Australia Maternal Healthcare Products Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End-User, and Region, 2026-2034

Australia Maternal Healthcare Products Market Summary:

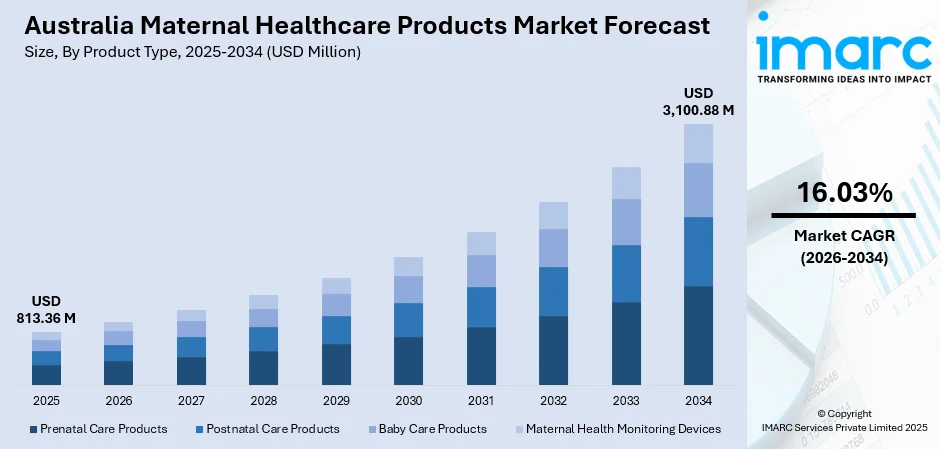

The Australia maternal healthcare products market size was valued at USD 813.36 Million in 2025 and is projected to reach USD 3,100.88 Million by 2034, growing at a compound annual growth rate of 16.03% from 2026-2034.

The Australia maternal healthcare products market is experiencing robust expansion driven by increasing awareness of maternal and infant health, rising demand for organic and natural products, and advancements in digital health technologies. The market benefits from supportive government healthcare policies, an expanding middle-class population seeking premium prenatal and postnatal care solutions, and the growing penetration of e-commerce platforms enabling convenient access to specialized maternal healthcare products across urban and regional areas, contributing to the Australia maternal healthcare products market share.

Key Takeaways and Insights:

- By Product Type: Prenatal care products dominates the market with a share of 40% in 2025, driven by heightened awareness of folic acid benefits, increasing physician recommendations, and growing demand for comprehensive prenatal nutrition supporting healthy fetal development.

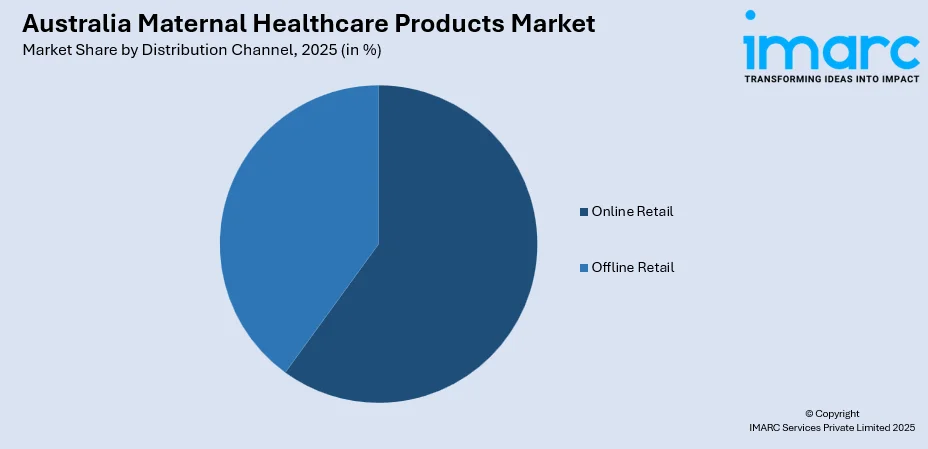

- By Distribution Channel: Online retail leads the market with a share of 54% in 2025, reflecting the convenience of digital shopping platforms, wider product variety, subscription-based delivery models, and increasing digital literacy among health-conscious millennial parents.

- By End-User: Hospitals and clinics represents the largest segment with a market share of 50% in 2025, supported by comprehensive antenatal care programs, professional medical guidance, and established procurement channels for maternal healthcare supplies within clinical settings.

- Key Players: The market features intense competition among multinational pharmaceutical companies, specialized maternal care brands, and emerging organic product manufacturers. Leading players focus on product innovation, clinical validation, sustainable packaging, and strategic distribution partnerships to strengthen their market presence across Australia.

To get more information on this market, Request Sample

The Australia maternal healthcare products market is advancing through technological integration, personalized nutrition solutions, and expanding healthcare access across metropolitan and regional communities. Rising government investments in maternal health infrastructure, coupled with increasing consumer preference for evidence-based prenatal supplements and natural baby care products, are reshaping market dynamics. For instance, in February 2025, University of Queensland researchers developed a revolutionary nanoflower sensor blood test capable of detecting pregnancy complications as early as 11-13 weeks with over 90% accuracy, potentially transforming prenatal screening practices across Australia.

Australia Maternal Healthcare Products Market Trends:

Integration of Digital Health Technologies

The Australia maternal healthcare products market is witnessing significant adoption of remote pregnancy monitoring solutions, wearable devices, and telehealth platforms. Healthcare providers are implementing digital maternity care models that enable real-time tracking of maternal and fetal vital signs from home. For instance, in March 2023, Gold Coast Hospital and Health Service announced plans to trial the HeraCARE remote pregnancy monitoring platform for high-risk pregnancies, representing the health service's commitment to leveraging technology for improved maternal care delivery across Queensland, contributing to Australia maternal healthcare products market growth.

Rising Demand for Organic and Natural Products

Consumer preferences are shifting toward maternal healthcare products containing organic, plant-based, and toxin-free ingredients. Australian parents increasingly prioritize products free from parabens, sulfates, and synthetic additives, driving manufacturers to develop cleaner formulations featuring botanical extracts and sustainably sourced components. In October 2024, Australian company Coco2 launched the world's first coconut-based infant formula developed in collaboration with the University of Queensland, offering dairy and soy-free alternatives that closely mimic breast milk composition for infants with dietary sensitivities.

Personalized Prenatal Nutrition Solutions

The market is experiencing growing demand for customized prenatal supplements tailored to individual health profiles and genetic factors. Advanced diagnostic assessments enable healthcare providers to recommend personalized vitamin combinations, ensuring optimal nutrient balance during pregnancy. Companies are expanding offerings with DNA-based and blood test-based evaluations, providing expectant mothers with precision nutrition solutions that address specific deficiencies and support healthy fetal development throughout pregnancy stages.

Market Outlook 2026-2034:

The Australia maternal healthcare products market demonstrates strong growth potential driven by increasing healthcare expenditure, expanding awareness programs, and technological innovations in maternal care. Government initiatives supporting prenatal screening, vaccination programs, and early childhood development are expected to accelerate product adoption rates. Rising investments in medical research, expanding e-commerce infrastructure, and growing emphasis on preventive maternal healthcare will continue propelling market expansion throughout the forecast period. The market generated a revenue of USD 813.36 Million in 2025 and is projected to reach a revenue of USD 3,100.88 Million by 2034, growing at a compound annual growth rate of 16.03% from 2026-2034.

Australia Maternal Healthcare Products Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Prenatal Care Products | 40% |

| Distribution Channel | Online Retail | 54% |

| End-User | Hospitals and Clinics | 50% |

Product Type Insights:

- Prenatal Care Products

- Prenatal Vitamins and Supplements

- Pregnancy Tests

- Maternity Belts and Support Products

- Postnatal Care Products

- Postnatal Recovery Kits

- Breastfeeding

- Postnatal Supplements

- Baby Care Products

- Baby Skincare Products

- Baby Feeding Products

- Baby Hygiene Products

- Maternal Health Monitoring Devices

- Blood Pressure Monitors

- Glucose Monitors

- Fetal Dopplers

The prenatal care products segment dominates with a market share of 40% of the total Australia maternal healthcare products market in 2025.

Prenatal care products are experiencing strong demand driven by increasing awareness among expectant mothers regarding the critical importance of proper nutrition during pregnancy. Healthcare providers across Australia routinely recommend prenatal vitamins containing folic acid, iron, calcium, and DHA to support healthy fetal development and prevent neural tube defects. The segment benefits from rising disposable incomes enabling premium product purchases, growing emphasis on preventive healthcare, and expanding educational campaigns highlighting the benefits of comprehensive prenatal supplementation.

Product innovation remains central to segment growth, with manufacturers introducing advanced formulations featuring improved bioavailability, organic ingredients, and convenient delivery formats such as gummies and liquid supplements. In April 2025, Biome Australia launched Biome Perinatal Probiotic specifically designed for pregnancy and postpartum support, containing clinically trialed probiotic strains that address maternal gut health, immune function, and mood balance during critical life stages, demonstrating the industry's commitment to evidence-based maternal nutrition solutions.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Online Retail

- Offline Retail

The online retail segment leads with a share of 54% of the total Australia maternal healthcare products market in 2025.

Online retail channels are experiencing accelerated growth as Australian consumers increasingly prefer the convenience of digital shopping platforms for maternal healthcare products. E-commerce platforms offer extensive product variety, competitive pricing, detailed product information, customer reviews, and doorstep delivery services that appeal to time-constrained new parents. The Australia e-commerce market size was valued at USD 536.0 Billion in 2024. Looking forward, the market is expected to reach USD 1,568.60 Billion by 2033, exhibiting a CAGR of 12.70% from 2025-2033. The segment benefits from rising smartphone penetration, improved logistics infrastructure, and subscription-based delivery models enabling automatic replenishment of essential supplies.

Industry insights indicate that online shopping has become a dominant purchasing channel in Australia, with millennial and Generation Z parents showing especially strong preferences for digital platforms when buying baby and maternal care products. Social media marketing, influencer promotions, and targeted online advertising play a major role in shaping buying decisions, as platforms like Instagram and Facebook help expectant mothers discover brands, compare options, and access trusted recommendations for maternal healthcare products.

End-User Insights:

- Hospitals and Clinics

- Homecare Settings

- Maternity Centers

The hospitals and clinics segment exhibits clear dominance with a 50% share of the total Australia maternal healthcare products market in 2025.

Hospitals and clinics represent the primary end-users for maternal healthcare products due to their established role in providing comprehensive antenatal, perinatal, and postnatal care services. Healthcare facilities maintain standardized procurement processes for essential maternal supplies including prenatal vitamins, monitoring devices, and postpartum care products. The Australia healthcare services market size reached USD 201.8 Billion in 2024. Looking forward, the market is projected to reach USD 382.3 Billion by 2033, exhibiting a growth rate (CAGR) of 6.8% during 2025-2033. The segment benefits from Medicare subsidies supporting maternal healthcare services, increasing hospital births requiring specialized products, and growing emphasis on evidence-based clinical protocols.

Government healthcare infrastructure investments continue to strengthen hospital-based maternal care delivery across Australia. In August 2024, the NSW Government announced accelerated initiatives to improve maternity care, including the AUD 376.5 million Brighter Beginnings cross-agency collaboration focusing on outcomes for children and families during the first 2000 days from pregnancy to school age, demonstrating an ongoing commitment to enhancing institutional maternal healthcare capacity.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Growth in the maternal healthcare products market across ACT and New South Wales is influenced by strong healthcare infrastructure, widespread access to prenatal and postnatal services, and rising awareness of maternal wellness. Higher adoption of digital health tools, improved insurance coverage, and growing demand for premium maternity products further support market expansion. The region’s large urban population also promotes faster uptake of advanced maternal and infant care solutions.

In Victoria and Tasmania, the market is driven by increasing maternal health awareness, government programs promoting safe pregnancy practices, and well-developed public health networks. Rising preference for natural, organic, and clinically tested maternity products also contributes to demand. Expanding retail and e-commerce channels, along with investments in women’s health services across metropolitan and regional areas, further boost the adoption of innovative maternal care and hygiene solutions.

Queensland’s maternal healthcare products market benefits from population growth, particularly among young families, and expanding maternal care services in both urban and regional areas. Increasing use of telehealth for pregnancy monitoring, demand for nutritional supplements, and improved access to maternity wellness programs all support market uptake. The state’s growing focus on preventive care and maternal education encourages higher consumption of specialized pregnancy and post-birth healthcare products.

In the Northern Territory and South Australia, demand is driven by efforts to enhance maternal health outcomes, especially in remote and Indigenous communities. Increased funding for community health programs, expanding outreach services, and rising awareness of pregnancy wellness support the market. Adoption of essential maternal products, nutritional formulations, and remote monitoring tools is growing as healthcare access improves through digital platforms and regional health initiatives.

Western Australia’s market is supported by strong investment in maternal and child health services, coupled with rising preference for high-quality and clinically approved maternity products. Growing awareness of prenatal nutrition, higher utilization of telehealth consultations, and expanding maternity education programs contribute to demand. The state’s economic stability and urban concentration around Perth also promote faster adoption of advanced maternal hygiene, wellness, and infant-care products.

Market Dynamics:

Growth Drivers:

Why is the Australia Maternal Healthcare Products Market Growing?

Government Healthcare Initiatives and Funding Support

Strong government backing through Medicare subsidies, the Pharmaceutical Benefits Scheme, and dedicated maternal health funding programs represents a primary growth driver for the Australia maternal healthcare products market. Federal and state governments continue investing in maternal healthcare infrastructure, research initiatives, and awareness campaigns supporting improved pregnancy outcomes. The Medical Research Future Fund allocates substantial resources toward maternal health research, including the 2025 Maternal Health and Healthy Lifestyles Grant Opportunity supporting research into perinatal mental health, early childhood development, and preventive health approaches. Additionally, the 2024-25 Federal budget identified women's health as a key priority area, with AUD 53.6 million allocated over four years, targeting research into pregnancy-related conditions, demonstrating ongoing governmental commitment to advancing maternal healthcare across Australia.

Rising Health Awareness Among Expectant Parents

Increasing awareness regarding maternal and fetal health importance is significantly driving market expansion. Australian parents are becoming more educated about prenatal nutrition requirements, the benefits of early screening, and the importance of quality healthcare products during pregnancy and postpartum periods. This heightened awareness stems from improved access to health information through digital platforms, healthcare provider recommendations, and public health campaigns emphasizing preventive care. The trend toward delayed parenthood among educated professionals has further intensified focus on optimal pregnancy outcomes, with parents willing to invest in premium products ensuring healthy fetal development. Healthcare practitioners nationwide routinely recommend prenatal supplements and specialized maternal care products, reinforcing consumer confidence in evidence-based healthcare solutions.

Technological Advancements in Maternal Healthcare

Rapid technological innovation in maternal health monitoring, diagnostic testing, and digital healthcare delivery is transforming product development and market opportunities. Wearable devices enabling continuous fetal heart rate monitoring, AI-powered diagnostic tools for early complication detection, and telehealth platforms facilitating remote prenatal consultations are expanding the scope of maternal healthcare products. In July 2025, researchers from the University of Western Australia and the University of Sydney announced DelivAssure, an innovative device enabling immediate detection of oxygen deprivation during labor, representing a significant breakthrough in fetal monitoring technology with potential to prevent birth asphyxia and cerebral palsy. Such technological advances are attracting investment, driving product innovation, and creating new market opportunities across the maternal healthcare sector.

Market Restraints:

What Challenges the Australia Maternal Healthcare Products Market is Facing?

High Cost of Premium Maternal Healthcare Products

Premium maternal healthcare products, particularly organic supplements, advanced monitoring devices, and specialized postnatal care items, carry significantly higher price points that limit accessibility for price-sensitive consumers. While quality-focused parents demonstrate willingness to invest in premium options, substantial portions of the population face affordability constraints restricting product choices. Cost barriers particularly affect families without adequate private health insurance coverage.

Limited Healthcare Access in Rural and Remote Areas

Geographic disparities in healthcare infrastructure create significant challenges for maternal healthcare product distribution and access across Australia's vast rural and remote regions. Limited availability of specialized maternal care services, reduced retail presence, and logistical difficulties in product delivery constrain market penetration beyond metropolitan centers. Indigenous communities and remote populations often experience reduced access to comprehensive prenatal care and quality maternal healthcare products.

Regulatory Complexity and Product Approval Timelines

Stringent regulatory requirements governing therapeutic goods, including prenatal supplements and medical devices, create barriers for market entry and product launches. The Therapeutic Goods Administration's comprehensive approval processes, while essential for consumer safety, extend product development timelines and increase compliance costs for manufacturers. Regulatory complexity particularly challenges smaller innovative companies seeking to introduce novel maternal healthcare solutions.

Competitive Landscape:

The Australia maternal healthcare products market exhibits moderate to high competitive intensity, with established multinational pharmaceutical companies competing alongside specialized maternal care brands and emerging organic product manufacturers. Market participants focus on product differentiation through clinical validation, organic certifications, innovative formulations, and strategic distribution partnerships. Companies are investing in research and development to introduce personalized nutrition solutions, advanced monitoring technologies, and sustainable packaging options. Digital marketing strategies, influencer partnerships, and direct-to-consumer sales channels are reshaping competitive dynamics as brands seek to establish direct relationships with health-conscious parents. Strategic collaborations between healthcare providers and product manufacturers are facilitating clinical validation studies and market access opportunities.

Recent Developments:

- April 2025: Biome Australia Limited announced the launch of two new products under its Activated Probiotics range: BiomeHer Pessary for vaginal health and Biome Perinatal Probiotic for pregnancy and postpartum support. Both products contain clinically trialed probiotic strains and aim to enhance women's health during critical life stages.

- December 2024: Premier Roger Cook and Health Minister Amber-Jade Sanderson inaugurated Australia’s first public hospital midwife-led maternity service, a A$2.6 million initiative. The new midwifery birth centre at Bentley Hospital, operated exclusively by Credentialed and Endorsed midwives, offers women across the East Metropolitan Health Service (EMHS) region an additional, dedicated option for childbirth.

Australia Maternal Healthcare Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Online Retail, Offline Retail |

| End-Users Covered | Hospitals and Clinics, Homecare Settings, Maternity Centers |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia maternal healthcare products market size was valued at USD 813.36 Million in 2025.

The Australia maternal healthcare products market is expected to grow at a compound annual growth rate of 16.03% from 2026-2034 to reach USD 3,100.88 Million by 2034.

Prenatal care products, holding the largest revenue share of 40%, remains pivotal for Australia's maternal healthcare market, driven by increasing awareness of prenatal nutrition importance, physician recommendations, and growing demand for comprehensive supplements supporting healthy fetal development.

Key factors driving the Australia maternal healthcare products market include supportive government healthcare policies, rising awareness of maternal and infant health importance, increasing demand for organic and natural products, technological advancements in monitoring devices, expanding e-commerce infrastructure, and growing investments in maternal health research.

Major challenges include high costs of premium maternal healthcare products limiting accessibility, geographical disparities in healthcare infrastructure affecting rural communities, regulatory complexity extending product approval timelines, and varying consumer awareness levels across different population segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)