Australia Luxury Interior Design Market Size, Share, Trends and Forecast by Type, Material, Style, Distribution Channel, Application, and Region, 2025-2033

Australia Luxury Interior Design Market Size Overview:

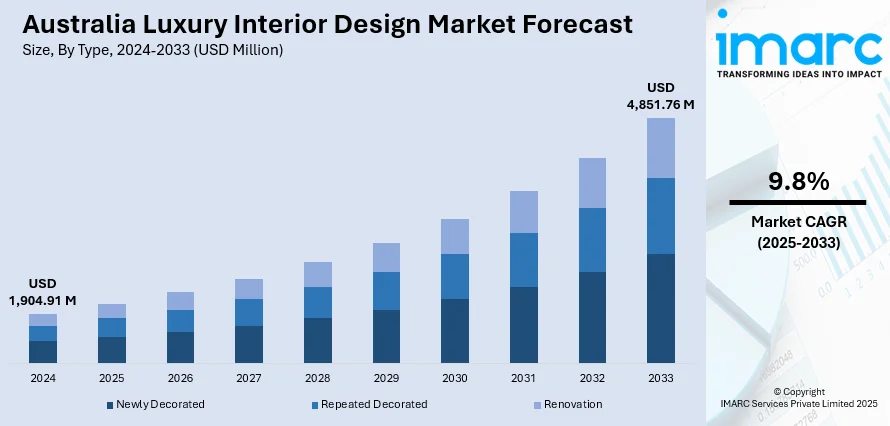

The Australia luxury interior design market size reached USD 1,904.91 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,851.76 Million by 2033, exhibiting a growth rate (CAGR) of 9.8% during 2025-2033. The market is thriving, propelled by rising affluence, urban development, and growing demand for personalized, high-end living spaces. Major cities like Sydney, Melbourne, and Brisbane lead this trend, with increasing interest in sustainable materials, smart home technologies, and bespoke aesthetics. These factors collectively shape the Australia luxury interior design market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,904.91 Million |

| Market Forecast in 2033 | USD 4,851.76 Million |

| Market Growth Rate 2025-2033 | 9.8% |

Australia Luxury Interior Design Market Trends:

Urbanization and High-End Real Estate Development

Australia’s luxury interior design market is strongly driven by rapid urbanization and the rise of premium real estate developments in major cities like Sydney, Melbourne, and Brisbane. These urban centers are witnessing increasing demand for bespoke interior solutions in upscale residences, commercial buildings, and hospitality spaces. Developers and property buyers are focusing on distinctive, design-forward interiors that elevate both functionality and aesthetic appeal. High-rise luxury apartments and exclusive homes are now integrating curated art, imported materials, and custom furnishings. As cities expand and high-income individuals invest in luxury properties, interior designers are crucial in crafting elegant, tailored environments. This strong link between urban growth and real estate sophistication continues to reinforce the vital role of interior design in defining modern Australian luxury living.

To get more information on this market, Request Sample

Sustainability and Eco-Conscious Design Preferences

The growing environmental awareness is acting as a major factor driving the Australia luxury interior design market growth. Increasingly, clients are requesting interiors that reflect sustainable values without compromising on elegance. Design professionals now source eco-friendly materials like recycled metals, reclaimed wood, and organic textiles to deliver premium aesthetics with a lower carbon footprint. Projects also integrate energy-efficient lighting, solar solutions, and smart ventilation systems to align with green building standards. National sustainability frameworks, like NABERS and the Green Star rating system, are accelerating this shift. Luxury clients view environmentally responsible choices as a marker of modern sophistication. As sustainability and ethics become lifestyle statements, interior designers in Australia are adapting by creating spaces that are beautiful, functional, and ecologically sound.

Rising Affluence and Lifestyle Aspirations

As income levels and discretionary spending rise in Australia, consumers increasingly seek to enhance their living environments through premium interior design. Affluent individuals now prioritize aesthetics, comfort, and personalization, choosing spaces that reflect their values, identity, and status. This growing wealth has expanded the client base for luxury interior designers, including entrepreneurs, executives, and investors seeking unique design statements. The desire for opulence without compromising on functionality has made custom finishes, exclusive décor pieces, and global design influences highly sought-after. Whether it’s a penthouse, private villa, or executive office, Australians are turning to design professionals to translate lifestyle aspirations into sophisticated, high-end spaces. This trend plays a key role in shaping the growth trajectory of Australia’s luxury interior design industry.

Australia Luxury Interior Design Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, material, style, distribution channel, and application.

Type Insights:

- Newly Decorated

- Repeated Decorated

- Renovation

The report has provided a detailed breakup and analysis of the market based on the type. This includes newly decorated, repeated decorated, and renovation.

Material Insights:

- Textiles

- Wood

- Metals

- Glass

- Ceramics

- Plastics

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes textiles, wood, metals, glass, ceramics, plastics, and others.

Style Insights:

- Modern

- Traditional

- Rustic

- Vintage

- Classical

- Others

A detailed breakup and analysis of the market based on the style have also been provided in the report. This includes modern, traditional, rustic, vintage, classical, and others.

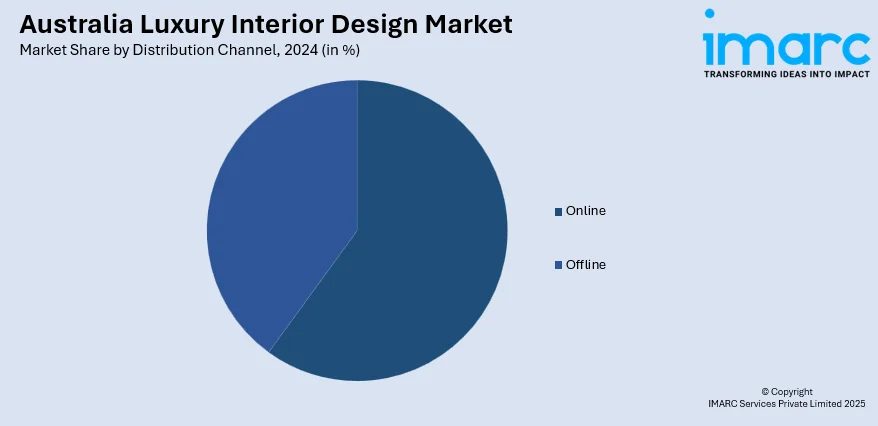

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Application Insights:

- Residential

- Commercial

- Hospitality

- Retail

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial, hospitality, retail, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include the Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Luxury Interior Design Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Newly Decorated, Repeated Decorated, Renovation |

| Materials Covered | Textiles, Wood, Metals, Glass, Ceramics, Plastics, Others |

| Styles Covered | Modern, Traditional, Rustic, Vintage, Classical, Others |

| Distribution Channels Covered | Online, Offline |

| Applications Covered | Residential, Commercial, Hospitality, Retail, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia luxury interior design market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia luxury interior design market on the basis of type?

- What is the breakup of the Australia luxury interior design market on the basis of material?

- What is the breakup of the Australia luxury interior design market on the basis of style?

- What is the breakup of the Australia luxury interior design market on the basis of distribution channel?

- What is the breakup of the Australia luxury interior design market on the basis of application?

- What is the breakup of the Australia luxury interior design market on the basis of region?

- What are the various stages in the value chain of the Australia luxury interior design market?

- What are the key driving factors and challenges in the Australia luxury interior design market?

- What is the structure of the Australia luxury interior design market and who are the key players?

- What is the degree of competition in the Australia luxury interior design market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia luxury interior design market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia luxury interior design market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia luxury interior design industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)