Australia Metallurgical Equipment Market Size, Share, Trends and Forecast by Type, Equipment, Application, and Region, 2026-2034

Australia Metallurgical Equipment Market Summary:

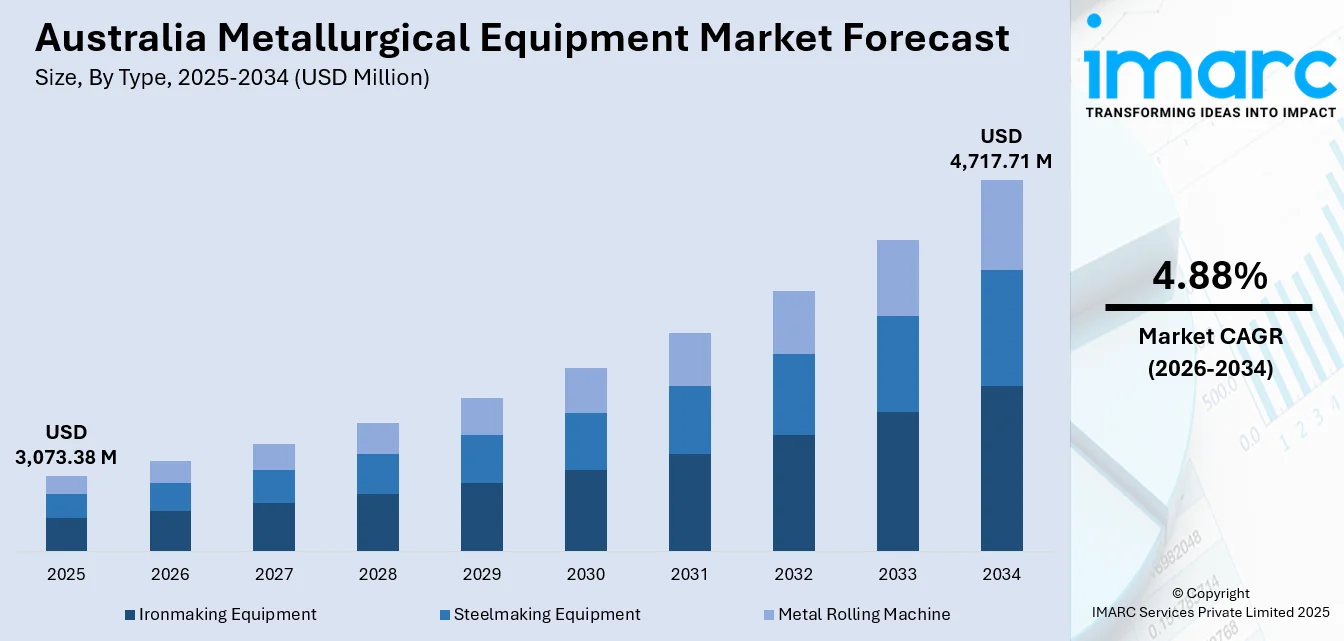

The Australia metallurgical equipment market size was valued at USD 3,073.38 Million in 2025 and is projected to reach USD 4,717.71 Million by 2034, growing at a compound annual growth rate of 4.88% from 2026-2034.

The Australia metallurgical equipment market is experiencing sustained expansion, driven by robust mining activities, infrastructure development, and industrial manufacturing growth. Rising demand for advanced processing equipment supports metal extraction and steel production capabilities. Technological innovations in automation and precision engineering are enhancing operational efficiency across metal fabrication operations. The strategic focus on domestic manufacturing capabilities and sustainable production methods continues to strengthen the market share.

Key Takeaways and Insights:

- By Type: Ironmaking equipment dominates the market with a share of 40% in 2025, owing to the extensive iron ore mining operations and steel production requirements across the nation. Expanding blast furnace installations and direct reduction iron technologies are driving segment expansion.

- By Equipment: Milling machines lead the market with a share of 31% in 2025. This dominance is driven by precision manufacturing requirements, increasing adoption of computer numerical control technologies, and growing demand for high-accuracy metal processing across the aerospace, automotive, and industrial sectors.

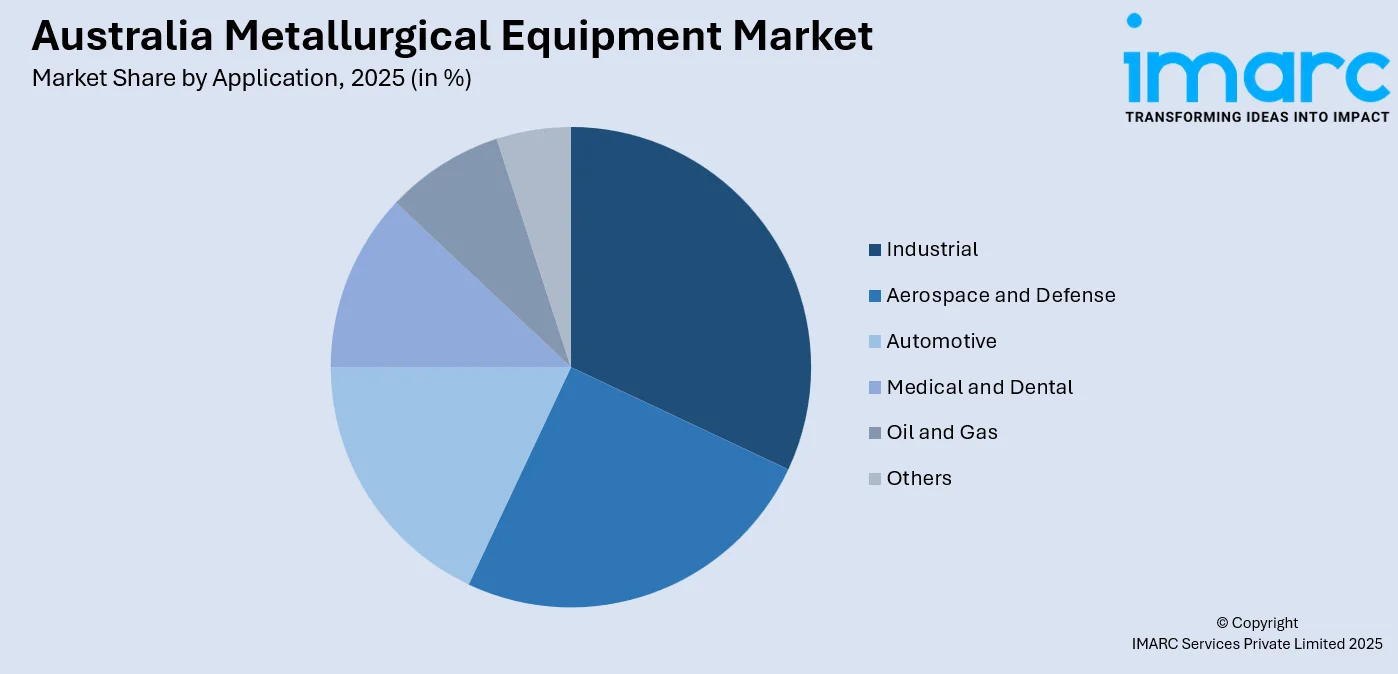

- By Application: Industrial represents the largest segment with a market share of 30% in 2025, reflecting the broad utilization of metallurgical equipment across manufacturing operations, heavy machinery production, and metal fabrication facilities that support diverse industrial operations throughout Australia.

- By Region: Australia Capital Territory & New South Wales comprises the largest region with 31% share in 2025, driven by the presence of manufacturing plants, modern infrastructure development, and significant government investments in domestic production capabilities across metropolitan centers.

- Key Players: Key players drive the Australia metallurgical equipment market by expanding product portfolios, investing in advanced automation technologies, and strengthening distribution networks. Their focus on innovation, energy efficiency, and sustainable manufacturing solutions boosts operational performance, accelerates equipment adoption, and ensures consistent product availability across diverse industrial segments.

To get more information on this market Request Sample

The Australia metallurgical equipment market is witnessing substantial momentum, driven by the nation's robust mining sector, expanding infrastructure investments, and growing emphasis on domestic manufacturing capabilities. The flourishing steel industry, supported by abundant iron ore reserves and advanced processing technologies, creates sustained demand for sophisticated metallurgical machinery. Government initiatives promoting advanced manufacturing, including substantial funding allocations for technology modernization and clean energy transitions, are fostering equipment upgrades across metal processing facilities. The adoption of Industry 4.0 technologies, including artificial intelligence (AI), Internet of Things (IoT) connectivity, and automation systems, is revolutionizing production efficiency and precision engineering capabilities. As per IMARC Group, the Australia Industry 4.0 market size reached USD 3,294.00 Million in 2024. Construction sector growth, particularly in urban development and transportation infrastructure projects, sustains demand for structural steel and specialized metal components, necessitating advanced fabrication equipment.

Australia Metallurgical Equipment Market Trends:

Integration of Industry 4.0 and Smart Manufacturing Technologies

The Australia metallurgical equipment market is experiencing a profound transformation through the widespread integration of Industry 4.0 technologies. Advanced automation systems, AI-powered analytics, and IoT connectivity are revolutionizing metal processing operations across the nation. As per IMARC Group, the Australia IoT market size reached USD 30.5 Billion in 2024. Real-time monitoring capabilities enable precise control over production parameters, enhancing quality consistency and operational efficiency. Remote operation centers manage autonomous equipment fleets from centralized hubs, optimizing resource utilization while minimizing human intervention in hazardous environments. These technological advancements position Australian manufacturers at the forefront of global metallurgical innovation.

Transition Towards Green and Sustainable Metal Production

Sustainability initiatives are reshaping metallurgical equipment specifications and operational practices throughout Australia. Metal producers are increasingly investing in energy-efficient furnaces, hydrogen-based reduction technologies, and electric smelting systems to minimize carbon emissions. The development of direct reduced iron technologies using renewable energy sources represents a significant advancement in decarbonizing steel production. Equipment manufacturers are responding by designing machinery compatible with cleaner fuel sources and incorporating recycling capabilities. This environmental focus aligns with national emissions reduction targets and positions Australian metallurgical operations favorably in international markets demanding sustainably produced metals.

Rising Adoption of Computer Numerical Control Precision Machinery

The demand for computer numerical control metallurgical equipment continues to accelerate across Australian manufacturing sectors. High-precision machining requirements in aerospace components, medical devices, and automotive parts drive investment in advanced milling, drilling, and grinding systems. Multi-axis machining capabilities enable complex geometries previously unattainable through conventional methods. Software integration allows seamless design-to-production workflows, reducing lead times and material waste. Training programs address the specialized skills required to operate sophisticated equipment, ensuring the workforce keeps pace with technological evolution in precision metal processing applications.

Market Outlook 2026-2034:

The Australia metallurgical equipment market demonstrates promising expansion prospects, as industrial modernization initiatives and infrastructure development programs continue to drive equipment demand. Government policies supporting domestic manufacturing resilience and strategic investments in critical minerals processing enhance long-term growth trajectories. The market generated a revenue of USD 3,073.38 Million in 2025 and is projected to reach a revenue of USD 4,717.71 Million by 2034, growing at a compound annual growth rate of 4.88% from 2026-2034. Technological advancements in automation and precision engineering continue to reshape operational capabilities across metal processing facilities. The renewable energy transition creates additional demand for specialized metallurgical equipment supporting wind turbine component manufacturing and battery material processing. Strategic partnerships between mining operations and equipment suppliers strengthen supply chain reliability while fostering innovations in sustainable production methodologies.

Australia Metallurgical Equipment Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Ironmaking Equipment |

40% |

|

Equipment |

Milling Machines |

31% |

|

Application |

Industrial |

30% |

|

Region |

Australia Capital Territory & New South Wales |

31% |

Type Insights:

- Ironmaking Equipment

- Steelmaking Equipment

- Metal Rolling Machine

Ironmaking equipment dominates with a market share of 40% of the total Australia metallurgical equipment market in 2025.

Ironmaking equipment holds the leading position in the Australia metallurgical equipment landscape, driven by the nation's extensive iron ore mining operations and steel production infrastructure. The segment encompasses blast furnaces, direct reduction equipment, and smelting technologies essential for converting raw iron ore into usable metallic products. Australia's position as one of the world's largest iron ore producers necessitates substantial investments in processing equipment. In December 2024, BHP, BlueScope, and Rio Tinto selected Kwinana Industrial Area in Western Australia to develop the nation's largest ironmaking electric smelting furnace pilot plant, targeting operations by 2028.

The growing emphasis on sustainable steelmaking technologies is driving modernization across ironmaking facilities nationwide. Direct reduced iron technologies and electric smelting furnace systems represent significant advancements enabling lower carbon emission intensity in iron production. These innovations address environmental regulations while maintaining production efficiency and output quality. Equipment manufacturers continue developing hydrogen-compatible furnace systems anticipating the energy transition. The combination of abundant ore resources, renewable energy potential, and technological innovation positions Australia as a strategic hub for advanced ironmaking equipment deployment and development.

Equipment Insights:

- Milling Machines

- Broaching Machines

- Grinding Machines

- Drilling Machines

Milling machines lead with a share of 31% of the total Australia metallurgical equipment market in 2025.

Milling machines command the largest equipment segment share, reflecting their versatility and essential role across diverse metal processing applications. These machines perform cutting, shaping, drilling, and surface finishing operations critical for component manufacturing in the aerospace, automotive, and industrial sectors. The adoption of computer numerical control technology has significantly enhanced precision capabilities and production efficiency. Additionally, milling machines support both high-volume production and custom fabrication requirements, making them indispensable across large manufacturing plants as well as specialized job shops.

The growing demand for high-precision components in aerospace defense applications and medical device manufacturing drives continued investments in advanced milling systems. Multi-axis machining capabilities enable complex geometry production previously unattainable through conventional methods. Software integration streamlines design-to-production workflows while minimizing material waste. Australian manufacturers increasingly prioritize equipment, featuring automation compatibility and remote monitoring capabilities. Training programs address specialized operational skills required for sophisticated milling equipment, ensuring workforce capabilities match technological advancement requirements across precision metal processing facilities.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Aerospace and Defense

- Automotive

- Medical and Dental

- Oil and Gas

- Industrial

- Others

Industrial exhibits a clear dominance with a 30% share of the total Australia metallurgical equipment market in 2025.

Industrial encompasses broad metallurgical equipment utilization across manufacturing operations, heavy machinery production, and metal fabrication facilities supporting diverse economic activities. This segment benefits from consistent demand generated by construction material requirements, mining equipment maintenance, and general manufacturing operations. The Australian Government's Future Made in Australia initiative has allocated substantial funding to strengthen domestic manufacturing capabilities. In March 2025, the government committed USD 750 Million through the Future Made in Australia Innovation Fund, specifically targeting metals sector modernization with low-emissions technologies.

Industrial applications require robust equipment capable of sustained operation under demanding conditions while maintaining precision standards. Fabrication shops, structural steel producers, and machinery manufacturers constitute significant equipment consumers within this segment. The emphasis on equipment durability, serviceability, and operational efficiency guides procurement decisions across industrial users. Technological advancements enabling remote monitoring and predictive maintenance capabilities enhance equipment utilization and minimize operational disruptions. The segment's stability provides manufacturers with reliable demand foundations supporting long-term investment in product development and market expansion.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales represents the leading region with a 31% share of the total Australia metallurgical equipment market in 2025.

Australia Capital Territory & New South Wales command the largest regional market share, driven by the concentration of advanced manufacturing facilities, substantial infrastructure development, and significant government investments in industrial capabilities. The region hosts major steel production facilities, including Port Kembla Steelworks, representing the heart of Australian steel manufacturing operations. Sydney's position as a commercial and industrial hub attracts substantial equipment investments across diverse manufacturing sectors. As of March 2025, New South Wales contributed approximately 30% of Australia's total manufacturing output, establishing the state as the nation's primary manufacturing center with extensive metallurgical equipment requirements.

Strategic partnerships between government agencies, research institutions, and industry stakeholders strengthen the region's manufacturing ecosystem. Educational institutions collaborate with industry partners developing specialized training programs addressing workforce skill requirements in metallurgical operations. The combination of established industrial infrastructure, skilled labor availability, and supportive policy frameworks positions the region favorably for continued metallurgical equipment market expansion and technological advancement across metal processing applications. The presence of efficient transport networks and proximity to ports further enhances equipment procurement, installation, and servicing efficiency for manufacturers operating across the region.

Market Dynamics:

Growth Drivers:

Why is the Australia Metallurgical Equipment Market Growing?

Robust Mining Sector Expansion and Equipment Modernization

Australia's position as a global mining powerhouse creates sustained demand for advanced metallurgical equipment across extraction, processing, and refining operations. Expenditure on exploration and various mining support services in Australia averaged USD 486 Million each quarter in the year ending March 2024, which was 25% greater than the average quarterly expenditure over the previous five years. The nation ranks among the world's largest producers of iron ore, lithium, bauxite, and various critical minerals essential for modern industrial applications. Mining operations increasingly require sophisticated equipment capable of processing diverse ore grades while maintaining operational efficiency and environmental compliance. The shift towards deeper mining operations necessitates equipment upgrades addressing more challenging extraction conditions and processing requirements. Autonomous mining technologies, including remotely operated drilling systems and automated haulage equipment, demand integrated metallurgical processing solutions ensuring seamless material handling from extraction through processing stages. Equipment manufacturers respond by developing machinery compatible with automated operational environments while maintaining precision processing capabilities.

Government Investments in Domestic Manufacturing Capabilities

Strategic government initiatives promoting domestic manufacturing capabilities significantly influence metallurgical equipment market expansion throughout Australia. Policy frameworks emphasizing industrial self-sufficiency, supply chain resilience, and sovereign manufacturing capacity drive substantial investments in metal processing infrastructure. National programs supporting advanced manufacturing development allocate considerable resources towards technology upgrades, facility modernization, and workforce training initiatives across metallurgical operations. Tax incentives and instant asset write-off provisions enable businesses to accelerate equipment acquisition and technology adoption timelines. Procurement policies prioritizing locally manufactured products create demand certainty encouraging equipment suppliers to expand domestic production capabilities. Defense industry development initiatives require specialized metallurgical equipment for producing high-performance alloys and precision components meeting stringent military specifications. The renewable energy transition generates additional equipment demand, as wind tower fabrication, battery component production, and hydrogen infrastructure development require sophisticated metal processing capabilities.

Infrastructure Development and Construction Sector Growth

Australia's substantial infrastructure development program generates consistent demand for metallurgical equipment, supporting structural steel production and metal fabrication operations. Major transportation projects, including road networks, railway systems, and bridge constructions, require significant steel volumes fabricated using advanced processing equipment. In February 2024, construction commenced on the Molonglo River Bridge, funded collaboratively by the Australian and ACT governments. The USD 225 Million initiative would establish an essential connection for the arterial road system. Urban development across metropolitan centers drives demand for construction materials processed through sophisticated metallurgical machinery ensuring quality consistency and structural integrity. The construction industry's substantial economic contribution, representing a significant proportion of national output, establishes reliable demand foundations for metal processing equipment manufacturers. Energy infrastructure development, encompassing power generation facilities, transmission networks, and renewable energy installations, necessitates specialized metallurgical equipment for producing corrosion-resistant and high-strength components.

Market Restraints:

What Challenges the Australia Metallurgical Equipment Market is Facing?

High Capital Investment Requirements

The substantial capital investment required for advanced metallurgical equipment presents significant acquisition barriers, particularly for small and medium enterprises (SMEs) operating within constrained budgets. Sophisticated machinery featuring automation capabilities, precision controls, and advanced monitoring systems commands premium pricing that challenges affordability for many manufacturers. Financing arrangements and equipment leasing options partially address capital constraints, yet many businesses remain hesitant to commit substantial resources toward equipment purchases amid economic uncertainties. This investment barrier limits equipment adoption rates and technological advancement across segments of the manufacturing sector.

Skilled Workforce Shortages and Training Gaps

The metallurgical equipment industry faces persistent challenges in securing adequately skilled workers capable of operating sophisticated machinery and maintaining advanced processing systems. Job vacancies in specialized positions, including robotics engineers, automation technicians, and computer numerical control machinists, remain unfilled for extended periods. Training programs struggle to produce sufficient graduates matching industry skill requirements and technological advancement pace. This workforce limitation constrains operational capacity expansion and equipment utilization optimization across manufacturing facilities. Elevated wage pressures further compound operational cost challenges affecting industry competitiveness.

Import Dependence and Supply Chain Vulnerabilities

The Australia metallurgical equipment market experiences significant import penetration, with overseas suppliers fulfilling substantial portions of domestic demand. This dependence on international supply chains creates vulnerability to global disruptions, logistics challenges, and currency fluctuations affecting equipment pricing and availability. Extended delivery timeframes for specialized machinery imported from international manufacturers can delay project timelines and operational commencement. Domestic equipment manufacturing capabilities remain limited in certain specialized categories, constraining options for locally sourced solutions and increasing exposure to international supply chain uncertainties affecting equipment procurement planning.

Competitive Landscape:

The Australia metallurgical equipment market features a moderately competitive landscape, characterized by the presence of established international equipment manufacturers alongside regional suppliers and specialized domestic fabricators. Market participants differentiate through technological capabilities, service network coverage, and application-specific expertise addressing diverse industrial requirements. Competition intensifies around automation features, energy efficiency specifications, and digital integration capabilities as manufacturers seek performance advantages. Strategic partnerships between equipment suppliers and end-users facilitate customized solutions development addressing specific operational needs. After-sales service quality, parts availability, and technical support responsiveness significantly influence procurement decisions and customer retention across the market.

Recent Developments:

- In April 2025, Epiroc secured an AUD 350 Million contract with Fortescue for 50 electric drill rigs to be delivered by 2030 for Pilbara operations. The fully autonomous equipment will be controlled remotely from an operations center in Perth, advancing automated metallurgical processing capabilities.

Australia Metallurgical Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Ironmaking Equipment, Steelmaking Equipment, Metal Rolling Machine |

| Equipments Covered | Milling Machines, Broaching Machines, Grinding Machines, Drilling Machines |

| Applications Covered | Aerospace and Defense, Automotive, Medical and Dental, Oil and Gas, Industrial, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia metallurgical equipment market size was valued at USD 3,073.38 Million in 2025.

The Australia metallurgical equipment market is expected to grow at a compound annual growth rate of 4.88% from 2026-2034 to reach USD 4,717.71 Million by 2034.

Ironmaking equipment dominated the market with a share of 40%, driven by Australia's extensive iron ore mining operations and steel production infrastructure requiring sophisticated blast furnaces, direct reduction systems, and smelting technologies.

Key factors driving the Australia metallurgical equipment market include robust mining sector expansion, government investments in domestic manufacturing capabilities, infrastructure development programs, technological advancements in automation and precision engineering, and the renewable energy transition.

Major challenges include high capital investment requirements for advanced equipment, skilled workforce shortages in specialized technical roles, import dependence creating supply chain vulnerabilities, elevated operational costs, and competition from international manufacturers offering cost-effective alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)