Australia Modular Construction Market Report by Type (Permanent, Relocatable), Module Type (Four Sided, Open Sided, Partially Open Sided, Mixed Modules and Floor Cassettes, Modules Supported by a Primary Structure, and Others), Material (Steel, Concrete, Wood, Plastic, and Others), End Use (Residential, Commercial, Education, Retail, Hospitality, Healthcare, and Others), and Region 2026-2034

Australia Modular Construction Market Size and Share:

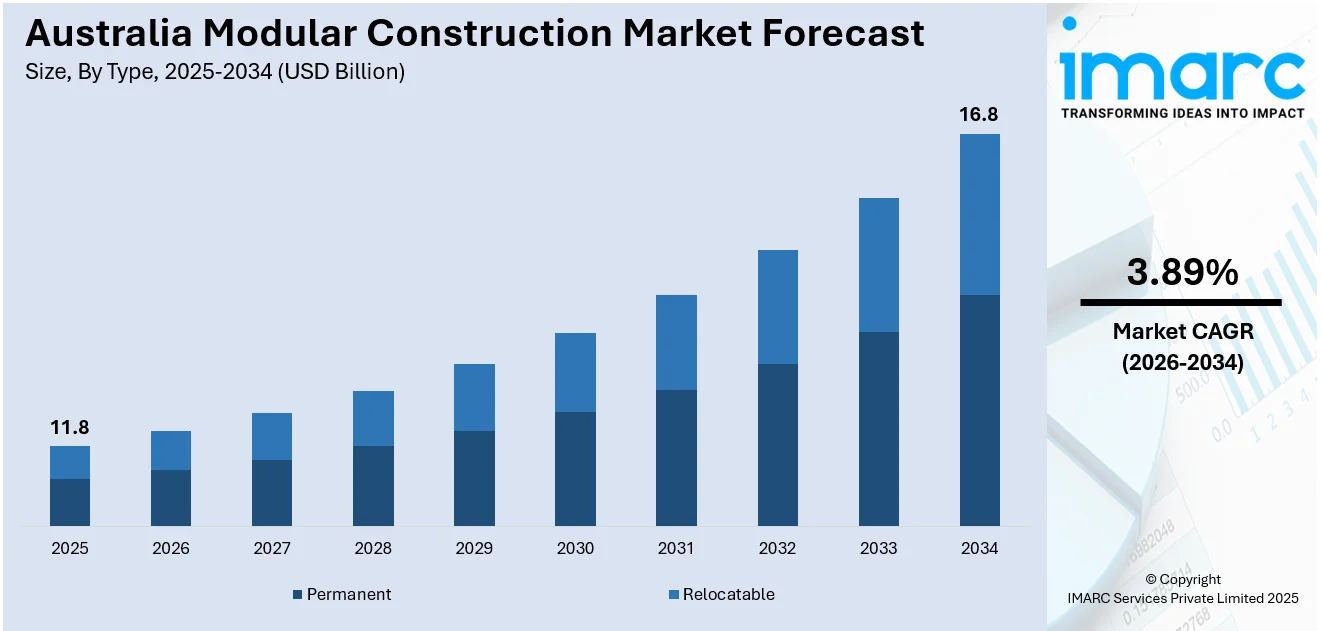

The Australia modular construction market size reached USD 11.8 Billion in 2025. Looking forward, the market is expected to reach USD 16.8 Billion by 2034, exhibiting a growth rate (CAGR) of 3.89% during 2026-2034. The market is primarily driven by government infrastructure support, increasing housing demand, environmental considerations, and technological advances addressing the rising demand for efficient, adaptable housing solutions in urban and remote areas across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 11.8 Billion |

| Market Forecast in 2034 | USD 16.8 Billion |

| Market Growth Rate 2026-2034 | 3.89% |

Key Trends of Australia Modular Construction Market:

Rising Housing Demand

Australia's population growth is set to significantly increasing the housing market. According to the latest data from the Australian Bureau of Statistics (ABS), Australia's population is expected to hit 30 million between 2029 and 2033, based on current trends. These population forecasts rely on assumptions about future fertility rates, life expectancy, and migration, reflecting recent demographic trends. Additionally, modular construction, known for its efficiency, is emerging as a key solution to meet this demand swiftly. This method leverages pre-fabricated modules that are assembled on-site, reducing the traditional build time significantly. This efficiency helps in quick resettlement but also addresses labor shortages and reduces construction waste, making it a sustainable choice in the face of rapid urbanization. As more developers and consumers recognize these benefits, modular construction is poised to capture a substantial share of the growing housing market, propelling its growth in Australia.

To get more information on this market Request Sample

Government Infrastructure Investment

The Australian government's dedication for enhancing the nation's infrastructure is visibly impacting the modular construction sector. According to the Infrastructure Partnerships Australia, during the 2023-2024 Budget Season, Australia's state and territory governments presented their fiscal strategies for the upcoming four years, navigating through numerous infrastructure assessments, ongoing inflation, and robust growth. This year, infrastructure spending increased with $256.6 Billion earmarked for infrastructure across all states and territories for the period up to FY 2026-2027. This represents a $1.6 Billion increase from the FY2022-2023 Budget Season. Moreover, Victoria continues to lead in the Budget Monitor rankings for the third consecutive year, dedicating $78.5 Billion to infrastructure over four years, which accounts for 20% of its total general government expenditure. Furthermore, modular construction fits into this framework with its promise of accelerated project timelines and reduced on-site work, which is crucial for minimizing disruptions in public areas during construction. This method supports the government's goals by enabling quicker project completions, thus allowing the public to benefit sooner from infrastructure improvements. As the government continues to prioritize infrastructure, the adoption of modular techniques is expected to increase, further stimulated by the need for efficient, cost-effective, and timely construction solutions that modular construction provides. Hence, this aligns well with national goals of economic stimulation and enhanced public services, driving further growth in the modular construction sector.

Growth Factors of Australia Modular Construction Market:

Sustainability and Waste Reduction Focus

Australia’s modular construction market is gaining traction due to its alignment with growing sustainability goals. Traditional construction methods generate high levels of material waste and emissions, prompting the industry to seek greener alternatives. Modular construction, with its off-site prefabrication model, ensures better material utilization and resource efficiency. Controlled factory environments reduce excess waste, enable precision engineering, and allow the use of sustainable materials that may not be viable on-site. Moreover, modular designs often include energy-efficient features such as advanced insulation, solar integration, and passive ventilation, contributing to reduced building lifecycle emissions. This approach also aligns with national green certification standards, such as Green Star and NABERS, which are driving the Australia modular construction market growth. As Australia tightens environmental regulations, modular construction presents a viable pathway toward achieving both regulatory compliance and long-term environmental stewardship.

Labor Shortage in Traditional Construction

Australia’s construction industry continues to face a persistent shortage of skilled labor, which is exacerbated by an aging workforce and lower apprenticeship uptake. This shortfall poses challenges to meeting project deadlines and maintaining quality standards. In this context, modular construction provides a compelling solution. By shifting much of the building process to controlled factory environments, it significantly reduces the dependency on on-site skilled labor. Fewer trades are needed during final assembly, and projects can be completed in shorter timeframes, lowering labor costs and exposure to weather-related delays. The ability to standardize processes and automate certain functions also increases productivity, thereby fueling the Australia modular construction market share. As construction companies face pressure to deliver more with less, modular construction's labor efficiency becomes a critical growth driver across urban, regional, and remote projects.

Technological Advancements

The rise of digital and automated technologies is transforming Australia’s modular construction landscape, boosting its appeal across both public and private sectors. Key innovations such as Building Information Modeling (BIM) allow for precise, data-driven planning and 3D visualization, which reduces errors and streamlines collaboration among stakeholders. Meanwhile, robotics and AI-integrated fabrication in modular plants enhance speed, accuracy, and consistency, improving productivity while minimizing human error. IoT-enabled monitoring and modular design software enable greater flexibility and real-time oversight throughout project lifecycles. These technologies also support better cost forecasting, compliance tracking, and quality assurance. As technology adoption accelerates, modular construction becomes not just a building method, but a smart construction solution that offers scalability, predictability, and efficiency, meeting Australia’s growing demand for faster, smarter, and more resilient infrastructure delivery.

Opportunities of Australia Modular Construction Market:

Remote and Regional Infrastructure Needs

Australia’s vast geography and dispersed population have created strong demand for fast, adaptable construction in remote and underserved regions. Modular construction presents an ideal solution, offering rapid deployment of essential infrastructure such as schools, medical clinics, aged care facilities, and workforce accommodations in isolated areas. These prefabricated buildings can be transported and assembled with minimal on-site labor, overcoming the logistical challenges of traditional construction in hard-to-reach locations, which is expected to boost the Australia modular construction market demand. Furthermore, modular units can be customized to suit extreme climates or terrain, enhancing their resilience and functionality. This approach supports broader efforts to deliver equitable services across regional Australia while reducing project lead times and costs. As regional development becomes a priority for governments and industries, modular construction is positioned to meet infrastructure needs efficiently and effectively.

Expansion into Commercial and Industrial Sectors

While modular construction in Australia has historically been concentrated in residential and mining-related applications, its adoption is rapidly expanding into commercial and industrial sectors. Industries such as healthcare, hospitality, education, and data centers increasingly turn to modular solutions for their ability to deliver high-quality buildings under tight schedules and budget constraints. For example, hospitals can quickly expand patient capacity with modular wings, while hotels benefit from repeatable, scalable designs that reduce construction disruption. Additionally, industrial facilities such as data centers require fast, precise builds with minimal downtime, needs that modular methods can meet efficiently. As businesses seek flexibility, cost control, and operational continuity, modular construction provides a reliable alternative to traditional models, creating substantial growth potential across a diverse range of commercial applications.

Export Potential and Cross-Border Demand

Australia’s modular construction industry is well-positioned to tap into the growing demand in nearby international markets, especially within the Asia-Pacific region. Countries such as New Zealand, Papua New Guinea, and various Pacific Island nations face urgent infrastructure needs, often coupled with limited local construction capacity. Australian firms, known for their high-quality prefabricated structures and adherence to global standards, are well-equipped to supply modular buildings for housing, education, healthcare, and emergency relief. Additionally, modular exports can be adapted for rapid assembly and tailored to diverse environmental and regulatory requirements. As demand for sustainable, fast-built solutions rises in emerging economies, Australian modular manufacturers have the opportunity to diversify revenue streams, build cross-border partnerships, and establish a regional leadership role in the global modular construction landscape.

Challenges of Australia Modular Construction Market:

Regulatory and Standardization Barriers

One of the most significant challenges facing the modular construction industry in Australia is the lack of harmonized regulations and building standards across states and territories. Each jurisdiction has its own set of codes, certifications, and approval processes, which creates confusion and delays in securing necessary permits. This inconsistency undermines the scalability and efficiency that modular construction is known for, especially in multi-state or national projects. Additionally, the absence of a unified national framework for modular construction limits design freedom and adds compliance costs. For manufacturers and developers, navigating this fragmented regulatory environment becomes time-consuming and resource-intensive. As a result, many construction firms remain hesitant to fully transition to modular solutions, despite their operational advantages, thereby slowing overall market growth and adoption rates.

Perception and Market Awareness Issues

Although modular construction offers numerous advantages such as speed, cost efficiency, and environmental benefits, outdated perceptions continue to hinder its wider adoption in Australia. Many stakeholders, including consumers, financiers, and even some developers, still associate modular buildings with low-quality, temporary structures lacking in durability or visual appeal. According to the Australia modular construction market analysis, this skepticism is often rooted in legacy practices or early examples of poorly executed modular projects. Moreover, limited public awareness about the advancements in design flexibility, structural integrity, and premium finishes achievable through modern modular methods further fuels resistance. These misperceptions can lead to reduced investor confidence, reluctance from architects to innovate, and constrained customer demand. Changing these views requires industry-wide efforts in education, marketing, and successful case studies that highlight the long-term value and performance of modular buildings.

Upfront Capital and Supply Chain Complexity

Modular construction requires significant upfront investment, especially for establishing dedicated manufacturing facilities, purchasing advanced equipment, and training skilled labor. These capital-intensive requirements can pose a major barrier for small and mid-sized companies entering the market. In addition, managing a seamless supply chain is essential for success, yet often complicated. Modular projects rely on just-in-time delivery of materials and highly coordinated logistics to ensure that prefabricated components arrive on-site without delays. Any disruption, such as transport bottlenecks, supplier shortages, or regulatory holdups, can significantly impact project timelines and costs. Furthermore, integration between design, production, and on-site assembly must be meticulously planned. This level of coordination demands advanced project management capabilities, which many traditional builders may lack. As a result, the high initial risk can deter broader participation.

Australia Modular Construction Market News:

- In May 2024, InQuik, an Australian company, made significant strides in modular bridge construction, revolutionizing the industry with its innovative approach. This company has developed a unique system that allows for the quick and cost-effective assembly of bridges. The process involves using prefabricated components that can be easily transported and assembled on-site, significantly reducing construction time and costs. This method not only simplifies the construction process but also enhances the accessibility and efficiency of building bridges in various locations. The success of InQuik highlights its potential to make a substantial impact on infrastructure development, particularly in regions needing swift improvements or replacements of existing structures.

- In May 2024, Fusco Constructions, a South Australian firm, is set to establish its new headquarters at the Tonsley Innovation District, positioning itself among the futuristic and distinctive structures of the Main Assembly Building's iconic sawtooth roof. Tonsley exemplifies the advantages of modular construction. It's quick, conserves materials, enhances safety during construction, and integrates seamlessly with existing structures. While traditional building methods remain unchanged, modular construction offers a glimpse into the future of the industry.

Australia Modular Construction Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, module type, material, and end use.

Type Insights:

- Permanent

- Relocatable

The report has provided a detailed breakup and analysis of the market based on the type. This includes permanent and relocatable.

Module Type Insights:

- Four Sided

- Open Sided

- Partially Open Sided

- Mixed Modules and Floor Cassettes

- Modules Supported by a Primary Structure

- Others

A detailed breakup and analysis of the market based on the module type have also been provided in the report. This includes four sided, open sided, partially open sided, mixed modules and floor cassettes, modules supported by a primary structure, and others.

Material Insights:

- Steel

- Concrete

- Wood

- Plastic

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes steel, concrete, wood, plastic, and others.

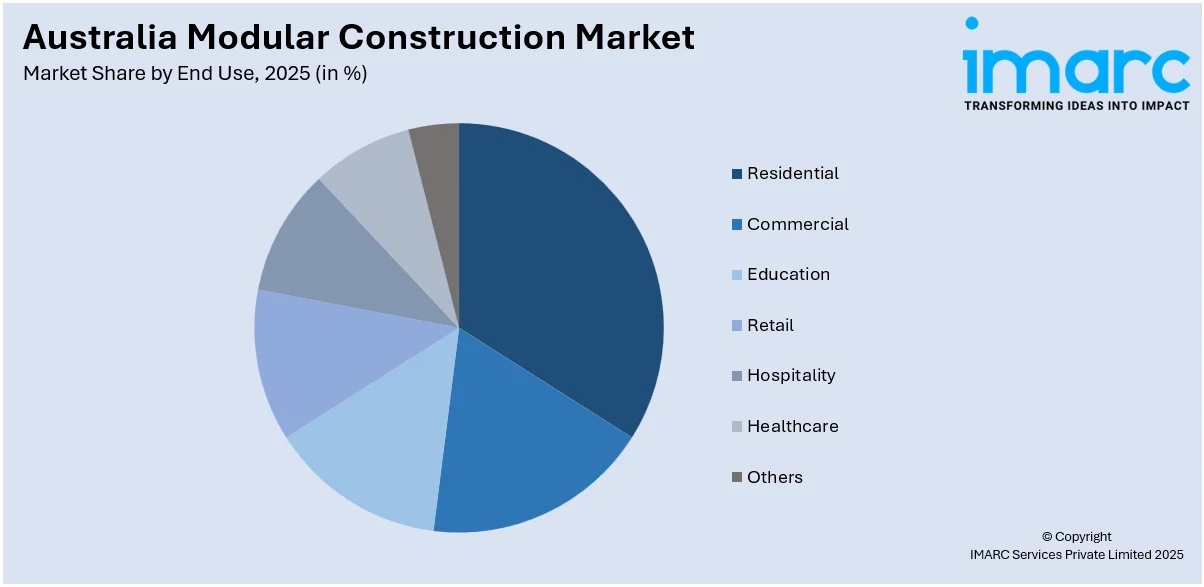

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Education

- Retail

- Hospitality

- Healthcare

- Others

A detailed breakup and analysis of the market based on the industry end use have also been provided in the report. This includes residential, commercial, education, retail, hospitality, healthcare, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Modular Construction Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Permanent, Relocatable |

| Module Types Covered | Four Sided, Open Sided, Partially Open Sided, Mixed Modules and Floor Cassettes, Modules Supported by a Primary Structure, Others |

| Materials Covered | Steel, Concrete, Wood, Plastic, Others |

| End Uses Covered | Residential, Commercial, Education, Retail, Hospitality, Healthcare, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia modular construction market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia modular construction market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia modular construction industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The modular construction market in Australia was valued at USD 11.8 Billion in 2025.

The Australia modular construction market is projected to exhibit a CAGR of 3.89% during 2026-2034.

The Australia modular construction market is projected to reach a value of USD 16.8 Billion by 2034.

Australia’s modular construction market is expanding across residential, social housing, and data-centre sectors, led by sustainability, speed, and cost efficiency. Robotics and AI-driven micro-factories boost precision and delivery times. High-end design, timber framing, granny-pod adoption, and public policy support further spur adoption amid housing crisis pressures.

Australia’s modular construction market growth is fuelled by government investment to ease housing shortages, rapid population and urbanization, and rising demand for affordable, sustainable housing. Technological advances like off-site automation, BIM, and green materials further accelerate delivery, reduce labor needs, costs, and waste.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)