Australia Managed Security Services Market Size, Share, Trends and Forecast by Type, Deployment Mode, Enterprises Size, Vertical, and Region, 2026-2034

Australia Managed Security Services Market Overview:

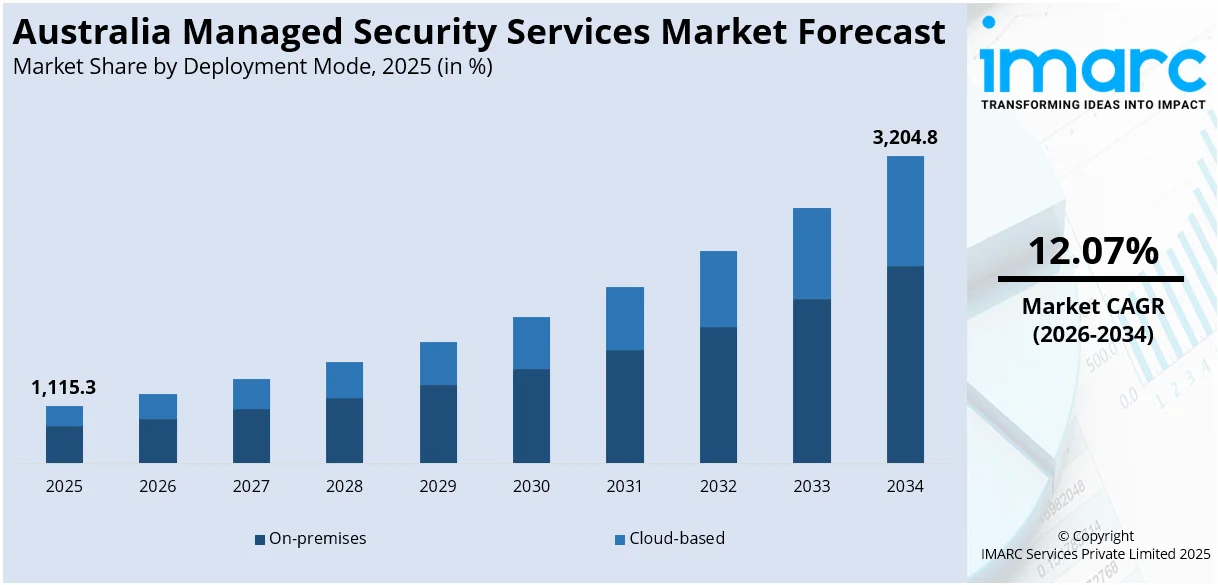

The Australia managed security services market size reached USD 1,115.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,204.8 Million by 2034, exhibiting a growth rate (CAGR) of 12.07% during 2026-2034. Rising cyberattack complexity, shortage of skilled professionals, rapid digital transformation, increasing cloud adoption, expanding remote workforces, growing regulatory pressures, surging demand for 24/7 threat monitoring, need for cost-effective security solutions, and advancements in artificial intelligence (AI) driven threat detection are factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,115.3 Million |

| Market Forecast in 2034 | USD 3,204.8 Million |

| Market Growth Rate 2026-2034 | 12.07% |

Australia Managed Security Services Market Trends:

Rising Sophistication of Cyber Threats

The increasing complexity and frequency of cyberattacks is one of the primary factors boosting the Australia managed security services market share. For instance, approximately 69% of Australian businesses reported ransomware attacks over the past five years, with 84% opting to pay the ransom. The average ransom payment increased to USD 1.35 million in 2024, up from USD 1.03 million in 2023. Threat actors are leveraging advanced persistent threats (APTs), polymorphic malware, and zero-day vulnerabilities, which demand more than conventional security tools. Enterprises across sectors are finding it difficult to maintain up-to-date, in-house defense mechanisms that can keep pace with evolving attack vectors. As a result, organizations are turning to managed security service providers (MSSPs) for specialized, real-time monitoring and rapid incident response. MSSPs offer advanced tools such as behavioral analytics, threat hunting, and automated remediation workflows, which are often financially and technically out of reach for internal teams. This shift is especially pronounced in sectors like banking, utilities, and telecommunications, which face a heightened risk of targeted cybercrime. Moreover, the need to minimize operational downtime and reputational damage is reinforcing the role of managed security solutions as a strategic asset in enterprise IT planning, further stimulating the market growth.

To get more information on this market Request Sample

Shortage of In-House Cybersecurity Expertise

The persistent talent gap in cybersecurity is one of the key contributors to the Australia managed security services market growth. Despite rising investments in digital infrastructure, many organizations are struggling to recruit and retain qualified professionals with expertise in threat intelligence, cloud security, and governance risk compliance. The high cost of hiring, combined with the rapid pace at which threat environments evolve, has made it impractical for many businesses to build comprehensive internal teams. Managed service providers are filling this void by offering access to trained personnel and sophisticated tools on a subscription basis. This model allows companies to stay compliant with security standards and better manage their exposure without the overhead of permanent staffing. Additionally, MSSPs provide round-the-clock surveillance and response capabilities that are difficult for small and mid-sized enterprises to maintain independently, which is creating a positive Australia managed security services market outlook.

Expanding Digital Transformation Initiatives

Ongoing digital transformation across Australian industries has created a growing need for robust cybersecurity frameworks, fueling demand for managed services. Organizations in sectors such as retail, logistics, healthcare, and education are adopting cloud-native platforms, the Internet of Things (IoT) enabled systems, and digital customer engagement tools to improve service delivery and operational efficiency. However, this expanded digital footprint also introduces a wider attack surface, increasing the vulnerability of systems and data assets. MSSPs are being engaged to secure these evolving environments by providing end-to-end protection, including network security, endpoint defense, and compliance monitoring. As digital adoption accelerates, particularly among traditional businesses moving toward hybrid IT infrastructure, the role of MSSPs has shifted from reactive support to proactive risk prevention. As per the Australia managed security services market forecast, key players are also aligning their offerings with clients’ broader transformation strategies, ensuring that security policies and protocols scale with business growth.

Australia Managed Security Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on type, deployment mode, enterprises size, and vertical.

Type Insights:

- Managed SIEM

- Managed UTM

- Managed DDoS

- Managed XDR

- Managed IAM

- Managed Risk and Compliance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes managed SIEM, managed UTM, managed DDoS, managed XDR, managed IAM, managed risk and compliance, and others.

Deployment Mode Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based solutions.

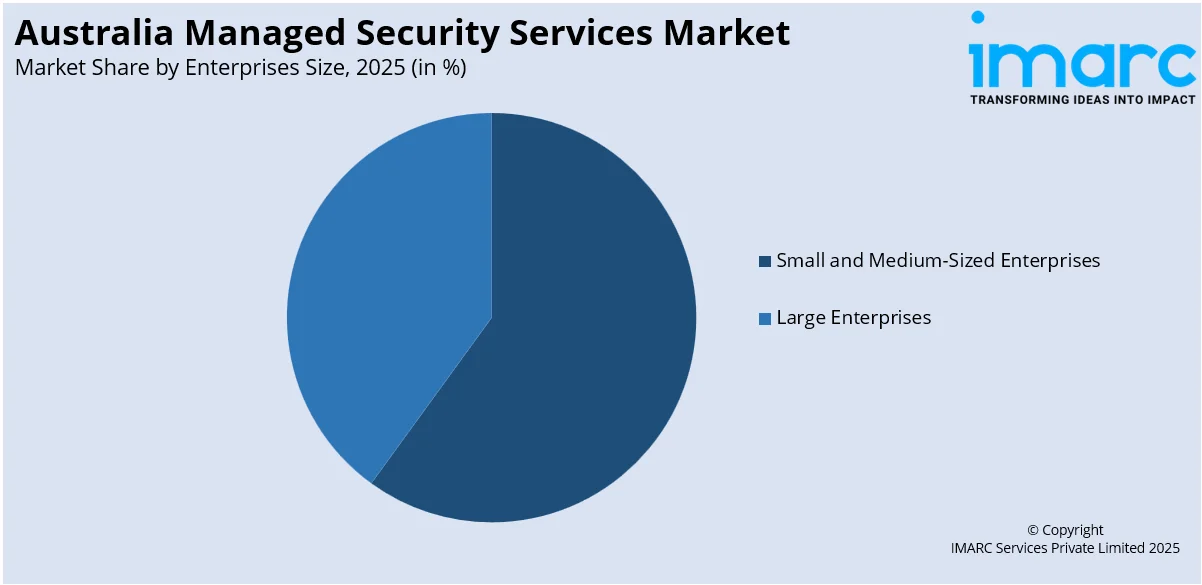

Enterprises Size Insights:

Access the comprehensive market breakdown Request Sample

- Small and Medium-Sized Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on enterprise size. This includes small and medium-sized enterprises and large enterprises.

Vertical Insights:

- BFSI

- Healthcare

- Manufacturing

- IT and Telecom

- Retail

- Defense/Government

- Others

A detailed breakup and analysis of the market based on vertical have also been provided in the report. This includes BFSI, healthcare, manufacturing, IT and telecom, retail, defense/government, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Managed Security Services Market News:

- In 2024, Bastion Security Group expanded into Australia by acquiring Melbourne-based Cythera Cyber Security. This move enhances Bastion's capabilities in delivering advanced cyber protection and managed services across the region.

- In 2024, Optus announced a strategic partnership with Devo Technology to launch a 24/7 Managed Threat Monitoring Service in Australia. This collaboration aims to provide enterprise and mid-market customers with enhanced security data analytics and threat detection capabilities.

Australia Managed Security Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Managed SIEM, Managed UTM, Managed DDoS, Managed XDR, Managed IAM, Managed Risk and Compliance, Others |

| Deployment Modes Covered | On-premises, Cloud-based |

| Enterprises Sizes Covered | Small and Medium-Sized Enterprises, Large Enterprises |

| Verticals Covered | BFSI, Healthcare, Manufacturing, IT and Telecom, Retail, Defense/Government, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia managed security services market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia managed security services market on the basis of type?

- What is the breakup of the Australia managed security services market on the basis of deployment mode?

- What is the breakup of the Australia managed security services market on the basis of enterprises size?

- What is the breakup of the Australia managed security services market on the basis of vertical?

- What is the breakup of the Australia managed security services market on the basis of region?

- What are the various stages in the value chain of the Australia managed security services market?

- What are the key driving factors and challenges in the Australia managed security services?

- What is the structure of the Australia managed security services market and who are the key players?

- What is the degree of competition in the Australia managed security services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia managed security services market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia managed security services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia managed security services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)