Australia Low Calorie Sweeteners Market Size, Share, Trends and Forecast by Source, Type, Application, and Region, 2025-2033

Australia Low Calorie Sweeteners Market Size & Growth:

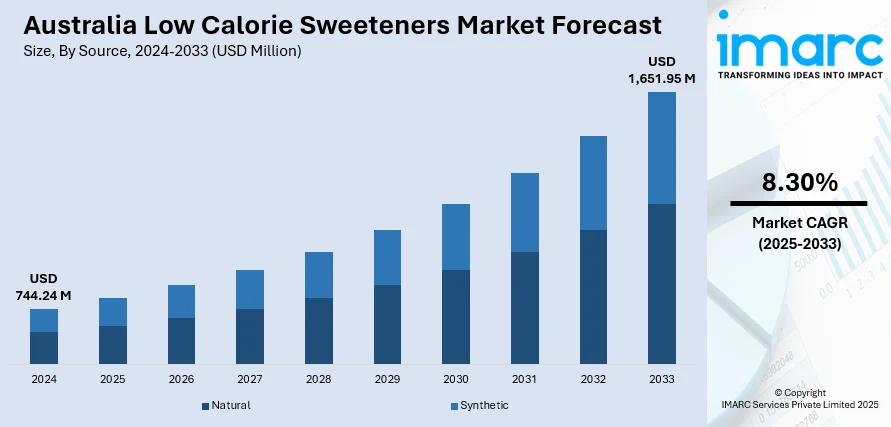

The Australia low calorie sweeteners market size reached USD 744.24 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,651.95 Million by 2033, exhibiting a growth rate (CAGR) of 8.30% during 2025-2033. Rising health consciousness, increasing diabetic and obese population, growing demand for sugar alternatives, and government initiatives promoting healthier lifestyles are some of the factors contributing to Australia low calorie sweeteners market share. Expanding food and beverage industry adoption and innovation in natural sweeteners further boost market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 744.24 Million |

| Market Forecast in 2033 | USD 1,651.95 Million |

| Market Growth Rate 2025-2033 | 8.30% |

Australia Low Calorie Sweeteners Market Trends:

Shift Toward Natural and Low Calorie Sugar Alternatives

In Australia, the low calorie sweeteners market is witnessing growing consumer interest in natural sugar substitutes that replicate traditional sugar’s taste and functionality. With rising awareness of health issues such as obesity and diabetes, there is increasing demand for sweeteners that offer significant calorie reduction without compromising on flavor. Consumers are seeking options that are plant-based, low in carbohydrates, and suitable for everyday use in cooking and baking. The availability of these alternatives in mainstream retail channels reflects their broad acceptance and integration into daily diets. As health-conscious eating becomes more mainstream, the market continues to evolve toward clean-label, functional products that support wellness goals while maintaining the sensory experience of conventional sugar. These factors are intensifying the Australia low calorie sweeteners market growth. For example, in September 2023, Lakanto Australia expanded its presence in the low calorie sweeteners market with the launch of Brown Lakanto, a natural 1:1 brown sugar alternative containing zero carbs and 93% fewer calories. Now available at major retailers nationwide, this product meets growing consumer demand for healthier, low calorie sweeteners, supporting the market’s shift toward natural, sugar-reduced options that align with wellness and dietary goals.

To get more information on this market, Request Sample

Rising Demand for Sweet Proteins in Functional Food Formulations

Natural sweet proteins like brazzein and thaumatin II are increasingly being used to create healthier food and beverage options with reduced sugar content. These ingredients allow for significant calorie reduction while preserving taste, making them ideal for functional foods aimed at supporting wellness goals. In Australia, consumer interest in clean-label, low calorie alternatives continues to rise, especially among those managing weight, diabetes, or general health. As taste remains a key factor in food choices, products using sweet proteins are gaining appeal for their ability to offer both health benefits and flavor. This growing preference is contributing to steady expansion in the use of low calorie sweeteners across functional food categories, reflecting a broader shift toward health-oriented eating habits. For instance, in April 2023, Sweegen introduced Sweetensify Flavors, featuring the sweet proteins brazzein and thaumatin II, enabling greater sugar reduction and healthier product formulations. This innovation aligns with trends in the Australia low calorie sweeteners market, where demand is rising for functional foods that support wellness goals. As Australian consumers prioritize health without sacrificing taste, the market share of low calorie sweeteners in functional food applications is expected to grow steadily.

Australia Low Calorie Sweeteners Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source, type, and application.

Source Insights:

- Natural

- Synthetic

The report has provided a detailed breakup and analysis of the market based on the source. This includes natural and synthetic.

Type Insights:

- Sucralose

- Saccharin

- Aspartame

- Neotame

- Advantame

- Acesulfame Potassium

- Stevia

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes sucralose, saccharin, aspartame, neotame, advantame, acesulfame potassium, stevia, and others.

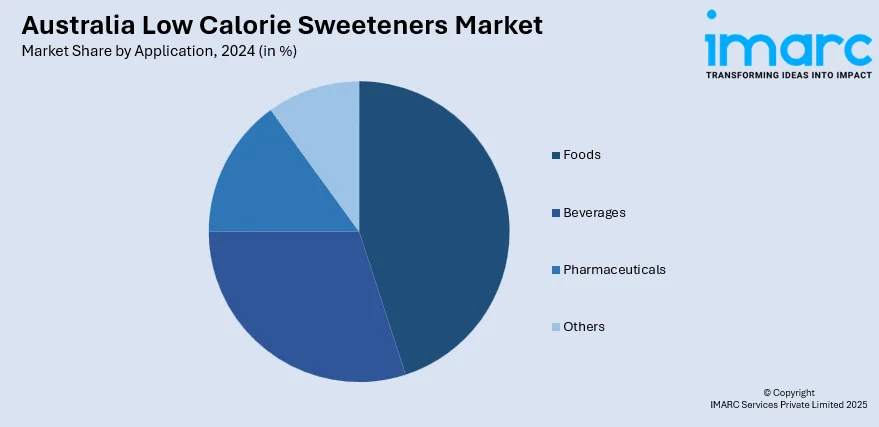

Application Insights:

- Foods

- Bakery

- Frozen Food and Dairy

- Confectionery

- Others

- Beverages

- Pharmaceuticals

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes foods (bakery, frozen food and dairy, confectionery, and others), beverages, pharmaceuticals, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Low Calorie Sweeteners Market News:

- In November 2024, Samyang Corporation became the first global producer to introduce allulose to the Australian and New Zealand markets, following FSANZ approval as a Novel Food. This rare, near-zero-calorie sugar offers a sucrose-like taste and functionality. Its approval aligns with Australia's growing demand for low sugar, healthier food options, fueled by high obesity rates and increasing consumer preference for organic and wellness-focused products, boosting prospects for alternative sweeteners like allulose.

Australia Low Calorie Sweeteners Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Natural, Synthetic |

| Types Covered | Sucralose, Saccharin, Aspartame, Neotame, Advantame, Acesulfame Potassium, Stevia, Others |

| Applications Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia low calorie sweeteners market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia low calorie sweeteners market on the basis of source?

- What is the breakup of the Australia low calorie sweeteners market on the basis of type?

- What is the breakup of the Australia low calorie sweeteners market on the basis of application?

- What is the breakup of the Australia low calorie sweeteners market on the basis of region?

- What are the various stages in the value chain of the Australia low calorie sweeteners market?

- What are the key driving factors and challenges in the Australia low calorie sweeteners market?

- What is the structure of the Australia low calorie sweeteners market and who are the key players?

- What is the degree of competition in the Australia low calorie sweeteners market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia low calorie sweeteners market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia low calorie sweeteners market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia low calorie sweeteners industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)