Australia Meat Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Region, 2026-2034

Australia Meat Market Summary:

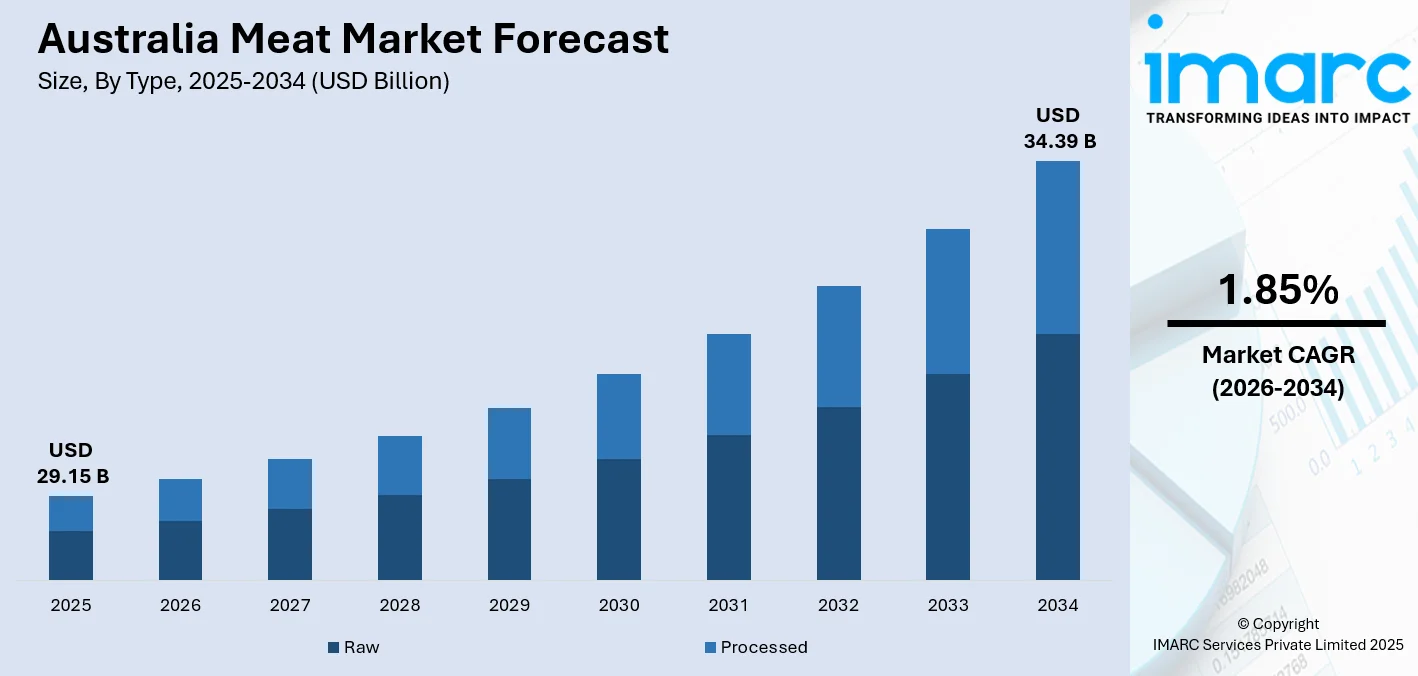

The Australia meat market size was valued at USD 29.15 Billion in 2025 and is projected to reach USD 34.39 Billion by 2034, growing at a compound annual growth rate of 1.85% from 2026-2034.

The Australia meat market is underpinned by robust domestic consumption patterns, a well-established livestock production infrastructure, and expanding export opportunities across global markets. The sector benefits from favourable climatic conditions that support pastoral agriculture, advanced meat processing technologies that ensure quality and traceability, and strategic free trade agreements that facilitate international market access. Growing consumer preference for premium and ethically sourced protein products continues to shape Australia meat market share.

Key Takeaways and Insights:

- By Type: Raw dominates the market with a share of 64% in 2025, driven by strong household preference for fresh, unprocessed meat cuts suitable for traditional cooking methods and barbecue culture.

- By Product: Beef leads the market with a share of 40% in 2025, supported by Australia’s status as a leading global beef supplier, robust local demand, and production systems strongly aligned with export markets.

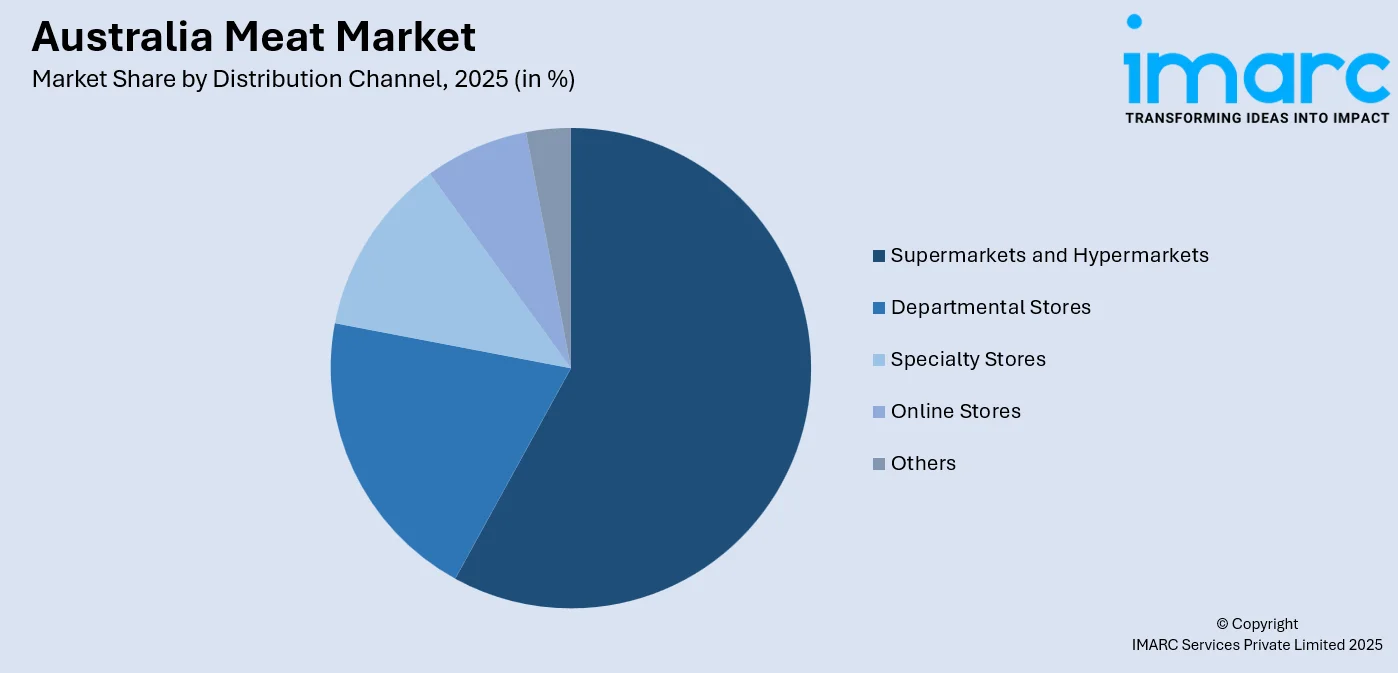

- By Distribution Channel: Supermarkets and hypermarkets dominate the market with a share of 60% in 2025, benefiting from extensive retail networks, competitive pricing strategies, and convenient one-stop shopping experiences.

- By Region: Australia Capital Territory & New South Wales represent the largest segment with 31% market share in 2025, supported by the highest population concentration and well-developed retail and processing infrastructure.

- Key Players: The Australia meat market exhibits a moderately concentrated structure with established processing conglomerates competing alongside regional operators. Major processors maintain extensive supply chain networks, feedlot operations, and export-certified facilities, while independent butchers and specialty retailers capture niche premium segments.

To get more information on this market Request Sample

Australia's meat industry represents a cornerstone of the national agricultural economy, generating substantial rural employment and foreign exchange earnings through diversified export channels. The sector encompasses beef, lamb, pork, poultry, and goat production, supported by extensive grazing lands, modern feedlot facilities, and world-class processing infrastructure. Consumer demand remains anchored by high per capita meat consumption patterns, with beef consumption averaging over twenty kilograms per person annually, significantly exceeding global averages. The market continues evolving in response to shifting dietary preferences, sustainability imperatives, and technological innovations transforming production and distribution systems. For instance, in February 2025, Jack's Creek introduced its premium Wagyu X range of beef into the United Kingdom via Ocado, reflecting the growing international appetite for Australian premium meat products and the sector's capacity to capture value in discerning overseas markets.

Australia Meat Market Trends:

Rise of Premium and Grass-Fed Meat Products

Australian consumers increasingly prioritise health, sustainability, and ethical sourcing when selecting meat products, driving substantial growth in grass-fed and premium offerings. Grass-fed beef and lamb command premium pricing due to perceived nutritional benefits, including reduced fat profiles and elevated omega-3 content. Enhanced product labelling emphasising natural feeding practices and ethical production processes strengthens consumer confidence. For instance, in 2024, Stone Axe Pastoral Company's Margaret River Wagyu achieved the Open Crossbred Steak Champion title at the Wagyu Branded Beef Competition with a marbling score exceeding nine, demonstrating Australia's premium production capabilities.

Growth in Plant-Based and Hybrid Meat Alternatives

The market witnesses a gradual expansion of plant-based and hybrid meat alternatives, catering to flexitarian consumers seeking reduced conventional animal protein dependency. Innovation focuses on improved taste, texture, and nutritional profiles to address evolving expectations among health-conscious buyers. Institutional food service providers increasingly incorporate these options across school, healthcare, and corporate catering menus. For instance, in September 2024, Australian brand vEEF introduced a carbon-neutral range of plant-based meats including sausages and mince, at price parity with conventional meat, expanding accessibility across national retail networks.

Increased Demand for Export-Ready and Traceable Meat

Escalating global requirements around food safety, provenance verification, and quality certification drive heightened emphasis on export-ready, fully traceable products. Sophisticated traceability systems now monitor livestock from paddock to packaging, providing end-to-end visibility for international buyers. Digital platforms streamline export documentation and logistics, facilitating market access particularly in Asia-Pacific and Middle Eastern destinations. For instance, in 2024, Australian red meat exports reached record volumes totalling over two million tonnes shipped to more than one hundred countries, underpinned by a comprehensive traceability infrastructure.

Market Outlook 2026-2034:

The Australia meat market outlook remains positive, underpinned by stable domestic protein consumption, growing demand from Asian export markets, and ongoing investment in processing efficiency and sustainability. A strong focus on premium and value-added segments, alongside deepening free trade linkages, supports long-term revenue growth despite production limitations linked to environmental factors. At the producer level, wider adoption of renewable energy, precision farming tools, and carbon-reduction initiatives reflects a strategic response to tightening regulations and shifting consumer preferences. The market generated a revenue of USD 29.15 Billion in 2025 and is projected to reach a revenue of USD 34.39 Billion by 2034, growing at a compound annual growth rate of 1.85% from 2026-2034.

Australia Meat Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Raw |

64% |

|

Product |

Beef |

40% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

60% |

|

Region |

Australia Capital Territory & New South Wales |

31% |

Type Insights:

- Raw

- Processed

Raw dominates with a market share of 64% of the total Australia meat market in 2025.

The raw meat segment maintains commanding market leadership, reflecting entrenched Australian consumer preferences for fresh, unprocessed cuts suited to home preparation and outdoor cooking traditions. Strong household consumption patterns centre on natural beef steaks, lamb chops, and pork cuts purchased through supermarket and butcher channels. Quality-conscious consumers increasingly seek premium fresh offerings with clear provenance information and grass-fed credentials. The segment benefits from sophisticated cold chain logistics ensuring product freshness from abattoir to retail display.

Australian barbecue culture reinforces demand for raw meat products suitable for grilling and roasting applications central to social gatherings. Retailers respond with expanded fresh meat ranges, including marinated and portion-controlled options, addressing convenience requirements without sacrificing product freshness. Investment in retail presentation, including butcher-style service counters within supermarkets, enhances consumer confidence and supports premium positioning. In 2024, Meat and Livestock Australia confirmed that grainfed Australian beef exports reached a record 375,195 tonnes, reflecting strong demand for quality fresh product in international markets.

Product Insights:

- Chicken

- Beef

- Pork

- Mutton

- Others

Beef leads with a share of 40% of the total Australia meat market in 2025.

Beef maintains its position as the cornerstone of Australian meat consumption, supported by an extensive cattle industry spanning diverse production systems from northern pastoral operations to southern grain-finishing regions. Strong cultural affinity for beef roasts, steaks, and mince products underpins consistent household purchasing patterns across demographic segments. The sector benefits from rigorous quality assurance programmes, including the Meat Standards Australia grading system, ensuring consistent eating experiences. Premium wagyu and grass-fed beef categories capture growing value share as consumers trade up for special occasion purchases.

Export market success reinforces domestic industry viability, with Australian beef commanding premium positioning in discerning international markets. Record production volumes in 2024 reached over 2.57 million tonnes, representing the highest annual output in industry history. Robust demand from the United States, influenced by tighter domestic cattle supplies, has strengthened Australia’s beef export performance. The beef segment continues to attract investment across feedlot capacity, processing efficiency, and brand building, with a strong emphasis on quality positioning for both domestic consumers and premium international markets.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

Supermarkets and hypermarkets represent the largest share of 60% of the total Australia meat market in 2025.

Supermarkets and hypermarkets dominate meat distribution through extensive store networks, competitive pricing strategies, and comprehensive product assortments meeting diverse consumer requirements. Major chains including Woolworths and Coles together command approximately sixty-five percent of grocery market share, leveraging substantial purchasing power and sophisticated supply chain capabilities. In-store butcher counters complement pre-packaged offerings, providing service-oriented experiences differentiating major retailers from discount competitors. Loyalty programmes and promotional activities drive customer traffic and purchase frequency across meat categories.

Investment in cold chain infrastructure, including automated distribution centres and temperature-controlled logistics, ensures product quality from supplier to store shelf. Online grocery channels continue expanding, with major retailers developing delivery subscription services and rapid fulfillment capabilities. Private label meat ranges grow in prominence as retailers control supply chains and capture margin while offering value-positioned alternatives. For instance, in 2024, Coles opened two highly automated customer fulfillment centres powered by advanced technology in Victoria and New South Wales, enhancing service capabilities for online meat purchases.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales exhibit clear dominance with a 31% share of the total Australia meat market in 2025.

The meat market in the ACT is driven by strong local demand from households, foodservice outlets, and institutional buyers, supported by a well-developed retail infrastructure. Consumer preferences for high-quality, safe, and traceable meat products encourage the adoption of premium cuts and specialty offerings. Health-conscious and ethically minded consumers increasingly seek sustainably sourced and locally produced meat, prompting suppliers to focus on animal welfare standards, environmental practices, and branding strategies that resonate with the region’s discerning population.

In New South Wales, market growth is propelled by a large and diverse population alongside robust urban and regional demand for red meat, poultry, and processed products. Rising disposable incomes and evolving dietary trends, including preference for protein-rich diets, support premium and value-added segments. Strong export-oriented production systems also contribute, as NSW producers capitalize on access to Asian markets. Investments in processing efficiency, cold chain logistics, and food safety compliance further strengthen supply reliability and reinforce consumer confidence in the meat sector.

Market Dynamics:

Growth Drivers:

Why is the Australia Meat Market Growing?

Strong Agricultural Heritage and Export Capability

Australia’s long-established agricultural heritage underpins a reliable and resilient meat production base, supported by expansive pastoral resources, varied climatic conditions, and generations of livestock management expertise. Its strategic geographic location provides efficient access to high-growth Asia-Pacific protein markets, while rigorous biosecurity and food safety standards create strong differentiation in quality-driven destinations. Broad free trade coverage further enhances market accessibility and competitiveness. Together, these structural advantages reinforce the sector’s export orientation and its ability to support sustained industry growth and value creation.

Evolving Consumer Preferences and Health Awareness

Shifting consumer lifestyles and heightened nutritional consciousness reshape demand patterns, with growing emphasis on lean cuts, minimally processed products, and transparent sourcing credentials. Health-aware consumers increasingly favour grass-fed, hormone-free, and organic meat options, aligning with dietary objectives and wellness priorities. Ethical considerations around animal welfare, environmental sustainability, and supply chain traceability influence purchasing decisions across demographic segments. According to Meat and Livestock Australia research, ninety-two percent of Australian households purchased beef, and seventy-two percent bought lamb during 2024, confirming meat's enduring central role in national dietary patterns while highlighting opportunities for premium positioning, addressing evolving consumer expectations.

Technological Integration and Sustainable Practices

Technological advancement across farming, processing, and distribution operations enhances productivity, quality assurance, and waste reduction throughout the meat value chain. Precision agriculture applications, automated processing systems, and sophisticated cold chain logistics improve operational efficiency while maintaining premium product standards. Environmental sustainability emerges as a strategic priority, driving the adoption of renewable energy, enhanced land management practices, and emissions reduction programmes across production systems. The Australian Meat Processor Corporation's Innovation Showcase in Brisbane highlights advances in automation, artificial intelligence, and labour-saving technologies reshaping processing efficiency and addressing workforce constraints that have historically challenged the sector. For instance, in November 2025, JBS Australia achieved an industry first by securing AUS-MEAT’s Facility Objective Carcase Measurement (OCM) Device Approval for MEQ Solutions’ cold carcase grading camera, representing a significant advancement in carcase assessment technology. Developed through close collaboration with Meat & Livestock Australia, the Australian Meat Processor Corporation, and MEQ Solutions, the initiative has led to authorisation for camera-based grading across three JBS processing facilities using the advanced system.

Market Restraints:

What Challenges the Australia Meat Market is Facing?

Labour Shortages in Processing and Agriculture

Critical workforce shortages across rural production areas and processing facilities constrain operational capacity and elevate labour costs throughout the supply chain. The industry relies increasingly on skilled migration programmes and seasonal worker schemes to address persistent staffing deficits affecting slaughter throughput, meat processing efficiency, and on-farm labour requirements.

Climate Variability and Environmental Pressures

Climate variability, including recurring droughts, extreme weather events, and altered seasonal cycles, periodically disrupts livestock production systems. These conditions affect feed availability, herd health, and overall farm sustainability. At the same time, increasing scrutiny of greenhouse gas emissions from cattle production creates regulatory uncertainty and heightens reputational risks for meat industry participants.

Global Economic Uncertainty and Price Volatility

Global economic fluctuations influence consumer confidence and purchasing behavior, particularly for premium meat products in both domestic and export markets. Exchange rate volatility, evolving trade policies, and geopolitical developments add uncertainty to export earnings. Rising input costs, including feed, energy, and logistics, further pressure producer profitability and operational planning.

Competitive Landscape:

The Australia meat market exhibits a moderately concentrated competitive structure characterised by established multinational processors operating alongside regional and family-owned enterprises. Major processing groups including JBS Australia and the recently restructured Teys Australia maintain extensive supply chain networks, feedlot operations, and export-certified processing facilities capturing significant production volumes. Mid-tier processors focus on regional supply relationships and specialty product categories while independent butchers and artisanal producers serve premium retail and food service segments. Competition intensifies around supply chain efficiency, quality assurance credentials, export market access, and sustainability certifications differentiating offerings in increasingly discerning consumer and customer markets.

Recent Developments:

- November 2025: Cargill completed its full acquisition of Teys Australia, increasing ownership to one hundred percent following regulatory approvals. The transaction marks a significant milestone in the longstanding partnership, ensuring continuity for employees, producers, and partners while honouring the company's seventy-five-year Australian legacy under new chief executive Andrew MacPherson.

- February 2025: Meat and Livestock Australia, through its Aussie Beef and Lamb brand, made a prominent return to Gulfood in Dubai, marking fifty years of Australian red meat presence in the Middle East and reinforcing export market relationships in the strategically important Gulf region.

Australia Meat Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Raw, Processed |

| Products Covered | Chicken, Beef, Pork, Mutton, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia meat market size was valued at USD 29.15 Billion in 2025.

The Australia meat market is expected to grow at a compound annual growth rate of 1.85% from 2026-2034 to reach USD 34.39 Billion by 2034.

Raw represent the largest share at 64% in 2025, driven by strong consumer preference for fresh, unprocessed meat cuts suited to Australian cooking traditions and barbecue culture.

Key factors driving the Australia meat market include strong agricultural heritage supporting export capabilities, evolving consumer preferences toward premium and ethically sourced products, and technological integration enhancing production efficiency and sustainability practices.

Major challenges include persistent labour shortages in processing and agricultural sectors, climate variability impacting livestock production, environmental sustainability pressures, and global economic uncertainty affecting consumer spending and export market demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)