Australia Managed Print Services Market Size, Share, Trends and Forecast by Type, Deployment Mode, Organization Size, Industry Vertical, and Region, 2025-2033

Australia Managed Print Services Market Overview:

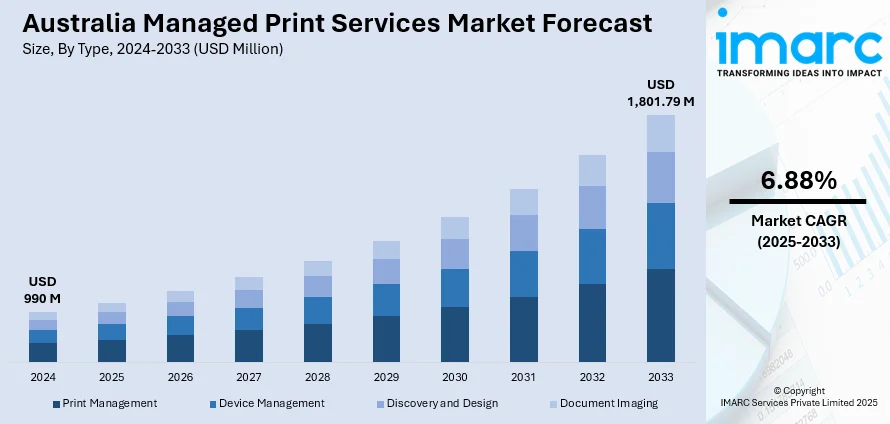

The Australia managed print services market size reached USD 990 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,801.79 Million by 2033, exhibiting a growth rate (CAGR) of 6.88% during 2025-2033. Cost efficiency, increased focus on reducing operational expenses, the growing need for document security, improved workflow automation, and the rising adoption of cloud-based solutions are some of the factors contributing to Australia managed print services market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 990 Million |

| Market Forecast in 2033 | USD 1,801.79 Million |

| Market Growth Rate 2025-2033 | 6.88% |

Australia Managed Print Services Market Trends:

Increased Vendor Accountability in Print Infrastructure Management

Procurement models in Australia’s managed print services market are shifting toward full-service agreements where providers assume end-to-end responsibility for print infrastructure. This includes deployment, maintenance, performance tracking, and optimization of print environments. Such frameworks allow public sector agencies to access flexible service terms, including varied ownership and subscription models. The approach enhances operational efficiency by minimizing administrative overhead and aligning vendor accountability with specific performance and service delivery standards. These factors are intensifying the Australia managed print services market growth. For example, in July 2024, the NSW Government's C9827 PID panel outlined the scope of Lot 3, focusing on managed print services. Suppliers under this lot take primary responsibility for customers' print infrastructure, offering a range of commercial and ownership options tailored to individual agency needs, ensuring flexibility and efficiency in service delivery.

To get more information on this market, Request Sample

Centralized Procurement Driving Service Standardization

Australia’s managed print services landscape is seeing stronger consolidation through centralized procurement frameworks designed to streamline vendor selection and contract management. Public sector departments now operate under unified panels that categorize device types and bundle associated services, making purchasing decisions more structured and consistent across agencies. This shift supports greater cost efficiency, transparency in pricing, and alignment with standardized service expectations, enabling government entities to better manage their print environments. For instance, in April 2024, the New South Wales Government replaced its C2390 Imaging Devices panel with a new mandatory all-of-government panel, Print and Imaging Devices and Services (C9827 PID). This panel includes suppliers such as Canon, Sharp, Epson, and Toshiba, offering structured device categories and managed print service bundles. The initiative aims to provide competitive pricing and better value-for-money for government departments.

Australia Managed Print Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, deployment mode, organization size, and industry vertical.

Type Insights:

- Print Management

- Device Management

- Discovery and Design

- Document Imaging

The report has provided a detailed breakup and analysis of the market based on the type. This includes print management, device management, discovery and design, and document imaging.

Deployment Mode Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

Organization Size Insights:

- Large Enterprises

- Medium Enterprises

- Small Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes large enterprises, medium enterprises, and small enterprises.

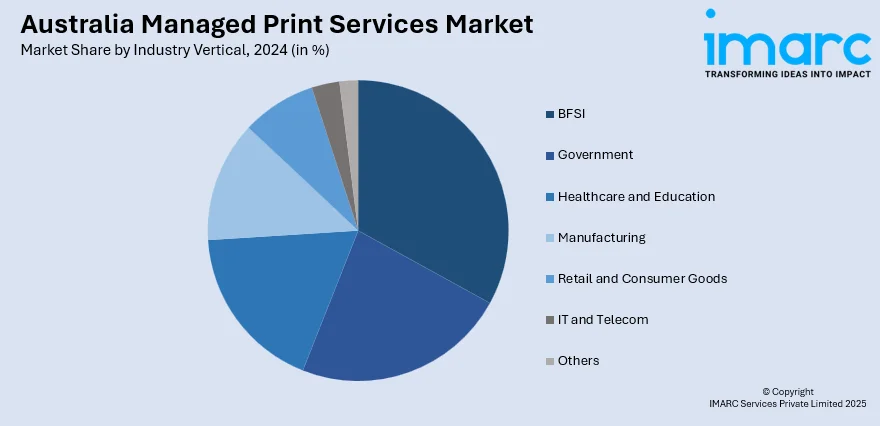

Industry Vertical Insights:

- BFSI

- Government

- Healthcare and Education

- Manufacturing

- Retail and Consumer Goods

- IT and Telecom

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes BFSI, government, healthcare and education, manufacturing, retail and consumer goods, IT and telecom, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Managed Print Services Market News:

- In March 2025, Ricoh Australia partnered with PrintReleaf to integrate automated reforestation into its managed print services. The platform tracks customers' paper usage and calculates equivalent replanting needs, enabling verified tree planting projects globally. This initiative, supported by Dynamic Software Solutions, allows seamless data collection through Ricoh’s print service software, offering Australian businesses a way to offset environmental impact without additional hardware.

Australia Managed Print Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Print Management, Device Management, Discovery and Design, Document Imaging |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Large Enterprises, Medium Enterprises, Small Enterprises |

| Industry Verticals Covered | BFSI, Government, Healthcare and Education, Manufacturing, Retail and Consumer Goods, IT and Telecom, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia managed print services market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia managed print services market on the basis of type?

- What is the breakup of the Australia managed print services market on the basis of deployment mode?

- What is the breakup of the Australia managed print services market on the basis of organization size?

- What is the breakup of the Australia managed print services market on the basis of industry vertical?

- What is the breakup of the Australia managed print services market on the basis of region?

- What are the various stages in the value chain of the Australia managed print services market?

- What are the key driving factors and challenges in the Australia managed print services market?

- What is the structure of the Australia managed print services market and who are the key players?

- What is the degree of competition in the Australia managed print services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia managed print services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia managed print services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia managed print services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)