Australia Microgreens Market Size, Share, Trends and Forecast by Type, Farming Method, Distribution Channel, End Use, and Region, 2025-2033

Australia Microgreens Market Overview:

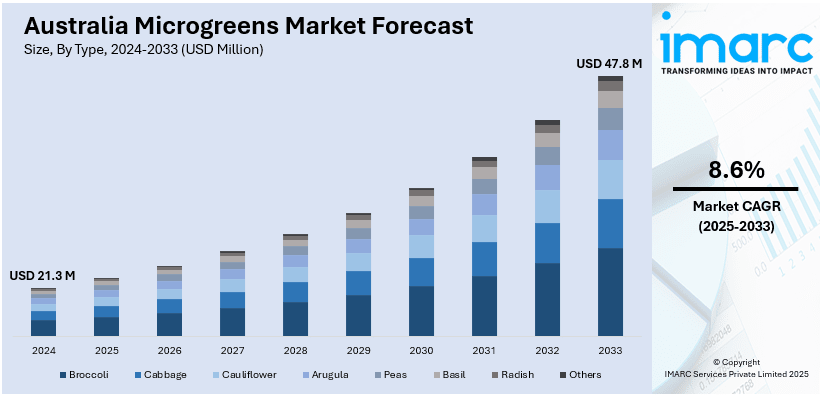

The Australia microgreens market size reached USD 21.3 Million in 2024. Looking forward, the market is expected to reach USD 47.8 Million by 2033, exhibiting a growth rate (CAGR) of 8.6% during 2025-2033. The market is witnessing rapid expansion driven by rising health consciousness, demand for locally sourced nutrient-rich foods, and adoption of sustainable indoor farming methods. Increasing retail availability, integration into restaurant menus, and supportive government initiatives are enhancing accessibility and production efficiency, fostering consistent consumer interest and growth across the nation, and strengthening the Australia microgreens market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 21.3 Million |

| Market Forecast in 2033 | USD 47.8 Million |

| Market Growth Rate 2025-2033 | 8.6% |

Key Trends of Australia Microgreens Market:

Sustainable Innovation in Livestock Nutrition

The microgreens market in Australia is evolving with a focus on sustainable practices, especially in livestock nutrition. Microgreens, known for their high nutritional density, provide a significant boost in protein levels compared to traditional grains. Their ability to be cultivated in compact spaces with minimal resource use enhances their appeal. This farming method uses fewer resources like water, making it a highly efficient and eco-friendly alternative to conventional crops. As sustainability becomes more important in agriculture, microgreens are gaining traction as a nutritious, resource-conscious option for animal feed. According to the Australia microgreens market analysis, this shift toward innovative farming techniques is shaping the future of livestock nutrition in Australia, offering a greener, more efficient approach to food production. According to an article published in January 2025, the Australian microgreens market is embracing sustainable practices, particularly in animal fodder production. Microgreens, like sprouted barley, offer high nutritional density, significantly boosting protein levels compared to traditional grains. They can be grown in small spaces, requiring only 9-18 square meters of indoor area, and are highly water-efficient, using up to 90% less water than conventional crops. This innovative approach to livestock nutrition is becoming increasingly popular in Australia due to its sustainability and space efficiency.

To get more information on this market, Request Sample

Revolutionizing Microgreens Cultivation

The Australia microgreens market growth is embracing innovative, sustainable solutions with the introduction of a new soilless growth medium. Developed using advanced biotechnologies, this medium enhances the cultivation process by offering an eco-friendly alternative to traditional growing methods. Early trial results have shown promising outcomes, leading to a strategic collaboration aimed at improving controlled environment agriculture. This partnership aims to support more efficient, sustainable practices in microgreens farming, reducing reliance on conventional resources while boosting productivity. As the market shifts towards more environmentally conscious agricultural solutions, this new approach is expected to play a pivotal role in transforming the commercial microgreens sector in Australia. For instance, in September 2023, Nanollose Limited partnered with Greenspace ESG Pty Ltd to exclusively evaluate and supply MicroGel, a soilless growth medium for Australia's commercial microgreens market. Developed using Nanollose's Biollose technology, MicroGel offers sustainable cultivation solutions. Encouraging trial results have led to this collaboration, aiming to revolutionize controlled environment agriculture in Australia.

Growth Drivers of Australia Microgreens Market:

Expanding Consumer Demand for Fresh and Local Produce

The growing awareness of the fact that microgreens have nutritional density with culinary appeal drives strong consumer interest throughout Australia. Health-conscious buyers increasingly prioritize locally grown, pesticide-free foods that offer superior flavor and concentrated vitamins. Microgreens meet these hopes, and they turn into essentials within high-end salads, smoothies, and suppers. The farmers’ markets and subscription-based vegetable boxes with direct-to-consumer delivery services further improve accessibility for all. These services let producers reach urban households fast, securing freshness. This shift toward fresh, nutrient-packed produce strengthens market momentum and encourages more growers to adopt microgreen cultivation methods, ensuring a steady supply to meet rising domestic demand while supporting regional food security and reducing dependency on imports.

Integration into Mainstream Retail and Foodservice

Microgreens have transitioned from niche gourmet ingredients to widely used components in Australian retail and foodservice operations, which is further driving the Australia microgreens market demand. Major supermarket chains, specialty grocery stores, and meal-kit providers increasingly feature microgreens in ready-to-eat salads, sandwiches, and garnish packs. Restaurants and cafés highlight their vibrant appearance and intense flavor to enhance visual appeal and nutritional value in diverse dishes, from breakfast bowls to fine-dining entrées. This expanded presence encourages repeat purchases and familiarizes consumers with microgreens as everyday items rather than occasional delicacies. As chefs and retailers promote creative uses, demand continues to climb, prompting steady investments in commercial-scale production, streamlined distribution networks, and advanced packaging solutions to maintain freshness and shelf stability nationwide.

Supportive Government and Industry Initiatives

Federal and state-level agricultural grants, training programs, and sustainability-driven policies are accelerating microgreens cultivation throughout Australia. These initiatives provide financial incentives and technical guidance for small-scale producers and startups to adopt innovative farming methods, such as vertical hydroponics and climate-controlled indoor systems. By reducing water usage and land requirements, these practices align with national goals for resource-efficient food production. Industry associations and cooperative networks further assist growers through marketing support and best-practice sharing, helping them expand market reach and maintain consistent quality standards. This supportive environment not only drives innovation and improves production efficiency but also creates new income opportunities for farmers seeking to diversify crops and capitalize on escalating consumer demand.

Australia Microgreens Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, farming method, distribution channel, and end use.

Type Insights:

- Broccoli

- Cabbage

- Cauliflower

- Arugula

- Peas

- Basil

- Radish

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes broccoli, cabbage, cauliflower, arugula, peas, basil, radish, and others.

Farming Method Insights:

- Indoor Vertical Farming

- Commercial Greenhouses

- Others

A detailed breakup and analysis of the market based on the farming method have also been provided in the report. This includes indoor vertical farming, commercial greenhouses, and others.

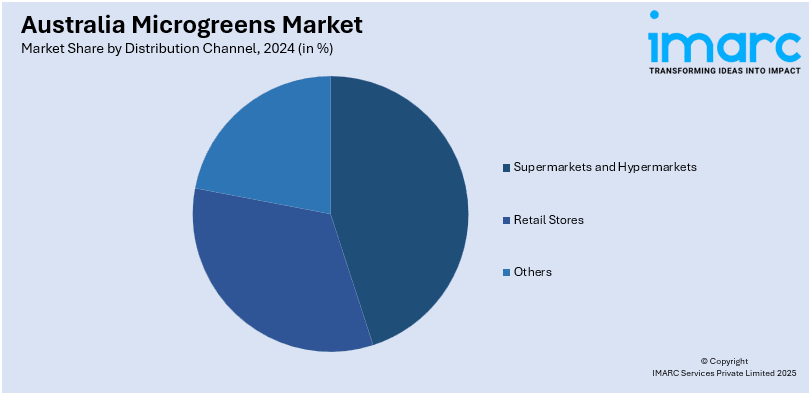

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Retail Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, retail stores, and others.

End Use Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential and commercial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Microgreens Market News:

- In April 2025, Eden Towers, an Australian vertical farming company, announced its plans to expand its operations across major cities in Australia within the next 24 months. The company, which supplies leafy greens, herbs, microgreens, and edible flowers, aims to tackle the complex and costly value chain in Australian agriculture. Eden Towers focuses on offering year-round, sustainable, and locally grown produce, including specialty crops like microgreens, which are gaining popularity in the market.

Australia Microgreens Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Broccoli, Cabbage, Cauliflower, Arugula, Peas, Basil, Radish, Others |

| Farming Methods Covered | Indoor Vertical Farming, Commercial Greenhouses, Others |

| Distribution Channel s Covered | Supermarkets and Hypermarkets, Retail Stores, Others |

| End Uses Covered | Residential, Commercial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia microgreens market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia microgreens market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia microgreens industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia microgreens market was valued at USD 21.3 Million in 2024.

The Australia microgreens market is projected to exhibit a CAGR of 8.6% during 2025-2033.

The Australia microgreens market is projected to reach a value of USD 47.8 Million by 2033.

The Australia microgreens market is driven by rising demand for nutrient-rich foods, growing adoption in restaurants and gourmet cooking, increasing urban farming and vertical cultivation, consumer preference for organic produce, and expansion of retail and online distribution channels offering convenient access to fresh, premium-quality microgreens.

The growth in Australia’s microgreens market is supported by rising health-conscious consumers, higher disposable incomes that enables premium purchases, government initiatives encouraging sustainable farming, popularity among home gardeners, strong presence in farmer’s markets, culinary experimentation, and innovations in packaging that extend shelf life and improve supply chain efficiency for retailers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)