Australia Luxury Apparel Market Size, Share, Trends and Forecast by Type, Distribution Channel, End User, and Region, 2025-2033

Australia Luxury Apparel Market Overview:

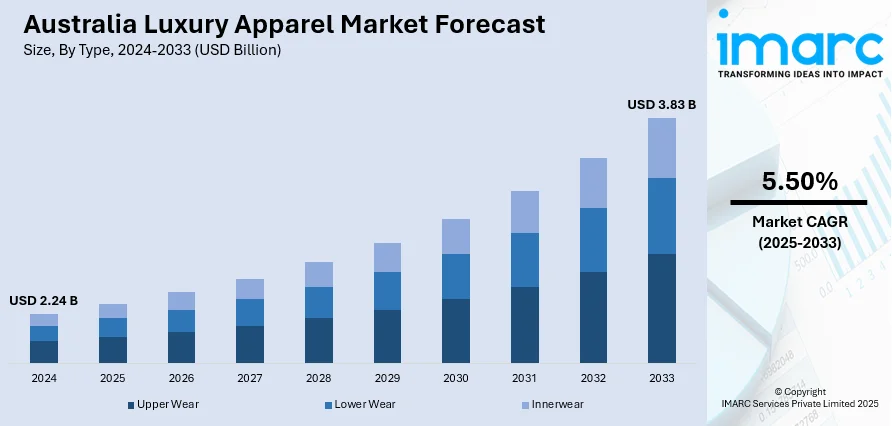

The Australia luxury apparel market size reached USD 2.24 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.83 Billion by 2033, exhibiting a growth rate (CAGR) of 5.50% during 2025-2033. The market is experiencing steady growth, driven by rising disposable incomes, growing interest in high-end fashion, and expanding affluent consumer base. Premium brands and designer labels are also in high demand, especially in urban areas. With increasing global connectivity and the rise of online shopping, Australia luxury apparel market share is poised to expand, fueled by both local and international consumer interest in luxury fashion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.24 Billion |

| Market Forecast in 2033 | USD 3.83 Billion |

| Market Growth Rate 2025-2033 | 5.50% |

Australia Luxury Apparel Market Trends:

Rising Affluence

Increased prosperity is one of the primary drivers of the expanding Australian market for high fashion. Increased disposable incomes translate into more and more consumers spending on luxury and premium clothing. According to the data published by the Australian Bureau of Statistics, the household saving-to-income ratio rose to 5.2% as gross disposable income increased. Australia's growing base of prosperous consumers, especially in major cities such as Sydney and Melbourne, is building a bigger market for designer brands, exclusive ranges, and high-end craftsmanship. This trend is also indicated by changing consumer tastes toward luxury as a status symbol and mode of self-expression. With the accumulation of wealth among younger generations, including millennials and Gen Z, the luxury clothing industry is opening up to a larger group. Luxury consumers are also increasingly concerned with value, looking for classic, long-lasting pieces over momentary fashions. Consequently, the luxury fashion demand keeps rising, altering the fashion landscape in Australia.

To get more information on this market, Request Sample

Growing Focus on Sustainability

Australia luxury apparel market growth is being strongly influenced by a shift toward sustainability, with consumers increasingly prioritizing eco-friendly and ethically produced fashion. With increased awareness on environmental concerns and ethical behavior, Australian consumers are increasingly interested in luxury brands that emphasize sustainable resources, green footprints, and fair labor conditions. Luxury brands are adapting by embracing organic material, reused materials, and transparent supply channels. Luxury consumers are also looking for classic, long-lasting products rather than fast fashion, as they appreciate quality that lasts and integrity in sourcing. This call for sustainability not only is influencing the shopping behavior of Australian consumers but is also compelling luxury brands to realign their business models. For instance, in June 2024, CABLE Boutique opened on Rundle Street East, offering sustainable luxury fashion using natural fibres like Merino wool. Founded by Georgina Austin, the brand emphasizes durability and eco-friendly practices. With 19 locations nationwide, CABLE aims to lead the sustainable fashion movement while providing stylish, high-quality garments for modern women. Luxury consumers' increasing inclination towards sustainable fashion is anticipated to be sustained, having a major impact on the market in the future.

Australia Luxury Apparel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, distribution channel, and end user.

Type Insights:

- Upper Wear

- Lower Wear

- Innerwear

The report has provided a detailed breakup and analysis of the market based on the type. This includes upper wear, lower wear, and innerwear.

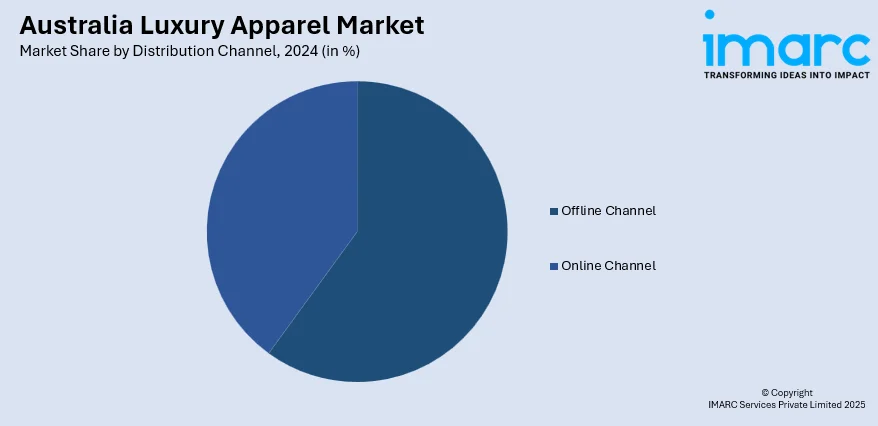

Distribution Channel Insights:

- Offline Channel

- Online Channel

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline channel and online channel.

End User Insights:

- Men

- Women

- Children

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes men, women, and children.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Luxury Apparel Market News:

- In May 2025, Burnside Village in Adelaide announced its plans to launch its major expansion featuring luxury brands like CAMILLA and Gucci. The development emphasizes a high-end retail experience, including MECCA's largest store in South Australia and new dining options. Over 80 retailers will eventually join the precinct, enhancing the shopping landscape.

- In September 2024, Gucci opened a new boutique in Perth's Raine Square, showcasing creative director Sabato De Sarno's vision. The 4,399 square foot space features a blend of heritage and modern design, eco-friendly elements, and striking interiors.

Australia Luxury Apparel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Upper Wear, Lower Wear, Innerwear |

| Distribution Channels Covered | Offline Channel, Online Channel |

| End Users Covered | Men, Women, Children |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia luxury apparel market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia luxury apparel market on the basis of type?

- What is the breakup of the Australia luxury apparel market on the basis of distribution channel?

- What is the breakup of the Australia luxury apparel market on the basis of end user?

- What is the breakup of the Australia luxury apparel market on the basis of region?

- What are the various stages in the value chain of the Australia luxury apparel market?

- What are the key driving factors and challenges in the Australia luxury apparel market?

- What is the structure of the Australia luxury apparel market and who are the key players?

- What is the degree of competition in the Australia luxury apparel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia luxury apparel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia luxury apparel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia luxury apparel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)