Australia Luxury Watch Market Size, Share, Trends and Forecast by Type, End User, Distribution Channel, and Region, 2025-2033

Australia Luxury Watch Market Overview:

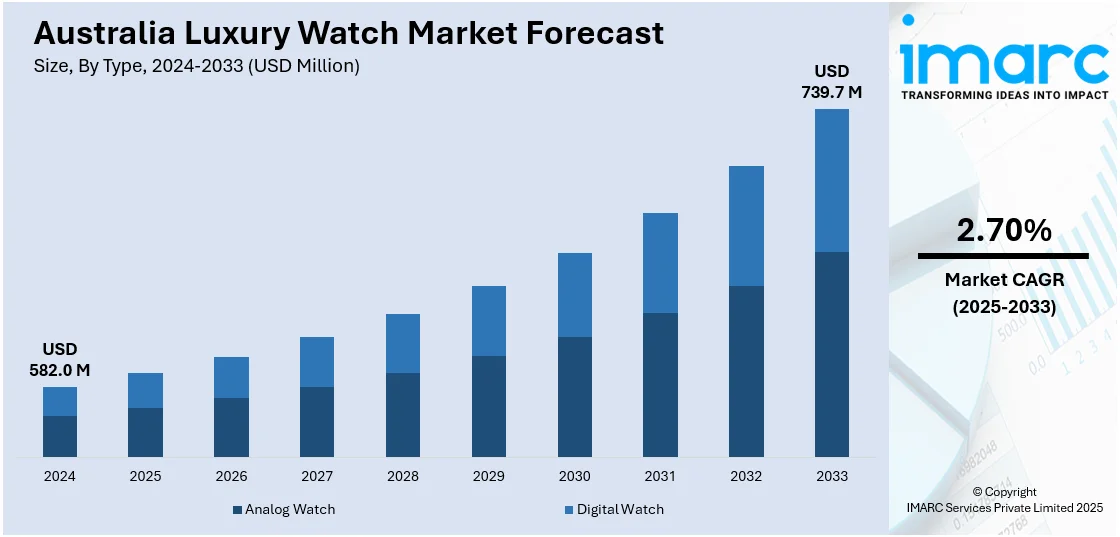

The Australia luxury watch market size reached USD 582.0 Million in 2024. Looking forward, the market is expected to reach USD 739.7 Million by 2033, exhibiting a growth rate (CAGR) of 2.70% during 2025-2033. The market is witnessing substantial growth, fueled by the growing high-net-worth population in the country who are investing in luxury watches as symbols of status and investment opportunities. The growth of online shopping platforms has further increased the reach of luxury watches to a wider audience, making it easier for them to be purchased online and accessed remotely.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 582.0 Million |

| Market Forecast in 2033 | USD 739.7 Million |

| Market Growth Rate 2025-2033 | 2.70% |

Key Trends of Australia Luxury Watch Market:

Pre-Owned Luxury Watch Growth

The Australia luxury watch market growth is fueled by a major shift toward pre-owned watches, owing to the affordability, sustainability, and the charm of vintage watches. This is driven by the growing popularity of second-hand goods among consumers, who see the appeal in being able to afford luxury watches at more manageable prices. Sites such as Chrono24 and WatchBox are fueling this demand further by supplying certified pre-owned watches, thus deepening the market reach. The secondary market gives consumers greater access to watches and also supports sustainability by extending the life cycle of luxury watches, resonating with the increasing consumer desire for sustainable purchasing practices.

To get more information on this market, Request Sample

Focus on Experiential Shopping Environments

The Australia luxury watch market share is increasing as several retailers are re-configuring their stores to deliver rich and experiential experiences that transcend traditional transactional environments. The movement is being pioneered by companies like Audemars Piguet and Vacheron Constantin, through "AP Houses" and "Club 1755," creating boutique-in-spirit space with the looks and feel of a private club or boutique hotel. These establishments concentrate on connecting clients more emotionally with the purchase by providing selective experience like specialty craft beer sampling or art viewings, more so than transacting. This strategy aims to engage consumers on a deeper level, with a sense of belonging and strengthened brand loyalty. By highlighting individual connection and relaxed environment, these brands are winning over high-spending customers as well as new ones and redefining their store spaces for luxury shopping and cultural experiences. This is indicative of a wider shift across the luxury market to build significant and memorable consumer experiences.

Diversification of Consumer Demographics

The Australia luxury watch market outlook is undergoing a diversification in consumer demographics, with increasing interest among younger consumers who are both knowledgeable and enthusiastic about horology. The younger generation appreciates the status symbol that luxury watches signify along with the craftsmanship, heritage, and mechanical sophistication behind every watch. This change has been observed by retailers, who have extended their inventory to cover more brands and styles to accommodate the changing tastes of this group. There is growing demand for diverse and vibrant patterns, and for vintage and one-of-a-kind items, as the new generation aims to be different and express themselves. This shift is encouraging brands to innovate and reposition their product lines to cater to a more sophisticated and diverse customer base. With the evolution of the market, luxury watch retailers in Australia are catching up with this change by providing a wider range of timepieces that appeal to the values and tastes of the contemporary consumer.

Growth Factors of Australia Luxury Watch Market:

Economic Wealth and High-Net-Worth Individuals

Among the most vital drivers of growth for the Australia luxury watch market is the increased number of wealthy consumers and high-net-worth individuals in key cities such as Sydney and Melbourne. Wealth creation in sectors such as mining, finance, property, and technology has given birth to a population with both the means and willingness to spend on high-end watches. In contrast to some markets where luxury watches are viewed mainly as fashion items, in Australia they are also viewed as status goods and long-term investments. This is supported by local clients attending global auctions or buying from boutique outlets in luxury precincts such as Sydney's CBD or Melbourne's Collins Street. In addition, the psychological desire to own traditional Swiss timepieces with highly technical mechanical movements fits with an increasing love affair with craftsmanship and heritage—a sentiment that resonates strongly within Australian culture of tasteful consumption. Collectively, this synergy defines a space in which luxury watches are not mere accessories but rather an investment and emblem of achievement.

Travel and Tourism-Driven Sales

International tourism and outbound travel behavior further fuel the growth of the Australia luxury watch market demand. Overseas travelers, especially from Asia and Europe, tend to buy premium Swiss watches in Australia's duty-free shopping points or main stores, benefiting from comparative price advantage through exchange rate and attractive local taxes. Moreover, Australians traveling overseas for business or pleasure also venture into high-end watch markets abroad, shipping back their buys and adding to domestic appreciation and demand. Metropolises like Melbourne, which attracts tourists through its cultural draw, and Sydney, the port of entry for visitors, have emerged as hubs for luxury watch tourism. The status of working with limited-edition watches and interacting with qualified technicians in these storehouses raises the level of customer experience, cementing confidence about authenticity and post-purchase support. This connection between foreign travel and local demand boosts the growth of luxury watch sales and raises consumer aspiration.

Digital Integration and Online Retail Shifts

According to the Australia luxury watch market analysis, another growth factor that distinguishes the region’s luxury watch market is its rapid shift toward e-commerce and digital engagement. Heritage boutiques and traditional jewelers are investing in user-friendly online platforms featuring interactive high-resolution images, virtual try-on features, and 24/7 concierge services. This digital approach targets the needs of younger, technology-minded consumers in metropolitan areas who anticipate frictionless omnichannel experiences, marrying online browsing and showroom visits. Online marketplaces and certified pre-owned sites have also become popular, providing verified second-hand luxury watches with full-service history, appealing to collectors seeking value and scarcity. Local watch communities and social media influencers, meanwhile, feature Australian-owned collectable pieces, creating peer-driven interest. Other brands have also introduced timepiece rental or subscription models, which allow consumers to switch between models before making a purchase.

Australia Luxury Watch Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, end user, and distribution channel.

Type Insights:

- Analog Watch

- Digital Watch

The report has provided a detailed breakup and analysis of the market based on the type. This includes analog watch and digital watch.

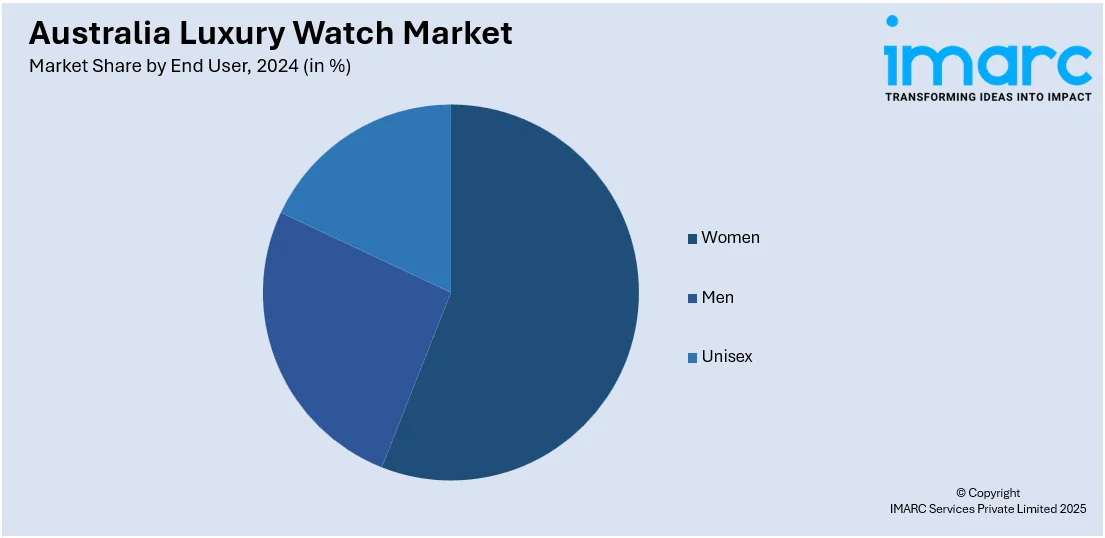

End User Insights:

- Women

- Men

- Unisex

The report has provided a detailed breakup and analysis of the market based on the end user. This includes women, men, and unisex.

Distribution Channel Insights:

- Online Stores

- Offline Stores

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online stores and offline stores.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Luxury Watch Market News:

- In September 2023, the Swiss watchmaker Piaget expanded by launching a flagship store on King Street, enhancing its increasing presence in the area. There is also a shop in Westfield Sydney.

- In June 2025, Kennedy Watches & Jewelry transferred its profitable license as a Rolex retailer in Australia to Singapore’s The Hour Glass, stating it was the appropriate moment to sell since the Swiss watchmaker might sell directly to consumers in the future. James Kennedy, who leads the company, stated that The Hour Glass would take over the leases of its four flagship stores – including a key site at Sydney’s Martin Place – for $90 Million as part of the agreement.

- In August 2023, Jacob & Co, renowned for their luxurious Astronomia complications, made their debut in Australia with Hardy Brothers designated as the official Authorized Dealer for the brand.

Australia Luxury Watch Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Analog Watch, Digital Watch |

| End Users Covered | Women, Men, Unisex |

| Distribution Channels Covered | Online Stores, Offline Stores |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia luxury watch market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia luxury watch market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia luxury watch industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia luxury watch market was valued at USD 582.0 Million in 2024.

The Australia luxury watch market is projected to exhibit a CAGR of 2.70% during 2025-2033.

The Australia luxury watch market is expected to reach a value of USD 739.7 Million by 2033.

The Australia luxury watch market is experiencing a shift toward pre-owned and certified vintage timepieces, reflecting growing consumer interest in sustainability and heritage craftsmanship, representing primary market trend. Meanwhile, digital-first sales strategies, including virtual try-ons and online concierge services, are strengthening connections with younger affluent Australians across Sydney and Melbourne.

Key factors driving Australia's luxury watch market are increasing disposable incomes, demand for collectible watches, and increasing online retail channels. High-net-worth consumers in urban centers such as Sydney and Melbourne also drive demand, as well as rising brand acceptance and appreciation for craftsmanship among fashion-conscious youth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)