Australia Mining Truck Market Size, Share, Trends and Forecast by Type, Payload Capacity, Application, Drive, and Region, 2026-2034

Australia Mining Truck Market Summary:

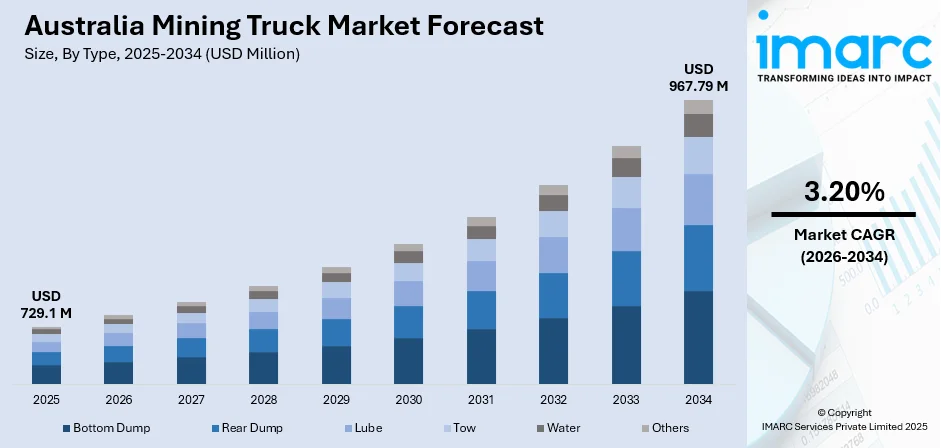

The Australia mining truck market size was valued at USD 729.1 Million in 2025 and is projected to reach USD 967.79 Million by 2034, growing at a compound annual growth rate of 3.20% from 2026-2034.

The market is experiencing steady growth, supported by expanding mining activities, increased investment in resource extraction, and rising demand for high-capacity hauling equipment. Advancements in automation, electrification, and fleet management technologies are transforming operational efficiency across mines. Growing focus on safety, productivity, and cost optimization encourages mining companies to upgrade to next-generation trucks. Additionally, strong replacement demand and long-term mining project pipelines continue to sustain market momentum.

Key Takeaways and Insights:

- By Type: Bottom dump dominates the market with a share of 45% in 2025, owing to their efficient bulk material discharge capabilities and widespread adoption in large-scale open-pit mining operations.

- By Payload Capacity: <90 metric tons leads the market with a share of 35% in 2025, reflecting strong demand for versatile trucks suitable for diverse mining applications and site conditions.

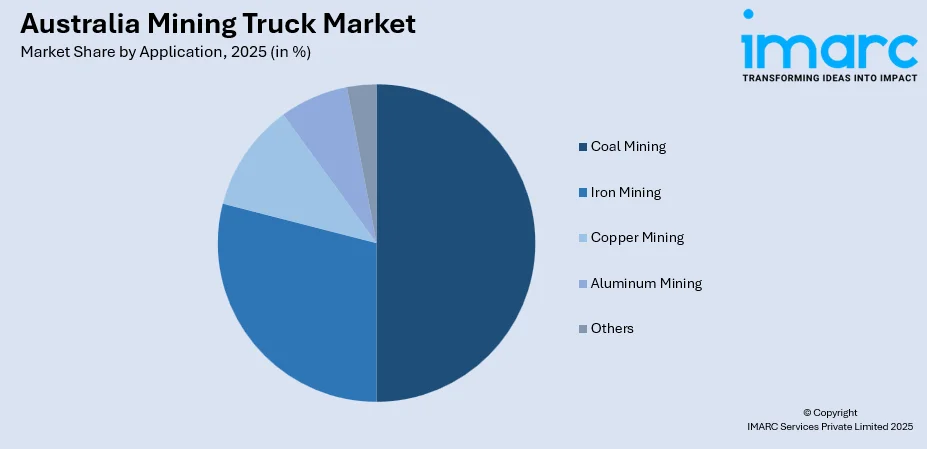

- By Application: Coal mining prevails the market with a share of 50% in 2025, driven by Australia's substantial coal production activities concentrated in Queensland and New South Wales.

- By Drive: Mechanical drive represents the largest segment with a market share of 80% in 2025, reflecting established operational preferences and proven reliability in harsh mining environments.

- Key Players: The Australia mining truck market exhibits moderate to high competitive intensity, with established global equipment manufacturers competing alongside specialized technology providers. Market leaders focus on autonomous haulage systems, electrification solutions, and advanced fleet management technologies to differentiate their offerings and capture growing demand.

To get more information on this market Request Sample

The Australia mining truck market is expanding steadily, driven by the country’s strong mining sector and continuous investment in large-scale iron ore, coal, gold, and critical mineral projects. In July 2025, the Australian Government granted major project status to two new clean energy initiatives: Diatreme Resources' Northern Silica Project, which will supply high-purity silica for solar panels, and INPEX's Bonaparte Carbon Capture and Storage Project, aimed at reducing emissions in heavy industries. Two existing projects also received renewed support. Mining operators are focusing on improving productivity, fuel efficiency, and safety, prompting a shift toward advanced, high-capacity trucks equipped with digital monitoring and autonomous capabilities. The growing adoption of electric and hybrid mining trucks also reflects the industry’s commitment to sustainability and emissions reduction. Additionally, fleet modernization and replacement cycles are accelerating as companies aim to reduce downtime and enhance operational reliability. Increasing use of fleet management systems, predictive maintenance technologies, and data-driven decision-making further strengthens market growth. Overall, the market remains well-positioned due to robust mineral demand, long-term project pipelines, and rising preference for technologically advanced equipment.

Australia Mining Truck Market Trends:

Rapid Adoption of Autonomous and Semi-Autonomous Trucks

Australia’s mining sector is steadily adopting autonomous and semi-autonomous hauling systems to enhance operational safety and efficiency. In May 2025, Thiess, Norton Gold Fields, and EACON launched a groundbreaking partnership to implement autonomous haulage technology in Australia. The two-phase project will begin with retrofitting Komatsu trucks at Norton’s gold mines, aiming to enhance safety, productivity, and sustainability while addressing skilled driver shortages and unlocking previously uneconomical resources. These technologies help reduce human error, address labor shortages, and enable continuous 24/7 operations. Autonomous fleets also support better route optimization, lower fuel consumption, and improved productivity across large and complex mine sites.

Growing Implementation of Advanced Telematics and Fleet Analytics

Telematics and advanced fleet analytics are transforming mining operations by providing real-time insights into truck performance, fuel usage, and maintenance needs. Predictive maintenance helps minimize unplanned downtime, while AI-driven optimization enables better route planning and load management. These technologies collectively enhance productivity, improve safety, and support data-driven operational efficiency.

Rising Shift Toward Electric and Hybrid Mining Trucks

Mining operators are increasingly transitioning to electric and hybrid trucks as part of broader sustainability targets. In October 2025, SANY announced its plans to launch its hybrid mining trucks, starting with the SET150S model, in Australia by January 2026. With a focus on compliance and safety, the trucks cater to medium-sized and contractor miners seeking flexibility. SANY is also preparing to introduce additional models in the near future. These vehicles help reduce carbon emissions, lower fuel dependency, and improve long-term operating costs. The shift is further driven by regulatory pressures, corporate ESG commitments, and rising interest in cleaner, quieter, and more energy-efficient mining equipment.

Market Outlook 2026-2034:

The Australia mining truck market outlook remains positive, supported by sustained investment in major mining projects and the industry's focus on enhancing operational efficiency. Growing adoption of autonomous, electric, and high-capacity trucks is reshaping fleet strategies as miners prioritize safety, productivity, and cost control. Increasing integration of telematics, predictive maintenance, and digital optimization tools further strengthens market momentum. With long-life resource deposits and continuous exploration activity, demand for advanced and reliable mining trucks is expected to remain strong in the coming years. The market generated a revenue of USD 729.1 Million in 2025 and is projected to reach a revenue of USD 967.79 Million by 2034, growing at a compound annual growth rate of 3.20% from 2026-2034.

Australia Mining Truck Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Bottom Dump | 45% |

| Payload Capacity | <90 Metric Tons | 35% |

| Application | Coal Mining | 50% |

| Drive | Mechanical Drive | 80% |

Type Insights:

- Bottom Dump

- Rear Dump

- Lube

- Tow

- Water

- Others

The bottom dump dominates with a market share of 45% of the total Australia mining truck market in 2025.

Bottom dump mining trucks remain the preferred choice due to their efficiency in handling loose materials such as coal, gravel, and ore. Their ability to unload quickly without requiring complex maneuvering improves productivity in large open-pit operations. These trucks also enhance safety by enabling controlled discharge, reducing spill risks, and supporting continuous material flow in high-volume mining environments.

Bottom dump trucks are especially valued for applications requiring rapid cycle times and stable unloading on flat surfaces. Their structural design supports heavy payloads while maintaining operational stability, making them suitable for demanding mining conditions. The lower center of gravity contributes to better handling, while reduced dump height minimizes dust emissions. These features collectively drive broader adoption across Australia’s mining sector.

Payload Capacity Insights:

- <90 Metric Tons

- 90≤149 Metric Tons

- 150≤290 Metric Tons

- >290 Metric Tons

The <90 metric tons leads with a share of 35% of the total Australia mining truck market in 2025.

Mining trucks with payload capacities below 90 metric tons are widely used across medium-scale operations where flexibility, lower fuel consumption, and cost efficiency are critical. Their smaller size allows easier navigation in constrained terrains and diverse mining layouts. These trucks also require lower operating and maintenance costs, making them attractive for operators seeking dependable performance without heavy capital investment.

The <90 metric ton segment also benefits from rising adoption among contractors involved in short-haul and specialized mining activities. Their adaptability to varied minerals, shorter cycle times, and compatibility with existing fleet infrastructure support continued demand. In October 2024, Scania and Regroup launched a fleet of 11 autonomous 40-tonne mining trucks at Element 25’s Butcherbird Mine by late 2025. This partnership aims to enhance mining efficiency and sustainability while reducing environmental impact, marking a significant step toward future fully electric vehicle operations in the industry. Manufacturers are enhancing this segment with improved engines, stronger frames, and telematics-ready systems to increase reliability and optimize fleet utilization.

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Coal Mining

- Iron Mining

- Copper Mining

- Aluminum Mining

- Others

The coal mining represents the largest segment with a share of 50% of the total Australia mining truck market in 2025.

Coal mining continues to generate strong demand for mining trucks due to high material volumes, frequent hauling cycles, and large-scale excavation needs. In August 2025, Bravus, a subsidiary of Adani, announced its plans to invest AUD 50 Million to expand the Carmichael coal mine in Queensland from 10 million to 16 million tons per year over four years. This initial investment supports a larger AUD 500 Million expansion and follows a royalty deferral agreement with the Queensland government. Coal sites rely on robust, durable trucks capable of continuous operation under tough conditions. High-horsepower engines, reinforced frames, and efficient dumping mechanisms make these trucks indispensable for meeting daily production targets.

Fleet modernization within coal mines further strengthens demand as operators adopt more efficient and technologically advanced trucks. Features such as GPS tracking, fuel monitoring, and payload optimization are increasingly integrated to improve output and reduce operational inefficiencies. As coal remains a major component of Australia’s resource sector, mining trucks play a critical role in maintaining productivity and supply continuity.

Drive Insights:

- Mechanical Drive

- Electrical Drive

The mechanical drive exhibits a clear dominance with a 80% share of the total Australia mining truck market in 2025.

Mechanical drive mining trucks dominate due to their proven reliability, robust power transmission, and suitability for heavy-duty operations. These trucks offer strong tractive performance on uneven terrains and steep gradients, making them ideal for Australia’s open-pit mines. Their simpler mechanical structure also supports easier maintenance and lower long-term servicing costs.

Operators prefer mechanical drive systems because they deliver consistent performance in high-load applications and are less sensitive to harsh operating environments. Their durability under extreme conditions and compatibility with conventional repair practices help minimize downtime. As mines prioritize operational continuity and cost control, mechanical drive trucks maintain strong market preference across diverse mining projects.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The market in the Australia Capital Territory and New South Wales is supported by strong urban demand, advanced infrastructure, and increasing investment across key industries. Growing consumer expectations and steady commercial expansion further enhance overall market performance in these regions.

Victoria and Tasmania benefit from improving economic activity, rising consumer engagement, and expanding industrial applications. Strong support for innovation, sustainability initiatives, and modern supply-chain networks strengthens the market's growth prospects and enables greater competitiveness across both regions.

Queensland’s market performance is driven by diversified industrial operations, rising consumer spending, and growth in retail and manufacturing. Supportive regulations and expanding commercial projects contribute to consistent demand, creating opportunities for businesses across the region.

Northern Territory and Southern Australia experience stable demand supported by infrastructure development, mining operations, and growing investment in regional industries. Expanded logistics networks and steady modernization efforts help strengthen overall market activity and long-term growth potential.

Western Australia’s market benefits from strong mining activity, steady industrial investment, and rising demand for advanced products and services. The region’s expanding infrastructure networks and resilient business environment support sustained growth and broaden commercial opportunities across key sectors.

Market Dynamics:

Growth Drivers:

Why is the Australia Mining Truck Market Growing?

Expansion of Large-Scale Mining Projects

Australia’s mining sector continues to invest heavily in major iron ore, coal, gold, and critical mineral projects, creating sustained demand for advanced mining trucks. In December 2025, Australia’s Genmin Limited secured a letter of intent from China's SHICO to fund 60% of its USD 200 Million Baniaka iron ore project in Gabon. This follows a USD 250 million financing offer from Sinohydro. Genmin targets commercial production by 2026, with Gabon holding up to a 35% stake. These large-scale operations require high-capacity, durable trucks capable of handling tough terrain and continuous heavy-duty cycles. As new mines are developed and existing ones expand, operators prioritize trucks with enhanced reliability, automation compatibility, and improved payload efficiency, driving consistent market growth across both greenfield and brownfield projects.

Increasing Focus on Operational Efficiency and Cost Reduction

Mining operators are adopting modern mining trucks to improve productivity, enhance fuel efficiency, and reduce overall operating costs. In June 2025, NewSteel announced its plans to launch its groundbreaking electric truck transformation in Chile and Australia this August. Originally diesel-powered, the newly converted 220-ton trucks promise 70% fuel savings and 80% maintenance savings. This innovation marks a significant advancement in sustainable mining technology, enhancing operational efficiency and reducing environmental impact. Upgrading to high-performance models equipped with telematics, improved engines, and stronger components helps minimize downtime and extend service life. Companies are also leveraging fleet analytics to streamline hauling cycles, optimize routes, and reduce maintenance requirements. This focus on operational excellence makes advanced trucks essential for achieving long-term cost competitiveness in mining operations.

Growing Emphasis on Sustainability and Low-Emission Operations

Environmental priorities are pushing mining companies to integrate electric, hybrid, and low-emission trucks into their fleets. In October 2025, XCMG Group signed a strategic agreement with Australia’s Fortescue in Beijing for the supply of 150 to 200 electric mining trucks, set for delivery between 2028 and 2030. This deal supports Fortescue’s goal of zero ground emissions by 2030 and marks a significant milestone in sustainable mining equipment exports from China. These trucks help reduce carbon emissions, lower diesel dependency, and support long-term ESG commitments. Technological improvements in battery capacity, charging infrastructure, and regenerative braking are making eco-friendly trucks increasingly viable for demanding mining environments. As sustainability becomes central to mining strategies, demand for cleaner, energy-efficient hauling equipment continues to accelerate across major operations.

Market Restraints:

What Challenges the Australia Mining Truck Market is Facing?

High Upfront Costs and Expensive Fleet Upgrades

Advanced mining trucks equipped with autonomous, electric, or high-efficiency systems involve substantial capital expenditure, making it challenging for smaller and mid-sized operators to invest. The high cost of fleet modernization slows down adoption rates and forces companies to balance operational improvement goals with financial constraints, particularly in volatile commodity markets.

Infrastructure Limitations for Electric and Hybrid Trucks

Adopting electric and hybrid mining trucks remains difficult due to inadequate charging infrastructure at remote mine sites. These vehicles require high-capacity power systems, specialized maintenance setups, and reliable energy availability. The operational complexity and investment required to build supporting infrastructure slow the transition to low-emission fleets across the mining industry.

Skilled Labor Shortages for Advanced Technologies

As mining trucks become more technologically advanced, operators and maintenance teams require specialized training to manage complex autonomous systems, sensors, and digital platforms. Ongoing labor shortages in the mining sector make it challenging to find skilled technicians. This gap slows the integration of modern equipment and increases reliance on costly external expertise.

Competitive Landscape:

The competitive landscape of the Australia mining truck market is driven by a strong focus on technology advancement, fleet modernization, and operational efficiency. Leading manufacturers compete by offering high-capacity trucks equipped with automation-ready systems, advanced telematics, and improved fuel or energy efficiency. Companies are also investing in electric and hybrid truck development to align with the industry’s sustainability goals. Intense competition is pushing players to enhance aftersales services, maintenance solutions, and on-site support programs. Partnerships with mining operators to deploy autonomous hauling systems and long-term service contracts further strengthen market positioning and customer loyalty.

Recent Developments:

- In September 2025, STM Trucks & Machinery recently showcased its new range of Hydrema equipment, including dump trucks and excavators, highlighting their exceptional performance, durability, and safety features. The launch event allowed customers to inspect the machinery up close, emphasizing Hydrema's versatility in construction and demanding environments.

- In April 2025, AUSEV launched Australia’s first right-hand drive, fully electric 4×4 ute, the Ford F-150 Lightning, catering to the mining and construction sectors. Produced locally in Queensland, the vehicle supports emission reduction efforts while fostering job creation, showcasing a commitment to Australian manufacturing and sustainable practices in the electric vehicle industry.

Australia Mining Truck Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bottom Dump, Rear Dump, Lube, Tow, Water, Others |

| Payload Capacities Covered | <90 Metric Tons, 90≤149 Metric Tons, 150≤290 Metric Tons, >290 Metric Tons |

| Applications Covered | Coal Mining, Iron Mining, Copper Mining, Aluminum Mining, Others |

| Drives Covered | Mechanical Drive, Electrical Drive |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia mining truck market size was valued at USD 729.1 Million in 2025.

The Australia mining truck market is expected to grow at a compound annual growth rate of 3.20% from 2026-2034 to reach USD 967.79 Million by 2034.

Bottom Dump trucks held the largest market share at 45% in 2024, driven by their efficiency in bulk material discharge and widespread adoption across Australia's large-scale open-pit iron ore and coal mining operations.

Key factors driving the Australia mining truck market include expanding mineral extraction activities, rising investments in fleet modernization, increasing adoption of autonomous and electric trucks, and strong demand for high-capacity haulage systems to improve productivity and operational efficiency.

Major challenges include high initial procurement and maintenance costs, shortage of skilled operators, supply-chain delays affecting component availability, and growing pressure to reduce carbon emissions, pushing companies to transition toward low-emission technologies and costly advanced automation systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)