Australia Meal Replacements Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2026-2034

Australia Meal Replacements Market Overview:

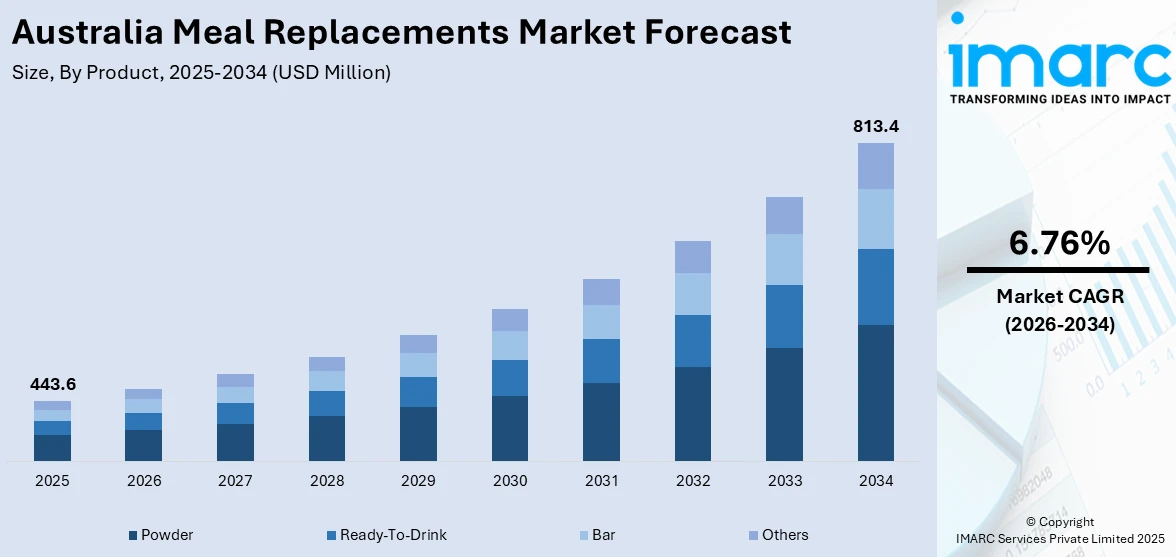

The Australia meal replacements market size reached USD 443.6 Million in 2025. Looking forward, the market is expected to reach USD 813.4 Million by 2034, exhibiting a growth rate (CAGR) of 6.76% during 2026-2034. Australian consumers are becoming more focused on health and well-being, and this is leading to an increase in the demand for meal replacement options. Moreover, Australia's busy lifestyle is catalyzing the demand for easy and time-saving food solutions among the masses. This, along with the rising popularity of specialized diets like keto, vegan, gluten-free, and paleo, is expanding the Australia meal replacements market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 443.6 Million |

| Market Forecast in 2034 | USD 813.4 Million |

| Market Growth Rate 2026-2034 | 6.76% |

Key Trends of Australia Meal Replacements Market:

Rising Health and Wellness Awareness

Australian consumers are becoming more focused on health and well-being, and this is leading to a rise in the demand for meal replacements. As people are becoming aware about the need for balanced nutrition, they are looking for meal replacements as a quick, nutritionally balanced solution to complement their active lifestyles. Individuals are also becoming conscious of their nutrition options and choosing products that provide regulated calories, necessary vitamins, and minerals with no cooking time. With the growing demand for healthier lifestyles, meal replacement products are gaining popularity among working professionals, athletes, and individuals with certain dietary restrictions. Firms are constantly innovating and developing products that meet these demands, making sure that they match customers' requirements for clean, plant-based, and functional ingredients. For instance, in 2024, FULFIL Vitamin & Protein Bars launched in Australia, offering a wide range of flavors, including chocolate peanut butter, chocolate hazelnut whip, milk chocolate crunch, and chocolate salted caramel.

To get more information on this market Request Sample

Growing Demand for Convenience

Australia's busy lifestyle is increasing demand for easy and time-saving food solutions, where meal replacers are gaining popularity as quick and healthy solutions. Consumers are in search of products that complement their hectic lifestyles well, with ready-to-eat solutions being easily taken on the move. Meal replacements such as shakes, bars, and powders are being extensively used by those looking for a convenient, quick option in place of full-fledged meals. It is especially attractive for city residents, working individuals, and people who have busy lifestyles. The heightened number of single-person households living on quick and convenient meal options, is contributing to the Australia meal replacements market growth. Moreover, as meal replacements are increasingly being made available through online shopping channels and grocery stores, they are favored by an expanding market. The IMARC Group predicts that the Australia e-commerce market is projected to attain USD 1,568.60 Billion by 2033.

Increased Demand for Specialized Diets

The rising popularity of specialized diets in Australia, including keto, vegan, gluten-free, and paleo, is heavily fueling the Australia meal replacements market demand. As Australians are increasingly sticking to particular diet regimes to control health conditions or for personal fitness purposes, they are resorting to meal replacement products that suit their nutritional requirements. Brands are proactively developing and marketing products for these specialty diets, providing high-protein, low-carb, and plant-based meal replacements. This shift toward customized nutrition is influencing producers to develop and expand product lines to accommodate the needs of the changing consumer population. The increased emphasis on personalized nutrition, as well as the greater availability of nutritional information, is further driving the demand for meal replacement. As increasing numbers of individuals adopt specialized diets as a means of their overall health and wellness plan, the market for personalized meal replacements in Australia is growing further. In 2024, Hemp Foods Australia unveiled its first vegan beauty supplement, which was a collagen product for enhancing hair, skin, and nail quality. The product was also capable of filling the nutritional gap created by plant-based consumable options.

Growth Drivers of Australia Meal Replacements Market:

Surging Demand for Weight Management Solutions

Increased demand for efficient weight management solutions is one of the key growth drivers in Australia's meal replacement market. As more people are concerned about obesity and resultant health complications, Australians are increasingly relying on meal replacements as an efficient, controlled method to regulate calorie consumption while maintaining balanced nutrition. Meal replacements offer an easy solution for individuals who want to lose or gain weight without the hassle of meal planning or preparation. This applies especially in Australia, where lifestyle-disease issues are common and consumers are on the lookout for products that can aid in healthier eating. Convenience and portion-controlled nature of meal replacements are what make them appealing to consumers seeking simple solutions to overcome weight issues, contributing to steady market expansion.

Increasing Rise of Sports Nutrition and Fitness Culture

Australia's active sports and fitness lifestyle contributes heavily to the demand for meal replacements. Fitness enthusiasts, athletes, and active adults increasingly look for easy-to-consume nutrition that aids muscle recovery, repletion of energy, and overall performance. Meal replacement foods—particularly those with high protein and fortification with vitamins and minerals—are easily incorporated into the lifestyles of Australian athletes and gym participants. Australia's strong outdoor activity and active lifestyle culture, from surfing and bushwalking to team sports, drives demand for functional nutrition that supports physical activity. This is helped by local and global brands providing specialized products for the sports nutrition segment, which promise convenience without sacrificing nutritional content. As knowledge of the place of nutrition in fitness increases, so does demand for meal replacements in Australia.

Product Diversification and Innovation

Product diversification and innovation are vital drivers of growth as per the Australia meal replacements market analysis. Australian consumers increasingly demand variety, flavor, and functional value in their meal replacement products, forcing brands to innovate new formulations and tastes. Local brands and international players are spending on research to formulate products that are tailored to Australian taste buds and nutritional requirements, including high-protein, low-sugar, and nutrient-dense versions. The addition of natural and organic ingredients is also on the rise, in line with greater food industry trends of transparency and clean labels. The market is also moving beyond conventional shakes and bars to ready-to-eat meals, snacks, and fortified drinks appealing to a broader consumer base. This expansion enables meal replacement to position itself for different occasions, including weight loss and sports nutrition as well as general health and wellness. As brands continue to innovate and customize offerings, the meal replacements market in Australia is poised for sustained growth and increased consumer loyalty.

Opportunities of Australia Meal Replacements Market:

Expansion Through Health-Conscious Consumer Segments

The growing health-conscious consumer base in Australia presents significant opportunities for the meal replacements market. Australians are increasingly prioritizing balanced nutrition and healthier lifestyles, driven by rising awareness about the impacts of diet on long-term wellness. This has created a boom in demand for products that are convenient to use without sacrificing nutritional quality. Meal replacement is particularly attractive to working individuals, health club enthusiasts, and weight managers, as it is an easy means of taking controlled portions of necessary nutrients. Moreover, the growing popularity of niche diets like keto, vegan, and gluten-free provides brands with the opportunity to create specialized meal replacement products for these consumers. As Australians are increasingly choosy about ingredients, transparency, and quality, products highlighting organic, natural, and local ingredients can address niche market segments and generate brand loyalty. Seizing this changing health consciousness allows manufacturers to launch new products and increase market share.

Opportunity in Regional and Remote Markets

Australia's immense geography and spread-out population present special opportunities to address regional and remote markets with meal replacement foods. A great number of consumers beyond urban centers experience restricted access to fresh, nutritious foods owing to geographical remoteness, such that convenient, shelf-stable meal replacements are especially appealing. With the growth of e-commerce and enhanced logistics networks in Australia, brands are able to access these underserved regions readily. Marketing and product offerings adapted to the regional Australian's lifestyle and dietary preferences, like high-energy versions for physically demanding rural laborers or products for extreme weather conditions, can set brands apart in these regions. Furthermore, collaboration with in-area health services and gyms to market meal replacements as components of healthy diets and weight management plans would aid in establishing trust and awareness. Augmenting presence in those markets provides a catalyst for long-term growth beyond crowded city centers.

Utilizing Digital Platforms and Personalized Nutrition

The emergence of digital platforms and personalized nutrition is a strong potential opportunity for the Australian market for meal replacements. Australians are increasingly employing internet-based tools and apps to monitor nutrition, health objectives, and fitness development, which provides the perfect platform for incorporating meal replacement foods into customized diet strategies. Companies that provide customizable meal replacement products, be it through subscription plans, customized nutrient content, or personal flavor preferences, can attract consumers who are looking for convenient, tailor-made solutions. In addition, the high prevalence of social media and influencer marketing in Australia presents an effective platform to reach health-driven consumers and create brand communities. Digital technology also allows firms to collect insightful consumer data that can guide product design and marketing efforts in accordance with Australian consumer patterns. Adopting technology improves customer experience while also simplifying distribution and pushing growth in the competitive industry.

Australia Meal Replacements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product and distribution channel.

Product Insights:

- Powder

- Ready-To-Drink

- Bar

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes powder, ready-to-drink, bar, and others.

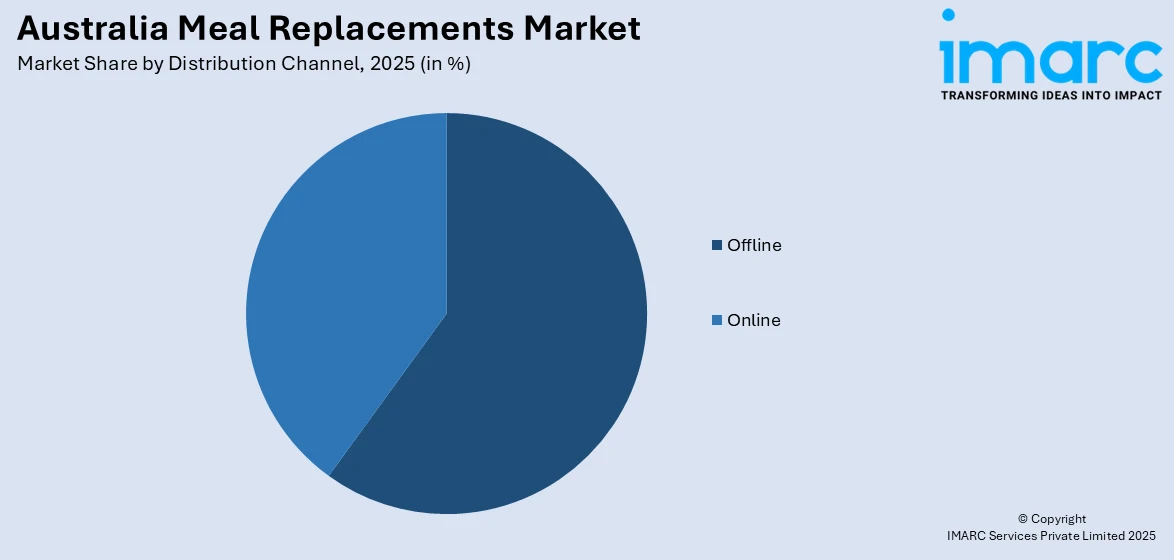

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline

- Hypermarkets and Supermarkets

- Convenience Stores

- Specialty Stores

- Others

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline (hypermarkets and supermarkets, convenience stores, specialty stores, and others) and online.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Meal Replacements Market News:

- In June 2024, a recent analysis revealed that CSIRO's Fast Start meal replacement shakes, included in the CSIRO Total Wellbeing Diet online program, have assisted Australians in initiating their weight loss efforts, with 98% of participants losing weight within 12 weeks. The examination of more than 10,300 CSIRO Total Wellbeing Diet participants using Fast Start revealed that 28% of individuals moved out of the obese range after 12 weeks, while 31 percent achieved this after 24 weeks. The research supported Fast Start program assists overweight or obese Australians in achieving lasting and healthy dietary adjustments, beginning with partial meal replacements, combined with education, behavior change assistance, and organized meal plans.

- On Thursday, March 6, 2025, the Therapeutic Goods Advertising Consultative Committee (TGACC) convened in Sydney. Members expressed worries regarding foods and supplements that assert they enhance the use of GLP-1 receptor agonists (GLP-1 RAs), including meal replacements or dietary supplements. Members also talked about how economic factors affect vitamin supplement usage. Worries were expressed regarding the promotion of these products, given health effects for consumers replacing fresh fruits and vegetables with supplements.

- In July 2025, a clinical trial in Queensland revealed encouraging indications of a safe and effective new weight loss method for individuals with kidney disease. Senior Kidney Dietitian Margie Conley was among just 20 researchers chosen to present at the Queensland Health Research Excellence Showcase, where she discussed results from a study by Metro South and Metro North examining aggressive weight loss for individuals with kidney disease and obesity. The research, supported by Kidney Health Australia, examined if a low-energy diet featuring meal replacements alongside whole foods could enable individuals with chronic kidney disease to achieve substantial weight loss safely, and if that loss could subsequently slow disease progression and enhance quality of life.

Australia Meal Replacements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Powder, Ready-To-Drink, Bar, Others |

| Distribution Channels Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia meal replacements market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia meal replacements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia meal replacements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia meal replacements market was valued at USD 443.6 Million in 2025.

The Australia meal replacements market is projected to exhibit a CAGR of 6.76% during 2026-2034.

The Australia meal replacements market is expected to reach a value of USD 813.4 Million by 2034.

The Australia meal replacements market trends include a growing preference for plant-based and clean-label products, increased demand for high-protein and low-sugar options, and the rise of ready-to-drink formats. Digital platforms and personalized nutrition solutions are also shaping consumer choices, driving innovation and expanding the market’s reach.

The Australia meal replacements market is driven by increasing health awareness, busy lifestyles, and rising demand for convenient, nutritious options. Growth in fitness culture and weight management solutions further fuels demand. Additionally, product innovation and expanding e-commerce channels enhance accessibility, supporting steady market expansion across diverse consumer segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)