Australia Medical Cannabis Market Size, Share, Trends and Forecast by Species, Derivatives, Application, Route of Administration, End Use, and Region, 2025-2033

Australia Medical Cannabis Market Size and Trends:

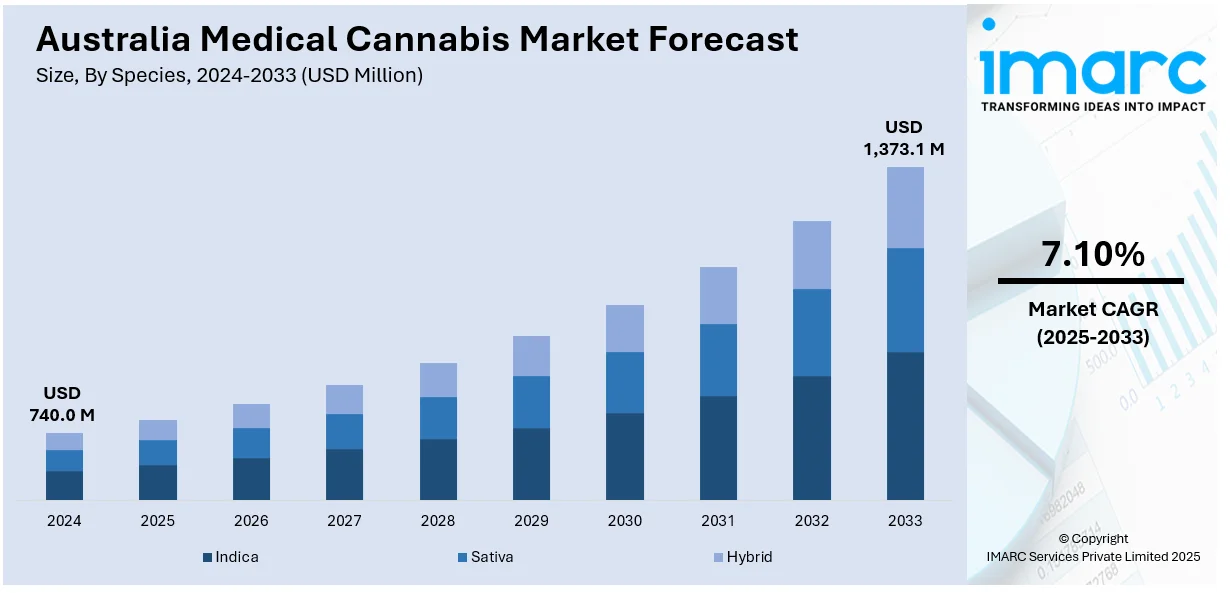

The Australia medical cannabis market size reached USD 740.0 Million in 2024. The market is projected to reach USD 1,373.1 Million by 2033, exhibiting a growth rate (CAGR) of 7.10% during 2025-2033. The market is driven by increasing government approvals, rising patient demand for alternative treatments, expanding research on therapeutic benefits, and growing investment in domestic cannabis production. Improved accessibility, physician acceptance, and evolving regulations further contribute to the Australia medical cannabis market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 740.0 Million |

| Market Forecast in 2033 | USD 1,373.1 Million |

| Market Growth Rate 2025-2033 | 7.10% |

Key Trends of Australia Medical Cannabis Market:

Increasing Government Approvals and Regulatory Support

The Australian government has progressively eased restrictions on medical cannabis, making it more accessible to patients. The Therapeutic Goods Administration (TGA) allows medical cannabis prescriptions under the Special Access Scheme (SAS) and Authorised Prescriber pathways, which is positively impacting the Australia medical cannabis market outlook. The expansion of legal frameworks has fueled doctor willingness to prescribe cannabis-based medicated treatments leading to industry development. The medical cannabis industry continues to advance through rules established at the state level which enhance patient access. The market is expected receive a boost from policymakers who understand cannabis' medical capabilities by quickly approving new products along with better regulations. Government support for Australia's medical cannabis industry will enhance both industrial development and medication distribution and technological advancements. For instance, in September 2024, a global leader in medical cannabis, Tilray Medical, a division of Tilray Brands, Inc., declared the introduction of Redecan EU-GMP-certified medical cannabis products in Australia. This partnership enables patients and healthcare professionals to make well-informed, personalized health decisions. Australia’s supportive regulatory framework is enabling more global medical cannabis brands to enter the market, reinforcing the trend of increased accessibility and acceptance of cannabis-based treatments.

To get more information on this market, Request Sample

Rising Patient Demand for Alternative Treatments

Patients suffering from chronic pain, epilepsy, anxiety, multiple sclerosis, and cancer-related symptoms are increasingly turning to medical cannabis as an alternative or complementary therapy. Traditional pharmaceuticals often come with side effects or limited effectiveness, leading many to seek cannabis-based treatments for pain relief, inflammation, and neurological conditions. Greater awareness of CBD (cannabidiol) and THC (tetrahydrocannabinol) benefits, along with patient advocacy, has driven demand, which is fueling the Australia medical cannabis market share. As more Australians explore natural, plant-based medicines, the demand for prescription cannabis products continues to surge, encouraging growth in the sector. This rising acceptance is prompting companies to scale operations and explore regional expansion to meet growing patient needs. For instance, in February 2025, Dispensed, a leading Australian medicinal cannabis company announced its plans to launch New Zealand operations, utilizing kiosks in various locations such as pharmacies and clinics. As patient trust in cannabis-based therapies continues to build, the sector is expected to see sustained momentum, reinforcing the upward trajectory of the Australia medical cannabis market.

Product Diversification

Australia’s medical cannabis market is seeing a steady shift toward varied product offerings. While oils and capsules were once the dominant formats, patient preferences are now increasingly leaning toward dried flower, particularly high-THC strains. This shift is driven by the need for faster onset of relief, especially for chronic pain, anxiety, and insomnia. Vaporized flower offers more immediate therapeutic effects compared to oral formats, which take longer to metabolize. Clinics and prescribers are responding to this demand by expanding access to a wider range of flower products, often imported from Canada or Europe, though local cultivation is rising. Topicals and sprays are also entering the market, targeting niche conditions like arthritis and localized pain. This broadening range gives patients more tailored options based on their condition, tolerance, and treatment goals. According to Australia medical cannabis market analysis, the trend toward diversified product formats is expected to continue, with dried flower projected to hold a significant share due to patient demand for fast-acting relief and broader acceptance among prescribers.

Growth Drivers of Australia Medical Cannabis Market:

Expansion of Telehealth Clinics

Telehealth has become a major driver in the Australian medical cannabis market, removing traditional access barriers for patients. Online clinics offer streamlined consultations, reducing the need for in-person visits and eliminating long wait times. This convenience is particularly important for patients in rural or underserved areas who struggle to find cannabis-aware GPs. Many platforms handle both the prescription and product ordering processes, making it easier for patients to start and maintain treatment. These services often have doctors already approved under the TGA’s Authorised Prescriber Scheme, speeding up approvals. As patient comfort with digital healthcare grows, telehealth clinics continue to expand their footprint, playing a key role in normalizing cannabis-based therapies and connecting more Australians to legal, safe products.

Pharmaceutical-Grade Quality Standards

Pharmaceutical-grade standards, particularly adherence to Good Manufacturing Practice (GMP), are essential in gaining the trust of healthcare professionals and regulators in Australia. GMP-certified production ensures consistency, safety, and accuracy in dosing, which is critical in clinical settings. This level of quality control aligns cannabis medicines with traditional pharmaceuticals, reducing concerns about variability and contamination. It also supports product traceability, vital for pharmacovigilance and adverse event monitoring. Doctors are more likely to prescribe products that meet rigorous quality benchmarks, especially in a system governed by the Therapeutic Goods Administration (TGA). As more licensed producers achieve GMP compliance, the legitimacy of cannabis therapies strengthens, driving broader prescriber adoption and patient confidence. This is particularly important in a market where clinical validation is still growing.

Chronic Disease Burden

Australia faces a significant burden from chronic conditions such as persistent pain, anxiety, PTSD, and insomnia many of which respond poorly to conventional treatments. This unmet clinical need has created a large and steady demand for alternative therapies, including medical cannabis. Patients often turn to cannabinoid-based products after exhausting standard options, especially for pain and sleep-related issues. With over 3 million Australians estimated to suffer from chronic pain alone, the addressable market is substantial. Cannabis treatments are also gaining traction in palliative care and for managing cancer-related symptoms. The increasing willingness of healthcare providers to consider cannabis as a long-term adjunct or alternative therapy contributes to the growing Australia medical cannabis market demand. This chronic disease burden ensures that patient interest and prescription rates remain strong, supporting market expansion.

Australia Medical Cannabis Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on species, derivatives, application, route of administration, and end use.

Species Insights:

- Indica

- Sativa

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the species. This includes indica, sativa, and hybrid.

Derivatives Insights:

- Cannabidiol (CBD)

- Tetrahydrocannabinol (THC)

- Others

A detailed breakup and analysis of the market based on the derivatives have also been provided in the report. This includes cannabidiol (CBD), tetrahydrocannabinol (THC), and others.

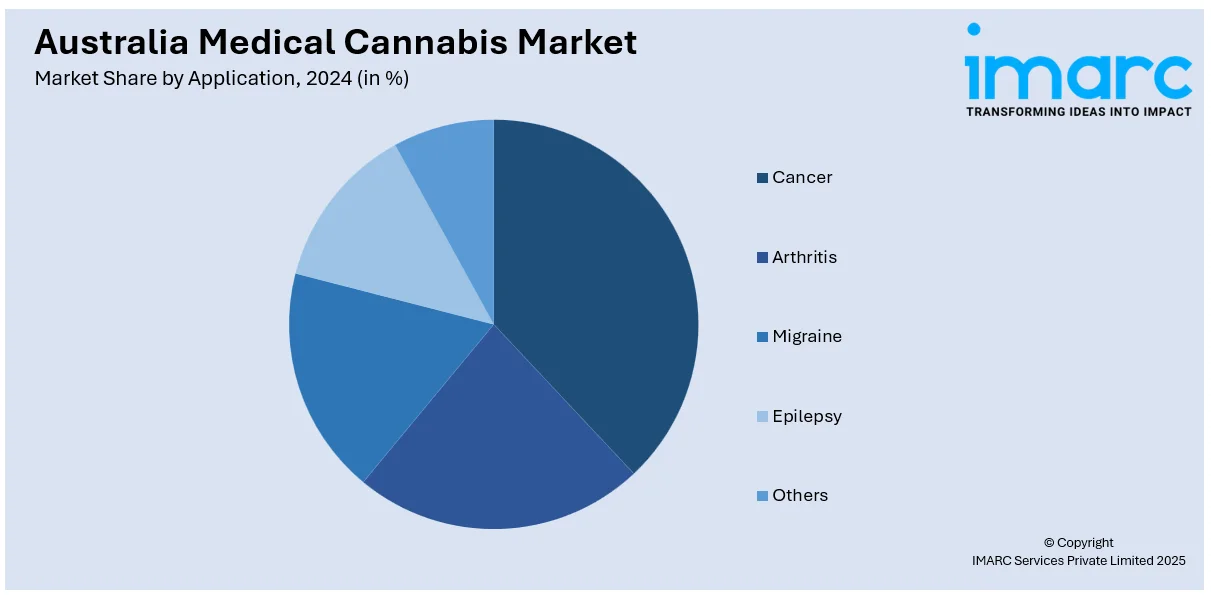

Application Insights:

- Cancer

- Arthritis

- Migraine

- Epilepsy

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cancer, arthritis, migraine, epilepsy, and others.

Route of Administration Insights:

- Oral Solutions and Capsules

- Vaporizers

- Topicals

- Others

A detailed breakup and analysis of the market based on the route of administration have also been provided in the report. This includes oral solutions and capsules, vaporizers, topicals, and others.

End Uses Insights:

- Pharmaceutical Industry

- Research and Development Centres

- Others

A detailed breakup and analysis of the market based on the end uses have also been provided in the report. This includes the pharmaceutical industry, research and development centers, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Medical Cannabis Market News:

- In Oct 2024, Spring Sciences Australia (SSA) announced its partnership with Canngea to supply up to 5 tons of premium organic medicinal cannabis products, enhancing local availability. This groundbreaking agreement aims to meet rising demand in Australia’s cannabis market by offering high-quality, pharmaceutical-grade alternatives to imported goods, leveraging both companies' strengths.

- In December 2024, Aurora Cannabis Inc. announced its partnership with The Entourage Effect to enhance distribution in Australia, making MedReleaf Australia's premium medical cannabis products more accessible. This collaboration aims to support patient care while strengthening Aurora's presence in the growing Australian market, leveraging MedReleaf’s TGA-GMP compliance for quality assurance.

Australia Medical Cannabis Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Species Covered | Indica, Sativa, Hybrid |

| Derivatives Covered | Cannabidiol (CBD), Tetrahydrocannabinol (THC), Others |

| Applications Covered | Cancer, Arthritis, Migraine, Epilepsy, Others |

| Route of Administrations Covered | Oral Solutions and Capsules, Vaporizers, Topicals, Others |

| End Uses Covered | Pharmaceutical Industry, Research and Development Centers, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia medical cannabis market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia medical cannabis market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia medical cannabis industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The medical cannabis market in the Australia was valued at USD 740.0 Million in 2024.

The Australia medical cannabis market is projected to exhibit a compound annual growth rate (CAGR) of 7.10% during 2025-2033.

The Australia medical cannabis market is expected to reach a value of USD 1,373.1 Million by 2033.

The market is witnessing increased adoption of high-THC flower, expansion of telehealth clinics, growing local cultivation, and product diversification into oils, capsules, and topicals. Price reduction, rising patient numbers, and greater GP participation are also shaping market behavior.

Key drivers include rising demand for chronic pain and mental health treatments, supportive TGA regulations, increased GMP-certified production, growing prescriber confidence, and improved access via telehealth. Lower product costs and a widening range of dosage formats also support sustained market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)