Australia Modular Furniture Market Size, Share, Trends and Forecast by Product Type, Material, End User, and Region, 2025-2033

Australia Modular Furniture Market Size Overview:

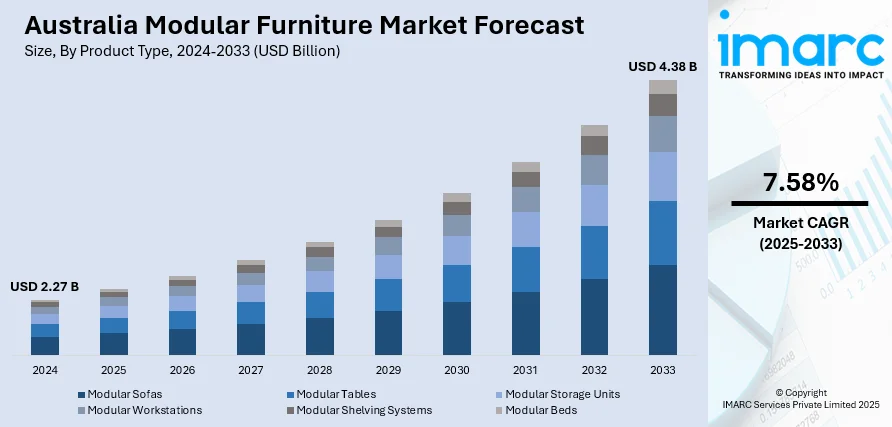

The Australia modular furniture market size reached USD 2.27 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.38 Billion by 2033, exhibiting a growth rate (CAGR) of 7.58% during 2025-2033. The market is driven by demand for space-saving solutions in high-density urban housing and growing residential preference for flexible interiors. Commercial buyers are investing in adaptable workplace and institutional furnishings aligned with hybrid use cases, thereby fueling the market. Sustainability mandates, coupled with local manufacturing incentives, are prompting wider adoption of modular systems, further augmenting the Australia modular furniture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.27 Billion |

| Market Forecast in 2033 | USD 4.38 Billion |

| Market Growth Rate 2025-2033 | 7.58% |

Australia Modular Furniture Market Trends:

Urban Housing Trends and Space Optimization Demand

Australia’s urban population continues to grow, particularly in cities like Sydney, Melbourne, and Brisbane, where apartment living is prevalent. Rising residential density and the shrinking size of living spaces have created strong demand for space-efficient and customizable furniture. Australian furniture market is projected to generate a revenue of AUD 12.65 billion (USD 7.89 billion) in 2025, with an annual growth rate of 4.89% from 2025 to 2029. Living room furniture accounts for the largest segment within this market, estimated to reach AUD 3.18 billion (USD 2 billion) in 2025. Modular furniture offers flexibility in design, allowing users to adapt layouts as per room configurations or changing needs. Consumers are prioritizing functionality, aesthetics, and minimalism—characteristics well-suited to modular setups including multi-use sofas, foldable tables, and stackable storage units. Moreover, housing developers and interior designers are increasingly collaborating with modular furniture vendors to pre-fit apartments with tailored, space-saving solutions that appeal to first-time buyers and renters. The popularity of modular kitchens and integrated wardrobes is also growing across suburban and high-rise developments. As rental markets expand and residents seek furniture that accommodates relocations, the demand for lightweight, flat-pack modular furniture is increasing. These evolving residential preferences and the shift toward versatile, space-conscious interiors are shaping the procurement and design trends in urban furniture. This consumer behavioral shift is directly aligned with Australia modular furniture market growth.

To get more information on this market, Request Sample

Sustainability Mandates and Local Manufacturing Incentives

Australia’s increasing emphasis on sustainability, circular economy models, and local production is accelerating the adoption of modular furniture. The issue of "fast furniture" in Australia is highly prevalent, with the country generating 30,000 tons of commercial furniture waste annually, 95% of which ends up in landfills. As a result, consumers are seeking eco-conscious furniture options made with recyclable or sustainably sourced materials, often favoring brands that provide transparency on sourcing and environmental certifications. As per recent industry reports, 89% of Australians view living sustainably as important. Modular furniture aligns with green design principles by reducing material waste, supporting longer product lifespans, and enabling easy repairs or upgrades. Additionally, government incentives encouraging local manufacturing and SME development have prompted small furniture makers to invest in modular product lines. Several Australian firms are now marketing FSC-certified timber-based modules or recyclable metal-framed systems to environmentally aware consumers. Retailers are also adopting modular displays in stores, showcasing how furniture can be expanded or rearranged with minimal ecological impact. Moreover, bulk buyers, such as government agencies and educational bodies are incorporating sustainability criteria into procurement frameworks, favoring modular suppliers who can demonstrate low carbon footprints and reusability. As awareness of environmental responsibility increases across both residential and commercial buyers, manufacturers offering sustainable, modular options are becoming more competitive in the national market landscape.

Australia Modular Furniture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material, and end user.

Product Type Insights:

- Modular Sofas

- Modular Tables

- Modular Storage Units

- Modular Workstations

- Modular Shelving Systems

- Modular Beds

The report has provided a detailed breakup and analysis of the market based on the product type. This includes modular sofas, modular tables, modular storage units, modular workstations, modular shelving systems, and modular beds.

Material Insights:

- Wood

- Metal

- Plastic

- Glass

- Upholstery

The report has provided a detailed breakup and analysis of the market based on the material. This includes wood, metal, plastic, glass, and upholstery.

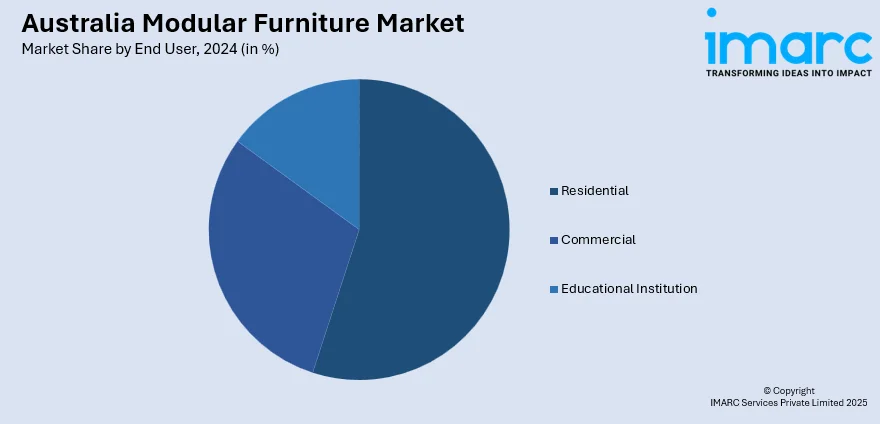

End User Insights:

- Residential

- Commercial

- Offices

- Hotels

- Retail Spaces

- Restaurants

- Educational Institution

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, commercial (offices, hotels, retail spaces, and restaurants), and educational institution.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all major regional markets. This includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Modular Furniture Market News:

- On October 11, 2024, CMTP, a Colac-based pallet manufacturer, launched a new modular housing brand, EchidnaBuilt, expanding into the growing Australian modular housing market. The company, with 270 employees across eleven sites, aims to meet the increasing demand for faster, more sustainable construction methods by offering modular homes in 2, 3, and 4-bedroom designs. Leveraging its expertise in manufacturing, CMTP expects EchidnaBuilt’s modular units, produced locally in Colac, to reduce construction time and costs while offering eco-friendly housing solutions.

Australia Modular Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Modular Sofas, Modular Tables, Modular Storage Units, Modular Workstations, Modular Shelving Systems, Modular Beds |

| Materials Covered | Wood, Metal, Plastic, Glass, Upholstery |

| End Users Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia modular furniture market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia modular furniture market on the basis of product type?

- What is the breakup of the Australia modular furniture market on the basis of material?

- What is the breakup of the Australia modular furniture market on the basis of end usee?

- What is the breakup of the Australia modular furniture market on the basis of region?

- What are the various stages in the value chain of the Australia modular furniture market?

- What are the key driving factors and challenges in the Australia modular furniture market?

- What is the structure of the Australia modular furniture market and who are the key players?

- What is the degree of competition in the Australia modular furniture market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia modular furniture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia modular furniture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia modular furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)