Australia Material Testing Equipment Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2026-2034

Australia Material Testing Equipment Market Summary:

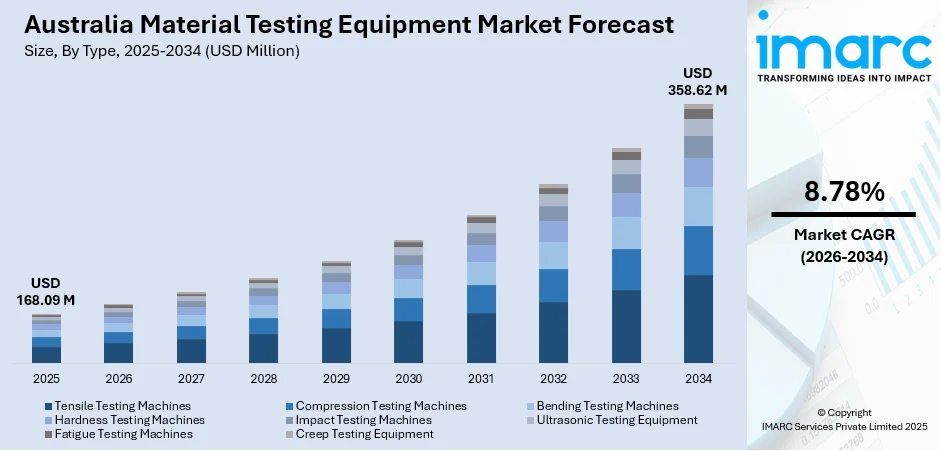

The Australia material testing equipment market size was valued at USD 168.09 Million in 2025 and is projected to reach USD 358.62 Million by 2034, growing at a compound annual growth rate of 8.78% from 2026-2034.

The Australia material testing equipment market is driven by infrastructure-led construction mandates that enforce rigorous material validation protocols across urban and transport projects. Mining and resource sectors require precise and compliant testing to support export-grade quality assurance, especially in metals and minerals. Rapid innovation in manufacturing and product safety obligations further accelerate the need for advanced testing solutions, strengthening the Australia material testing equipment market share.

Key Takeaways and Insights:

- By Type: Tensile Testing Machines dominate the market with a share of 22% in 2025, driven by widespread adoption across automotive, aerospace, and construction industries for precise stress and strain measurements on materials.

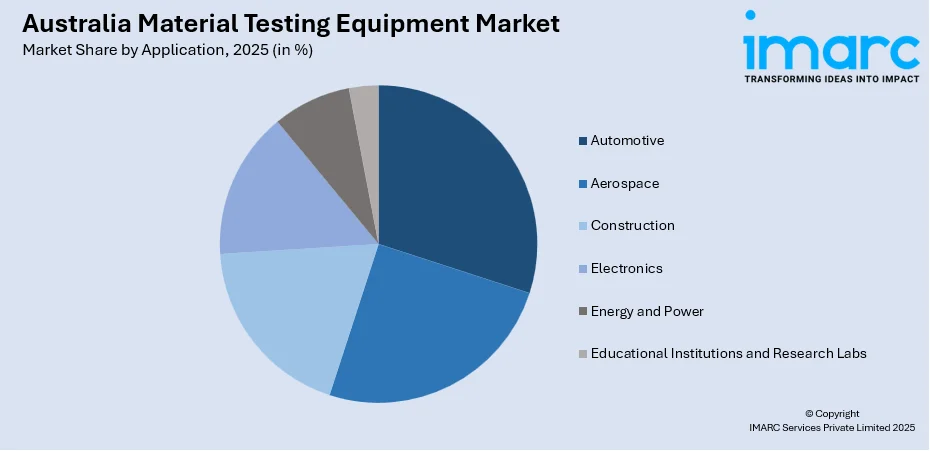

- By Application: Automotive leads the market with a share of 25% in 2025, supported by stringent quality control requirements for vehicle components and emerging electric vehicle manufacturing demands.

- By End User: Manufacturers represent the largest segment with a market share of 45% in 2025, owing to mandatory compliance with Australian Standards and ISO certifications across production facilities.

- Key Players: The Australia material testing equipment market exhibits moderate competitive intensity, with multinational testing equipment corporations competing alongside regional manufacturers and specialized service providers across various price segments.

To get more information on this market, Request Sample

The Australia material testing equipment market is experiencing sustained growth driven by expanding infrastructure investments and stringent regulatory compliance requirements. The construction sector's adherence to National Construction Code specifications and Australian Standards necessitates comprehensive material validation protocols. According to reports, under the upcoming Australian Building Codes Board (ABCB)’s proposed 2025 update to NCC, fire‑hazard and combustibility tests for building materials will be required to be conducted only by recognised National Association of Testing Authorities Australia (NATA)–accredited laboratories — strengthening the demand for accredited material testing equipment across Australia. Manufacturing facilities increasingly adopt automated testing systems to enhance quality assurance capabilities while meeting international export standards. Research institutions and universities contribute to market expansion through specialized testing requirements for advanced material development programs. The mining sector's emphasis on export-grade quality verification further reinforces demand for precision testing equipment across the country.

Australia Material Testing Equipment Market Trends:

Automation and Digital Integration in Testing Processes

The Australia material testing equipment market is witnessing accelerated adoption of automated testing systems integrated with digital reporting capabilities. Laboratories are scaling up automation and real-time reporting to meet tighter delivery schedules across construction and manufacturing sectors. For example, in 2023 SGS recently announced the implementation of its Laboratory Information Management System (LIMS) across Australian laboratories, enabling paperless workflows, standardised test methods, and secure, traceable reporting. This trend enables enhanced precision, reduced manual errors, and traceable results throughout testing workflows.

Rising Demand for Non-Destructive Testing Solutions

Non-destructive testing methods are gaining prominence across Australian industries seeking to evaluate material integrity without compromising structural components. For example, in March 2025, Applus+ Australia secured a major contract with a leading energy provider to deliver a full suite of NDT services — including phased-array ultrasonic testing, digital radiography, and remote visual inspection — highlighting the growing reliance on NDT across heavy-industry sectors. Ultrasonic testing equipment and advanced imaging technologies enable comprehensive inspections of critical infrastructure assets, particularly in mining operations and transport networks where continuous monitoring ensures operational safety and regulatory compliance.

Integration of Advanced Materials Testing for Emerging Technologies

The emergence of additive manufacturing and composite materials in industrial design has introduced new variables requiring customized testing instruments. For example — in March 2024, CSIRO together with Swinburne University of Technology launched the National Industry 4.0 Testlab, a world‑first facility for industrial‑scale additive manufacturing of carbon‑fibre composites in Australia. Research institutions and manufacturing facilities are procuring multifunctional testing systems capable of assessing novel material behaviors and meeting multi-standard compliance requirements across domestic and international regulatory frameworks.

Market Outlook 2026-2034:

The Australia material testing equipment market outlook remains positive, driven by sustained infrastructure investments, expanding manufacturing capabilities, and increasing regulatory stringency across industries. The continued emphasis on quality assurance in construction, mining, and automotive sectors positions the market for steady expansion throughout the forecast period. The market generated a revenue of USD 168.09 Million in 2025 and is projected to reach a revenue of USD 358.62 Million by 2034, growing at a compound annual growth rate of 8.78% from 2026-2034.

Australia Material Testing Equipment Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Tensile Testing Machines | 22% |

| Application | Automotive | 25% |

| End User | Manufacturers | 45% |

Type Insights:

- Tensile Testing Machines

- Compression Testing Machines

- Bending Testing Machines

- Hardness Testing Machines

- Impact Testing Machines

- Ultrasonic Testing Equipment

- Fatigue Testing Machines

- Creep Testing Equipment

Tensile Testing Machines dominate with a market share of 22% of the total Australia material testing equipment market in 2025.

Tensile testing machines hold the largest share within the equipment type segment, driven by their essential role in determining material strength, elasticity, and deformation characteristics across multiple industries. These machines are indispensable for quality assurance in automotive component manufacturing, construction material verification, and aerospace applications where precise stress-strain measurements ensure structural integrity and safety compliance. For example, in May 2023 University of Queensland (UQ)’s Mechanical Testing Laboratory — a facility providing compressive, tensile and fatigue testing — earned accreditation from the National Association of Testing Authorities, Australia (NATA), reinforcing the credibility and demand for accredited tensile and mechanical testing services across industries.

The widespread adoption of universal testing machines capable of performing tensile, compression, and flexural tests contributes to segment dominance. Manufacturing facilities across Australia increasingly procure multifunctional tensile testing systems that accommodate diverse material types including metals, polymers, composites, and textiles while meeting Australian Standards and international testing protocols required for export certification.

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Aerospace

- Automotive

- Construction

- Electronics

- Energy and Power

- Educational Institutions and Research Labs

Automotive leads with a share of 25% of the total Australia material testing equipment market in 2025.

The automotive sector commands the largest application share, driven by stringent quality control requirements for vehicle components and materials. The Australia automotive market size was valued at 1.22 Million Units in 2024. Looking forward, the market is expected to reach 2.50 Million Units by 2033, exhibiting a CAGR of 7.60% from 2025-2033. Australian automotive manufacturing and re-manufacturing facilities require comprehensive testing of materials ranging from metals and polymers to advanced composites used in vehicle production. The emergence of electric vehicle manufacturing has introduced additional testing requirements for battery materials and lightweight structural components.

Automotive testing encompasses fatigue analysis of safety-critical components, weld quality verification, and polymer property assessment for interior and exterior applications. Major automotive facilities in Victoria and other states maintain dedicated testing laboratories equipped with universal testing machines, hardness testers, and impact testing equipment to ensure compliance with Australian Design Rules and international automotive standards.

End User Insights:

- Manufacturers

- Research and Development Laboratories

- Quality Control and Assurance Departments

- Academic Institutions

- Governmental Regulatory Bodies

Manufacturers dominate with a market share of 45% of the total Australia material testing equipment market in 2025.

The manufacturing sector represents the primary end-user segment, encompassing producers across aerospace, automotive, defense, and consumer goods industries. Australian manufacturers are mandated to conduct stringent testing of raw materials and finished components to ensure compliance with product safety standards. For instance — in June 2024, National Association of Testing Authorities Australia (NATA) signed a new five‑year Memorandum of Understanding with the Australian Government to reinforce its role as the national authority for lab accreditation and conformity assessment, underscoring the government’s push to strengthen reliability and traceability of testing results for export‑oriented manufacturing and regulatory compliance. ISO certifications and Australian regulatory standards require validation of material integrity under stress, temperature, and mechanical deformation conditions.

Manufacturers serving international markets further adhere to ASTM, EN, and JIS testing frameworks, driving demand for equipment capable of multi-standard compliance. Digital integration and automated reporting capabilities are now expected in manufacturing test environments to minimize manual error and support traceable results throughout production processes.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales region holds a strong position in the Australia material testing equipment market, driven by concentrated manufacturing activities and major infrastructure investments including the Western Sydney International Airport and Sydney Metro projects. The presence of extensive research institutions, universities, and government laboratories in Sydney and Canberra creates sustained demand for advanced testing equipment across construction, aerospace, and defense applications.

Victoria holds a significant market position supported by Melbourne's established manufacturing base and automotive industry presence. The Melbourne Metro Tunnel Project and North East Link infrastructure developments drive construction material testing demand. Automotive re-manufacturing facilities and research centers in Melbourne's southeast require comprehensive testing capabilities for vehicle components and advanced materials.

Queensland represents a rapidly growing regional market with substantial mining sector activity and expanding infrastructure investments. The state's major project pipeline has doubled compared to previous years, supporting demand for material testing in construction and mining applications. Brisbane's Cross River Rail and Bruce Highway upgrades reinforce testing equipment requirements across transport infrastructure projects.

This combined region shows emerging growth potential driven by mining operations and the North-South Corridor infrastructure project in Adelaide. Defense manufacturing facilities and critical minerals processing operations create specialized testing equipment demand. Energy sector developments and remote infrastructure projects support market expansion in these regions.

Western Australia's material testing equipment demand is substantially driven by the mining and resources sector requiring precise quality assurance for export-grade minerals and metals. The Department of Mines, Industry Regulation and Safety oversees stringent testing requirements across mining operations. Perth's construction sector and METRONET transport infrastructure investments contribute to regional market growth.

Market Dynamics:

Growth Drivers:

Why is the Australia Material Testing Equipment Market Growing?

Infrastructure Projects and Construction Sector Compliance

Australia's massive investment in transport, defense, and public utilities drives steady demand for advanced material testing. In August 2025, NTRO and the Western Australia government launched the Accelerated Loading Facility near Neerabup, enabling rapid evaluation of pavements, asphalt, and concrete. Bridges, tunnels, rail, and ports require rigorous testing to meet standards, while contractors increasingly adopt universal testing machines, hardness testers, and compression equipment. Frequent audits and certification mandates have made material testing essential for ensuring strength, durability, and safety in public infrastructure projects.

Manufacturing and Product Safety Compliance Requirements

Australia’s regulated manufacturing sector, spanning aerospace, automotive, defence, and consumer goods, requires rigorous testing of raw materials and finished components to meet safety standards. Producers rely on accurate outputs for metals, polymers, and welds. In 2025, the Australian Composites Manufacturing CRC enhanced testing infrastructure and certification-ready facilities to support additive manufacturing and composites adoption. Advanced material testing remains vital for operational reliability and compliance in domestic and international markets.

Mining Sector Quality Assurance and Export Standards

The mining sector is a major driver of material testing equipment demand in Australia, with iron ore, gold, copper, and critical minerals requiring strict quality verification for export. Intertek’s new Minerals Global Centre of Excellence in Perth, a large state-of-the-art automated laboratory, reflects the growing role of advanced mineral testing in the value chain. Record export revenues and government-backed exploration initiatives reinforce the need for precise grade verification, property assessment, and compliance testing across mining hubs in Western Australia, Queensland, and beyond.

Market Restraints:

What Challenges the Australia Material Testing Equipment Market is Facing?

High Capital Investment Requirements for Advanced Equipment

The high cost of specialized testing equipment represents a significant barrier for small and medium-sized enterprises, limiting their ability to invest in state-of-the-art testing systems. Advanced multifunctional testing machines with digital integration capabilities require substantial capital expenditure, creating procurement challenges for smaller manufacturers and laboratories.

Skilled Labor Shortage and Technical Expertise Requirements

The material testing equipment market faces challenges from skilled labor shortages affecting equipment operation and maintenance. Technical expertise requirements for operating sophisticated testing systems and interpreting complex results create workforce development challenges across manufacturing and research sectors.

Geographic Challenges and Remote Location Accessibility

Australia's vast geography presents logistical challenges for testing equipment deployment and servicing in remote mining and construction locations. Sourcing construction materials, equipment, and skilled workers in geographically distant areas adds risk to project delivery timelines and increases operational costs for testing service providers.

Competitive Landscape:

The Australia material testing equipment market exhibits moderate competitive intensity with multinational corporations and regional manufacturers competing across various price segments and application areas. Global testing equipment leaders maintain strong market presence through established distribution networks and service capabilities. Regional manufacturers and specialized testing service providers compete through customized solutions and local expertise. The market structure includes equipment manufacturers, testing service providers, and calibration specialists serving diverse end-user requirements. Strategic partnerships between equipment suppliers and research institutions support technology development and market expansion across construction, mining, manufacturing, and academic sectors.

Recent Developments:

- In November 2025, Walkinshaw Group officially opened its new $114 million headquarters and expanded manufacturing facility in Dandenong South, Victoria, featuring what is described as “Australia’s most advanced automotive engineering centre.” The 100,000 sq m plant consolidates previous sites, supports more than four production lines, and will produce over 10,000 vehicles per year for the Australian market.

- In April 2025, RMIT University announced a breakthrough in bio-oil production technology and secured a government-backed funding partnership for a commercial-scale demonstration plant. The initiative advances material testing and evaluation for new sustainable materials in industrial applications, aiming to accelerate adoption of greener technologies across manufacturing and energy sectors.

Australia Material Testing Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Tensile Testing Machines, Compression Testing Machines, Bending Testing Machines, Hardness Testing Machines, Impact Testing Machines, Ultrasonic Testing Equipment, Fatigue Testing Machines, Creep Testing Equipment |

| Applications Covered | Aerospace, Automotive, Construction, Electronics, Energy and Power, Educational Institutions and Research Labs |

| End Users Covered | Manufacturers, Research and Development Laboratories, Quality Control and Assurance Departments, Academic Institutions, Governmental Regulatory Bodies |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia material testing equipment market size was valued at USD 168.09 Million in 2025.

The Australia material testing equipment market is expected to grow at a compound annual growth rate of 8.78% from 2026-2034 to reach USD 358.62 Million by 2034.

Tensile testing machines held the largest type segment share at 22% in 2024, driven by widespread adoption across automotive, aerospace, and construction industries for precise material strength measurements.

Key factors driving the Australia material testing equipment market include substantial infrastructure investments, stringent regulatory compliance requirements, manufacturing sector expansion, mining quality assurance demands, and increasing adoption of automated testing technologies.

Major challenges include high capital investment requirements for advanced equipment, skilled labor shortages affecting equipment operation, geographic challenges for remote location servicing, and cost pressures on small and medium enterprises seeking testing capabilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)