Australia Luxury Fashion Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2026-2034

Australia Luxury Fashion Market Overview:

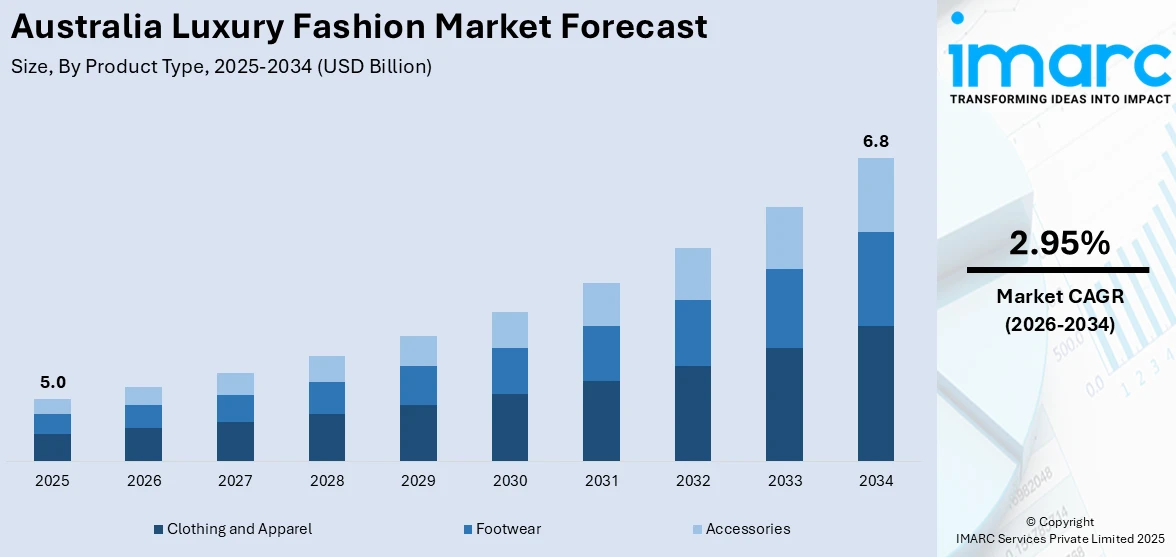

The Australia luxury fashion market size reached USD 5.2 Billion in 2025. Looking forward, the market is projected to reach USD 6.8 Billion by 2034, exhibiting a growth rate (CAGR) of 2.95% during 2026-2034. The rising disposable incomes, increasing demand for premium apparel, growing influence of celebrity culture, expanding urban population, increasing social media influence, digital retail expansion, and heightened consumer awareness regarding global fashion trends are some of the major factors augmenting the Australia luxury fashion market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5.2 Billion |

| Market Forecast in 2034 | USD 6.8 Billion |

| Market Growth Rate 2026-2034 | 2.95% |

Key Trends of Australia Luxury Fashion Market:

Sustainability and Ethical Fashion Consumption

The significant shift toward sustainability, driven by increasing consumer awareness of environmental and ethical concerns, is positively impacting Australia luxury fashion market outlook. According to an industry report, approximately 46% of consumers are more inclined to purchase a fashion item when it is labeled as "sustainably made" or something similar. This puts increased pressure on brands to curb their carbon emissions, use environmentally responsible materials, and ensure ethical labor practices across their supply chains. Australian consumers, especially millennials and Gen Z, are prioritizing transparency and traceability, expecting brands to disclose the origins of raw materials, production methods, and working conditions. This trend is resulting in luxury labels adopting circular fashion models, including garment recycling, resale platforms, and rental services. Indigenous fashion designers are also gaining traction by integrating eco-conscious practices rooted in traditional knowledge and land stewardship. Moreover, local and international luxury players are investing in green certifications, low-impact dyes, and organic textiles to align with sustainability goals. The Australian government's focus on reducing textile waste through national waste policies further complements these industry efforts. This movement is redefining brand value, where authenticity, responsibility, and sustainability increasingly influence purchasing decisions.

To get more information on this market Request Sample

Digital Innovations and Omnichannel Integration

Digital transformation is redefining the luxury apparel industry in Australia, where the convergence of online and offline shopping experiences is becoming mandatory. Luxury labels are increasing their digital presence with rich e-commerce platforms, mobile apps, and social media interactions that appeal to digital-savvy consumers who are looking for ease without sacrificing exclusivity. The merge of artificial intelligence (AI) driven personalization, virtual fitting rooms, and fashion events live streamed is revolutionizing how customers engage with luxury brands. For example, on May 8, 2024, an Australian-based online personal styling service launched the Curated Collection, an AI-driven platform that delivers personal clothing suggestions based on individual styles and budgets. This service enables consumers to find and shop from a tailored range without a subscription. The move is set to improve online shopping by providing a more efficient and personalized method of fashion retailing. Additionally, Australian retailers are investing more in omnichannel strategies that combine physical boutiques with digital interfaces. Facilities like click-and-collect, same-day delivery, and AI-powered customer service are enhancing shopping experience and brand loyalty. Along with this, augmented reality (AR) and virtual reality (VR) are also increasing in popularity, allowing consumers to see products more realistically prior to purchase, which is facilitating Australia luxury fashion market growth. Moreover, influencer marketing and partnerships with digital influencers are also increasing brand visibility.

Geographic Expansion

Geographical expansion is an emerging trend in the Australian luxury fashion industry as brands are seeking beyond the traditional luxury centers of Sydney and Melbourne. Fast-emerging cities such as Brisbane and Perth are experiencing increased luxury consumption fueled by an emerging affluent population. They are becoming a key region for luxury brands seeking to expand their base and access new high-net-worth segments. The growing urbanization and increasing disposable incomes in these cities have provided the necessary conditions for upscale retailing. As demand increases for premium products in these regions brands are opening new outlets and providing customized experiences to attract native customers to ensure increased presence and market share throughout Australia.

Growth Drivers of Australia Luxury Fashion Market:

Rapid Urbanization

Urbanization is also a major catalyst in the Australian high-end fashion industry, with Sydney and Melbourne becoming principal urban centers for luxury retail. As the cities develop, they attract more affluent, diversified consumers who demand the high-end products, fuelling growth. Flagship stores and upscale boutiques have opened in prime locations, providing services for high net-worth individuals who are looking to access the current fashion trends and designer range. The metropolitan population is attracted to luxury shopping experiences that are bespoke in nature, exclusive in nature, and that will enable them to display their status. As urbanization continues, Sydney and Melbourne will maintain their dominant influence in shaping Australia luxury fashion market share, setting the pace for luxury consumption in the country.

Cultural Shift Towards Premium Lifestyles

Australians are increasingly moving towards a culture of high-end living, where luxury brands are regarded not merely as fashion accessories but as expressions of uniqueness and lifestyle. This shift in culture has created increasing demand for premium, exclusive, and limited-edition fashion products that symbolize uniqueness and prestige. Consumers are now more inclined to spend money on high-end apparel and accessories that epitomize their values, tastes, and status. This trend is driven by a need for high-quality craftsmanship, standout designs, and one-of-a-kind pieces that enhance their sense of style. As demand for quality and uniqueness intensifies, the luxury fashion sector keeps growing in Australia.

Influence of Social Media

Social media has become a powerful tool in driving the Australia luxury fashion market demand, with platforms like Instagram and TikTok influencing consumer behavior. The increased use of influencers and celebrities has democratized luxury fashion, with these individuals promoting top-end brands and making trends that others emulate. Fashion events and collaborations between brands and consumption shared on the internet also drive consumer demand and foster a sense of privilege. As Australians engage more on social media, their exposure to global fashion trends has increased their desire for luxury items. Social media has broken down the gap between consumers and brands, and luxury fashion has become more accessible and desirable to wide-ranging demographics.

Opportunities of Australia Luxury Fashion Market:

Collaborations and Limited-Edition Collections

Collaborations and special-edition collections are effective strategies in the luxury fashion industry, providing brands with the ability to produce limited, highly sought-after products. Through collaboration with well-known artists, designers, or celebrities, brands can create publicity and hype, drawing high-end customers seeking rare and one-of-a-kind products. These collaborations capitalize on shoppers' need for exclusivity and originality, as possessing limited-edition items frequently translates into social status and distinction. The feeling of rarity and exclusivity that goes with such collections creates great demand and brand awareness. In addition to this, limited-product offerings build loyalty for current customers while attracting new customers. With the growing competition in the luxury market, collaborations and special collections are fast becoming a way of life for differentiation and expansion.

Customization and Personalization

Providing unique, personalized products is emerging as an important opportunity for luxury fashion brands targeting high-net-worth consumers in search of distinctiveness and exclusivity. Providing customized articles like custom-designed apparel, monogrammed accessories, or personalized clothes is attractive to consumers seeking individuality. The provision of such personalized services enables brands to stand out from the competition and establish strong customer loyalty. With technology allowing for more streamlined customization procedures, such as virtual design tools and direct customer interactions, luxury fashion brands can deliver a very personalized experience. As customers continue to desire unique, one-of-a-kind garments that express their individual tastes, the trend of customization and personalization will be a key driver for the Australian luxury fashion industry.

Rise of Luxury Streetwear

The growing popularity of luxury streetwear represents an exciting opportunity for brands to tap into a new, younger market segment that blends high-end fashion with casual, everyday wear. This trend, driven by the influence of celebrities, influencers, and fashion-forward youth, is shifting the perception of luxury fashion. No longer limited to formal or traditional styles, luxury streetwear embraces bold, casual, and comfortable designs that appeal to those seeking luxury without compromising on style or comfort. Brands that merge premium quality with streetwear aesthetics can attract younger consumers who value exclusivity and design innovation. By tapping into this emerging trend, luxury brands can diversify their product offerings and cater to a wider audience, ensuring long-term market relevance in the evolving fashion landscape. According to Australia luxury fashion market analysis, the rise of luxury streetwear is set to play a pivotal role in the industry’s growth.

Australia Luxury Fashion Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type, distribution channel, and end user.

Product Type Insights:

- Clothing and Apparel

- Jackets and Coats

- Skirts

- Shirts and T-Shirts

- Dresses

- Trousers and Shorts

- Denim

- Underwear and Lingerie

- Others

- Footwear

- Accessories

- Gems and Jewellery

- Belts

- Bags

- Watches

The report has provided a detailed breakup and analysis of the market based on the product type. This includes clothing and apparel (jackets and coats, skirts, shirts and T-shirts, dresses, trousers and shorts, denim, underwear and lingerie, and others), footwear, and accessories (gems and jewellery, belts, bags, and watches).

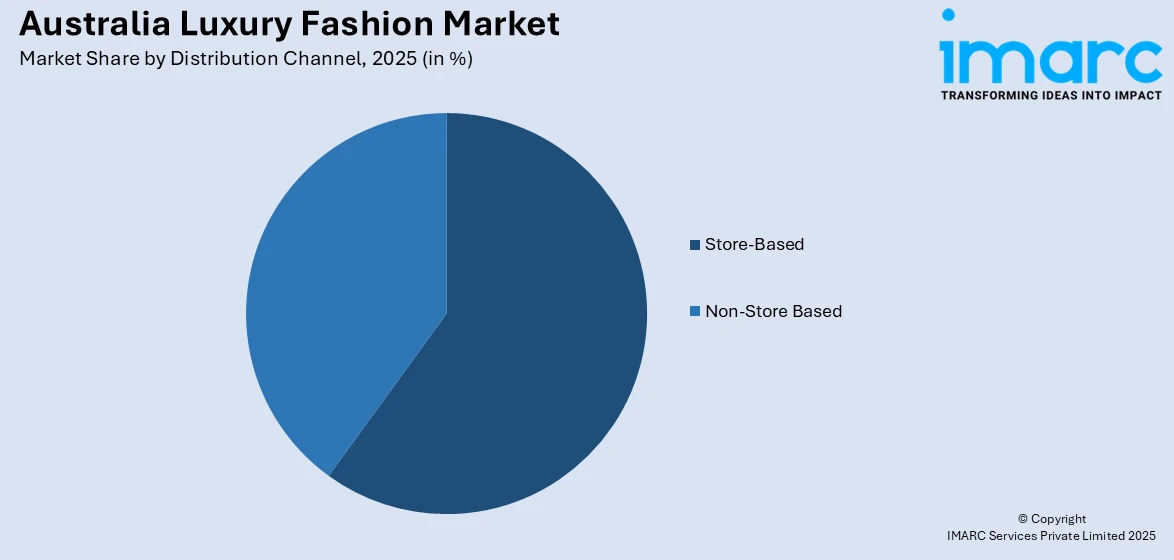

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Store-Based

- Non-Store Based

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes store-based and non-store based.

End User Insights:

- Men

- Women

- Unisex

The report has provided a detailed breakup and analysis of the market based on the end user. This includes men, women, and unisex.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Luxury Fashion Market News:

- On January 14, 2025, Moda Operandi and Australian brand Posse unveiled an exclusive 16-piece capsule collection emphasizing timeless silhouettes and sustainable materials. The collection features neutral, muted hues and includes standout pieces such as the Harlan Knit Jacket and the Alice Silhouette in red floral linen. This collaboration aims to blend Posse's sleek Australian aesthetic with Moda Operandi's commitment to offering curated, fashion-forward selections.

- In May 2025, Goldfield & Banks launched its Pacific Rock Flower fragrance at a pop-up in Sydney International Airport, in collaboration with Heinemann Oceania. The aquatic, floral eau de parfum celebrates Australian botanicals. Founder Dimitri Weber emphasized its tribute to the coastline, making it a proud milestone for the luxury fragrance brand.

- In March 2025, Balmain Beauty launched Les Éternels de Balmain in Australia, partnering exclusively with David Jones. The collection features eight all-gender eaux de parfum inspired by Pierre Balmain’s heritage and Olivier Rousteing’s vision. This expansion marks a significant step in Balmain’s growth within the luxury beauty market, backed by Estée Lauder.

- In October 2024, Dior opened a boutique in Westfield Bondi, Sydney, featuring a blend of traditional and modern design. The store showcases a beach-themed capsule collection with eco-friendly items and highlights the Autumn-Winter 2024-2025 ready-to-wear collection by Maria Grazia Chiuri, along with Kim Jones’ Winter 2024-2025 collection inspired by Rudolf Nureyev.

- In July 2024, the Australian luxury fashion brand ZIMMERMANN, founded by sisters Nicky and Simone Zimmermann, announced plans for international expansion following Advent's acquisition in 2023. With over 20 stores in the US and new locations opening in Europe, Asia, and the Middle East, the brand remains dedicated to its Australian heritage while pursuing global growth.

Australia Luxury Fashion Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Store-Based, Non-Store Based |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia luxury fashion market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia luxury fashion market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia luxury fashion industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The luxury fashion market in the Australia was valued at USD 5.2 Billion in 2025.

The Australia luxury fashion market is projected to exhibit a compound annual growth rate (CAGR) of 2.95% during 2026-2034.

The Australia luxury fashion market is expected to reach a value of USD 6.8 Billion by 2034.

Growth drivers of the Australia luxury fashion market are fueled by rising disposable income, allowing affluent consumers to invest in high-end fashion. Urbanization is also contributing, as luxury consumption grows beyond traditional cities like Sydney and Melbourne to emerging regions. A cultural shift toward luxury as a status symbol, exposure to global fashion trends, and the integration of technology in retail are also driving growth.

Key trends in the Australia luxury fashion market include the rise of quiet luxury, where consumers prefer subtle, high-quality items over obvious branding and logos. Sustainability is another key trend, with a growing demand for eco-friendly and ethically sourced products. The expansion of e-commerce platforms is making luxury fashion more accessible, while social media, driven by influencers and celebrities, plays a significant role in shaping consumer preferences.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)