Australia Medical Imaging Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2025-2033

Australia Medical Imaging Market Size and Share:

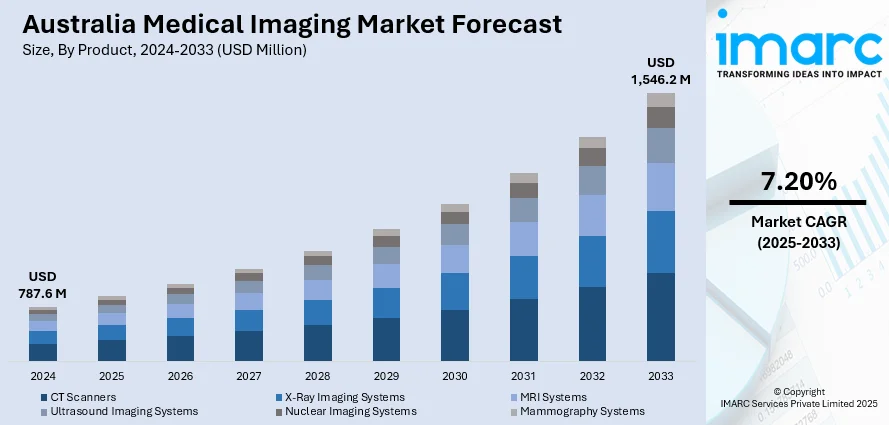

The Australia medical imaging market size reached USD 787.6 Million in 2024. Looking forward, the market is projected to reach USD 1,546.2 Million by 2033, exhibiting a growth rate (CAGR) of 7.20% during 2025-2033. The market includes increasing demand for early disease detection, rising adoption of advanced imaging technologies, and growing healthcare access in rural areas. Government support for telehealth, coupled with a shortage of radiologists, is also accelerating the use of AI and teleradiology services nationwide, contributing to the expansion of the Australia medical imaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 787.6 Million |

| Market Forecast in 2033 | USD 1,546.2 Million |

| Market Growth Rate 2025-2033 | 7.20% |

Key Trends of Australia Medical Imaging Market:

Expansion of Telemedicine and Teleradiology

Telemedicine, particularly teleradiology, is revolutionizing the delivery of Australia medical imaging market outlook. The wide geographical expanse of the country makes digital tools more convenient for sending scans to radiologists elsewhere to enable faster review and diagnosis. It is a break for rural and remote areas where access to specialist doctors can be limited. Healthcare professionals now are able to work together more seamlessly using secure cloud-based platforms, enhancing the continuity of information and care coordination. Telehealth services also are assisting with managing mounting workloads in high-density urban areas. The continued emphasis on telehealth is closing gaps in access and bridging a more integrated healthcare system.

To get more information of this market, Request Sample

Innovation in Imaging Technologies and Equipment

Advances in imaging technology in Australia are driving more detailed, accurate, and faster diagnostics, with hybrid machines combining imaging types like CT, PET, and SPECT offering a comprehensive view of a patient's condition. These technologies are crucial in diagnosing complex diseases such as cancer and heart conditions, where precise imaging significantly impacts treatment outcomes. The rise of portable and point-of-care (POC) devices further enhances accessibility, bringing diagnostics directly to patients in emergency rooms or remote clinics. In keeping with these developments, $162.6 million has been set aside in the Australian Government's 2024–2025 Budget to reform diagnostic imaging services that are covered by Medicare. This funding aims to expand access, integrate cutting-edge technologies, and streamline service delivery, ensuring that medical imaging becomes an even more versatile and reliable tool for healthcare professionals across the country.

Growing Role of Artificial Intelligence in Imaging

The rise in the use of artificial intelligence (AI) is impelling the Australia medical imaging market growth. It's used to assist radiologists by flagging patterns within scans that would otherwise go unseen, assisting early diagnosis and planning for treatment. AI software also accelerates routine tasks such as sorting images and writing reports, allowing specialists more time to interact with patients. In underserved or rural areas, AI can be particularly valuable, providing assistance where radiologists are scarce. As the technology continues to advance, AI is likely to play an increasingly important role in individualizing diagnostics and improving the accuracy of imaging, creating a more streamlined healthcare experience for clinicians and patients nationwide.

Growth Drivers of Australia Medical Imaging Market:

Rising Prevalence of Chronic Diseases

The increasing occurrence of chronic diseases such as cancer, cardiovascular issues, and neurological disorders significantly boosts the demand for medical imaging technologies in Australia. These health conditions necessitate continuous monitoring and precise diagnosis leading to a higher need for imaging services like MRIs, CT scans, and ultrasounds. As diseases related to lifestyle choices become more prevalent early and accurate imaging is crucial for enhancing patient outcomes and lowering long-term treatment expenses. Healthcare providers are increasingly depending on advanced imaging techniques to inform clinical decisions particularly for complex or progressive health issues. With the ongoing rise in chronic disease rates the healthcare sector is experiencing a marked increase in Australia medical imaging market demand especially for high-quality ad non-invasive diagnostic options.

Aging Population

The aging demographic in Australia is significantly influencing the medical imaging market, as older adults are more susceptible to chronic and degenerative diseases that require regular monitoring. Seniors often need frequent diagnostic evaluations for bone health, cardiovascular functionality, and organ imaging, which leads to a rise in the use of services like X-rays, MRIs, and CT scans. This demographic transition is prompting healthcare providers to enhance imaging infrastructure and improve service availability for geriatric care. The heightened emphasis on preventive diagnostics and early intervention for age-related health issues further reinforces this trend. As the elderly population continues to increase, the demand for dependable, timely, and advanced medical imaging solutions is likely to rise consistently across Australia.

Government Healthcare Initiatives

Government initiatives through public healthcare financing, policy measures, and national screening programs are crucial in enhancing access to diagnostic imaging throughout Australia. Programs aimed at the early detection of diseases such as breast cancer, lung disorders, and cardiovascular conditions are promoting the use of imaging services. Investments in public hospitals, mobile diagnostic units, and rural telehealth services have significantly improved access to imaging technologies in underserved regions. Moreover, government subsidies and reimbursements are helping to lessen out-of-pocket expenses for patients, which in turn boosts overall imaging utilization. These proactive strategies play a vital role in closing healthcare disparities and fostering timely diagnoses across various populations, according to Australia medical imaging market analysis, and are critical for ensuring equitable imaging services nationwide.

Australia Medical Imaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, application, and end user.

Product Insights:

- CT Scanners

- X-Ray Imaging Systems

- MRI Systems

- Ultrasound Imaging Systems

- Nuclear Imaging Systems

- Mammography Systems

The report has provided a detailed breakup and analysis of the market based on the product. This includes CT scanners, X-ray imaging systems, MRI systems, ultrasound imaging systems, nuclear imaging systems, and mammography systems.

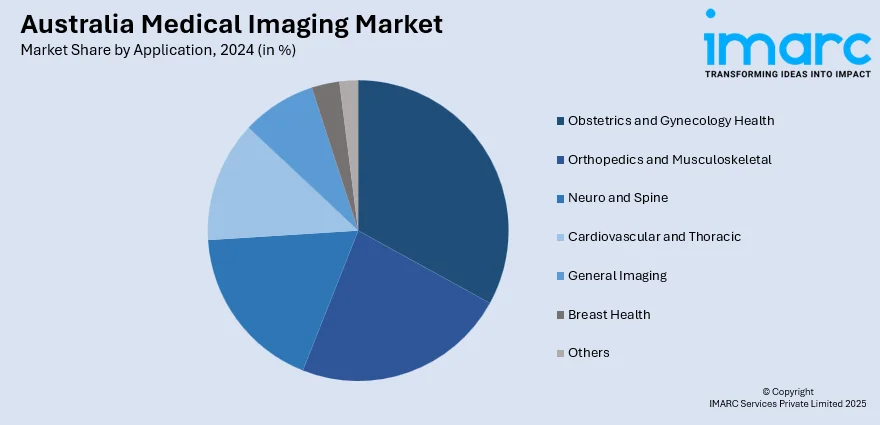

Application Insights:

- Obstetrics and Gynecology Health

- Orthopedics and Musculoskeletal

- Neuro and Spine

- Cardiovascular and Thoracic

- General Imaging

- Breast Health

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes obstetrics and gynecology health, orthopedics and musculoskeletal, neuro and spine, cardiovascular and thoracic, general imaging, breast health, and others.

End User Insights:

- Hospitals

- Diagnostic Centers

- Academic Institutes and Research Organizations

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, diagnostic centers, and academic institutes and research organizations.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Benson Radiology

- Capital Radiology

- Healius Limited

- IDX Group

- I-MED Radiology Network

- Qscan Services Pty Ltd

- Sonic Healthcare Limited

Australia medical imaging Market News:

- In October 2024, Enlitic acquired LAITEK Inc., enhancing its position in medical imaging data management. Backed by a AU$22.5M equity raise, the move combines Enlitic’s AI-driven data standardization with LAITEK’s four decades of imaging migration expertise. This strategic acquisition aims to streamline clinical workflows, improve data interoperability, and elevate healthcare efficiency, marking a pivotal step in Enlitic’s global growth strategy.

- In July 2024, I-MED Radiology, the biggest medical imaging supplier in Australia and New Zealand, grew globally by purchasing StatRad, a leading teleradiology company based in the United States. This strategic move marks I-MED’s entry into the competitive U.S. market and signals a shift in global teleradiology dynamics. The acquisition unites two major players, enhancing cross-border imaging capabilities and positioning I-MED for significant influence in international telehealth and radiology services.

Australia medical imaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | CT Scanners, X-Ray Imaging Systems, MRI Systems, Ultrasound Imaging Systems, Nuclear Imaging Systems, Mammography Systems |

| Applications Covered | Obstetrics and Gynecology Health, Orthopedics and Musculoskeletal, Neuro and Spine, Cardiovascular and Thoracic, General Imaging, Breast Health, Others |

| End Users Covered | Hospitals, Diagnostic Centers, Academic Institutes and Research Organizations |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Benson Radiology, Capital Radiology, Healius Limited, IDX Group, I-MED Radiology Network, Qscan Services Pty Ltd, Sonic Healthcare Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia medical imaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia medical imaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia medical imaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The medical imaging market in Australia was valued at USD 787.6 Million in 2024.

The Australia medical imaging market is projected to exhibit a compound annual growth rate (CAGR) of 7.20% during 2025-2033.

The Australia medical imaging market is expected to reach a value of USD 1,546.2 Million by 2033.

Market is driven by rising healthcare awareness, expanding private diagnostic centers, and the need for non-invasive diagnostic tools. Supportive telehealth policies, advancements in imaging software, and increased screening programs for early disease detection are also accelerating the demand for imaging services across urban and rural areas in Australia.

Key trends include the growing use of AI and machine learning for image interpretation, rising adoption of portable and point-of-care imaging devices, and the integration of imaging data with electronic health records. There is also increasing demand for 3D and real-time imaging in both diagnostics and interventional procedures.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)