Australia Mushroom Market Size, Share, Trends and Forecast by Mushroom Type, Form, Distribution Channel, End-Use, and Region, 2025-2033

Australia Mushroom Market Size and Share:

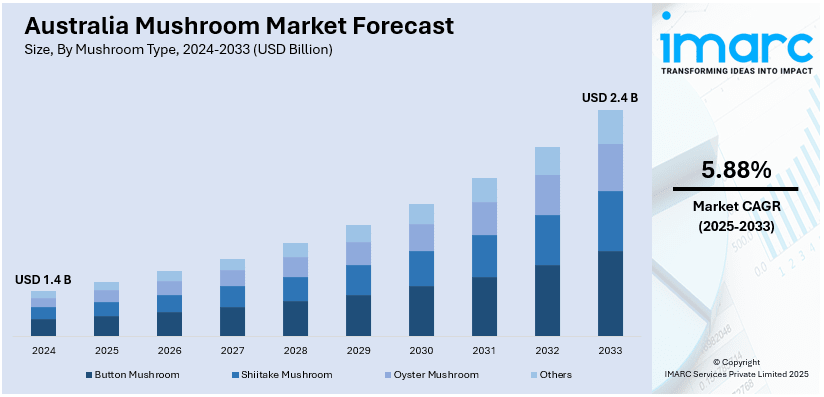

The Australia mushroom market size reached USD 1.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.4 Billion by 2033, exhibiting a growth rate (CAGR) of 5.88% during 2025-2033. The market is expanding because of the growing popularity of plant-based diets, broader distribution networks, and increased retail availability, as consumers seek convenient, nutritious, and sustainable food options, boosting demand for both fresh and processed mushroom products across various outlets.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.4 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Market Growth Rate 2025-2033 | 5.88% |

Australia Mushroom Market Trends:

Increasing Adoption of Plant-Based Diets

Australia's mushroom industry is seeing significant growth as consumer interest in plant-based diets rises. With the rise of vegetarian, vegan, and flexitarian diets, mushrooms are increasingly seen as a favored substitute for meat. Their rich texture and delicious umami taste make them perfect for substituting meat in dishes without sacrificing flavor or enjoyment. This change is affecting both home cooking and the creation of convenience foods, as mushrooms are being frequently incorporated into plant-based items such as burgers, sausages, and imitation steaks. The nutritional benefits of mushrooms, such as high in protein, fiber, and essential vitamins, add to their attractiveness to health-minded shoppers. Environmental and ethical issues are also influencing many people to pursue sustainable food options. The increasing popularity of mushrooms goes beyond fresh produce to include processed and packaged products, indicating a wider shift in dietary preferences. In 2024, Fascin8foods expanded its FROOM™ mushroom-based products into New South Wales, the Australian Capital Territory, and Queensland. The products, already a hit in IKU meals, offered plant-based alternatives like mince and balls that are nutritious, eco-friendly, and low in calories. This expansion aligned with the growing demand for sustainable, plant-based food options in Australia, emphasizing the importance of mushrooms as a vital component in the changing food environment.

To get more information on this market, Request Sample

Expanding Distribution Channels and Retail Availability

Broader distribution and enhanced retail visibility are significantly strengthening the growth of the Australian mushroom market. Shoppers now enjoy improved access to mushrooms at supermarkets, local markets, and specialty shops, where both familiar and rare varieties can be easily found. This accessibility goes further than fresh produce, as retailers provide dried mushrooms, powders, and convenient mushroom-based meals to accommodate shifting preferences and hectic lifestyles. Online grocery platforms and delivery services are enhancing convenience, enabling more individuals to purchase mushrooms from home. Retailers are addressing the growing demand by broadening their mushroom offerings and maintaining consistent inventory across various locations. This wider outreach is introducing mushrooms to a more varied consumer base, offering a favorable market outlook. In 2023, Epicurean Food Group (EFG) launched its Mr. Umami exotic mushroom burger range in Foodland Supermarkets and Tony & Marks outlets across South Australia. The range included four patty options and aimed to reduce reliance on imported mushrooms. EFG has expanded production, with plans to supply major retailers like Coles and Woolworths in the future. This move emphasizes how enhanced retail collaborations and varied distribution are aiding mushroom products in gaining popularity in mainstream markets nationwide.

Australia Mushroom Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on mushroom type, form, distribution channel, and end-use.

Mushroom Type Insights:

- Button Mushroom

- Shiitake Mushroom

- Oyster Mushroom

- Others

The report has provided a detailed breakup and analysis of the market based on the mushroom type. This includes button mushroom, shiitake mushroom, oyster mushroom, and others.

Form Insights:

- Fresh Mushroom

- Canned Mushroom

- Dried Mushroom

- Others

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes fresh mushroom, canned mushroom, dried mushroom, and others.

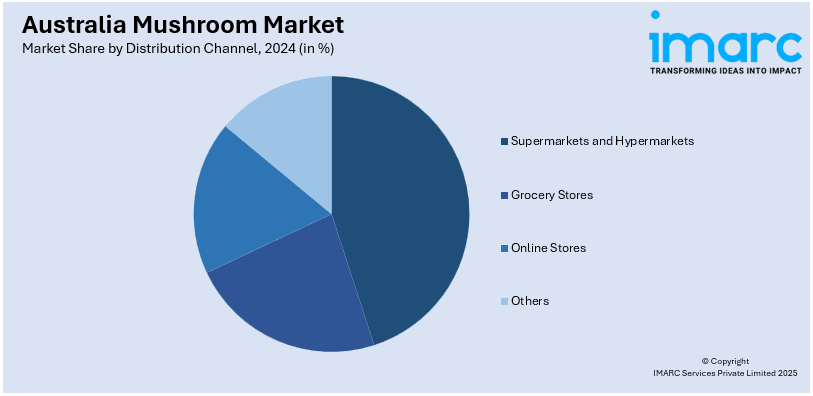

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Grocery Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, grocery stores, online stores, and others.

End-Use Insights:

- Food Processing Industry

- Food Service Sector

- Direct Consumption

- Others

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes food processing industry, food service sector, direct consumption, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Mushroom Market News:

- In January 2025, Australian Mushrooms launched the 'MMMMMushrooms' brand platform, highlighting the versatility and flavor of mushrooms through playful visuals and sound. The campaign, created by Thinkerbell, also introduced Mushroom Shaker Bags, allowing consumers to season mushrooms easily.

- In October 2024, Kinoko-Tech, an Israeli mycelium protein startup, partnered with Australia’s Metaphor Foods to produce mycelium-based protein products, including burgers, sausages, and muesli bars. The collaboration aimed to commercialize these fungi-based foods in Australia starting in 2025. The products are sustainable, clean-label, and high in protein and fiber, with a focus on minimizing food waste.

Australia Mushroom Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Mushroom Types Covered | Button Mushroom, Shiitake Mushroom, Oyster Mushroom, Others |

| Forms Covered | Fresh Mushroom, Canned Mushroom, Dried Mushroom, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Grocery Stores, Online Stores, Others |

| End-Uses Covered | Food Processing Industry, Food Service Sector, Direct Consumption, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia mushroom market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia mushroom market on the basis of mushroom type?

- What is the breakup of the Australia mushroom market on the basis of form?

- What is the breakup of the Australia mushroom market on the basis of distribution channel?

- What is the breakup of the Australia mushroom market on the basis of end-use?

- What is the breakup of the Australia mushroom market on the basis of region?

- What are the various stages in the value chain of the Australia mushroom market?

- What are the key driving factors and challenges in the Australia mushroom market?

- What is the structure of the Australia mushroom market and who are the key players?

- What is the degree of competition in the Australia mushroom market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia mushroom market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia mushroom market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia mushroom industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)