Australia Lubricants Market Size, Share, Trends and Forecast by Product Type, Base Oil, End Use Industry, and Region, 2026-2034

Australia Lubricants Market Summary:

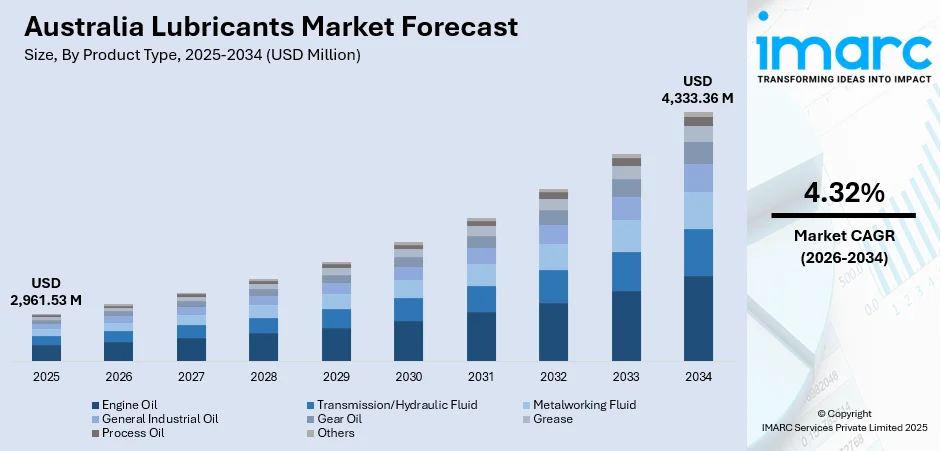

The Australia lubricants market size was valued at USD 2,961.53 Million in 2025 and is projected to reach USD 4,333.36 Million by 2034, growing at a compound annual growth rate of 4.32% from 2026-2034.

The Australia lubricants market is witnessing steady growth, supported by a strong automotive industry, large-scale mining activities, and ongoing infrastructure development. Rising vehicle ownership and increased industrial mechanization are driving consistent lubricant demand across multiple sectors. In addition, a growing shift toward high-performance, energy-efficient, and environmentally sustainable lubricant formulations is reshaping product preferences, further strengthening market expansion across automotive, industrial, and heavy equipment applications.

Key Takeaways and Insights:

-

By Product Type: Engine oil dominates the market with a share of 26% in 2025, driven by Australia's extensive vehicle fleet requiring regular maintenance, rising passenger and commercial vehicle ownership, and growing consumer awareness regarding engine protection and fuel efficiency.

-

By Base Oil: Mineral oil leads the market with a share of 48% in 2025, owing to its cost-effectiveness, widespread availability, and established usage across traditional automotive and industrial applications where extreme performance specifications are not mandated.

-

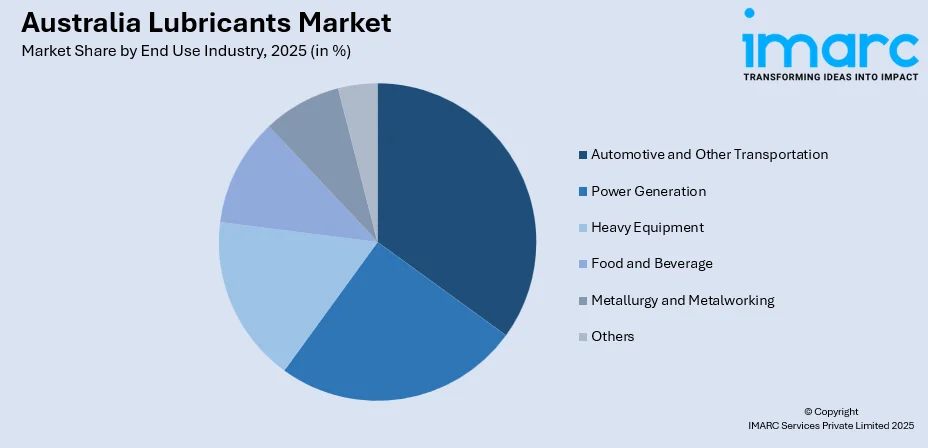

By End Use Industry: Automotive and other transportation represent the largest segment with a market share of 30% in 2025, supported by the nation's growing vehicle population, expanding logistics and freight services, and increasing emphasis on preventive vehicle maintenance practices.

-

By Region: Australia Capital Territory & New South Wales dominate the market with a share of 27% in 2025, indicating the region’s high population density, robust industrial activity, significant vehicle presence, and extensive commercial operations.

-

Key Players: The Australia lubricants market exhibits a moderately consolidated competitive landscape, characterized by the presence of established multinational petroleum corporations alongside specialized regional manufacturers. Market participants compete across product innovation, distribution network expansion, sustainability credentials, and strategic partnerships with original equipment manufacturers.

To get more information on this market Request Sample

The Australia lubricants market is positioned for sustained expansion, underpinned by the nation's robust economic fundamentals and diverse industrial base. The automotive sector continues to serve as a primary demand driver, with vehicle maintenance culture deeply embedded in Australian consumer behavior. The Australia automotive market size was valued at 1.22 Million Units in 2024. Looking forward, the market is expected to reach 2.50 Million Units by 2033, exhibiting a CAGR of 7.60% from 2025-2033. Industrial applications, particularly within the mining and construction sectors, generate substantial lubricant requirements for heavy machinery operating under demanding conditions. The transition toward synthetic and bio-based lubricants reflects evolving performance expectations and environmental consciousness among end-users. Government infrastructure initiatives, including substantial road and rail development programs, are creating additional demand channels. The mining industry's reliance on advanced lubrication solutions for equipment reliability and operational efficiency further reinforces market growth trajectories across the forecast period.

Australia Lubricants Market Trends:

Accelerating Adoption of Synthetic and High-Performance Lubricants

The Australian market is witnessing a pronounced shift toward synthetic and semi-synthetic lubricant formulations that deliver superior thermal stability, extended drain intervals, and enhanced equipment protection. Vehicle manufacturers are increasingly specifying advanced lubricants for modern engine technologies, including turbocharged powertrains and start-stop systems. End-users across automotive and industrial segments are recognizing the total cost of ownership benefits associated with premium lubricant products, driving premiumization trends. For instance, in May 2025, Graphene Manufacturing Group Ltd. (GMG) launched its website, www.g-lubricant.com, enabling direct sales of its energy-saving G® Lubricant, a graphene-based liquid concentrate designed to improve the performance of diesel and petrol engines. The website debut is accompanied by an animated video highlighting the product’s benefits and ease of use, offering customers a visually engaging overview of G-Lubricant’s performance-enhancing capabilities.

Growing Emphasis on Sustainable and Biodegradable Lubricant Solutions

Environmental sustainability is emerging as a critical consideration influencing lubricant selection across Australian industries. Biodegradable lubricants are gaining traction in environmentally sensitive applications, including forestry, marine operations, and agricultural machinery. The circular economy concept is driving interest in re-refined lubricants and waste oil management programs. Manufacturers are investing in research and development to formulate eco-friendly products that meet stringent performance requirements while minimizing environmental impact. For instance, in September 2024, Viva Energy Australia introduced the Shell PANOLIN line of biodegradable lubricants, offering improved environmental performance while maintaining high operational efficiency. Although biodegradable lubricants have been used in the construction sector for years, particularly in projects near water bodies and environmentally sensitive locations, they were traditionally viewed as inferior in quality. Growing advancements in formulation are now changing this perception, positioning environmentally acceptable lubricants as reliable, high-performance solutions for demanding jobsite conditions.

Integration of Digital Technologies and Predictive Maintenance Systems

The lubricants industry is increasingly leveraging digital technologies to optimize product application and maintenance scheduling. Condition monitoring systems utilizing sensors and data analytics enable real-time lubricant performance assessment and predictive maintenance capabilities. Mining operations and industrial facilities are adopting smart lubrication management solutions to reduce equipment downtime, extend machinery life cycles, and optimize lubricant consumption. These technological advancements are transforming traditional lubrication practices across the market.

Market Outlook 2026-2034:

The Australia lubricants market outlook remains positive, supported by favorable macroeconomic conditions, expanding industrial activity, and sustained automotive sector growth. Infrastructure development programs, including government-sanctioned road and rail investments, are expected to generate consistent demand for construction equipment lubricants. The mining sector's continued expansion, particularly in critical minerals extraction, will sustain requirements for heavy-duty industrial lubricants. Electric vehicle adoption, while growing, is anticipated to have a gradual impact on lubricant demand patterns, with traditional combustion engine vehicles maintaining market dominance through the medium term. The market generated a revenue of USD 2,961.53 Million in 2025 and is projected to reach a revenue of USD 4,333.36 Million by 2034, growing at a compound annual growth rate of 4.32% from 2026-2034.

Australia Lubricants Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Engine Oil | 26% |

| Base Oil | Mineral Oil | 48% |

| End Use Industry | Automotive and Other Transportation | 30% |

| Region | Australia Capital Territory & New South Wales | 27% |

Product Type Insights:

- Engine Oil

- Transmission/Hydraulic Fluid

- Metalworking Fluid

- General Industrial Oil

- Gear Oil

- Grease

- Process Oil

- Others

The engine oil dominates with a market share of 26% of the total Australia lubricants market in 2025.

Engine oil maintains its position as the leading product category within Australia's lubricants market, reflecting the nation's substantial automotive fleet and established vehicle maintenance practices. The segment benefits from consistent replacement cycles driven by manufacturer-recommended service intervals and growing consumer understanding of lubricant quality. With over one million new vehicles sold annually and an existing vehicle population requiring regular servicing, engine oil demand remains resilient. The Australian preference for personal transportation and the presence of vast distances between population centers necessitate reliable vehicle performance, supporting sustained engine oil consumption.

The evolution of engine technologies toward more sophisticated designs is driving premiumization within the engine oil segment. Modern engines featuring turbocharging, direct injection, and start-stop systems demand lubricants with superior thermal stability, deposit control, and wear protection properties. Synthetic and semi-synthetic engine oils are gaining market penetration as vehicle manufacturers increasingly specify advanced formulations. The aftermarket channel, including independent workshops and retail outlets, continues to play a significant role in engine oil distribution, complementing authorized service networks across metropolitan and regional areas.

Base Oil Insights:

- Mineral Oil

- Synthetic Oil

- Bio-based Oil

The mineral oil leads with a share of 48% of the total Australia lubricants market in 2025.

Mineral oil dominates the Australia lubricants market due to its cost-effectiveness and widespread suitability across automotive, industrial, and commercial applications. Many vehicle owners, fleet operators, and industrial users prefer mineral-based lubricants for standard engines and machinery because they provide reliable performance at a lower price point compared to synthetic alternatives. In price-sensitive segments such as heavy-duty transport, mining, and agriculture, mineral oils remain the preferred choice due to their proven effectiveness and broad availability.

Another key factor supporting the leadership of mineral oil is Australia’s large installed base of older vehicles and industrial equipment designed to operate efficiently with conventional lubricants. Mineral oils are compatible with a wide range of engines and machinery, simplifying maintenance and reducing the need for specialized products. Additionally, well-established distribution networks and familiarity among service providers reinforce continued usage, sustaining strong demand for mineral-based lubricants across both urban and regional markets.

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Power Generation

- Automotive and Other Transportation

- Heavy Equipment

- Food and Beverage

- Metallurgy and Metalworking

- Others

The automotive and other transportation exhibit a clear dominance with a 30% share of the total Australia lubricants market in 2025.

The automotive and transportation segment leads the Australia lubricants market due to the country’s high vehicle ownership levels and strong dependence on road transport for passenger and freight movement. Long travel distances between cities and regional areas result in higher vehicle usage, increasing the frequency of engine oil and lubricant consumption. A large on-road vehicle fleet, including passenger cars, commercial vehicles, and two-wheelers, sustains consistent demand for lubricants used in engines, transmissions, and drivetrains.

Additionally, Australia’s well-developed logistics, mining, and construction sectors rely heavily on heavy-duty trucks, buses, and off-highway vehicles, all of which require specialized lubricants for reliable performance. Harsh operating conditions, including high temperatures, dust, and extended operating hours, accelerate lubricant wear and replacement cycles. This drives sustained demand for high-performance automotive and transportation lubricants, reinforcing the segment’s leading position in the overall Australia lubricants market.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales represent the largest share with 27% of the total Australia lubricants market in 2025.

In the Australian Capital Territory (ACT) and New South Wales (NSW), steady economic growth and expanding infrastructure development are key factors driving the lubricants market. The expansion of road networks, public transport projects, and construction activities increases the use of construction machinery and heavy vehicles, which rely on engine oils and specialty lubricants for efficient operations. Additionally, the high concentration of urban commuters and commercial fleets in cities like Canberra and Sydney supports demand for automotive lubricants, as regular maintenance is critical to vehicle performance and longevity.

Another major driver in ACT and NSW is the thriving logistics and transportation sector. Both regions serve as transportation hubs, with NSW housing Australia’s busiest ports and freight corridors. This leads to increased usage of lubricants in long-haul trucking, warehousing equipment, and rail services. Moreover, the focus on industrial upgrades and the adoption of advanced machinery across the manufacturing and services sectors further boost lubricant consumption. Combined with regulatory emphasis on vehicle safety and emissions standards, these trends promote sustained market growth.

Market Dynamics:

Growth Drivers:

Why is the Australia Lubricants Market Growing?

Expanding Automotive Fleet and Vehicle Ownership Growth

Australia's automotive sector continues to drive substantial lubricant demand through expanding vehicle ownership and consistent aftermarket activity. For instance, on December 3, the Federal Chamber of Automotive Industries reported that November 2025 saw 97,037 new vehicle registrations. Cumulative new vehicle sales for the first eleven months reached 1,111,064 units. Population growth, rising disposable incomes, and the essential role of personal transportation in Australian lifestyle contribute to sustained vehicle sales and an expanding vehicle parc. The geographic distribution of Australia's population across significant distances necessitates vehicle ownership for daily commuting and regional travel. Vehicle manufacturers and dealerships promote regular maintenance schedules, reinforcing lubricant replacement practices. The commercial vehicle segment, including light commercial vehicles popular among tradespeople and small businesses, adds incremental demand. The combination of new vehicle acquisitions and maintenance requirements for existing vehicles creates a robust and recurring lubricant demand base that supports market growth.

Mining Industry Expansion and Heavy Equipment Operations

Australia's mining industry represents a critical demand driver for industrial lubricants, requiring specialized formulations for heavy-duty machinery operating under extreme conditions. The nation's abundant mineral resources, including iron ore, coal, lithium, and rare earth elements, support extensive mining operations across multiple states. Mining equipment including haul trucks, excavators, drilling rigs, and processing machinery require substantial quantities of hydraulic fluids, gear oils, and greases to maintain operational efficiency. The harsh operating environments characterized by high temperatures, dust exposure, and continuous operation necessitate premium lubricant solutions offering enhanced protection and extended service intervals. Investments in automation and advanced mining technologies are creating additional requirements for specialized lubrication solutions compatible with sophisticated machinery systems.

Infrastructure Development and Government Investment Programs

Government-led infrastructure development programs are generating sustained demand for lubricants across the construction and transportation sectors. Federal and state government commitments to road, rail, and urban development projects require extensive deployment of construction machinery and heavy equipment. Major infrastructure initiatives, including highway expansions, railway developments, and urban renewal projects create consistent lubricant consumption patterns across project lifecycles. The construction sector's reliance on earthmoving equipment, concrete machinery, and material handling systems generates requirements for diverse lubricant product categories. Australia's focus on regional connectivity and logistics infrastructure enhancement further supports lubricant demand growth. The long-term nature of infrastructure investment programs provides visibility and stability for lubricant demand forecasting across the construction sector.

Market Restraints:

What Challenges the Australia Lubricants Market is Facing?

Rising Electric Vehicle Adoption and Reduced Lubricant Requirements

The increasing adoption of electric vehicles presents a structural challenge to traditional lubricant demand patterns in the automotive segment. Electric vehicles require significantly fewer lubricant products compared to internal combustion engine vehicles, eliminating the need for engine oil changes. As electric vehicle penetration accelerates, supported by government incentives and charging infrastructure expansion, the traditional automotive lubricant market faces potential volume displacement. Battery electric vehicles, while requiring some specialized fluids for thermal management and transmissions, represent a fundamentally different consumption profile for lubricant suppliers.

Raw Material Price Volatility and Supply Chain Complexities

Lubricant manufacturers face challenges from volatile base oil and additive prices influenced by global petroleum markets and supply chain dynamics. The cost structure of lubricant production remains tied to crude oil price movements, creating margin pressure during periods of feedstock cost increases. Australia's geographic isolation adds logistics costs and lead times for imported base oils and specialty additives. Supply chain disruptions, whether from geopolitical factors or transportation constraints, can impact product availability and pricing stability across the market.

Extended Drain Intervals and Reduced Consumption Frequency

Advances in lubricant technology enabling extended drain intervals present a paradoxical challenge to market volume growth. High-performance synthetic lubricants offering longer service life reduce replacement frequency, potentially constraining volume growth despite their premium pricing. Vehicle manufacturers are extending recommended service intervals, reducing the number of lubricant changes required over vehicle lifespans. While this trend supports premiumization and value growth, it creates headwinds for volume-based market expansion.

Competitive Landscape:

The Australia lubricants market features a competitive landscape characterized by established multinational petroleum corporations, specialized lubricant manufacturers, and regional distributors. Market participants compete across multiple dimensions including product performance, brand reputation, distribution network coverage, and technical service capabilities. Original equipment manufacturer relationships and approvals represent significant competitive advantages, particularly in automotive and heavy equipment segments. The market demonstrates consolidation among major suppliers while accommodating niche players serving specialized applications. Distribution partnerships with automotive service networks, mining operators, and industrial facilities constitute essential market access channels. Sustainability credentials and environmental certifications are emerging as competitive differentiators as end-users increasingly prioritize ecological considerations. Innovation in lubricant formulations, packaging solutions, and digital service offerings enables differentiation in a mature market environment.

Recent Developments:

-

In December 2024, LIQUI MOLY launched its new Special Tec T series generalist motor oils for the Australian market, designed and formulated in Germany and manufactured in Thailand. The range provides outstanding wear protection, lowers oil and fuel consumption, keeps engines clean, and ensures fast oil penetration using modern base oils and additives to fulfill the requirements of modern vehicles.

-

In August 2024, SKF announced its acquisition of John Sample Group's (JSG) Lubrication and Flow Management divisions, a strategy designed to enhance its lubrication management solutions, especially in the expanding India and Southeast Asia markets. JSG, based in Sydney, Australia, is recognized for offering sophisticated lubrication management solutions and services in sectors like mining, construction, pulp and paper, and food and beverages.

Australia Lubricants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Engine Oil, Transmission/Hydraulic Fluid, Metalworking Fluid, General Industrial Oil, Gear Oil, Grease, Process Oil, Others |

| Base Oils Covered | Mineral Oil, Synthetic Oil, Bio-based Oil |

| End Use Industries Covered | Power Generation, Automotive and Other Transportation, Heavy Equipment, Food and Beverage, Metallurgy and Metalworking, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia lubricants market size was valued at USD 2,961.53 Million in 2025.

The Australia lubricants market is expected to grow at a compound annual growth rate of 4.32% from 2026-2034 to reach USD 4,333.36 Million by 2034.

Engine oil dominated the market with a share of 26% in 2025, driven by Australia's substantial automotive fleet, established vehicle maintenance culture, and growing demand for premium lubricant formulations compatible with modern engine technologies.

Key factors driving the Australia lubricants market include expanding vehicle ownership and automotive aftermarket activity, extensive mining operations requiring heavy-duty lubricants, government infrastructure investment programs, growing adoption of synthetic and high-performance lubricant formulations, and increasing emphasis on equipment reliability and operational efficiency.

Major challenges include rising electric vehicle adoption reducing traditional lubricant requirements, raw material price volatility affecting production costs, extended drain intervals enabled by advanced formulations constraining volume growth, supply chain complexities due to geographic isolation, and intensifying competition requiring continuous product innovation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)