Australia Mobile Cloud Market Size, Share, Trends and Forecast by Service, Deployment, User, Application, and Region, 2026-2034

Australia Mobile Cloud Market Summary:

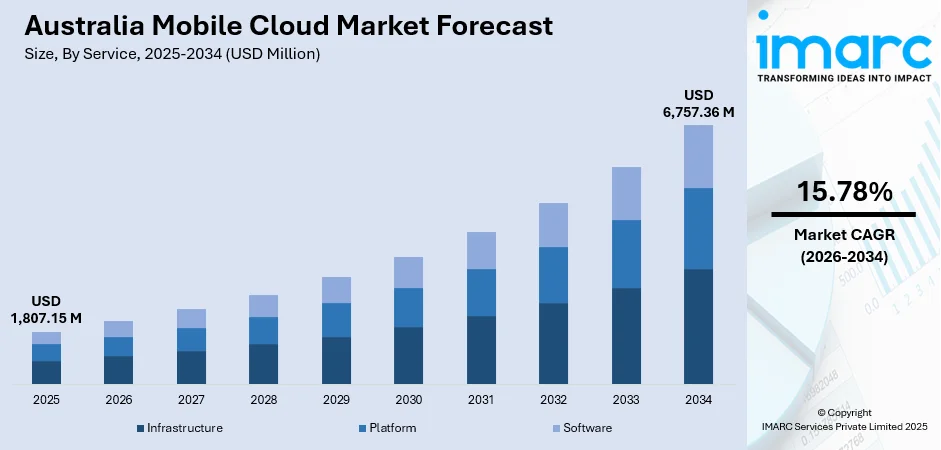

The Australia mobile cloud market size was valued at USD 1,807.15 Million in 2025 and is projected to reach USD 6,757.36 Million by 2034, growing at a compound annual growth rate of 15.78% from 2026-2034.

The market is expanding steadily as businesses and consumers shift toward mobile-first digital ecosystems. Growing adoption of cloud-based applications, rising smartphone penetration, and increasing demand for remote access to data and enterprise tools are strengthening market growth. Organisations are prioritising scalability, security, and cost efficiency, driving investment in mobile cloud platforms. Additionally, advancements in 5G connectivity are enhancing application performance, supporting wider integration across industries.

Key Takeaways and Insights:

-

By Service: Platform dominates the market with a share of 25% in 2025, driven by widespread enterprise adoption of cloud-based development environments, integrated mobile application platforms, and scalable infrastructure services supporting digital transformation initiatives.

-

By Deployment: Public cloud leads the market with a share of 45% in 2025, fueled by government cloud-first mandates, cost-effective scalability options, and substantial investments from global hyperscalers establishing local data center infrastructure.

-

By User: Enterprise prevails the market with a share of 65% in 2025, reflecting strong corporate demand for mobile workforce enablement, cloud-based collaboration tools, and AI-driven business applications.

-

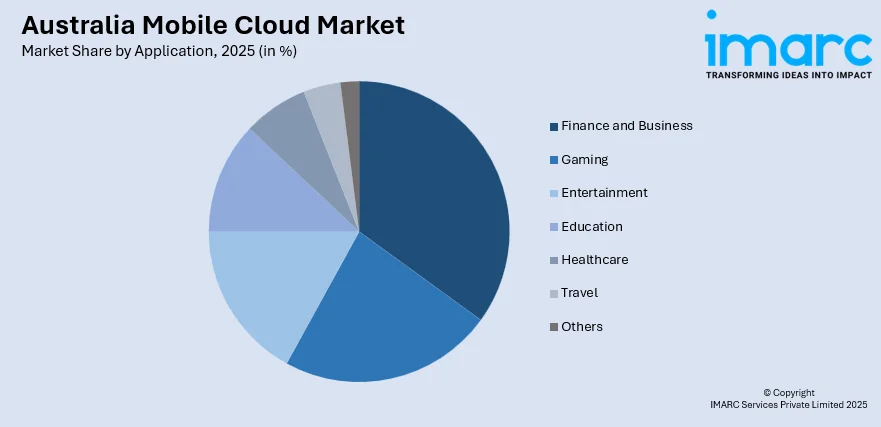

By Application: Finance and business represents the largest segment with a market share of 30% in 2025, underpinned by digital banking transformation, real-time payment platforms, and mobile-first financial services adoption across the sector

-

Key Players: The Australia mobile cloud market exhibits strong competitive intensity, with global hyperscalers expanding regional infrastructure, domestic providers developing sovereign cloud solutions, and telecommunications companies enhancing 5G-enabled mobile cloud offerings through strategic partnerships and continuous innovation.

To get more information on this market Request Sample

The Australian mobile cloud market is gaining momentum as organisations in the country fast-track digital transformation and embrace mobile centricity in their workflows. The trend of increasing utilization of smartphones for professional needs, communication, and access to data accelerates the use of cloud-based applications across industries. Enterprises are increasingly moving to mobile cloud platforms to boost the mobility of their workforce, streamline operations, and facilitate real-time collaboration in hybrid and remote work models. Advancing 5G connectivity further increases application responsiveness, enabling quicker data transfers and seamless mobile experiences. In September 2025, Vocus launched Vocus Mobile, a business-focused MVNO, challenging major telcos by offering comprehensive connectivity solutions. The service includes advanced self-service fleet management tools at no extra cost, allowing businesses to manage mobile services efficiently and streamline operations with tailored pricing and extensive national coverage. Cloud-native security enhancements and scalable deployment models are also encouraging adoption among SMEs and large enterprises seeking flexibility and cost efficiency. As businesses prioritise automation, mobility, and data accessibility, mobile cloud solutions continue to play a critical role in improving productivity and supporting Australia’s rapidly evolving digital landscape.

Australia Mobile Cloud Market Trends:

Increasing Use of Mobile Cloud in Customer Engagement

Companies across Australia are increasingly adopting mobile cloud platforms to enhance customer experience through personalised digital services, seamless mobile payments, and app-based interaction channels. These solutions enable real-time communication, tailored recommendations, and faster service delivery. As consumer demand for convenience and digital connectivity grows, businesses in retail, finance, healthcare, and other service sectors rely more heavily on mobile cloud technologies to strengthen engagement and maintain competitive differentiation.

Growing Shift Toward Mobile-First Enterprise Solutions

Australian organisations are rapidly transitioning to mobile-first operations, prioritising cloud-based applications for communication, workflow management, and field productivity. This shift supports remote work arrangements, enhances real-time collaboration, and reduces reliance on legacy desktop systems. In September 2025, Alcatel-Lucent Enterprise launched its Rainbow Hub cloud communications platform in Australia, partnering with various businesses. This expansion follows successful launches in other countries and offers features like unified communications, telephony services, and enhanced security, along with AI capabilities for improved collaboration and operations. By adopting mobile-accessible enterprise tools, businesses can improve employee flexibility and operational agility. This trend is reshaping IT strategies across industries, with companies placing stronger emphasis on mobility, scalability, and cloud-native integration.

Rising Adoption of 5G-Enabled Cloud Applications

The expansion of 5G networks in Australia is accelerating the adoption of advanced mobile cloud applications. In February 2025, Telstra partnered with Ericsson to launch a cutting-edge programmable 5G Advanced network, enhancing operational efficiency with AI-driven automation. This upgrade will double 5G capacity, improve coverage, and enable tailored connectivity for customers, supporting Australia's Industry 4.0 and empowering innovative applications across various sectors. Faster speeds and reduced latency enable seamless use of data-intensive tools such as mobile video conferencing, real-time analytics, augmented reality applications, and automated workflows. Organisations are leveraging 5G-powered mobile cloud solutions to improve responsiveness, boost productivity, and enhance user experience. This shift is driving the development of more sophisticated mobile applications across enterprise and consumer environments.

Market Outlook 2026-2034:

The Australia mobile cloud market is set for steady growth as enterprises deepen their reliance on mobile-based digital ecosystems. Expanding remote and hybrid work models continue to push organisations toward cloud-enabled mobility, real-time collaboration, and app-driven workflows. The rollout of 5G is further enhancing performance, enabling faster, more reliable mobile applications across industries. Rising demand for scalable, secure, and cost-efficient cloud solutions will support broader adoption, making mobile cloud technologies a critical component of Australia’s ongoing digital transformation. The market generated a revenue of USD 1,807.15 Million in 2025 and is projected to reach a revenue of USD 6,757.36 Million by 2034, growing at a compound annual growth rate of 15.78% from 2026-2034.

Australia Mobile Cloud Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Service | Platform | 25% |

| Deployment | Public | 45% |

| User | Enterprise | 65% |

| Application | Finance and Business | 30% |

Service Insights:

- Infrastructure

- Platform

- Software

The platform segment leads the market with a share of 25% of the total Australia mobile cloud market in 2025.

The platform segment holds a strong position in the Australia mobile cloud market as organisations increasingly rely on cloud-based development environments to build, deploy, and manage mobile applications. Its ability to support scalability, seamless integration, and rapid application delivery makes it essential for businesses undergoing digital transformation. Companies value platforms for enabling faster updates, secure data handling, and centralised control across distributed mobile teams.

Growing adoption of mobile-first strategies continues to strengthen demand for platform services. Enterprises are using platform-based tools to streamline backend processes, automate workflows, and support real-time data synchronisation across devices. The flexibility to customise applications and integrate analytics, security layers, and automation features further enhances its relevance. As mobile cloud ecosystems expand, platform solutions remain core to modern application development and deployment.

Deployment Insights:

- Public

- Private

- Hybrid

The public dominates the market with a share of 45% of the total Australia mobile cloud market in 2025.

The public deployment segment leads due to its cost efficiency, scalability, and accessibility for enterprises of all sizes. Organisations favour public cloud environments for hosting mobile applications because they offer flexible storage, extensive computing resources, and reduced infrastructure expenses. The Australia public cloud market size reached USD 23.96 Billion in 2024 and is projected to reach USD 150.97 Billion by 2033, reflecting strong nationwide momentum toward cloud-based mobility. This makes public cloud ideal for supporting high-traffic applications, digital services, and mobile-first business models.

Public cloud solutions also promote rapid deployment and continuous innovation. Vendors frequently update security features, development tools, and performance capabilities, enabling smoother mobile operations. Businesses benefit from improved reliability, global access, and simplified management without heavy capital investment. As Australian companies accelerate cloud adoption, public cloud platforms remain the preferred choice for mobile application hosting, remote collaboration, and enterprise-wide digital transformation.

User Insights:

- Enterprise

- Consumer

The enterprise segment exhibits clear dominance with a 65% share of the total Australia mobile cloud market in 2025.

Enterprises dominate the Australia mobile cloud market as they rely heavily on mobile-enabled digital infrastructure to streamline operations, enhance collaboration, and strengthen customer engagement. Large organisations use mobile cloud solutions to support remote work, manage field operations, and centralise business applications for seamless access. Mobile cloud tools also help enterprises enhance security, automate processes, and reduce dependence on traditional IT systems.

The segment continues to expand as enterprises adopt advanced workflows such as mobile analytics, real-time monitoring, and cloud-based customer service platforms. These solutions improve operational efficiency and decision-making while enabling faster service delivery across industries like finance, logistics, healthcare, and retail. The enterprise focus on productivity, scalability, and mobility ensures sustained demand for mobile cloud technologies.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Gaming

- Finance and Business

- Entertainment

- Education

- Healthcare

- Travel

- Others

The finance and business segment holds the largest share at 30% of the total Australia mobile cloud market in 2025.

Finance and business applications dominate the market as organisations increasingly adopt mobile cloud platforms to deliver secure, real-time services. Banks, fintech firms, and corporate enterprises rely on mobile cloud infrastructure to support mobile banking, digital payments, automated workflows, and compliance-heavy operations. In February 2025, AMP's new mobile-first bank launched in Australia targets 2.4 million micro and small businesses, representing 90% of the country's business landscape. Powered by Engine by Starling, it offers features like advanced fraud protection, spending insights, and no monthly fees, aiming to enhance financial management for solopreneurs and everyday customers. These solutions ensure high performance, data protection, and uninterrupted service availability, making them essential for modern financial ecosystems.

The segment also benefits from rising demand for mobility among business users. Cloud-based tools enable digital documentation, analytics, CRM platforms, and collaborative work environments accessible across devices. Mobile cloud services help streamline operations, reduce IT overheads, and improve customer engagement. As digital financial transactions and mobile-driven business processes continue to rise, this segment maintains strong market momentum.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia Western Australia

Australia Capital Territory and New South Wales show strong mobile cloud adoption driven by advanced digital infrastructure, high smartphone usage, and a mature enterprise sector. Government digitalisation programs and steady connectivity upgrades further strengthen demand for scalable cloud-based mobility solutions.

Victoria and Tasmania maintain steady growth supported by rapid enterprise cloud migration, rising mobile application usage, and increasing reliance on mobile-first business operations. Improving regional connectivity and expanding remote work practices continue to drive adoption across both states.

Queensland demonstrates growing demand for mobile cloud platforms across mining, logistics, tourism, and public services. Expanding 4G and 5G coverage, along with rising use of mobile-enabled workflows, continues to enhance operational efficiency across the state.

Northern Territory and South Australia are experiencing gradual expansion in mobile cloud usage supported by improved digital infrastructure and ongoing connectivity enhancements. Key industries including defence, agriculture, and government services increasingly rely on mobile cloud capabilities to improve access and streamline operations.

Western Australia shows strong adoption of mobile cloud technologies across mining, energy, and industrial sectors. The region's dependence on real-time data access and remote site connectivity continues to accelerate the need for robust, scalable mobile cloud services.

Market Dynamics:

Growth Drivers:

Why is the Australia Mobile Cloud Market Growing?

Rising Adoption of Remote and Hybrid Work Models

The shift toward remote and hybrid work arrangements is significantly increasing reliance on mobile cloud platforms across Australia. According to the industry reports, remote work in Australia has surged, with 53% of employees working part-time and 14% fully remote. Hybrid models are offered by 69% of employers. Notably, 43% of businesses report increased productivity, while 71% of remote workers enjoy better work-life balance, and turnover is 25% lower. Organisations are prioritising secure, scalable, and device-agnostic solutions that enable employees to collaborate, access files, and manage workflows from any location. This trend is driving investment in cloud-based communication tools, productivity applications, and mobility-focused enterprise systems. As businesses continue to modernise their work environments, mobile cloud technologies are becoming essential for operational continuity and real-time connectivity.

Increasing Smartphone Penetration and Mobile App Usage

Growing smartphone adoption and expanding mobile connectivity are accelerating the shift toward cloud-enabled mobile environments in Australia. In early 2025, the country recorded 34.4 million active cellular mobile connections, equal to 128 percent of the population, while 26.1 million individuals were internet users with an online penetration rate of 97.1 percent. This widespread digital access is pushing businesses to migrate operations, customer services, and engagement tools to mobile cloud platforms. The trend is improving productivity, streamlining workflows, and enhancing user experience, strengthening overall demand for advanced mobile cloud solutions.

Rising Demand for Real-Time Data Access and Mobility

Australian organisations increasingly require instant access to business applications, analytics, and operational data, especially as mobile workforces expand. Mobile cloud platforms enable employees to make faster, more informed decisions by providing seamless connectivity across devices and locations. This demand is growing across sectors such as logistics, retail, healthcare, and field services, where continuous access to real-time information is essential for efficiency and responsiveness. As mobility becomes central to business operations, companies are investing more in cloud-based solutions that deliver reliable, on-the-go data availability.

Market Restraints:

What Challenges the Australia Mobile Cloud Market is Facing?

Concerns Around Data Security and Privacy

Many Australian businesses remain cautious about adopting mobile cloud solutions due to potential vulnerabilities such as data breaches, cyberattacks, and unsecured mobile access points. Sensitive information stored on cloud-based mobile platforms requires robust security frameworks, and organisations may hesitate if they lack confidence in encryption, authentication, and endpoint protection measures, slowing adoption across regulated and data-sensitive industries.

Limited Awareness Among Small Enterprises

Small and medium enterprises often have limited understanding of the operational and cost benefits offered by mobile cloud technologies. A lack of technical expertise, budget constraints, and uncertainty about implementation requirements can reduce adoption rates. Without adequate guidance or awareness initiatives, SMEs may continue relying on outdated systems, delaying their transition to mobile-enabled cloud environments and restricting overall market growth.

High Dependence on Network Quality

Mobile cloud solutions rely heavily on stable and high-speed network connectivity to function efficiently. In areas with weak coverage, slow internet speeds, or frequent outages, businesses may experience disruptions in data access, collaboration, and app performance. Such limitations particularly affect remote and regional locations, making organisations more cautious about fully adopting mobile cloud platforms that depend on continuous, reliable connectivity.

Competitive Landscape:

The competitive landscape of the Australia mobile cloud market is characterised by the presence of global cloud providers, telecom operators, and local technology firms offering specialised mobility solutions. Competition is driven by advancements in 5G connectivity, demand for secure mobile infrastructure, and growing enterprise adoption of cloud-based applications. Providers are focusing on integrating enhanced security features, AI-driven optimisation, and scalable deployment models to strengthen their market position. As businesses prioritise mobile-first strategies, vendors are expanding their service portfolios, forming strategic partnerships, and investing in edge capabilities to deliver faster, more reliable mobile cloud experiences across industries.

Australia Mobile Cloud Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Infrastructure, Platform, Software |

| Deployments Covered | Public, Private, Hybrid |

| Users Covered | Enterprise, Consumer |

| Applications Covered | Gaming, Finance and Business, Entertainment, Education, Healthcare, Travel, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia mobile cloud market size was valued at USD 1,807.15 Million in 2025.

The Australia mobile cloud market is expected to grow at a compound annual growth rate of 15.78% from 2026-2034 to reach USD 6,757.36 Million by 2034.

Platform services lead the market with a 25% revenue share, driven by enterprise demand for comprehensive development environments, integrated mobile application capabilities, and scalable infrastructure supporting digital transformation across Australian organizations.

Key factors driving the Australia mobile cloud market include increasing mobile app usage, rapid 5G expansion, rising enterprise digital transformation, and strong adoption of remote work models that require seamless access to cloud-based applications across devices.

Major challenges include data security concerns, limited cloud adoption awareness among small enterprises, and network reliability issues in remote regions, which can affect application performance and slow the transition toward fully mobile-centric cloud environments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)