Australia Metal Coatings Market Size, Share, Trends and Forecast by Resin Type, Process, Technology, End Use Industry, and Region, 2025-2033

Australia Metal Coatings Market Overview:

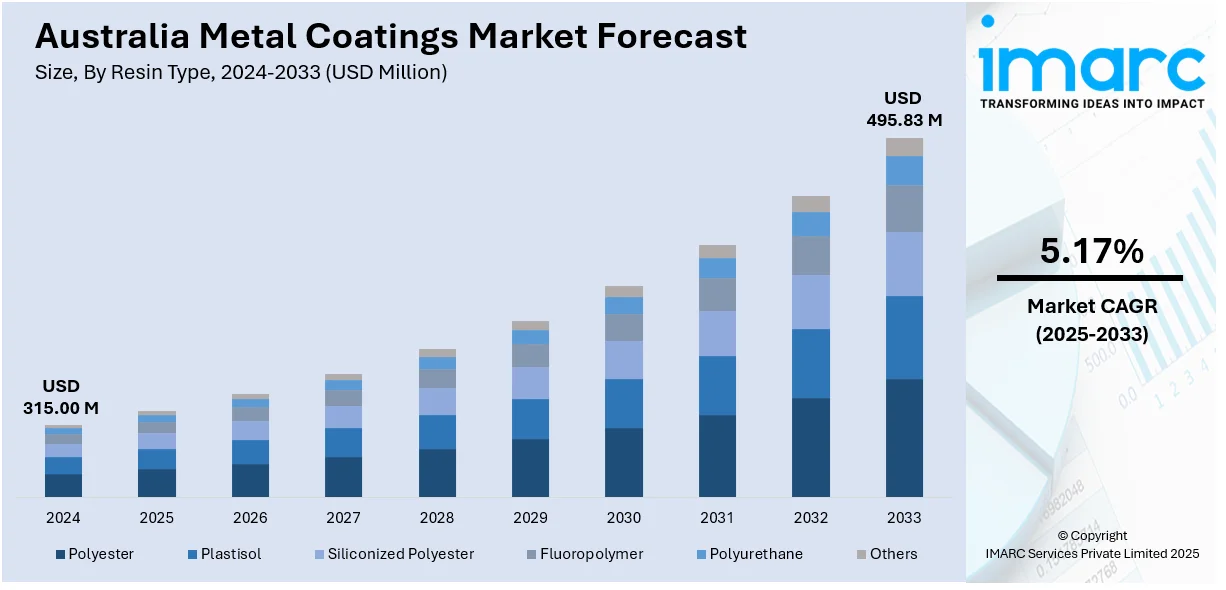

The Australia metal coatings market size reached USD 315.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 495.83 Million by 2033, exhibiting a growth rate (CAGR) of 5.17% during 2025-2033. The market is driven by rising demand for corrosion protection in infrastructure and industrial assets, especially amid ongoing construction and mining activity. Growing environmental awareness is pushing the shift toward eco-friendly, low-volatile organic compound (VOC) coatings. Simultaneously, technological innovations are enhancing product performance, with advanced formulations offering features like self-healing and resistance to extreme conditions. These factors, combined with regulatory pressure and the need for long-term durability, are fueling consistent rise in Australia metal coatings market share and transformation across key industrial and commercial sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 315.00 Million |

| Market Forecast in 2033 | USD 495.83 Million |

| Market Growth Rate 2025-2033 | 5.17% |

Australia Metal Coatings Market Trends:

Sustainability and Green Coatings

The transition towards ecologically sound practices is one of the dominant trends in Australia's metal coatings market. With industries opting for their environmental impact, a greater inclination has been observed toward coatings that are less chemically harmful and safer for people as well as the environment. This has sparked innovation in water-based, powder, and plant-based coatings, where performance is achieved without departing from environmental standards. Australia metal coatings market trends reflect this shift, as regulatory environments are also nudging businesses to discontinue conventional solvent-based products and adopt sustainable alternatives. This move is not just compliance but brand responsibility and customer expectations as well. Thus, businesses in construction, manufacturing, and automotive industries are going out of their way to find coatings aligned with green construction practices and cleaner production. This increasing demand for sustainable metal coatings is driving product development and investment plans across the industry.

To get more information on this market, Request Sample

Infrastructure and Industrial Expansion

Australia's growing infrastructure and manufacturing industries are fueling high demand for long-lasting metal coatings. With growing public and private construction projects, such as bridges, highways, factories, and mining vehicles, there is a higher requirement for wear, corrosion, and extreme environmental condition-resistant coatings such as salt-contaminated air and high ultraviolet (UV) exposures. These coatings assist in prolonging the life of metal assets and lowering maintenance expense, especially in the construction, energy, and transport sectors. This is highly consistent with the Australian Government's pledge to an over $120 billion 10-year pipeline of infrastructure investment centered on sustainable land transport initiatives. Such massive development guarantees consistent demand for advanced, high-performance coatings that are able to resist extreme conditions, enhance operating efficiency, and aid in ensuring long-term asset life throughout both city and rural areas of Australia.

Technological Advancements in Coating Solutions

Coating technology innovation is revolutionizing the way metal surfaces are protected and improved in industries in Australia. Contemporary coatings extend far beyond mere protection—providing functionalities such as microbial resistance, self-cleaning, and even self-healing abilities. Advances in nanotechnology and material science have paved the way for sophisticated formulations that excel under extreme conditions. These new coatings are being embraced in industries where precision and longevity are of essence, such as aerospace, electronics, and the marine industry. As interest increases in smart materials, firms are also looking into coatings that react to environmental stimuli, such as temperature or humidity fluctuations. These advances enhance efficiency, minimize the need for repeated applications, and provide long-term cost savings. As multifunctional surface demand grows, technology-based solutions are emerging as a foundation of competitive strength in the metal coatings industry, driving Australia metal coatings market growth and positioning R&D-focused firms as leaders in the field.

Australia Metal Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on resin type, process, technology, and end use industry.

Resin Type Insights:

- Polyester

- Plastisol

- Siliconized Polyester

- Fluoropolymer

- Polyurethane

- Others

The report has provided a detailed breakup and analysis of the market based on the resign type. This includes polyester, plastisol, siliconized polyester, fluoropolymer, polyurethane, and others.

Process Insights:

- Coil Coating

- Extrusion Coating

- Hot-Dip Galvanizing

A detailed breakup and analysis of the market based on the process have also been provided in the report. This includes coil coating, extrusion coating, and hot-dip galvanizing.

Technology Insights:

- Liquid Coating

- Powder Coating

The report has provided a detailed breakup and analysis of the market based on the technology. This includes liquid coating, and powder coating.

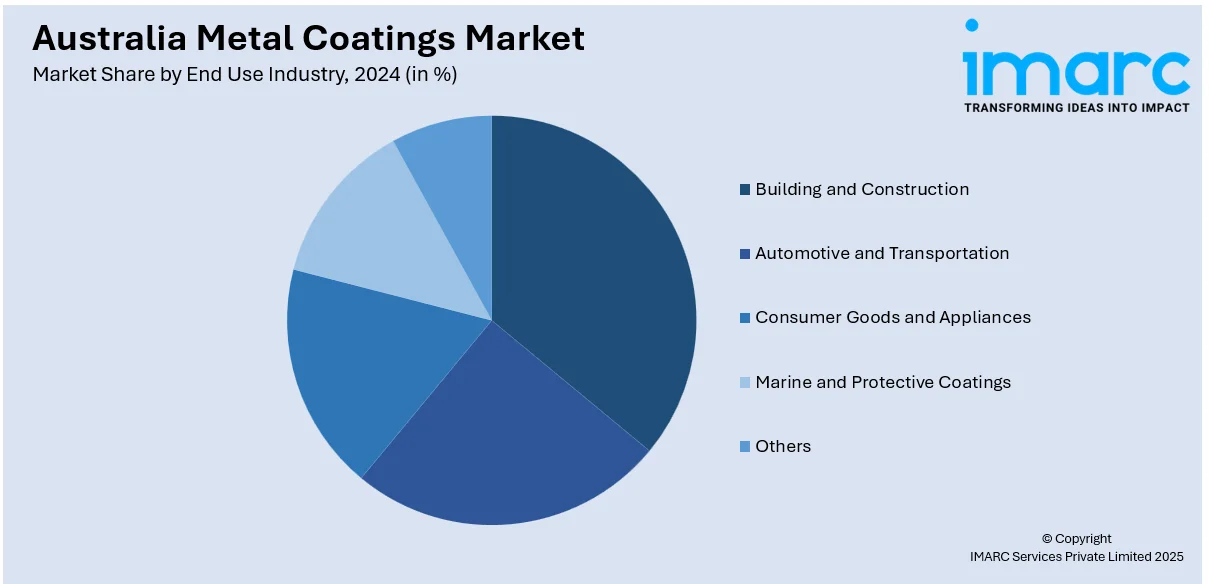

End Use Industry Insights:

- Building and Construction

- Automotive and Transportation

- Consumer Goods and Appliances

- Marine and Protective Coatings

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes building and construction, automotive and transportation, consumer goods and appliances, marine and protective coatings, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Metal Coatings Market News:

- In May 2025, INX International Ink Co. expanded its footprint in Australasia by acquiring Servicom New Zealand Limited and signing an agreement to acquire Galaxy Inks & Coatings Australia Pty Ltd, expected to close this month. Servicom specializes in high-performance inks and coatings, while Galaxy, INX’s exclusive Australian distributor, offers packaging and digital ink solutions. These moves aim to boost INX’s regional capabilities, streamline operations, and support long-term growth across Australia and New Zealand.

- In January 2025, WEG signed a deal to acquire the assets of Heresite Protective Coatings, a U.S.-based company specializing in industrial coatings for harsh environments like oil & gas and water treatment. The $9.5 million acquisition strengthens WEG’s presence in North America and supports its focus on high-tech, sustainable solutions. Heresite’s international footprint and specialized HVAC coatings align with WEG’s global expansion strategy in the industrial coatings segment.

Australia Metal Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered | Polyester, Plastisol, Siliconized Polyester, Fluoropolymer, Polyurethane, Others |

| Processes Covered | Coil Coating, Extrusion Coating, Hot-Dip Galvanizing |

| Technologies Covered | Liquid Coating, Powder Coating |

| End Use Industries Covered | Building and Construction, Automotive and Transportation, Consumer Goods and Appliances, Marine and Protective Coating, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia metal coatings market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia metal coatings market on the basis of resin type?

- What is the breakup of the Australia metal coatings market on the basis of process?

- What is the breakup of the Australia metal coatings market on the basis of technology?

- What is the breakup of the Australia metal coatings market on the basis of end use industry?

- What is the breakup of the Australia metal coatings market on the basis of region?

- What are the various stages in the value chain of the Australia metal coatings market?

- What are the key driving factors and challenges in the Australia metal coatings market?

- What is the structure of the Australia metal coatings market and who are the key players?

- What is the degree of competition in the Australia metal coatings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia metal coatings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia metal coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia metal coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)