Australia Logistics Market Report by Model Type (2 PL, 3 PL, 4 PL), Transportation Mode (Roadways, Seaways, Railways, Airways), End Use (Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, and Others), and Region 2025-2033

Australia Logistics Market Size:

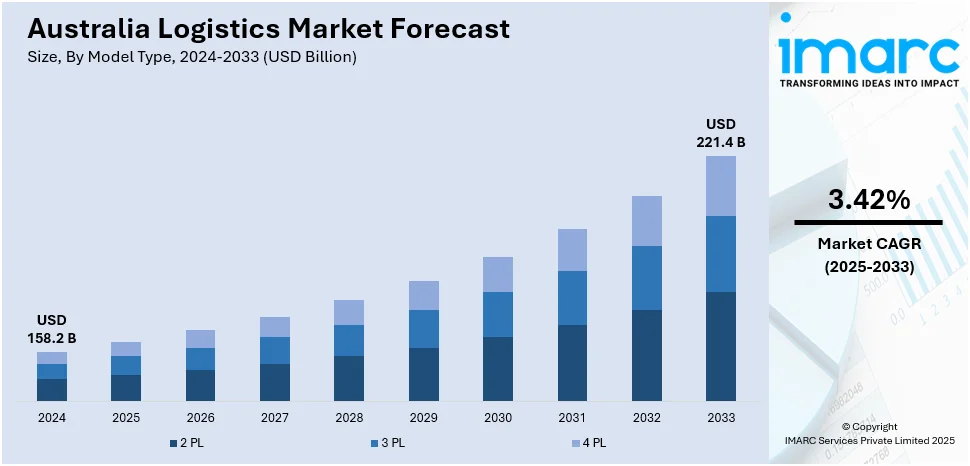

Australia logistics market size reached USD 158.2 Billion in 2024. Looking forward, the market is expected to reach USD 221.4 Billion by 2033, exhibiting a growth rate (CAGR) of 3.42% during 2025-2033. The increasing need for the execution of various interconnected activities and strategic coordination to facilitate the timely delivery of goods and services and continuous improvements in supply chain management are primarily augmenting the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 158.2 Billion |

| Market Forecast in 2033 | USD 221.4 Billion |

| Market Growth Rate (2025-2033) | 3.42% |

Australia Logistics Market Analysis:

- Major Market Drivers: The increasing international trade ties across the country and its strategic geographical location are primarily stimulating the demand for efficient logistics services in Australia. Additionally, companies in the country are introducing novel inventory management systems, which is acting as another significant growth-inducing factor.

- Key Market Trends: The development of technological advancements is playing a crucial role in augmenting the market growth in Australia. Besides this, the rising integration of advanced technologies, including automation, real-time tracking systems, artificial intelligence, etc., to provide a competitive edge to logistics providers is further catalyzing the Australia logistics market.

- Challenges and Opportunities: The logistics market in Australia faces numerous challenges that can impact cost efficiency, efficiency, and sustainability. Primarily, the extensive distances between remote areas and major cities are leading to higher transportation costs and longer delivery miles, which can hinder the market growth across the country. Also, the growing consumer expectations for faster, more transparent, and cheaper delivery solutions pose a serious challenge for logistics providers. Meeting these expectations requires numerous investments in logistics infrastructures and technology. However, the rising focus on strategic planning, skilled workforce development, and several technological advancements will continue to propel the market growth across the country.

To get more information on this market, Request Sample

Key Trends Australia Logistics Market:

The Growing E-Commerce Industry

The increasing number of e-commerce activities is positively influencing how goods are stored, delivered, and handled. Australia is the 12th largest market for the e-commerce industry, with a predicted revenue of US$ 53,066.5 Million by 2024, placing it ahead of Italy. It is anticipated to bolster by 10.3% in 2024. As consumers in Australia are inclining towards online platforms, leading logistics companies are innovating to meet the evolving demands of customers in the e-commerce industry. This, in turn, is leading to the development of more novel supply chains. As reported by Australia Post, more individuals across the county are shopping online, with four-in-five households, 81% buying something online at some point during the year. In addition, shoppers spent US$ 62.3 Billion on online physical goods. Such high grossing in online sales indicates the country's rising interest in e-commerce activities, which will continue to augment the Australia logistics market demand.

The Rising Focus on Sustainability

The increasing focus among businesses and individuals on sustainability is positively influencing logistics operations in Australia. Consequently, they are widely utilizing electric vehicles for deliveries, optimizing routes to minimize carbon dioxide emissions, implementing sustainable packaging solutions, etc., which is bolstering the market growth. For example, DHL Freight developed the Go Green Plus service to minimize CO2 emissions from road transport vehicles. This was achieved via carbon in setting, which is a reduction in emissions of carbon dioxide and other greenhouse gases through extensive investments in green road transportation technologies and fuels. In addition, The Port of Brisbane is the largest seaport in the state of Queensland. It is the third fastest and busiest-growing port in all of Australia. This port is responsible for more than 28 million cargo each year and 2600 ships and is ranked at the Maritime Security Level 1. Consequently, stringent regulations in Brisbane are expected to augment the market growth in the coming years.

The Growing Improvements in Supply Chain Management

Australian logistics companies are extensively focusing on investing in enhanced inventory management solutions and exploring reshoring or nearshoring options to ensure supply chain continuity and mitigate risk factors. For instance, Amazon announced the construction of its first sort center facility in the country commenced in Melbourne. The 15,600 sqm operations facility was developed at Goodman Group's new Amaroo Business Park in Craigieburn. The purpose-built sort center located in the north of Melbourne was introduced to enhance the company's delivery speed for customers across the country. In addition to this, an online retailer named MyDeal launched a new global activities marketplace called Amazed.com in Australia. The new website was developed to utilize MyDeal's proprietary marketplace technology and the existing 1 million active customer base, which, in turn, offered a one-stop shopping experience for locals.

The Launch of Regulatory Policies and Infrastructure Developments

Government bodies in Australia are launching numerous favorable policies that are acting as significant factors fueling the Australia logistics market share. They are implementing regulations, including safety standards, trade agreements, environmental guidelines, etc., which are propelling the Australia logistics market. For example, regulation authorities implemented the Heavy Vehicle National Law (HVNL) regarding the usage of heavy vehicles that have a gross vehicle mass of more than 4.5 tons. It applies nationally, except for Western Australia and the Northern Territory. Moreover, these bodies are also significantly investing in infrastructure projects, including rail network expansions and port upgrades, to improve logistics connectivity and efficiency. They introduced a robust 10-year infrastructure pipeline valued at US $120 Billion, specifically focusing on delivering land transport projects that hold national significance and contribute to shaping the nation's future. The 2023-24 budget represented their initiatives to invest in infrastructure development pipelines that are integral to nation-building endeavors. These policies are crucial for constructing sustainable projects, selected based on diverse economic and societal goals, encompassing quality of life enhancement, regional connectivity, and safety enhancement.

Growth Drivers of Australia Logistics Market:

Rising Demand for Cold Chain Logistics Services

The increasing demand for temperature-controlled transport solutions is significantly boosting growth in Australia’s logistics sector. As the pharmaceutical, fresh produce, and frozen food industries expand, so does the need for cold chain infrastructure that maintains precise temperature ranges during storage and transit. Strict compliance standards and consumer expectations around product quality are driving investment in specialized vehicles, refrigerated storage units, and real-time temperature monitoring systems. This trend is especially vital in exporting perishable goods to international markets, where cold chain reliability ensures competitiveness. Moreover, domestic food delivery services and growing interest in specialty health products are adding to the pressure for last-mile cold chain capabilities, creating new opportunities for logistics firms that offer scalable and tech-enabled refrigeration solutions.

Growing Regional Industrial Activity and Resource Sector Expansion

Australia’s logistics market is experiencing growth due to increased activity in regional areas, especially in mining, agriculture, and energy sectors. These industries rely heavily on robust transportation networks to move equipment, raw materials, and finished goods to ports and markets across vast distances. As exploration and production intensify in remote areas, demand for reliable logistics services—particularly bulk freight, heavy haulage, and intermodal transport—continues to rise. Government support for regional development and infrastructure funding further strengthens logistics operations supporting these sectors. Logistics providers capable of managing remote supply chains, handling over-dimensional cargo, and offering customized freight solutions are well-positioned to benefit from the expanding footprint of Australia’s resource and industrial economy.

Rising Demand for Real-Time Visibility and Customer-Centric Logistics

Consumer expectations for faster, more transparent delivery services are reshaping logistics operations in Australia. Businesses are increasingly adopting digital tools that provide real-time tracking, delivery updates, and customer engagement features. This demand is driven by e-commerce as well as B2B sectors such as retail, manufacturing, and healthcare, where supply chain visibility enhances operational planning. As logistics evolves from purely functional to experience-oriented, companies must prioritize data integration, dynamic routing, and proactive communication. Meeting these expectations improves brand loyalty and competitive advantage. The shift toward customer-centric logistics is fueling the adoption of technology platforms and fostering partnerships between logistics providers and tech startups, ultimately accelerating market growth through innovation and value-added services.

Opportunities of Australia Logistics Market:

Expansion of Freight Digital Platforms and Logistics Tech Startups

Australia’s logistics sector is witnessing a surge in digital freight platforms and logistics tech startups that aim to streamline booking, routing, and fleet management processes. These platforms offer real-time pricing, availability tracking, and digital documentation, reducing manual tasks and improving operational efficiency for both shippers and carriers. As small and medium logistics operators look for ways to remain competitive and modernize, partnering with or adopting digital solutions presents a major opportunity. Additionally, investor interest in supply chain technology continues to rise, creating a fertile ecosystem for innovation. These developments open the door for scalable, cost-efficient logistics services that are better equipped to meet evolving business and consumer demands across domestic and international markets.

Development of Autonomous and Electric Delivery Fleets

The advancement of autonomous vehicle technology and the increasing viability of electric trucks and delivery vans present a transformative opportunity for Australia’s logistics industry. As urban congestion and emission regulations tighten, logistics companies have the chance to lead the shift toward cleaner and more efficient transport. Investment in last-mile delivery robots, drone-based parcel drops, and autonomous freight solutions can reduce labor dependency and operational costs over time. With Australia's vast geography and long-haul freight needs, electric long-range vehicles and autonomous convoys also offer sustainability and fuel-saving benefits. Early adoption and pilot programs can position logistics providers as innovators, attract eco-conscious clients, and future-proof operations amid rising environmental and regulatory expectations.

Growth Potential in Healthcare and Pharmaceutical Logistics

The growing demand for timely and secure delivery of pharmaceuticals, medical equipment, and vaccines creates strong opportunities within the healthcare logistics segment. As healthcare providers increasingly require specialized handling, compliance, and fast turnaround, logistics firms can capitalize by offering tailored cold chain services, secure packaging, and real-time tracking. In the wake of global health challenges and population aging, both urban and rural healthcare systems in Australia are expanding, creating consistent demand for efficient medical logistics. Additionally, the rise of telemedicine and home healthcare delivery models fuels the need for accurate, last-mile distribution. Firms that invest in industry-specific certifications, training, and infrastructure can capture a critical, high-trust market segment and establish long-term contracts with public and private healthcare clients.

Government Support of Australia Logistics Market:

Investment in Port Modernization and Maritime Logistics

The Australian government is actively investing in upgrading ports and surrounding logistics infrastructure to enhance international trade efficiency and reduce bottlenecks in coastal freight movement. Projects such as berth expansions, improved intermodal connectivity, and automation of port operations are helping accommodate growing container volumes and larger vessels. These investments also support smoother integration between maritime, rail, and road transport systems, improving end-to-end supply chain performance. Enhanced port facilities reduce turnaround times and promote Australia’s competitiveness in global trade, particularly in sectors like agriculture, minerals, and manufactured goods. By making ports more efficient and technologically advanced, the government fosters long-term logistics growth while attracting foreign investment and trade partnerships through world-class freight handling capabilities.

Development of Inland Rail and Intermodal Hubs

The federal and state governments have prioritized the development of inland rail networks and intermodal freight hubs as a key national logistics strategy. The Inland Rail project, one of the largest infrastructure undertakings in the country, aims to connect regional producers with major ports and urban centers more efficiently. It is expected to significantly reduce freight transit times, road congestion, and emissions by shifting long-haul cargo from trucks to rail. Additionally, government-supported intermodal terminals are being built to improve freight handling between modes, encouraging streamlined, multimodal logistics services. These investments unlock regional economic growth while helping logistics companies enhance service reliability, scalability, and cost-effectiveness across domestic supply chains.

Strategic Policy Frameworks and Industry Collaboration

The Australian government is increasingly engaging with logistics industry stakeholders to co-develop strategic frameworks that address long-term market needs. Through initiatives like the National Freight and Supply Chain Strategy, authorities aim to align federal, state, and industry efforts around performance standards, data sharing, resilience planning, and safety regulations. This collaborative governance model ensures that policies are responsive to on-the-ground challenges while driving innovation and investment. The government’s support for open dialogue and transparent policy development builds trust with logistics providers and promotes shared accountability. These frameworks also include goals for workforce development, sustainability benchmarks, and digital transformation, further strengthening the overall ecosystem and ensuring that Australia’s logistics market remains adaptive, efficient, and globally competitive.

Challenges of Australia Logistics Market:

Limited Digitization Among Small and Regional Operators

While major logistics companies in Australia are adopting digital tools and automation, many small and regional logistics providers struggle to keep up due to cost barriers, limited technical knowledge, and lack of access to scalable solutions. This digital divide results in inefficiencies such as poor visibility, manual errors, and slower communication across the supply chain. The fragmented adoption of technology hinders real-time tracking, predictive analytics, and inventory optimization—core elements of modern logistics. Additionally, the lack of digitization limits smaller players' ability to integrate with larger networks and meet client expectations for transparency and speed. Bridging this technological gap remains a critical challenge in building a cohesive, efficient, and competitive national logistics system.

Urban Congestion and Last-Mile Delivery Constraints

Increasing urbanization and rising parcel volumes are placing immense pressure on last-mile delivery operations in major Australian cities. Traffic congestion, parking limitations, and local delivery time restrictions make it difficult for logistics providers to meet tight service windows. Moreover, customer expectations for same-day or next-day delivery have escalated, further straining operational capacity. According to the Australia logistics market analysis, these issues raise costs, increase carbon emissions, and complicate route planning. Attempts to solve these problems, such as deploying micro-fulfilment centers or electric delivery vehicles, are still in early stages and require significant investment. Without effective urban logistics strategies and supportive regulations, last-mile delivery challenges will continue to impact efficiency, customer satisfaction, and profitability in dense metropolitan regions.

Vulnerability to Supply Chain Disruptions and Natural Disasters

Australia’s logistics market is highly exposed to supply chain disruptions caused by external factors such as bushfires, floods, and global geopolitical events. Natural disasters frequently damage transport infrastructure, delay shipments, and disrupt regional access—especially in remote areas. Additionally, global supply chain shocks, such as port closures or material shortages, have cascading effects on domestic logistics timelines and inventory levels. Australia’s geographic isolation and reliance on sea freight for international trade further amplify vulnerability to global disturbances. The lack of redundancy in certain freight corridors and limited alternate routing options also hinder swift recovery. Building a resilient and adaptive logistics network remains a challenge that requires coordinated investment, contingency planning, and digital tools for risk management and real-time response.

Australia Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on model type, transportation mode, and end use.

Breakup by Model Type:

- 2 PL

- 3 PL

- 4 PL

The report has provided a detailed breakup and analysis of the market based on the model type. This includes 2 PL, 3 PL, and 4 PL.

Breakup by Transportation Mode:

- Roadways

- Seaways

- Railways

- Airways

A detailed breakup and analysis of the market based on the transportation mode have also been provided in the report. This includes roadways, seaways, railways, and airways.

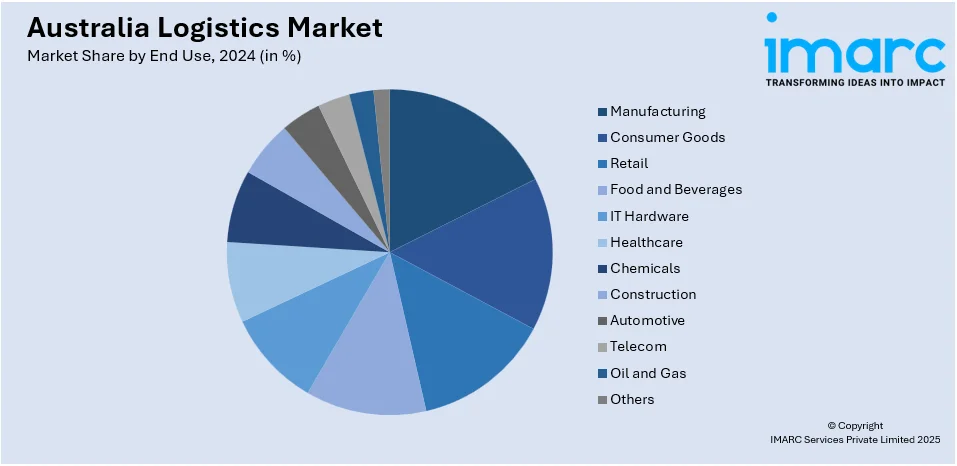

Breakup by End Use:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes manufacturing, consumer goods, retail, food and beverages, IT hardware, healthcare, chemicals, construction, automotive, telecom, oil and gas, and others.

Breakup by Region:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major Australia markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Aurizon LTD

- Centurion Transport

- DB Schenker

- DHL Group

- DSV A/S

- FedEx

- K&S Group

- Kuehne+Nagel

- Linfox Pty Ltd

- Qube Holdings Ltd.

Australia Logistics Market News:

- February 2024: The Federal Government has approved efforts to increase the activities that can be undertaken at Port of Broome, Western Australia, including working with border agencies to secure expanded First Point of Entry (FPOE) status for the port.

- February 2024: The Australian Rail Track Corporation (ARTC) organized a ribbon-cutting ceremony to mark the completion of works to duplicate the Botany Rail line and developed a new Cabramatta Loop after 2.5 years of construction.

- March 2024: The Brisbane Airport Corporation (BAC) has stated that construction has begun on a new state-of-the-art, parcel facility for Australia Post, the largest industrial facility undertaken by the airport to date. BAC is managing the delivery and design of Australia Post’s StarTrack Premium site, making it the postal service’s second largest in Queensland.

Australia Logistics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Model Types Covered | 2 PL, 3 PL, 4 PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Aurizon LTD, Centurion Transport, DB Schenker, DHL Group, DSV A/S, FedEx, K&S Group, Kuehne+Nagel, Linfox Pty Ltd, Qube Holdings Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia logistics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia logistics market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia logistics industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The logistics market in Australia was valued at USD 158.2 Billion in 2024.

The Australia logistics market is projected to exhibit a CAGR of 3.42% during 2025-2033.

The Australia logistics market is projected to reach a value of USD 221.4 Billion by 2033.

The Australia logistics market is embracing digital transformation, with growing adoption of real-time tracking, warehouse automation, and predictive analytics. There is also a rising shift toward multimodal transport solutions and sustainable practices, including electric delivery fleets and carbon-neutral initiatives, aimed at enhancing efficiency and environmental compliance across supply chains.

The rising online retail activity, expanding industrial zones, and government-backed infrastructure upgrades are fuelling logistics market growth in Australia. Increasing demand for cold chain services, cross-border trade, reliable freight movement across remote regions. and the sector benefiting from a stable regulatory environment and strong investment in supply chain resilience are also contributing.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)