Australia Mobile Health Market Size, Share, Trends and Forecast by Component, Service, Participant, and Region, 2025-2033

Australia Mobile Health Market Overview:

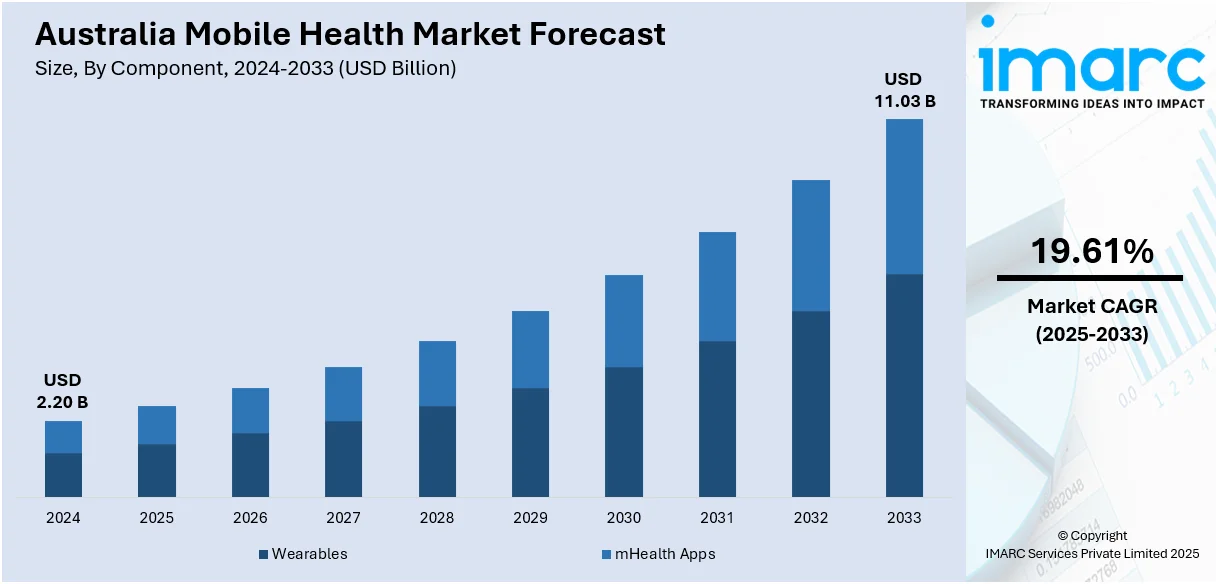

The Australia mobile health market size reached USD 2.20 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.03 Billion by 2033, exhibiting a growth rate (CAGR) of 19.61% during 2025-2033. The market is driven by the rapid adoption of telehealth services, fueled by improved digital infrastructure, government-backed medicare subsidies, and escalating patient demand for remote care post-pandemic. Wearable health technology is further accelerating growth, as smart devices and medical-grade wearables enable real-time health monitoring, supported by integration with mobile apps. Rising smartphone penetration, chronic disease prevalence, and private insurer coverage of digital health solutions are further augmenting the Australia mobile health market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.20 Billion |

| Market Forecast in 2033 | USD 11.03 Billion |

| Market Growth Rate 2025-2033 | 19.61% |

Australia Mobile Health Market Trends:

Increasing Adoption of Telehealth Services

The telehealth market is expanding rapidly due to increased digital infrastructure, shifting patient preferences, and other factors. The COVID-19 pandemic accelerated the shift to remote healthcare, and telehealth visits increased by over 50% recently. Mobile health apps now offer virtual doctor consultations, prescription suggestions, and AI symptom checkers, increasing the convenience of seeking healthcare, particularly for rural patients. The government is encouraging greater telehealth possibilities, as Medicare is subsidizing some telehealth services. Private insurance for healthcare has also started covering more digital health solutions. As smartphone penetration rises in Australia, consumers are more comfortable using mobile health platforms for routine consultations, chronic disease management, and mental health support. In 2024, smartphone penetration in Australia is expected to increase, with 90% of Australians owning a mobile device. With the growth of 5G technology, mobile health apps and wearable devices are becoming increasingly necessary, with 18% of Australians using mobile devices to track their fitness and health. The country's digital health infrastructure is expected to benefit from enhanced mobile accessibility, thereby driving the adoption of telemedicine and health-tracking services. This trend is expected to continue, with forecasts suggesting the telehealth sector will grow, reinforcing mobile health as a key component of Australia’s healthcare ecosystem.

To get more information on this market, Request Sample

Growth of Wearable Health Technology Integration

The increasing demand for fitness trackers, smartwatches, and medical-grade wearables is supporting the Australia mobile health market growth. These devices monitor vital signs such as heart rate, blood pressure, and sleep patterns, providing real-time data to users and healthcare providers. The integration of wearables with mobile health apps allows for continuous health tracking, improving preventive care and chronic disease management. Key companies dominate the consumer market, while local startups are developing specialized medical wearables for conditions such as diabetes and cardiovascular diseases. The Australian government is also promoting digital health records (My Health Record), which can sync with wearable data for better patient insights. In 2024, there are an estimated 23.8 million Australians who have a My Health Record, for which the government has spent over $2 billion. Consistent with its ongoing pursuit of facilitating digital health innovations, the Australian Digital Health Agency (ADHA) is actively managing and modernizing the national infrastructure through a $746 million deal with Accenture, which has been renewed multiple times since 2012. This digital health transformation is accelerating the uptake of mobile health, improving access to real-time health information and mobile health applications for consumers. With rising health consciousness and an aging population, the wearable health tech market is projected to grow by 15% annually, making it a key driver of mobile health innovation in Australia.

Australia Mobile Health Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, service, and participant.

Component Insights:

- Wearables

- Blood Pressure Monitors

- Blood Glucometers

- Pulse Oximeters

- Neurological Monitors

- Others

- mHealth Apps

- Medical Apps

- Fitness Apps

The report has provided a detailed breakup and analysis of the market based on the component. This includes wearables (blood pressure monitors, blood glucometers, pulse oximeters, neurological monitors, and others), and mhealth apps (medical apps and fitness apps).

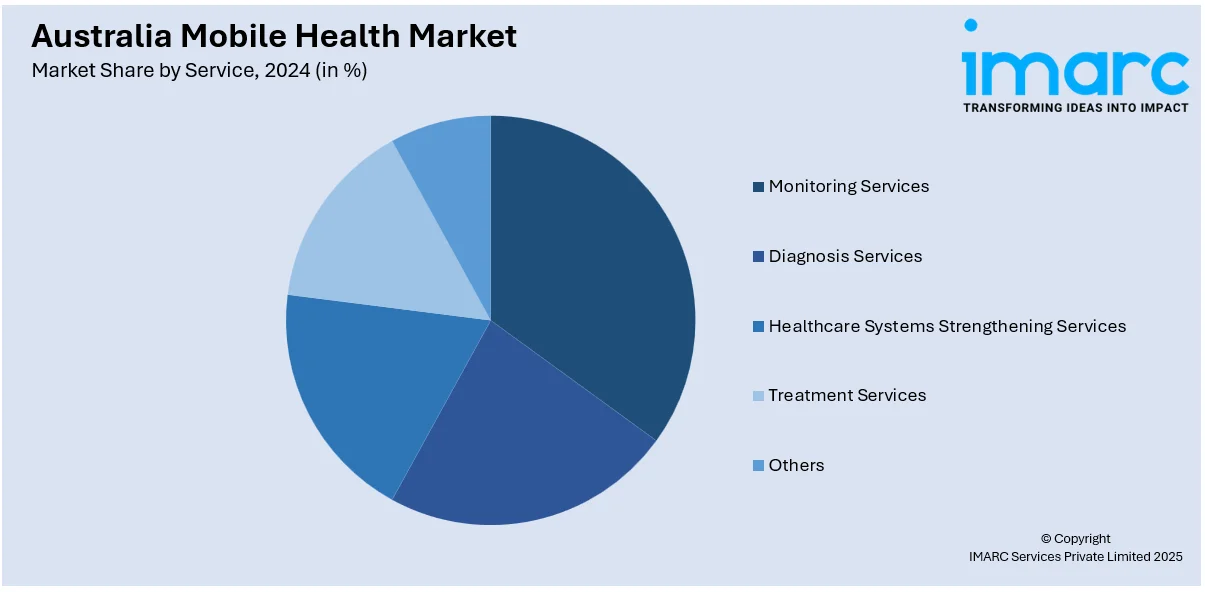

Service Insights:

- Monitoring Services

- Diagnosis Services

- Healthcare Systems Strengthening Services

- Treatment Services

- Others

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes monitoring services, diagnosis services, healthcare systems strengthening services, treatment services, and others.

Participant Insights:

- mHealth Application Companies

- Pharmaceuticals Companies

- Hospitals

- Health Insurance Companies

- Others

The report has provided a detailed breakup and analysis of the market based on the participant. This includes mhealth application companies, pharmaceuticals companies, hospitals, health insurance companies, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Mobile Health Market News:

- June 01, 2025: Street Side Medics launched its first regional mobile GP service in Nowra, bringing essential healthcare to the homeless population in the Shoalhaven region, where over 700 individuals face housing insecurity. The mobile vehicle offers free healthcare services, including wound management and chronic disease control, and operates each Tuesday with the help of local agencies. This move underscores the increasing significance of mobile health solutions in reaching underserved communities across Australia.

Australia Mobile Health Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Services Covered | Monitoring Services, Diagnosis Services, Healthcare Systems Strengthening Services, Treatment Services, Others |

| Participants Covered | mHealth Application Companies, Pharmaceuticals Companies, Hospitals, Health Insurance Companies, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia mobile health market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia mobile health market on the basis of component?

- What is the breakup of the Australia mobile health market on the basis of service?

- What is the breakup of the Australia mobile health market on the basis of participant?

- What is the breakup of the Australia mobile health market on the basis of region?

- What are the various stages in the value chain of the Australia mobile health market?

- What are the key driving factors and challenges in the Australia mobile health market?

- What is the structure of the Australia mobile health market and who are the key players?

- What is the degree of competition in the Australia mobile health market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia mobile health market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia mobile health market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia mobile health industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)