Australia Material Testing Market Size, Share, Trends and Forecast by Type, Material, End Use Industry, and Region, 2025-2033

Australia Material Testing Market Overview:

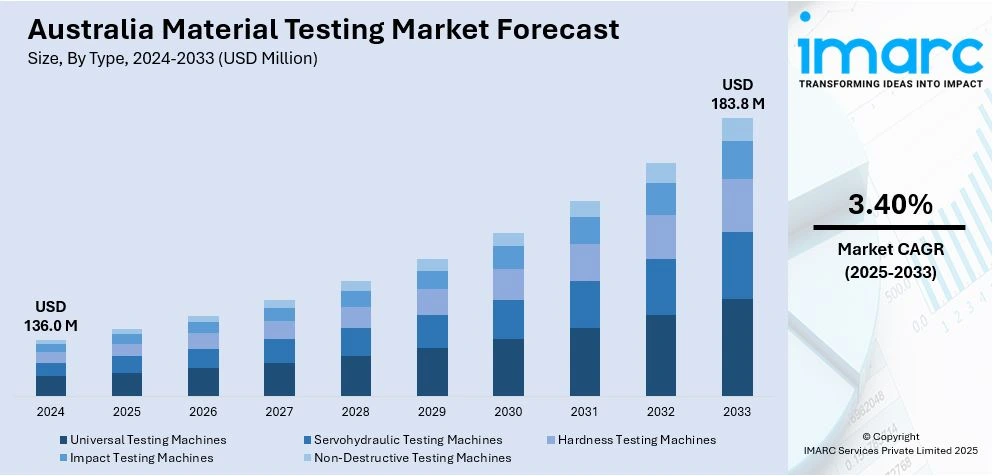

The Australia material testing market size reached USD 136.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 183.8 Million by 2033, exhibiting a growth rate (CAGR) of 3.40% during 2025-2033. Increasing demand for high-quality materials across industries, escalating awareness of safety regulations, technological advancements in testing methods, a growing focus on sustainability, rising construction activities, surging demand for high-performance materials, adoption of advanced composites, and quality assurance requirements are some of the factors fueling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 136.0 Million |

| Market Forecast in 2033 | USD 183.8 Million |

| Market Growth Rate 2025-2033 | 3.40% |

Australia Material Testing Market Trends:

Growing Demand for High-Quality Materials Across Industries

The primary factor fueling the Australia material testing market share is the growing demand for quality materials across industries, such as construction, automotive, aerospace, and electronics. Moreover, the surging demand for materials that provide enhanced performance, durability, and safety is another factor accelerating the market growth. In construction, the need for more robust materials, such as high strength concrete, steel, and others, to endure harsh environmental conditions is increasing, which is stimulating the market growth. In the automobile and aerospace industries, material must meet critical safety and performance criteria to guarantee the safety of the end-user. In addition to this, the rapid growth of high-performance materials including composites, alloys, and polymers has contributed to a heightened demand for comprehensive and accurate testing, which is fostering the market growth.

To get more information on this market, Request Sample

Increasing Awareness of Safety Regulations and Standards

The surging awareness about safety standards and regulations is one of the key factors propelling the market growth. Stringent safety regulations from governments and standardizing organizations for the protection of workers and consumers from any failure of materials is driving the Australia material testing market share. The construction, automotive, and manufacturing sectors are mostly impacted by such regulations, which has further compelled them to use materials that comply with a specified quality and safety level. Organizations are also heavily investing in material testing services to comply with national and international standards, like international organization for standardization (ISO) certifications and other governmental laws. According to a 2024 report by the Australian Government’s Department of Industry, Science and Resources, over 70% of manufacturers have increased their spending on quality assurance and material testing to meet evolving regulatory requirements. Apart from this, the growing focus on safety standards has led to the development of advanced testing technologies, which allow manufacturers to adhere to these rigorous standards while maintaining high product quality, which is driving the market growth.

Technological Advancements in Testing Methods

The evolution of technology in testing methods is creating a positive Australia material testing market outlook. In line with this, the growing integration of artificial intelligence (AI), machine learning (ML), and high-precision sensor technologies in the material testing processes for faster, more efficient, and accurate results is another factor fueling the market growth. Automated testing systems can perform high throughput testing that allows large amounts of materials to be tested rapidly, with minimal human intervention. In line with this, AI is increasingly integrated in existing software as it can interpret test results faster and more accurately by understanding complex relationships, which is fostering the market growth. Additionally, the use of sensors that can simulate extreme conditions, such as temperature, pressure, and stress, allows for more comprehensive testing of materials.

Australia Material Testing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, material, and end use industry.

Type Insights:

- Universal Testing Machines

- Servohydraulic Testing Machines

- Hardness Testing Machines

- Impact Testing Machines

- Non-Destructive Testing Machines

The report has provided a detailed breakup and analysis of the market based on the type. This includes universal testing machines, servohydraulic testing machines, hardness testing machines, impact testing machines, and non-destructive testing machines.

Material Insights:

- Metals and Alloys

- Plastics

- Rubber and Elastomers

- Ceramics and Composites

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes metals and alloys, plastics, rubber and elastomers, ceramics and composites, and others.

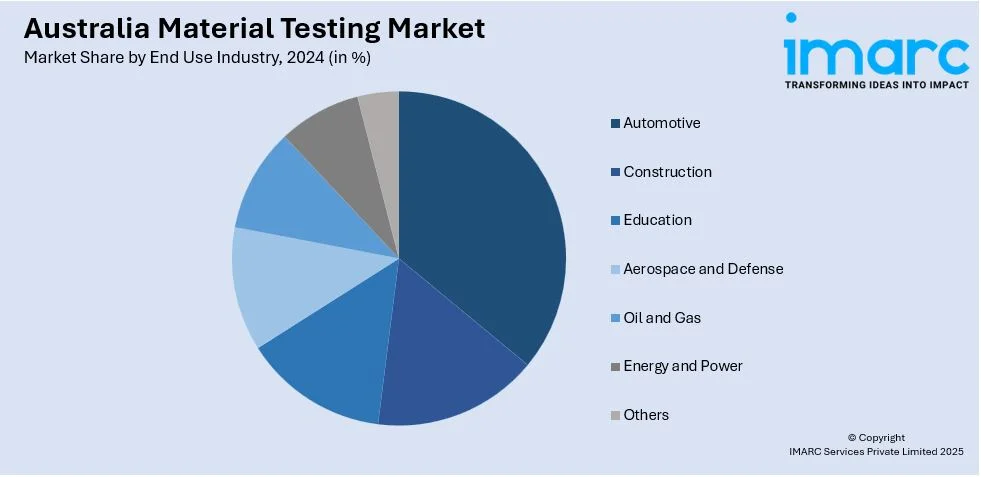

End Use Industry Insights:

- Automotive

- Construction

- Education

- Aerospace and Defense

- Oil and Gas

- Energy and Power

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive, construction, education, aerospace and defense, oil and gas, energy and power, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Material Testing Market News:

- In 2025, SGS acquired RTI Laboratories, a leading provider of environmental and materials testing services. This acquisition strengthens SGS’s capabilities in PFAS analysis and expands its testing portfolio to include metallurgical testing, alloy chemistry, failure analysis, and paint evaluations. It enhances SGS’s presence in the Midwest U.S. and supports growing demand for comprehensive environmental testing.

- In 2024, Intertek expanded its testing support for ASC Shipbuilding’s Hunter Class Frigate program in Australia. The company will provide comprehensive testing services for critical materials used in the program, including testing for corrosion resistance and mechanical properties of the steel used in the construction of the frigates.

Australia Material Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Universal Testing Machines, Servohydraulic Testing Machines, Hardness Testing Machines, Impact Testing Machines, Non-Destructive Testing Machines |

| Materials Covered | Metals and Alloys, Plastics, Rubber and Elastomers, Ceramics and Composites, Others |

| End Use Industries Covered | Automotive, Construction, Education, Aerospace and Defense, Oil and Gas, Energy and Power, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia material testing market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia material testing market on the basis of type?

- What is the breakup of the Australia material testing market on the basis of material?

- What is the breakup of the Australia material testing market on the basis of end use industry?

- What is the breakup of the Australia material testing market on the basis of region?

- What are the various stages in the value chain of the Australia material testing market?

- What are the key driving factors and challenges in the Australia material testing market?

- What is the structure of the Australia material testing market and who are the key players?

- What is the degree of competition in the Australia material testing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia material testing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia material testing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia material testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)