Australia Mineral Exploration Equipment Market Size, Share, Trends and Forecast by Equipment Type, Mineral Type, End User, and Region, 2026-2034

Australia Mineral Exploration Equipment Market Summary:

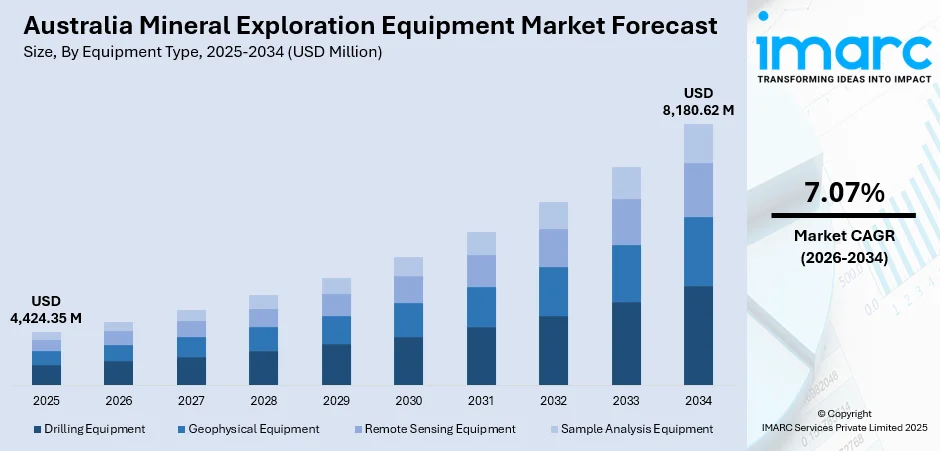

The Australia mineral exploration equipment market size was valued at USD 4,424.35 Million in 2025 and is projected to reach USD 8,180.62 Million by 2034, growing at a compound annual growth rate of 7.07% from 2026-2034.

In Australia, the market is expanding on the back of the country's abundant mineral wealth, substantial government investments in resource exploration initiatives, the global transition towards clean energy technologies, and the integration of advanced autonomous and artificial intelligence (AI)-powered exploration systems. Australia's position as a world-leading producer of critical minerals, including lithium, gold, and rare earths, continues to drive equipment demand, with mining companies accelerating exploration activities to meet growing international requirements for energy transition materials.

Key Takeaways and Insights:

-

By Equipment Type: Drilling equipment dominates the market with a share of 55.7% in 2025, as it is critical for sample extraction and deposit verification. Frequent use, increasing drilling depths, and ongoing exploration projects ensure steady and strong demand.

-

By Mineral Type: Metallic minerals lead the market with a share of 80% in 2025, owing to Australia's position as a top global producer of gold, iron ore, lithium, and rare earth elements.

-

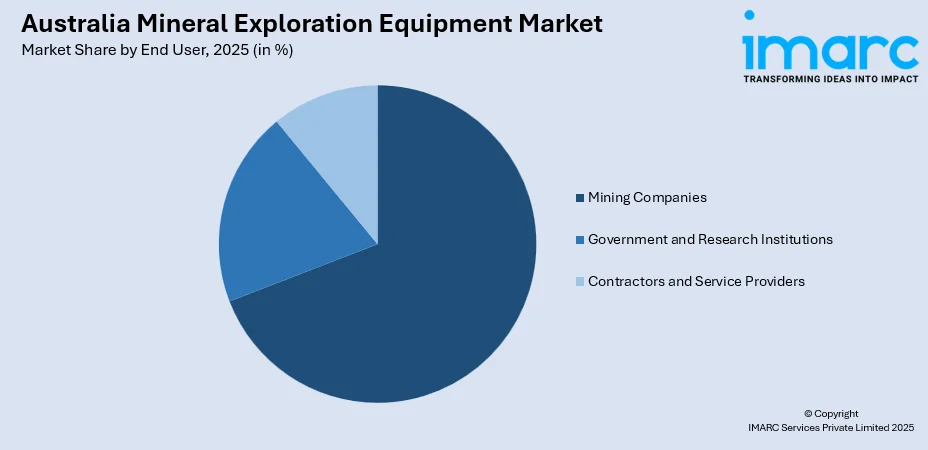

By End User: Mining companies prevail the market with a share of 69.4% in 2025. This dominance is driven by sustained corporate investments in resource discovery, reserve expansion, and technological advancements.

-

By Region: Western Australia represents the largest region with a market share of 65.0% in 2025, supported by its world-class mineral endowment, sophisticated exploration infrastructure, and high mineral exploration expenditure.

-

Key Players: The Australia mineral exploration equipment market features moderate competitive intensity, with global equipment manufacturers competing alongside specialized service providers and regional contractors to deliver integrated drilling solutions, geophysical survey systems, and advanced sample analysis technologies.

To get more information on this market Request Sample

The market is benefiting from Australia's strategic importance in global mineral supply chains, particularly for critical minerals essential to the energy transition. The Australian Government's committed AUD 566.1 Million over ten years from 2024-25 for Geoscience Australia to chart Australia’s national groundwater frameworks and resource assets, aiming to boost industry investment and pinpoint possible findings of all existing critical minerals and strategic resources. Technological improvements in drilling accuracy, data analysis, and automation are enhancing efficiency and reducing operational risks, encouraging equipment upgrades. Government support for responsible mining and approvals for new projects also strengthen industry confidence. Demand for critical minerals used in energy storage, electronics, and infrastructure further supports long-term exploration activities. Australia’s strong mining base and skilled workforce provide a stable foundation for market expansion.

Australia Mineral Exploration Equipment Market Trends:

Integration of AI and Machine Learning (ML) in Exploration

The mineral exploration landscape is undergoing transformation through AI-powered technologies that enhance deposit targeting and reduce discovery timeframes. Advanced predictive algorithms trained on geophysical, geochemical, and remote sensing datasets enable more accurate identification of mineralization in unexplored regions. In November 2024, Earth AI and Legacy Minerals revealed the inaugural greenfield palladium discovery achieved through AI at the Fontenoy Project located in New South Wales, demonstrating the commercial viability of AI-driven exploration approaches that significantly improve discovery success rates compared to traditional methodologies.

Rising private sector investments

Increasing private sector investments are driving the market growth by funding new projects and expanding exploration budgets. In July 2024, Sandvik received an MSEK 300 underground equipment order from Evolution Mining for operations in Australia, with equipment deliveries commencing during the third quarter of 2024. The order demonstrated continued investments in advanced underground drilling and loading capabilities across Australia's gold mining sector. Mining firms use fresh capital to purchase modern drilling and surveying equipment that improves accuracy and productivity. Higher investment confidence also supports long-term contracts, equipment upgrades, and greater adoption of advanced technologies across exploration operations.

Ongoing Technological Modernization

Mining companies are upgrading to advanced, automated, and tele-remote drilling systems to improve productivity, safety, and accuracy at large mines. In October 2024, Newmont placed a fleet order valued at approximately MSEK 335 with Epiroc for Pit Viper 231 and SmartROC D65 drill rigs to be deployed at the Boddington gold and copper mine in Western Australia. The tele-remotely operated rigs would replace existing equipment and continue the long-term partnership between the mining company and equipment provider at the Tier 1 gold asset. Replacing older rigs with modern equipment reduces downtime, lowers operating costs, and enhances drilling precision. This reflects strong investments in high-performance machinery for Tier-1 assets, where efficiency gains and long-term output reliability justify large capital spending on advanced exploration and production equipment.

Market Outlook 2026-2034:

The Australia mineral exploration equipment market is projected to demonstrate strong growth trajectory, driven by sustained exploration investments and equipment modernization requirements. The market generated a revenue of USD 4,424.35 Million in 2025 and is projected to reach a revenue of USD 8,180.62 Million by 2034, growing at a compound annual growth rate of 7.07% from 2026-2034. The growth momentum is supported by government-backed exploration incentives, expanding critical minerals programs, and increasing adoption of advanced drilling technologies. Equipment demand is expected to strengthen across automated drilling systems, sophisticated geophysical survey instruments, and AI-integrated sample analysis platforms, as mining companies pursue operational efficiency and discovery success.

Australia Mineral Exploration Equipment Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Equipment Type |

Drilling Equipment |

55.7% |

|

Mineral Type |

Metallic Minerals |

80% |

|

End User |

Mining Companies |

69.4% |

|

Region |

Western Australia |

65.0% |

Equipment Type Insights:

- Drilling Equipment

- Geophysical Equipment

- Remote Sensing Equipment

- Sample Analysis Equipment

Drilling equipment dominates with a market share of 55.7% of the total Australia mineral exploration equipment market in 2025.

The drilling equipment segment maintains market leadership due to its fundamental role across all exploration phases from initial target testing through resource delineation. Diamond core drilling, reverse circulation drilling, and rotary air blast drilling represent primary methodologies deployed across Australia's diverse geological terrains.

Drilling equipment demand is sustained by brownfield expansion programs at existing mining operations where companies seek to extend mine life through near-mine discovery. The segment is experiencing technological advancements through automated rod handling systems, real-time data transmission capabilities, and precision guidance technologies that improve drilling accuracy and sample quality. Equipment providers are responding to operator requirements for rigs capable of achieving greater depths with improved recovery rates while maintaining operational efficiency in challenging geological conditions.

Mineral Type Insights:

- Metallic Minerals

- Non-Metallic Minerals

- Coal Exploration

Metallic minerals lead with a share of 80% of the total Australia mineral exploration equipment market in 2025.

The metallic minerals segment commands market dominance owing to Australia's exceptional endowment in gold, iron ore, copper, lithium, and rare earth elements. Gold exploration budget alone commanded approximately USD 1.25 Billion in 2024. Australia maintained its world-leading position for gold, iron ore, lead, uranium, zinc, and zircon resources while achieving significant growth in critical mineral inventory, including vanadium, where the country holds a major part of global economic resources.

These minerals are critical for construction, manufacturing, energy transmission, and advanced technologies, keeping demand consistently strong. Exploration for metallic deposits is technically complex and requires intensive drilling, surveying, and sampling, which increases the need for advanced equipment. Large-scale mining projects also operate over long lifecycles, ensuring repeated equipment purchases, upgrades, and maintenance. Rising global demand for metals used in infrastructure, renewable energy, and electric vehicles encourages Australian miners to expand exploration budgets.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Mining Companies

- Government and Research Institutions

- Contractors and Service Providers

Mining companies exhibit a clear dominance with a 69.4% share of the total Australia mineral exploration equipment market in 2025.

Mining companies constitute the primary end user segment, owing to their direct ownership of exploration programs and substantial capital expenditure on equipment acquisition and deployment. Major producers and mid-tier operators maintain dedicated exploration fleets while supplementing capabilities through contractor engagement for specialized services. Western Australia's mining industry registered 135,693 full-time equivalent (FTE) on-site positions in 2024, representing the eighth consecutive year of employment growth and reflecting sustained operational investment across the sector's exploration activities.

In Australia, the mining companies segment demonstrates equipment demand patterns influenced by commodity price cycles and corporate exploration strategies. Large multinational mining corporations maintain significant exploration budgets supported by strong balance sheets and long-term resource development objectives. Equipment preferences across this segment increasingly favor integrated technology solutions offering automation capabilities, real-time data analytics, and remote operational control to maximize exploration efficiency.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Western Australia prevails the market with a 65.0% share of the total Australia mineral exploration equipment market in 2025.

Western Australia maintains overwhelming regional leadership supported by its extraordinary mineral wealth spanning iron ore, gold, lithium, nickel, and rare earth deposits concentrated across the Pilbara, Goldfields, and emerging critical minerals provinces. The state recorded mineral exploration expenditure of USD 2.57 Billion in 2024-25, maintaining near-record levels and accounting for approximately two-thirds of national exploration spending.

The region also benefits from strong infrastructure, skilled labor, and global mining company presence, making it a hub for large-scale exploration projects. Investment levels remain high as companies continuously upgrade machinery to improve safety, accuracy, and efficiency. Supportive policies, efficient logistics networks, and concentration of service providers further strengthen the supply chain. These advantages help Western Australia maintain leadership in adopting advanced exploration technologies and sustaining high equipment consumption nationwide.

Market Dynamics:

Growth Drivers:

Why is the Australia Mineral Exploration Equipment Market Growing?

Substantial Government Investment and Policy Support for Mineral Exploration

The Australian Government has committed significant financial resources to accelerate mineral exploration and discovery. In the 2024–25 Budget, the Australian Government revealed its Future Made in Australia package. This package facilitated Australia's shift toward a net zero economy. The Future Made in Australia initiative offered backing for investments in essential minerals processing in Australia via the Critical Minerals Production Tax Incentive (CMPTI). The CMPTI offered qualifying recipients a refundable tax offset of 10% on the eligible expenses for processing specific critical minerals in Australia. The offset will be accessible from 1 July 2027 to 30 June 2040, for a maximum duration of 10 years. Clear regulations and long-term resource strategies improve investor confidence and promote sustained exploration activities across the country.

Rising Global Demand for Critical Minerals Essential to Energy Transition

The ongoing transition towards renewable energy technologies and electric vehicles (EVs) is generating unprecedented demand for minerals that Australia produces in abundance. As per IMARC Group, the Australia EV market size was valued at USD 16.2 Billion in 2024. Minerals, such as lithium, copper, and nickel, are vital for renewable energy systems, batteries, and EV manufacturing, boosting exploration budgets. To meet this surge, companies invest in advanced drilling, surveying, and analytical equipment that improves accuracy and speeds up discovery. Long-term supply contracts and international interest further encourage exploration activities. As Australia is a key supplier of these minerals, equipment demand continues to rise alongside expanding global clean energy and EV demand.

Technological Advancement in Exploration Equipment and Methodologies

Technological advancements are improving exploration accuracy, efficiency, and safety. Modern drilling systems, automated rigs, and digital surveying tools help mining companies locate mineral deposits faster and at lower operational cost. Advanced data analytics and remote monitoring reduce human risk in hazardous locations while increasing productivity. As demand for minerals used in renewable energy systems, batteries, and EV production rises, companies adopt high-performance equipment to speed up resource discovery. Smart sensors and real-time reporting improve decision-making and reduce drilling errors. Lightweight and energy-efficient machines also lower fuel consumption and maintenance needs. Innovation in mapping software allows better reserve estimation, leading to confident investment decisions. Together, these technologies make exploration more reliable and scalable, encouraging companies to replace older equipment with modern systems. This continuous upgrade cycle strengthens market growth across Australia.

Market Restraints:

What Challenges the Australia Mineral Exploration Equipment Market is Facing?

Persistent Skilled Labor Shortages Affecting Equipment Operation

The Australian drilling and exploration sector faces ongoing challenges in recruiting and retaining qualified personnel capable of operating sophisticated exploration equipment. Competition from other industries and the remote location of many exploration sites create recruitment difficulties that constrain operational capacity. Training requirements for advanced automated and digital equipment systems add complexity to workforce development efforts.

Rising Exploration and Operational Cost Pressures

Exploration activities are experiencing elevated costs across labor, equipment, fuel, and regulatory compliance requirements. Equipment acquisition costs have increased substantially while operational expenses in remote locations continue to escalate. These cost pressures particularly impact junior exploration companies with limited capital resources, potentially constraining greenfield exploration activity and associated equipment demand.

Commodity Price Volatility Impacting Investment Decisions

Commodity price volatility affects the market growth by making miners cautious about capital spending. When prices fluctuate sharply, companies delay or scale down exploration projects, reducing demand for new equipment. Uncertain returns push firms to prioritize cost control, lease equipment, or extend the life of existing assets. This hesitation slows equipment sales and limits market growth despite long-term resource potential.

Competitive Landscape:

The Australia mineral exploration equipment market exhibits moderate consolidation with global original equipment manufacturers (OEMs) maintaining significant market presence alongside specialized regional service providers and exploration contractors. Major international companies deliver comprehensive equipment portfolios spanning drilling systems, geophysical instruments, and analytical technologies, supported by extensive aftermarket service networks across the continent. The competitive environment emphasizes product reliability, technological innovations, and localized service capabilities as key differentiators. Strategic partnerships between equipment suppliers and major mining companies increasingly involve long-term framework agreements covering equipment supply, maintenance, and technology upgrades. Regional contractors maintain competitive positions through specialized expertise in specific equipment categories or geographic markets, while the growing emphasis on autonomous and electric-powered equipment is reshaping competitive dynamics as manufacturers advance decarbonization-ready product offerings.

Recent Developments:

-

In April 2025, Epiroc secured its largest contract ever, valued at AUD 350 Million over five years, to supply autonomous and electric-powered drill rigs to Fortescue for deployment at the company's iron ore operations in Western Australia's Pilbara region. The contract included Pit Viper 271 E cable-electric and SmartROC D65 BE battery-electric blasthole drill rigs that would eventually operate fully autonomously from Fortescue's Perth operations center.

Australia Mineral Exploration Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Drilling Equipment, Geophysical Equipment, Remote Sensing Equipment, Sample Analysis Equipment |

| Mineral Types Covered | Metallic Minerals, Non-Metallic Minerals, Coal Exploration |

| End Users Covered | Mining Companies, Government and Research Institutions, Contractors and Service Providers |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia mineral exploration equipment market size was valued at USD 4,424.35 Million in 2025.

The Australia mineral exploration equipment market is expected to grow at a compound annual growth rate of 7.07% from 2026-2034 to reach USD 8,180.62 Million by 2034.

Drilling equipment dominated the market with 55.7% share, as it is essential for core sampling and resource confirmation. High usage frequency, deeper exploration needs, and continuous field activity keep demand consistently strong.

Key factors driving the Australia mineral exploration equipment market include substantial government investments, rising global demand for critical minerals essential to energy transition technologies, and technological advancements in autonomous and AI-powered exploration equipment.

Major challenges include persistent skilled labor shortages affecting equipment operation in remote locations, rising exploration and operational cost pressures impacting junior exploration companies, commodity price volatility creating investment uncertainty, extended regulatory approval timeframes for exploration permits, and supply chain constraints affecting equipment availability and maintenance parts delivery.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)