Australia Meat Processing Market Size, Share, Trends and Forecast by Product, Equipment, Meat, Mode of Operation, and Region, 2025-2033

Australia Meat Processing Market Overview:

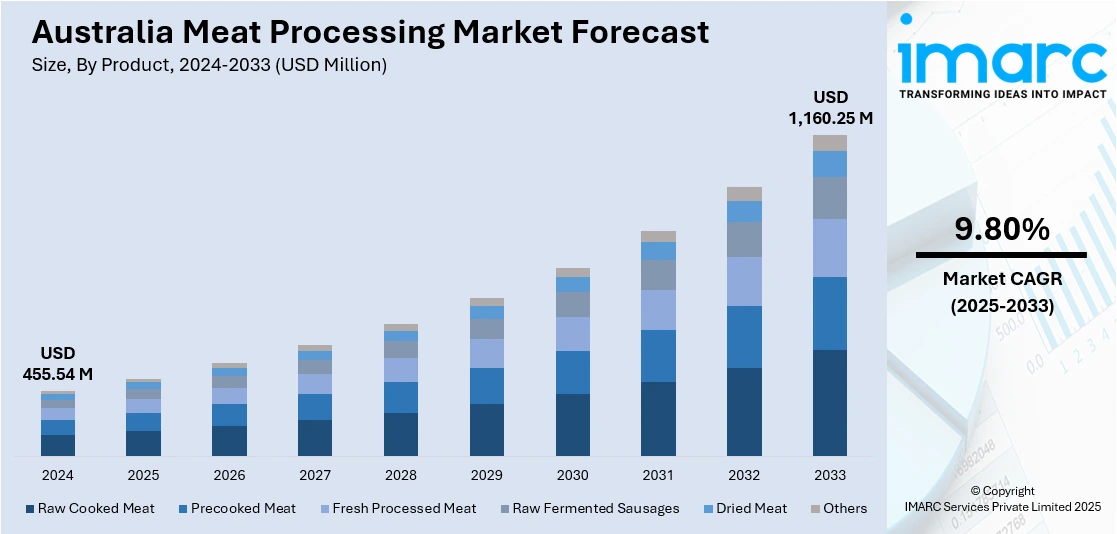

The Australia meat processing market size reached USD 455.54 Million in 2024. Looking forward, the market is projected to reach USD 1,160.25 Million by 2033, exhibiting a growth rate (CAGR) of 9.80% during 2025-2033. Increasing demand for high-quality meat products, strong export growth, technological advancements in processing, rising consumer preferences for sustainable and ethically produced meats, and a robust domestic agricultural sector supporting production capacity are some of the factors contributing to Australia meat processing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 455.54 Million |

| Market Forecast in 2033 | USD 1,160.25 Million |

| Market Growth Rate 2025-2033 | 9.80% |

Key Trends of Australia Meat Processing Market:

Growth and Global Expansion of Meat Processing Sector

Australia’s meat processing sector has seen remarkable growth, with a significant rise in employment opportunities. The industry continues to achieve impressive sales revenue, driven by strong demand for premium beef, lamb, goat, and mutton. Exports to numerous global markets underscore the international appeal of Australian red meat, highlighting its reputation for quality and reliability. The sector plays a vital role in bolstering regional Australia’s economy, providing substantial contributions to household income. This growth reflects the strength of local meat processors and their capacity to meet global consumer expectations while maintaining strict food safety and animal welfare standards. The ongoing success of the industry emphasizes its importance as a key player in both the national and international markets. These factors are intensifying the Australia meat processing market growth. For example, as per industry reports, Australia's red meat processing industry has significantly boosted the economy, supporting 189,487 jobs, an increase of over 50,000 since 2022. In 2024, the sector achieved USD 25.452 Billion in direct sales revenue, with record-breaking sales across beef, lamb, goat, and mutton. Australian red meat was exported to over 50 countries, highlighting strong global demand. The industry contributed USD 17.8 Billion to household income, emphasizing its vital role in regional Australia’s economy.

To get more information on this market, Request Sample

Strengthening Global Market Presence

Australia's meat processing industry continues to expand its global reach, particularly in the Middle East and North Africa (MENA) region. With increasing demand for high-quality, ethically produced red meat, Australian exporters are solidifying their reputation for premium beef, lamb, goat, and veal. Key market players are focusing on meeting rigorous food safety and animal welfare standards, alongside offering Halal-certified products, which align with regional consumer expectations. In addition to showcasing diverse product offerings, Australian meat processors are leveraging international events to foster partnerships and explore new market opportunities, contributing to the overall growth of the sector. This expansion highlights the growing importance of Australia as a trusted supplier in the global red meat market. For instance, in February 2025, Meat & Livestock Australia (MLA), through its Aussie Beef & Lamb brand, made a strong return to Gulfood 2025, marking 50 years in the Middle East. The event showcased Australia’s premium beef, lamb, goat, and veal products, emphasizing strict food safety and animal welfare standards. With all exports to the MENA region certified Halal, Aussie Beef & Lamb exceeded regulatory expectations. Thirty-four Australian brands exhibited, including Fettayleh, a finalist for the Innovation Awards.

Adoption of Automation and Technology

The integration of automation and technology is transforming the meat processing industry in Australia. Companies are making significant investments in robotic cutting systems, automated packaging lines, and sophisticated quality control tools to improve consistency, safety, and operational efficiency. These advancements contribute to lower labor costs, reduce human errors, and enhance productivity which is essential in a competitive global marketplace. Additionally, digital traceability systems provide improved monitoring of supply chains ensuring transparency from farm to fork. The incorporation of smart technologies meets the increasing consumer demand for quality and bolsters export competitiveness. This transformation greatly drives Australia meat processing market demand as efficiency and innovation become crucial differentiators in both domestic and international markets.

Growth Drivers of Australia Meat Processing Market:

Rising Domestic Consumption

The increase in meat demand within Australia is influenced by shifting dietary habits with more consumers focusing on incorporating protein-rich foods into their daily diets. Factors such as urbanization and hectic lifestyles are contributing to the rising appeal of processed meat products which provide convenience while maintaining taste and nutritional value. There is a growing interest in premium and value-added meat products as consumers actively seek out healthier and higher-quality choices. Additionally, rising affluence within the middle class and a readiness to invest in a variety of meat types further bolster market growth. This consistent rise in local consumption lays a solid groundwork for industry expansion ensuring sustained demand for the Australian meat processing market across different product categories.

Cold Chain and Logistics Development

An efficient cold chain and logistics framework is essential for preserving the quality and safety of processed meat items. With modern storage, refrigeration, and transportation systems, producers can guarantee that meat products are delivered to both domestic and international markets in peak condition. According to Australia meat processing market analysis, the growth of cold chain facilities minimizes waste, prolongs shelf life, and fosters consumer trust in product safety. Moreover, innovations in packaging technology and traceability systems enhance logistic capabilities, creating a smooth supply chain. This progress facilitates domestic distribution and enhances Australia’s competitiveness in the global meat market.

Government Support and Regulations

Supportive government initiatives and stringent regulations serve as key growth factors for the Australian meat processing sector. Authorities focus on upholding high standards of food safety, hygiene, and quality assurance, thereby bolstering consumer confidence. Trade agreements and export support initiatives open up broader market opportunities for Australian meat products, particularly in regions with high demand. Regulatory frameworks also promote sustainable practices that align with global consumer expectations. Additionally, government investment in research and innovation aids in modernizing the processing industry, enabling companies to embrace advanced technologies and increase their capacity. This robust regulatory and policy backing is crucial for enhancing the sector’s global standing and its long-term growth possibilities.

Opportunities of Australia Meat Processing Market:

Expansion into Premium Segments

The Australia meat processing market is seeing a rise in opportunities within premium categories as consumer preferences shift toward organic, grass-fed, and free-range meat. Health-conscious consumers are increasingly willing to pay more for products that promise higher nutritional value, ethical sourcing, and superior taste. This trend corresponds with an increasing awareness about sustainability and animal welfare, prompting processors to create value-added products that exceed standard offerings. Effective branding and certification are essential for gaining consumer confidence, with labels like “organic certified” or “grass-fed” serving as important differentiators. By concentrating on premium segments, meat processors can enhance their share in the domestic market while also improving their status in international markets where demand for high-quality Australian meat is robust.

Innovation in Processed Foods

A significant opportunity for the Australia meat processing market lies in innovation within the ready-to-eat (RTE) and ready-to-cook (RTC) categories. The fast-paced nature of urban lifestyles and the growing demand for convenience are motivating consumers to look for quick yet nutritious meal solutions. Products such as marinated cuts, frozen dinners, and portion-controlled packs are becoming popular as they offer a blend of taste, safety, and convenience. Companies that invest in advanced processing, packaging, and preservation methods can develop items with extended shelf life and enhanced quality. Furthermore, incorporating flavor innovation and healthier ingredients meets evolving consumer preferences. This focus on innovation allows meat processors to move beyond traditional products and capture a growing market share among those seeking easy-to-prepare, high-quality protein options.

Regional Expansion

Expanding meat processing operations into regional and rural areas presents substantial prospects for the Australia meat processing market. Developing new facilities outside metropolitan areas can alleviate logistical challenges, improve supply chain efficiency, and provide closer access to livestock sources. This strategy bolsters local economies by generating employment opportunities and promoting regional growth, while also encouraging community engagement. Additionally, decentralizing processing capabilities can lead to a more effective balance of supply and demand, particularly in regions with high export potential. Regional facilities can also focus on niche products tailored for specific markets, thereby diversifying business offerings. By making strategic investments in rural infrastructure, meat processors can develop wider distribution networks and long-term sustainability while contributing to national growth through balanced regional development.

Challenges of Australia Meat Processing Market:

High Operating Costs

The meat processing sector in Australia is grappling with substantial challenges stemming from escalating operating expenses. Factors such as labor costs, energy prices, and expenses related to compliance exert significant pressure on processors, particularly smaller and medium-sized enterprises. Skilled workers are seeking higher compensation, and the energy demands of operations like refrigeration and machinery further inflate overhead costs. In addition, stringent food safety and animal welfare regulations contribute to compliance expenses that squeeze profit margins. These climbing costs make it increasingly difficult for processors to maintain competitiveness in both local and international markets. Companies often struggle to find a balance between operational efficiency and quality while keeping their prices reasonable for consumers. Unless addressed through automation, technological advancements, and strategies to optimize costs, high operating expenses will continue to be a substantial obstacle to achieving profitability.

Environmental Concerns

Sustainability has emerged as an urgent issue in the Australian meat processing industry, with mounting scrutiny over environmental practices. The sector is under pressure to lessen its carbon footprint, conserve water, and handle waste in an environmentally friendly manner. Meat processing facilities consume significant resources, and worries regarding greenhouse gas emissions, water pollution, and land usage keep the industry under constant evaluation. There is a growing demand from consumers, investors, and regulatory bodies for sustainable and eco-friendly operations, compelling companies to implement greener technologies and sustainable processing practices. Although these changes require significant investments, failing to respond could negatively impact brand reputation and limit market access. The challenge remains in reconciling environmental responsibility with profitability while fulfilling rising expectations for ethical and sustainable meat production.

Changing Consumer Preferences

Consumer preferences are evolving rapidly, presenting challenges for the Australian meat processing market. An increasing interest in plant-based alternatives, vegetarian diets, and health-conscious eating habits has influenced the demand for traditional meat products. Younger consumers are particularly inclined toward sustainable and ethical food options, including a reduction in meat consumption. Furthermore, concerns regarding the health implications of processed meats, including connections to high cholesterol and heart disease, have led many to consider alternative protein sources. This trend places pressure on meat processors to revise their product lines, invest in healthier alternatives, or branch into plant-based offerings. While meat continues to be a staple, the gradual shift in consumer behavior presents long-term risks to the growth of demand for conventional meat products.

Australia Meat Processing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, equipment, meat, and mode of operation.

Product Insights:

- Raw Cooked Meat

- Precooked Meat

- Fresh Processed Meat

- Raw Fermented Sausages

- Dried Meat

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes raw cooked meat, precooked meat, fresh processed meat, raw fermented sausages, dried meat, and others.

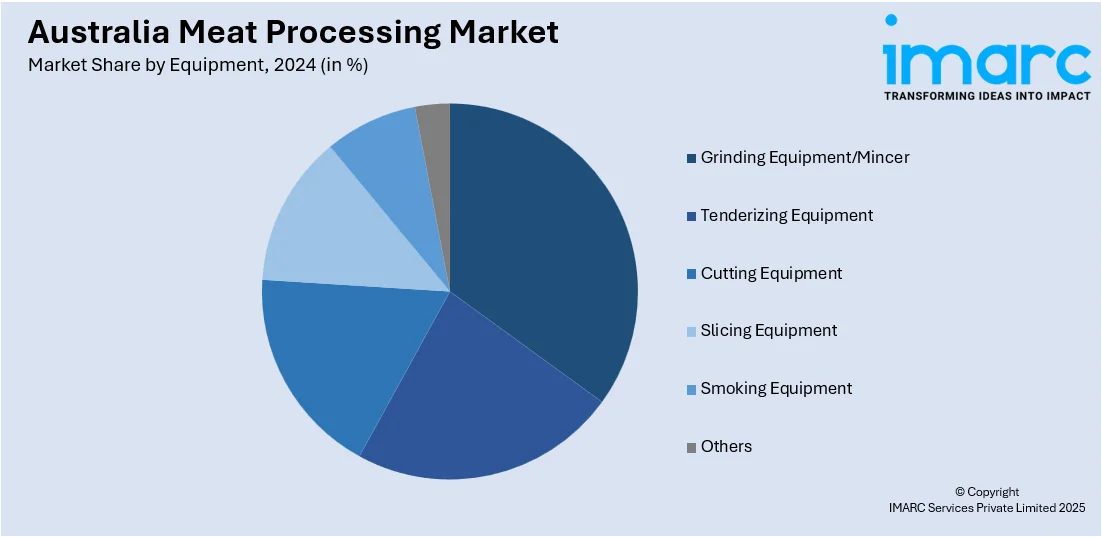

Equipment Insights:

- Grinding Equipment/Mincer

- Tenderizing Equipment

- Cutting Equipment

- Slicing Equipment

- Smoking Equipment

- Others

A detailed breakup and analysis of the market based on the equipment have also been provided in the report. This includes grinding equipment/mincer, tenderizing equipment, cutting equipment, slicing equipment, smoking equipment, and others.

Meat Insights:

- Beef

- Pork

- Mutton

- Others

The report has provided a detailed breakup and analysis of the market based on the meat. This includes beef, pork, mutton, and others.

Mode of Operation Insights:

- Manual

- Semi-Automatic

- Automatic

A detailed breakup and analysis of the market based on the mode of operation have also been provided in the report. This includes manual, semi-automatic, and automatic.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Meat Processing Market News:

- In April 2025, the Australian Meat Industry Council (AMIC) celebrated the approval of 17 Australian sheep, lamb, and goat export establishments for access to the China market. This includes new access for 10 establishments and expanded product categories for seven. The achievement reflects years of collaboration between industry and government, strengthening the China-Australia relationship. This milestone promises benefits for exporters, processors, and farmers, ensuring a reliable supply and adherence to China’s technical standards.

Australia Meat Processing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Raw Cooked Meat, Precooked Meat, Fresh Processed Meat, Raw Fermented Sausages, Dried Meat, Others |

| Equipments Covered | Grinding Equipment/Mincer, Tenderizing Equipment, Cutting Equipment, Slicing Equipment, Smoking Equipment, Others |

| Meats Covered | Beef, Pork, Mutton, Others |

| Mode of Operations Covered | Manual, Semi-Automatic, Automatic |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia meat processing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia meat processing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia meat processing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The meat processing market in Australia was valued at USD 455.54 Million in 2024.

The Australia meat processing market is projected to exhibit a compound annual growth rate (CAGR) of 9.80% during 2025-2033.

The Australia meat processing market is expected to reach a value of USD 1,160.25 Million by 2033.

The Australia meat processing market is witnessing trends such as adoption of automation and robotics for efficiency, rising demand for traceability and transparency, expansion of value-added premium meat products, and increasing focus on sustainable processing methods to meet evolving consumer and regulatory expectations.

The market is driven by rising domestic consumption of protein-rich diets, strong export demand from Asia-Pacific, advancements in cold chain and logistics, and supportive government policies promoting food safety and quality standards, which collectively enhance production capacity and international competitiveness for Australian meat processors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)