Australia Medical Gas Market Size, Share, Trends and Forecast by Gas Type, Application, End User, and Region, 2025-2033

Australia Medical Gas Market Overview:

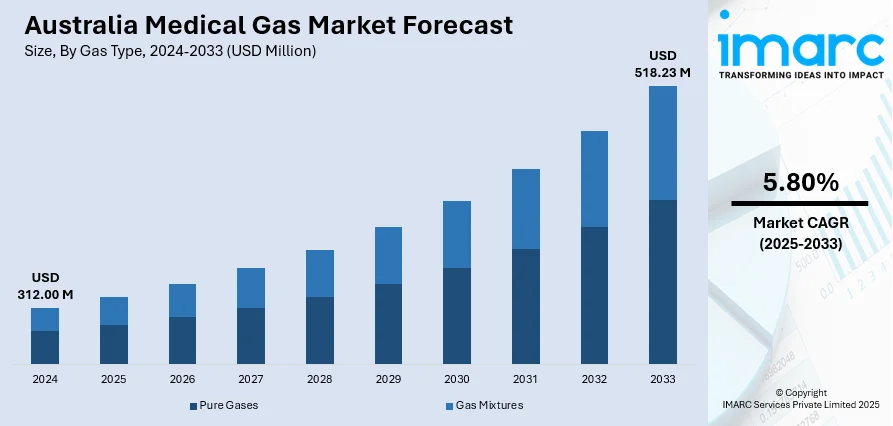

The Australia medical gas market size reached USD 312.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 518.23 Million by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The market is witnessing significant growth due to increasing demand for healthcare services, advanced medical technologies, and rising prevalence of chronic diseases. Key players in the industry are focusing on enhancing gas supply systems for hospitals, clinics, and homecare settings, which is also propelling the market growth. With innovations in gas storage and distribution, the Australia medical gas market share is further expected to grow significantly, offering opportunities for both local and international suppliers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 312.00 Million |

| Market Forecast in 2033 | USD 518.23 Million |

| Market Growth Rate 2025-2033 | 5.80% |

Australia Medical Gas Market Trends:

Growing Demand in Healthcare Services

The increasing healthcare service demand in Australia is highly fueling the medical gas market. With the aging population and increased needs for healthcare, more hospitalizations, surgeries, and treatments that call for medical gases like oxygen, nitrous oxide, and medical air are required. With chronic diseases, respiratory disorders, and cardiovascular conditions gaining momentum, healthcare facilities and hospitals are reporting greater utilization of medical gases in patient treatment, especially in emergency and critical care units. Further driving the demand for stable gas supply systems are advances in medical procedures such as anesthesia and intensive care. This increasing need for health care services is driving investment in infrastructure, enhancing medical gas delivery systems' efficiency and safety and underpinning the overall growth of the market.

To get more information on this market, Request Sample

Expansion of Homecare Services

The growth of homecare services in Australia is having a major contribution to increasing the demand for portable medical gas solutions. With healthcare systems trending towards more patient-focused models, home healthcare is gaining popularity, especially among patients who suffer from chronic respiratory diseases like COPD (Chronic Obstructive Pulmonary Disease) and need constant oxygen therapy. Portable medical gas equipment, such as oxygen concentrators and cylinders, are facilitating patients' receipt of the treatment they require in their own homes, enhancing their quality of life and avoiding hospitalization. It is also fueled by technology improvements in portable medical gases, which have made devices lighter, more efficient, and user-friendly. As a result, the growing homecare sector is contributing significantly to the Australia medical gas market growth, meeting the increasing demand for reliable, on-demand gas solutions.

Growing Demand for High-Purity Gases

There is a rising demand for high-purity medical gases in Australia, particularly for precise medical applications such as anesthesia, surgery, and diagnostic procedures. High-purity gases, like medical oxygen, nitrous oxide, and nitrogen, are essential in ensuring the safety and efficacy of critical medical treatments. These gases are used in environments where accurate dosages are necessary to support life-saving procedures, including in operating rooms and intensive care units. With advancements in medical technology and increased complexity of surgeries, the need for consistently high-quality medical gases has grown. This trend is driving suppliers to enhance production processes and ensure stringent purity standards, thereby meeting the evolving needs of healthcare professionals. The demand for high-purity gases is a key driver for the growth of the Australian medical gas market.

Australia Medical Gas Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on gas type, application, and end user.

Gas Type Insights:

- Pure Gases

- Medical Air

- Medical Oxygen

- Nitrous Oxide

- Nitrogen

- Carbon Dioxide

- Helium

- Gas Mixtures

- Aerobic Gas Mixtures

- Anaerobic Gas Mixtures

- Blood Gas Mixtures

- Lung Diffusion Mixtures

- Medical Laser Mixtures

- Medical Drug Gas Mixtures

- Others

The report has provided a detailed breakup and analysis of the market based on the gas type. This includes pure gases (medical air, medical oxygen, nitrous oxide, nitrogen, carbon dioxide, and helium) and gas mixtures (aerobic gas mixtures, anaerobic gas mixtures, blood gas mixtures, lung diffusion mixtures, medical laser mixtures, medical drug gas mixtures, and others).

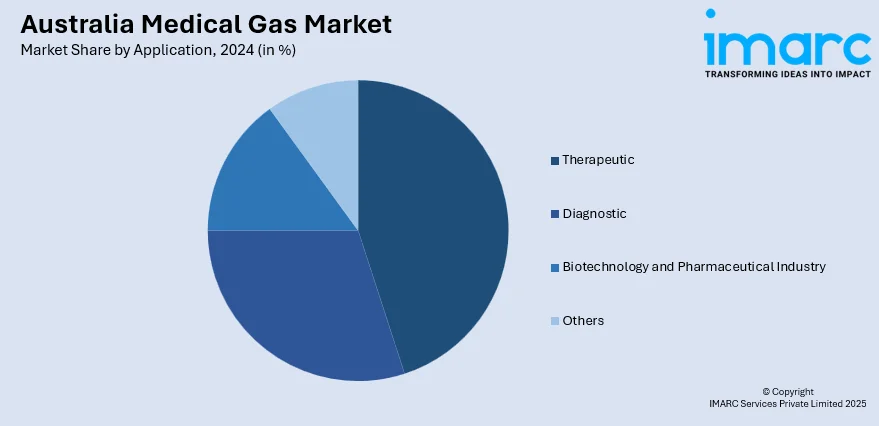

Application Insights:

- Therapeutic

- Diagnostic

- Biotechnology and Pharmaceutical Industry

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes therapeutic, diagnostic, biotechnology and pharmaceutical industry, and others.

End User Insights:

- Hospitals

- Home Healthcare

- Academic and Research Institutions

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, home healthcare, and academic and research institutions.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Medical Gas Market News:

- In May 2025, Air Liquide partnered with Manildra Group to construct Australia’s largest biogenic CO₂ plant in Bomaderry, NSW. The facility will utilize CO₂ from wheat fermentation, producing over 90,000 tons annually for food, beverage, and medical industries.

Australia Medical Gas Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Gas Types Covered |

|

| Applications Covered | Therapeutic, Diagnostic, Biotechnology and Pharmaceutical Industry, Others |

| End Users Covered | Hospitals, Home Healthcare, Academic and Research Institutions |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia medical gas market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia medical gas market on the basis of gas type?

- What is the breakup of the Australia medical gas market on the basis of application?

- What is the breakup of the Australia medical gas market on the basis of end user?

- What is the breakup of the Australia medical gas market on the basis of region?

- What are the various stages in the value chain of the Australia medical gas market?

- What are the key driving factors and challenges in the Australia medical gas market?

- What is the structure of the Australia medical gas market and who are the key players?

- What is the degree of competition in the Australia medical gas market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia medical gas market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia medical gas market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia medical gas industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)