Australia Medical Disposables Market Size, Share, Trends and Forecast by Product, Raw Material, End Use, and Region, 2025-2033

Australia Medical Disposables Market Overview:

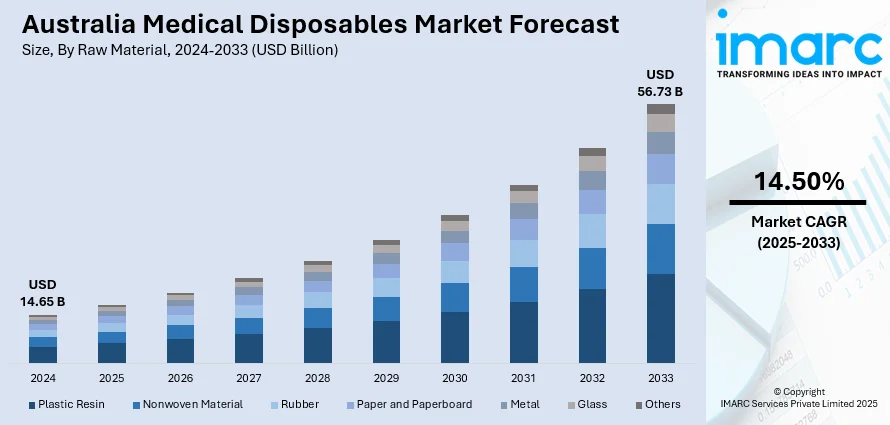

The Australia medical disposables market size reached USD 14.65 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 56.73 Billion by 2033, exhibiting a growth rate (CAGR) of 14.50% during 2025-2033. The market is fueled by the major trends of growing home healthcare adoption, focus on the use of environmentally sustainable materials, and the evolution of smart and antimicrobial disposable technologies. These changes are improving patient safety, convenience, and clinical efficacy in different healthcare settings. With changing healthcare delivery and regulatory attention, the need for quality, innovative disposable products keep on increasing, which adds to the growth of Australia medical disposables market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 14.65 Billion |

| Market Forecast in 2033 | USD 56.73 Billion |

| Market Growth Rate 2025-2033 | 14.50% |

Australia Medical Disposables Market Trends:

Increased Demand for Home Healthcare and Remote Monitoring

The trend towards home-based medical treatment is highly impacting the demand for medical disposables in Australia. An ageing population of geriatrics and increasing rates of chronic diseases have caused people to opt for in-patient treatments and home-monitoring of health remotely, leading to a surge in the use of disposable items like gloves, masks, dressings, and diagnostic kits. These products promote hygiene, minimize infection risks, and are convenient for patients as well as caregivers. Furthermore, government-backed programs and e-health platforms are encouraging home-based services, so the use of disposables is now a routine necessity. This trend is particularly marked in rural and remote regions where healthcare facilities are not easily accessible. With decentralization in the delivery of care, medical disposables are becoming indispensable to ensure clinical standards beyond formal structures. Australia medical disposables market growth is premised on this wider healthcare evolution, supporting their significance in the nation's changing medical infrastructure.

To get more information on this market, Request Sample

Sustainability and Eco-Friendly Product Design

Growing concerns about environmental sustainability are becoming a key trend defining the Australian medical disposables market. As awareness levels regarding single-use plastics and their impacts on the environment rise, there is an expanding momentum toward biodegradable and recyclable products being used in medical disposables. Regulatory requirements and customer demand are converging to stimulate innovation in materials like bio-based plastics and compostable non-wovens. Healthcare providers are increasingly giving preference to items that minimize landfill waste without compromising safety or performance. This trend is prompting suppliers and manufacturers to rethink product lifecycles, packaging, and end-of-life practices. In addition, public and private healthcare systems are investigating procurement policies promoting eco-friendly options. These innovations are slowly transforming procurement Australia medical disposables market trends and broadening the sustainable disposables market. The trend is also complementary to Australia's overall environment goals, fostering synergy between healthcare performance and environmental accountability. Sustainability is likely to continue being a pre-eminent driver of product development over the next decade.

Technological Advances in Material Composition

Material science advancements are revolutionizing the quality, performance, and safety of medical disposables in Australia. For instance, in October 2024, Vaxxas obtained a U.S. patent, for its HD-MAP needle-free vaccine production technology, facilitating accurate, high-speed coating of microprojections for scalable and consistent vaccine delivery. Moreover, technologies like antimicrobial coatings, hypoallergenic materials, and moisture-wicking non-wovens are improving the protection and comfort properties of items such as gloves, gowns, and respiratory devices. These technologies help achieve improved infection control, particularly in high-risk areas like operation rooms and intensive care units. Smart materials—those that react to temperature or biological markers—are also being investigated for diagnostic and wound care disposables. These characteristics have the potential to enhance treatment accuracy and patient outcomes. Australian medical facilities are increasingly using disposables that not only deliver utility but also data and performance advantages. With a mix of safety and innovation, technologically enhanced disposables enhance clinical effectiveness and resonate with the nation's stringent standards for patient care. These improved features will have the potential to draw in more healthcare investments in disposable innovation in the future.

Australia Medical Disposables Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, raw material, and end use.

Product Insights:

- Wound Management Products

- Drug Delivery Products

- Diagnostic and Laboratory Disposables

- Dialysis Disposables

- Incontinence Products

- Respiratory Supplies

- Sterilization Supplies

- Non-woven Disposables

- Disposable Masks

- Disposable Eye Gear

- Disposable Gloves

- Hand Sanitizers

- Gel

- Form

- Liquid

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes wound management products, drug delivery products, diagnostic and laboratory disposables, dialysis disposables, incontinence products, respiratory supplies, sterilization supplies, non-woven disposables, disposable masks, disposable eye gear, disposable gloves, hand sanitizers (gel, form, liquid, others), and others.

Raw Material Insights:

- Plastic Resin

- Nonwoven Material

- Rubber

- Paper and Paperboard

- Metal

- Glass

- Others

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes plastic resin, nonwoven material, rubber, paper and paperboard, metal, glass, and others.

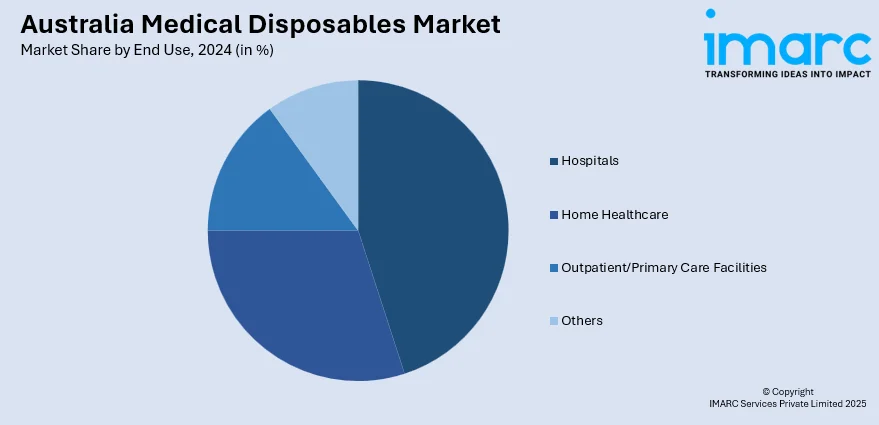

End Use Insights:

- Hospitals

- Home Healthcare

- Outpatient/Primary Care Facilities

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes hospitals, home healthcare, outpatient/primary care facilities, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Medical Disposables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Raw Materials Covered | Plastic Resin, Nonwoven Material, Rubber, Paper and Paperboard, Metal, Glass, Others |

| End Uses Covered | Hospitals, Home Healthcare, Outpatient/Primary Care Facilities, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia medical disposables market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia medical disposables market on the basis of product?

- What is the breakup of the Australia medical disposables market on the basis of raw material?

- What is the breakup of the Australia medical disposables market on the basis of end use?

- What is the breakup of the Australia medical disposables market on the basis of region?

- What are the various stages in the value chain of the Australia medical disposables market?

- What are the key driving factors and challenges in the Australia medical disposables?

- What is the structure of the Australia medical disposables market and who are the key players?

- What is the degree of competition in the Australia medical disposables market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia medical disposables market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia medical disposables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia medical disposables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)