasing popularity of outdoor recreational activities in Australia.

To get more information on this market, Request Sample

Key Trends of Australia Leisure Battery Market:

Technological Advancements and Innovation

The market is driven by ongoing technological developments and innovations in design and battery functions. Manufacturers emphasize R&D to produce batteries with higher energy density but with fast charging as well as a long lifecycle. These innovations improve the networking of leisure batteries, appealing to tech-savvy consumers who seek high-performance, low-maintenance units. Furthermore, the increasing use of smart batteries, which allow for real-time monitoring and management of energy usage, appeals to consumers who seek increased connectivity and control, thereby resulting in a high Australia leisure battery market growth rate. Such technological solutions help the consumer to save their electricity and address the issues of climate change according to the international trend of greener and more reliable energy supply. Australia's growth is fueled by government incentives and rising eco-awareness among consumers.

Increasing Adoption of Renewable Energy Sources

The leisure battery market in Australia is currently experiencing significant growth, primarily due to the extensive adoption of renewable energy, especially solar power, in both residential and business sectors. With more and more Australians utilizing solar systems to generate electricity from an inexhaustible source, the need for recreational batteries that store and manage solar energy efficiently is also rising constantly. It can also be facilitated by policy interventions of the government and due to decreasing costs of solar installations, solar power solutions have become more accessible to ordinary citizens. Besides, heightened consciousness among the Australian population about sustainable power techniques induces the market to promote greener and energy-efficient technologies, which places leisure batteries at the heart of the efforts to transform Australia into a green country.

Growth in Recreational Activities

Australia's wide diversity of landscapes makes it a perfect place for outdoor recreation and activities such as camping, fishing, and caravanning that are commonly powered independently from the electricity grid. Leisure batteries play a vital role by making sure some of the most vital equipment works on even remote localities like refrigerators, lighting, and GPS and communication devices. The rapidly growing popularity in the field of eco-tourism and the huge number of tourists seeking these types of activities are among the primary factors for the raised need for heavy-duty, durable leisure batteries which is creating a positive Australia leisure battery market outlook. Market growth also arises from the new technology in batteries including lithium-ion batteries endowed with longer life spans and better performance thus they are suitable for recreational use.

Growth Drivers of Australia Leisure Battery Market:

Growing Outdoor and Adventure Tourism

The increase in popularity for outdoor activities and adventure tourism in Australia plays an important role in expanding the leisure battery market. Home-based travel patterns, including camping, boating, and off-grid outings, have experienced growth as individuals want experiences that promote harmony with nature while maintaining comfort. Leisure batteries are vital for powering RVs, campervans, and boats, with guaranteed energy for lighting, appliances, and entertainment systems. Creation of tourist infrastructure and expansion of caravan parks and recreational facilities also support market demand. As tourists value convenience and independence, the need for large-capacity, durable batteries becomes critical. The trend follows overall lifestyle shifts toward experiential tourism, which guarantees consistent growth for the Australian leisure battery market.

Demand for Portable Power Solutions

The growing need for reliable, portable power sources is significantly enhancing the Australia leisure battery market. Today's outdoor lifestyles often require energy for electronic devices, lighting, and small appliances in remote or off-grid settings. Leisure batteries offer a practical and dependable energy solution, enabling longer trips without relying on external power sources. Moreover, the rise in mobile work environments, outdoor events, and recreational vehicles amplifies the demand for adaptable, high-capacity battery systems. Technological advancements, such as lightweight designs, maintenance-free functionality, and improved energy efficiency, further attract consumers. As Australians continue to adopt active, outdoor-oriented lifestyles, portable power solutions remain a vital element, driving consistent market growth and fostering continuous innovation in battery technologies.

Environmental Awareness

Environmental consciousness is becoming a significant factor driving the Australia leisure battery market. Consumers are increasingly looking for eco-friendly and recyclable battery solutions that help lower carbon footprints and reduce environmental impacts. In response, manufacturers are creating advanced lithium-ion and lead-acid alternatives that provide longer lifespans, improved energy efficiency, and decreased emissions. Awareness campaigns focused on sustainable practices and responsible disposal are also influencing buying decisions. Furthermore, government initiatives that encourage renewable energy integration, such as solar-powered recreational systems, are in line with this trend. By focusing on environmentally responsible products, the market meets consumer demands and fosters innovation in sustainable battery technologies. This emphasis on green solutions strengthens long-term adoption and positions the Australia leisure battery market for future growth.

Australia Leisure Battery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on fuel type, voltage range, and distribution channel.

Breakup by Fuel Type:

- AGM

- Lead Acid

- Lithium Iron Phosphate (LFP)

- Lithium Nickel Cobalt Aluminium Oxide (NCA)

- Lithium Nickel Manganese Cobalt (LI NMC)

- Lithium Cobalt Oxide (LCO)

- Lithium Manganese Oxide (LMO)

- Lithium Titanate Oxide (LTO)

- Others

AGM accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes AGM, lead acid, lithium iron phosphate (LFP), lithium nickel cobalt aluminium oxide (NCA), lithium nickel manganese cobalt (LI NMC), lithium cobalt oxide (LCO), lithium manganese oxide (LMO), lithium titanate oxide (LTO), and others. According to the report, AGM represented the largest segment.

According to the Australia leisure battery market forecast, AGM (Absorbent Glass Mat) accounted for the largest segment as the main highlight is their excellent features, for instance, the safety, reliability, and maintenance-free operation. AGM batteries are generally preferred for purposes such as stable and sustained power sources for their high-power efficiency and as they can function well in low temperatures. Which makes them suitable for start-stop vehicle systems, renewables storage, and backup power systems. The leak-proof design and capacity they have to strain vibrations have much to do with the passenger both in automotive and industrial applications. With the stricter environmental regulations and the rising leisure battery demand in Australia for more effective ways to solve this problem, AGM batteries are increasingly seen as the key component to sustainability strategies, thus giving them a lead position in the market.

Breakup by Voltage Range:

- 12 V

- Less than 12 V

- More than 12V but less than 48V

- 48V and More than 48V

12 V holds the largest share of the industry

A detailed breakup and analysis of the market based on the voltage range have also been provided in the report. This includes 12 V, less than 12V, more than 12V but less than 48V, and 48V and more than 48V. According to the report, 12 V accounted for the largest market share.

According to Australia leisure battery market share data, the 12 V segment is the largest one, and it mainly takes the leading position as it is broadly used in lots of leisure and auto applications. They are heavily employed in cars, marine vehicles, RVs, and solar power systems which are being paid much attention in Australia given its developed market of activities in outdoor areas and renewable energy solutions. The 12 V batteries offer versatility and compatibility, so they become a preferred option as they seamlessly perform the power requirements of many devices and equipment. Also, the 12 V batteries with different capacities and low-price factors substantially contribute to their leading position in the market, and they can be used by both economical buyers and those requiring a stable power source for more difficult applications.

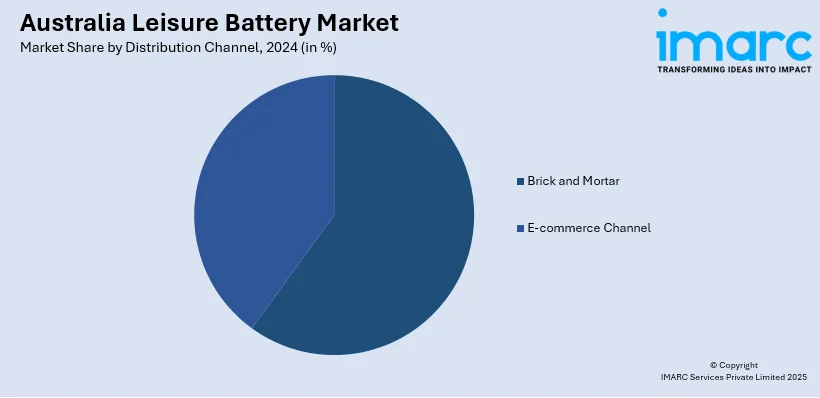

Breakup by Distribution Channel:

- Brick and Mortar

- E-commerce Channel

Brick and mortar represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes brick and mortar and e-commerce channels. According to the report, brick and mortar represented the largest segment.

According to the Australia leisure battery market report, the largest channel segment is brick-and-mortar. Traditional brick-and-mortar stores stand out as the main retail outlet for these products, offering proof of their value, and are stimulated by the growth of online shopping. Their physical stores give the benefit of direct product interaction which is crucial for products, where quality, fit, and accessibility at the moment are critical. Besides the traditional store's functionality as places with customers to help in person, and with fulfillment of instant gratification as it is impossible to be done online, the physical stores offer an added value. Moreover, several customers still tend to favor the in-store shopping model, where trust and assurance are intrinsic to making that experience a lot more robust than its online counterpart and thrive in sectors where these elements heavily influence customer decisions.

Breakup by Region:

- New South Wales

- Victoria

- Queensland

- Western Australia

- South Australia

- Tasmania

- Others

New South Wales leads the market, accounting for the largest market share

The report has also provided a comprehensive analysis of all the major markets in the region, which include New South Wales, Victoria, Queensland, Western Australia, South Australia, Tasmania, and others. According to the report, New South Wales was the largest market for leisure battery in Australia.

Among the regions in the leisure battery market in Australia, the largest region is New South Wales (NSW). This state of affairs is mostly a result of a highly concentrated population and a robust economy that is at the moment the main pillar of residential and commercial energy storage shipping. The state of NSW is the most coastal one with a wide variety of water-based and outdoor activities rising as the demand for stable Australia leisure batteries trends keeps rising. Besides, the area's dedication to renewable energy targets that are weightily found in the space of solar installations in houses and offices will consequently raise the demand for energy storage facilities like leisure batteries.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided. Some of the major market players in the Australia leisure battery industry include:

- ACDelco Australia (General Motors)

- ALLion Lithium Batteries

- Century Batteries (GS Yuasa Corporation)

- Deka Intimidator

- Delkor Co. Ltd

- Enerdrive

- Full River Battery

- Lifeline Batteries Inc

- Optima Batteries

- Power Sonic Corporation (The Blackbird Group)

- RELiON Batteries (Brunswick Corporation)

- Renogy

- Redarc Electronics

- 4WD Supacentre

- SuperCharge Batteries (Ramcar Batteries Inc.)

- U.S. Battery

- Victron Energy

- Yuasa Battery (GS Yuasa Corporation)

- Outbax

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

According to Australia leisure battery market data, the key players in this market are striving to improve their products by integrating new technology in the areas of high energy density, fast charging, and increased durability. Advanced lithium-ion technology is utilized in complex integration technical solutions due to its superior performance and ecological advantages. Besides this, the top-ranked suppliers are reinforcing their wholesale networks and service ratification tenets in a bid to upscale customer loyalty. In addition, there is an obvious increase in sustainability, and hence, companies are investing in recycling programs as well as more eco-friendly manufacturing technologies to respond to the needs of the increasing number of environmental enthusiasts in Australia.

Australia Leisure Battery Market News:

- On March 21, 2024, ACDelco is offering a motorsport trip to Chicago for an Aussie or Kiwi fan to see 2022 Supercars Champion Shane van Gisbergen race in the NASCAR street race.

- On May 1, 2024, Australia's solar panel installations hit record highs in late 2023, with 329MW in November and 321MW in December.

- On November 23, 2023, Clarios' Delkor brand won the 2023 Korean Standard Quality Excellence Index (KS-QEI) award for the 18th consecutive year and also secured the “Circular Economy Award” at the 2023 World Sustainability Awards, reinforcing its status as a leading global battery manufacturer.

Australia Leisure Battery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | AGM, Lead Acid, Lithium Iron Phosphate (LFP), Lithium Nickel Cobalt Aluminium Oxide (NCA), Lithium Nickel Manganese Cobalt (LI NMC), Lithium Cobalt Oxide (LCO), Lithium Manganese Oxide (LMO), Lithium Titanate Oxide (LTO), Others |

| Voltage Ranges Covered | 12 V, Less than 12 V, More than 12V but less than 48V, 48V and More than 48V |

| Distribution Channels Covered | Brick and Mortar, E-commerce Channel |

| Regions Covered | New South Wales, Victoria, Queensland, Western Australia, South Australia, Tasmania, Others |

| Companies Covered | ACDelco Australia (General Motors), ALLion Lithium Batteries, Century Batteries (GS Yuasa Corporation), Deka Intimidator, Delkor Co. Ltd, Enerdrive, Full River Battery, Lifeline Batteries Inc, Optima Batteries, Power Sonic Corporation (The Blackbird Group), RELiON Batteries (Brunswick Corporation), Renogy, Redarc Electronics, 4WD Supacentre, SuperCharge Batteries (Ramcar Batteries Inc.), U.S. Battery, Victron Energy, Yuasa Battery (GS Yuasa Corporation), Outbax., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia leisure battery market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia leisure battery market.

- The study maps the leading, as well as the fastest-growing, markets. It further enables stakeholders to identify the key country-level markets within the region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia leisure battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The leisure battery market in Australia was valued at USD 295.0 Million in 2024.

The Australia leisure battery market is projected to exhibit a compound annual growth rate (CAGR) of 3.9% during 2025-2033.

The Australia leisure battery market is expected to reach a value of USD 417.6 Million by 2033.

The market is witnessing increased adoption of lithium-ion and maintenance-free batteries, along with enhanced integration with solar and renewable energy systems. Smart battery management, portable power solutions for outdoor activities, and durable, lightweight designs are shaping consumer preferences and driving innovation in the leisure battery segment.

Rising popularity of recreational vehicles, boating, and camping, coupled with demand for reliable off-grid power, is driving market growth. Technological advancements in battery efficiency, longer lifespan, and eco-friendly options, along with expanding adventure tourism and outdoor lifestyles, further support increased adoption across Australia.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)