Australia Metal Additive Manufacturing Market Size, Share, Trends and Forecast by Type, Component, End Use Industry, and Region, 2025-2033

Australia Metal Additive Manufacturing Market Overview:

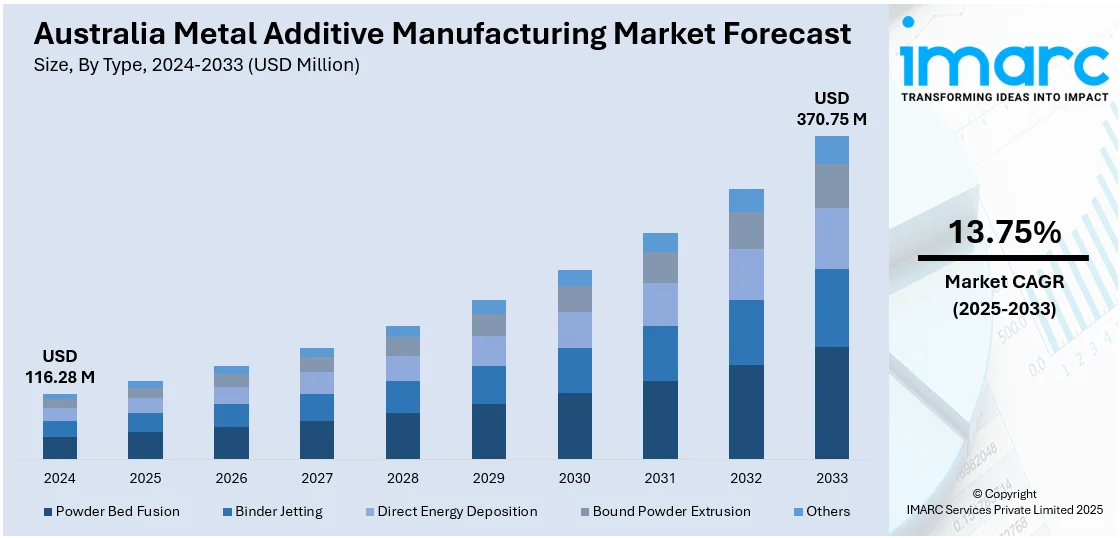

The Australia metal additive manufacturing market size reached USD 116.28 Million in 2024. Looking forward, the market is projected to reach USD 370.75 Million by 2033, exhibiting a growth rate (CAGR) of 13.75% during 2025-2033. The growth is fueled by accelerating adoption in aerospace, defense, and medical applications, in combination with the expanding need for light and intricate components. Government incentives, advances in technology, and increasing collaboration between industries and academia further drive expansion. These elements all contribute to the increasing Australia metal additive manufacturing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 116.28 Million |

| Market Forecast in 2033 | USD 370.75 Million |

| Market Growth Rate 2025-2033 | 13.75% |

Key Trends of Australia Metal Additive Manufacturing Market:

Integration of Artificial Intelligence in Metal Additive Manufacturing

The application of Artificial Intelligence (AI) in metal additive manufacturing is transforming Australian production processes. AI systems examine large data sets from print operations, including material characteristics and environmental factors, to optimize printing parameters, anticipate potential defects, and improve overall quality. This technology allows for the production of complex and tailored metal components with more accuracy and efficiency. Sectors such as aerospace, automotive, and healthcare gain through AI-based AM systems that minimize material wastage, lower the cost of production, and speed up time-to-market of new products. With ongoing development of AI, its use in metal AM is forecasted to boost further development and competitiveness for Australia's manufacturing industry. For instance, in April 2025, HP showcased new advancements in additive manufacturing at RAPID + TCT 2025, including a custom-built vehicle by Blazin Rodz featuring over 75 HP Multi Jet Fusion (MJF) parts. HP also introduced its halogen-free, flame-retardant 3D printing material, HP 3D HR PA 12 FR, which offers 60% reusability, enhancing sustainability and cost-efficiency. Additionally, HP demonstrated its AI-powered Text to 3D solution, enabling easier customization. Partnerships with Blazin Rodz and Eaton highlight HP's impact on automotive and industrial manufacturing.

To get more information on this market, Request Sample

Expansion of Materials for Metal Additive Manufacturing

The expansion of materials available for metal additive manufacturing is a significant trend shaping Australia's manufacturing landscape. Initially limited to plastics, 3D printing technologies have evolved to accommodate a diverse range of materials, including metals, ceramics, and composites. This diversification allows for the production of high-performance components essential in industries such as aerospace, automotive, and medical devices. The development of novel alloys and metal powders tailored for AM processes enables the fabrication of parts with enhanced mechanical properties and complex geometries. Australia's focus on material innovation supports the growth of metal AM, positioning the country as a leader in advanced manufacturing technologies. For instance, in September 2024, the Monash Centre for Additive Manufacturing (MCAM) hosted its 2024 User Conference, bringing together academia and industry to discuss performance, strategy, and innovation. MCAM, home to Australia’s largest metal 3D printer, doubled its industry collaborations across 13 sectors. Key projects include nickel superalloy parts for biomass energy, space engine components, and medical-grade stainless steel. Internationally, MCAM developed a beta titanium alloy with European partners, reinforcing its global leadership in additive manufacturing advancements.

Decentralization and Resilience in Supply Chains

The decentralization of manufacturing through metal additive manufacturing is enhancing supply chain resilience in Australia. Traditional manufacturing models often rely on centralized facilities, making supply chains vulnerable to disruptions. Metal AM enables distributed production, allowing components to be manufactured closer to end-users, reducing lead times and dependency on global supply chains. This capability is particularly advantageous for industries operating in remote areas, such as defense, mining, and agriculture, where access to traditional manufacturing resources is limited. By adopting decentralized AM systems, Australian companies can mitigate risks associated with supply chain disruptions and ensure a more agile and responsive manufacturing environment. This, in turn, is acting as a major driver for Australia metal additive manufacturing market growth. For instance, in March 2024, Australia’s first multi-metal 3D printer, installed at CSIRO’s Lab22 under the iLAuNCH Trailblazer initiative, advanced aerospace manufacturing by enabling efficient production of lightweight and durable components. The Nikon SLM-280 printed dissimilar metals in a single process, supported the development of novel superalloys for high-performance use, and enhanced local R&D. This strengthened sovereign capability and reduced reliance on global supply chains for complex aerospace and defence manufacturing requirements.

Growth Drivers of Australia Metal Additive Manufacturing Market:

Technological Advancements in Metal 3D Printing

The Australia metal additive manufacturing market demand is being significantly driven by swift technological advancements in metal 3D printing. Innovations in powder metallurgy, laser sintering, and electron beam melting are contributing to superior material quality, enhanced detailing, and improved build reliability. These developments enable manufacturers to produce intricate, high-performance metal components with reduced waste and lower machining needs. Additionally, hybrid manufacturing systems that merge additive and subtractive methods are gaining popularity, providing a fusion of speed and precision within a single platform. Sectors such as tooling, mining, and biomedical engineering are increasingly embracing these technologies to accelerate development timelines and boost operational efficiency. As these advancements become more affordable and widely available, there is a rising interest in the Australian market from both large manufacturers and niche startups targeting high-value applications.

Research and Development and Academic Collaborations

Research and development partnerships are essential for promoting metal additive manufacturing across Australia. Universities, technical colleges, and private firms are collaborating to create application-specific metal alloys, refine printing processes, and standardize performance evaluations. These partnerships promote a continual cycle of innovation, facilitating knowledge exchange and workforce training. Involvement from academic institutions also speeds up the progression from prototype to production-ready parts, particularly in precision-demanding areas like biomedical implants, aerospace structures, and industrial tools. Furthermore, research grants and innovation funding from the government are bolstering these collaborations, aiding in the transition from research to commercial use. This collaborative approach is enhancing Australia’s standing in the global metal AM arena and fostering the development of a skilled workforce capable of adapting these technologies for wider industry use.

Growing Aerospace and Defense Demand

According to Australia metal additive manufacturing market analysis, the aerospace and defense industries serve as a significant growth driver for metal AM technologies. These sectors require components that are lightweight, robust, and able to endure extreme conditions qualities that metal 3D printing can provide efficiently. Additive manufacturing allows for the creation of intricate designs that traditional methods cannot achieve, making it suitable for aerospace brackets, engine parts, and components for defense systems. Manufacturing these crucial parts locally bolsters supply chain resilience and diminishes reliance on international suppliers. Furthermore, metal AM is utilized for rapid prototyping and low-volume production, aligning well with the customized needs of the defense sector. With increased investment in national security and aerospace innovations, the demand for metal additive solutions is projected to rise significantly in the upcoming years.

Opportunities of Australia Metal Additive Manufacturing Market:

Localized Production for Critical Industries

Metal additive manufacturing (AM) offers Australia a vital chance to enhance its industrial self-sufficiency by facilitating localized, on-demand production of crucial components. Industries such as defense, aerospace, and energy frequently need high-precision, low-volume metal parts with specific requirements, which can be expensive and time-consuming to source internationally. Through metal AM, manufacturers can create these components domestically, minimizing lead times, bolstering supply chain security, and encouraging rapid innovation. This capability is particularly beneficial during global disruptions or geopolitical tensions, as reliance on overseas suppliers can introduce strategic vulnerabilities. By investing in localized AM capabilities, Australia strengthens its national resilience and generates skilled employment and supports regional manufacturing centers, setting itself up as a frontrunner in high-performance, mission-critical production.

Expansion in Medical Applications

The Australian healthcare sector presents an encouraging growth opportunity for metal additive manufacturing, especially in creating customized, biocompatible implants and surgical instruments. Metal AM allows for the precise fabrication of patient-specific devices, including joint replacements, cranial plates, and dental implants, adapted to individual anatomical requirements. This degree of personalization enhances patient outcomes, shortens surgical durations, and improves recovery times post-surgery. Moreover, the capacity to swiftly prototype and fine-tune complex medical devices fosters innovation across hospitals, research entities, and medical device manufacturers. As Australia’s population ages and the demand for sophisticated healthcare solutions increases, the necessity for flexible, high-quality production methods becomes more pronounced. Metal AM is ideally suited to address this need, providing both functional performance and design versatility positioning it as a transformative force in Australia’s healthcare manufacturing arena.

Development of Specialized Alloys

There exists a significant opportunity within Australia’s metal additive manufacturing sector to develop and market specialized metal powders and alloys tailored to local industry needs. Various sectors, including mining, aerospace, marine, and biomedical, require materials with distinct characteristics such as corrosion resistance, high tensile strength, or biocompatibility. By concentrating on alloy innovation, Australia has the potential to produce value-added materials optimized for performance and durability in its unique operational contexts. This focus provides domestic manufacturers with customized solutions and opens doors for exports to markets seeking advanced or niche materials. Additionally, collaborations between research institutions and private enterprises can expedite alloy development, giving Australia a competitive advantage in material science. Investing in local alloy production also lessens the reliance on imported raw materials, thereby strengthening the overall resilience and sustainability of the metal AM supply chain.

Government Support of Australia Metal Additive Manufacturing Market:

Funding for R&D and Innovation

Government support for research and development is crucial for enhancing growth in Australia’s metal additive manufacturing (AM) sector. Through specific innovation grants and financial incentives, the government is empowering companies and research institutions to investigate new applications, refine metal printing methods, and enhance material performance. These initiatives mitigate the financial risks tied to early-stage development, encouraging more organizations to try out AM technologies. Furthermore, commercialization assistance plays a vital role in bridging the divide between laboratory research and industrial application. Startups, small and medium enterprises, and universities all gain from this innovation support ecosystem. As Australia aspires to become a leader in high-tech manufacturing, funding in the metal AM sector is essential for establishing long-term competitiveness and promoting the creation of new, export-ready technologies.

Support for Advanced Manufacturing Hubs

The Australian government is actively committing resources to the establishment and expansion of advanced manufacturing hubs that feature specialized facilities for metal additive manufacturing. These hubs function as collaborative environments where industry, academia, and government can unite to hasten innovation and commercialization. By providing shared access to high-grade equipment, testing laboratories, and expert resources, these centers lower the barriers to entry for smaller manufacturers and startups. Additionally, they serve as training centers for the future workforce, allowing students and professionals to gain practical experience with 3D printing technologies. Regional hubs, in particular, are instrumental in distributing advanced manufacturing capabilities and promoting economic growth beyond major urban areas. This initiative guarantees that the advantages of metal AM development are widely shared, supporting Australia’s overarching industrial transformation strategy.

Skills Development and Training Initiatives

To meet the rising demand for skilled professionals in metal additive manufacturing, the Australian government has introduced various skills development and training programs. These initiatives aim to prepare the workforce with the necessary technical skills for operating metal 3D printers, grasping digital design, and overseeing additive production workflows. Offered through vocational institutions, universities, and partnerships between government and industry, these programs seek to create a pipeline of qualified professionals who can sustain the evolving manufacturing sector. Upskilling also encompasses training in design for additive manufacturing (DfAM), quality assurance, and safety protocols. This investment in human resources ensures that as technology progresses, the local talent pool is well-equipped to implement and advance metal AM across various industries. By enhancing workforce readiness, the government is laying the groundwork for sustainable and innovation-driven growth in the metal AM sector.

Challenges of Australia Metal Additive Manufacturing Market:

High Initial Investment Costs

One of the most significant obstacles in the Australian metal additive manufacturing market is the substantial capital investment needed to embrace this technology. Metal 3D printers are considerably more costly than their polymer counterparts, and they necessitate additional expenditures on specialized software, metal powder handling equipment, safety infrastructure, and post-processing tools. For small and medium enterprises (SMEs), these expenses can be overwhelming, particularly without assured short-term returns. Furthermore, the operational complexities of these machines often require dedicated personnel and technical training, which adds to the overall investment. This financial hurdle limits widespread adoption and hinders innovation across various industry sectors. To overcome this challenge, there may need to be enhanced access to government grants, public-private partnerships, and leasing or shared-access models to make metal additive manufacturing technologies more financially feasible.

Material and Supply Chain Constraints

Another significant issue confronting the metal additive manufacturing industry in Australia is the restricted availability of high-quality metal powders and feedstock materials. Most specialized metal powders utilized in additive manufacturing are imported, resulting in elevated procurement costs, extended lead times, and susceptibility to global supply chain disruptions. This dependence on foreign suppliers can disrupt production schedules and limit the flexibility for experimentation or customization. Additionally, inconsistent material standards and a lack of local production capabilities contribute to this uncertainty, particularly for critical industries that demand stringent quality control. These supply chain challenges can impede more widespread market adoption, especially among companies seeking reliable just-in-time production processes. Enhancing domestic powder production and recycling capacities could serve as a long-term solution to mitigate this bottleneck and improve supply chain resilience.

Slow Adoption in Traditional Industries

Traditional sectors such as mining, construction, and heavy manufacturing in Australia often display a cautious attitude toward embracing disruptive technologies, including metal additive manufacturing. These industries typically depend on well-established, cost-efficient fabrication methods and may see additive manufacturing as untested or needlessly complicated for their operational requirements. Concerns regarding high expenses, ambiguous return on investment, and the necessity for specialized skills contribute to this reluctance. Additionally, a dearth of case studies or industry-specific proof of concept can reinforce skepticism. Cultural resistance to change, combined with limited awareness of how additive manufacturing can address particular production challenges, further impedes adoption. To bridge this gap, targeted education, industry demonstrations, and collaborative pilot projects are required to highlight real-world benefits and foster broader acceptance of metal additive manufacturing in traditional manufacturing settings.

Australia Metal Additive Manufacturing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, component, and end use industry.

Type Insights:

- Powder Bed Fusion

- Binder Jetting

- Direct Energy Deposition

- Bound Powder Extrusion

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes powder bed fusion, binder jetting, direct energy deposition, bound powder extrusion, and others.

Component Insights:

- Systems

- Materials

- Service and Parts

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes systems, materials, and service and parts.

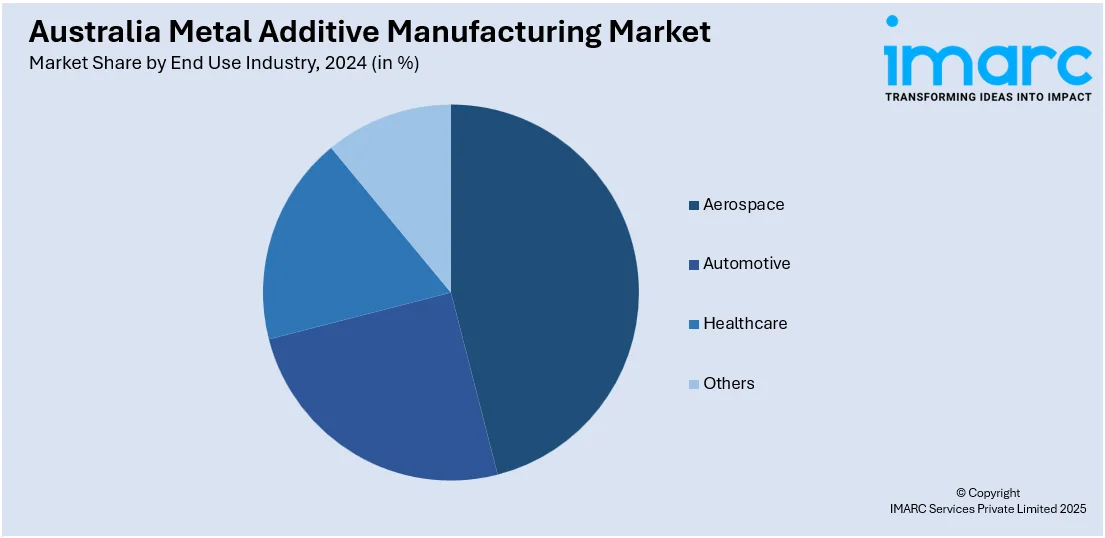

End Use Industry Insights:

- Aerospace

- Automotive

- Healthcare

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes aerospace, automotive, healthcare, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Metal Additive Manufacturing Market News:

- In April 2025, Australia’s additive manufacturing (AM) sector received a significant $271 million funding boost, including $58 million for the Additive Manufacturing Co-operative Research Centre (AMCRC). This initiative, based in South Australia's Future Industries Institute, aims to enhance AM capabilities across industries like defence, aerospace, healthcare, automotive, and construction. The funding supports advancements in 3D printing technology, workforce development, and full-scale commercial production. The collaboration includes contributions from universities, CSIRO, Boeing, and SMEs, boosting Australia’s global AM standing.

- In April 2025, Australia's Amaero secured a five-year exclusive supply deal with U.S.-based Velo3D, a leading manufacturer of advanced additive manufacturing technology for aerospace, space, and defense. Amaero will provide metal powders, including niobium C103 and other refractory alloys, supporting Velo3D's parts production. This partnership aims to bolster U.S. supply chains and meet rising demand in defense and space. The agreement is expected to generate about A$35 million in revenue, with Amaero investing A$72 million to expand its manufacturing capabilities.

- In December 2024, Objective3D merged with TCL Hofmann and TCL Hunt, both part of the Ravago Group, to form a unified additive manufacturing solutions provider in Australia and New Zealand. The merger expands Objective3D’s portfolio of cutting-edge AM technologies, including polymer, composite, ceramic, and metal solutions. It strengthens their expertise, customer support, and industry-focused solutions for sectors like aerospace, defense, and automotive. This collaboration enhances innovation, efficiency, and market reach, positioning Objective3D as a leader in advanced manufacturing technologies across the region.

- In June 2024, Tata Steel and Australia’s Monash University signed an MoU to establish a Centre for Innovation focused on sustainability, targeting decarbonisation, resource recovery, and intelligent manufacturing technologies. This collaboration aims to drive research, educational exchange, and innovation between India and Australia.

- In May 2024, AML3D secured a contract to supply a 6-part nozzle assembly for an Australian Government aerospace defense project, expanding its presence in the defense sector. The contract follows a successful delivery of a 4-stage nozzle assembly, demonstrating AML3D’s WAM® technology advantage. AML3D uses its proprietary Wire Additive Manufacturing (WAM®) technology, a type of metal 3D printing, to produce large-scale metal parts with superior quality, faster turnaround times, and reduced waste, supporting defense supply chains and global market growth.

- In April 2024, Additive Industries announced the installation of its MetalFABG2 3D printer at the Advanced Manufacturing Research Facility (AMRF) in Western Sydney, Australia. The AMRF, funded by the NSW Government, aims to support local manufacturing by fostering innovation and adopting advanced technologies. The MetalFABG2 will produce components for industries such as aerospace and defense, utilizing high-temperature nickel alloys and Scalmalloy. This installation strengthens Australia’s manufacturing capabilities, supports economic growth, and positions Western Sydney as a hub for advanced manufacturing.

Australia Metal Additive Manufacturing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Powder Bed Fusion, Binder Jetting, Direct Energy Deposition, Bound Powder Extrusion, Others |

| Components Covered | Systems, Materials, Service and Parts |

| End Use Industries Covered | Aerospace, Automotive, Healthcare, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia metal additive manufacturing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia metal additive manufacturing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia metal additive manufacturing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The metal additive manufacturing market in Australia was valued at USD 116.28 Million in 2024.

The Australia metal additive manufacturing market is projected to exhibit a compound annual growth rate (CAGR) of 13.75% during 2025-2033.

The Australia metal additive manufacturing market is expected to reach a value of USD 370.75 Million by 2033.

The market is witnessing increased adoption of hybrid manufacturing systems, growing use of metal AM in tooling and repair applications, and the emergence of localized powder production. Customization for niche sectors and the integration of AM with digital supply chains are also shaping the industry’s future.

Key drivers include rising demand for lightweight, complex metal components in aerospace and defense, supportive government funding for advanced manufacturing, and increased focus on reducing material waste. Localized production needs and expanding applications in medical and energy sectors are also accelerating market growth across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)