Australia Natural Sweeteners Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Australia Natural Sweeteners Market Overview:

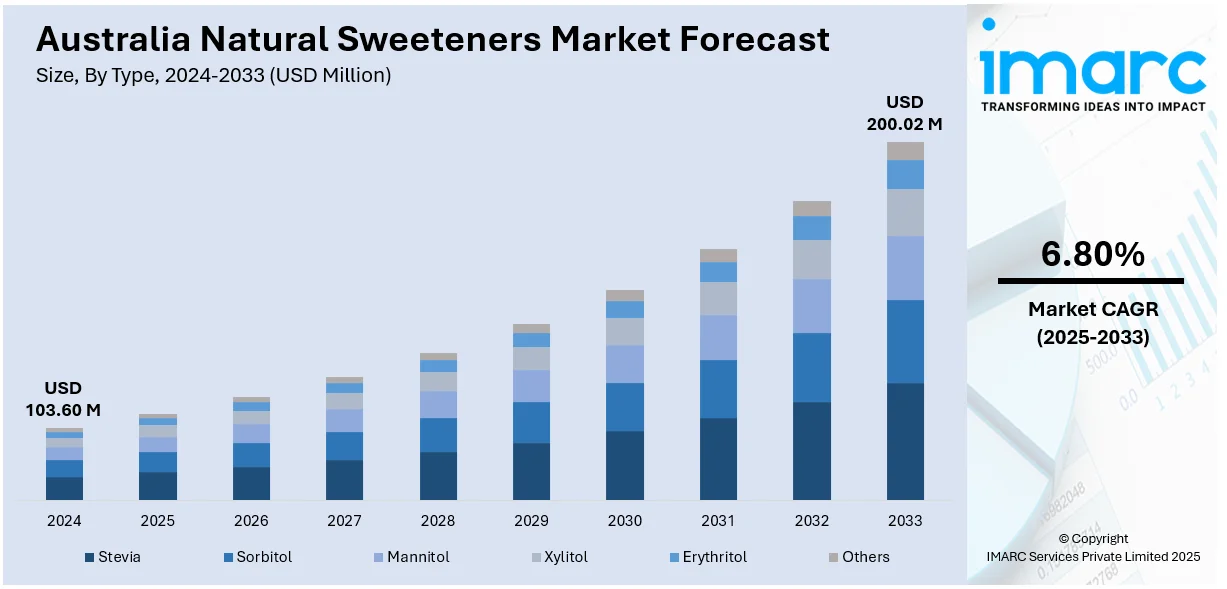

The Australia natural sweeteners market size reached USD 103.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 200.02 Million by 2033, exhibiting a growth rate (CAGR) of 6.80% during 2025-2033. The market is propelled by rising consumer demand for low-calorie, healthier substitutes of regular sugar. Increased health awareness for the negative implications of high consumption of sugar, including diabetes and obesity, is also propelling the market. Furthermore, the shift in preference towards clean label foods and organic products is urging manufacturers to provide natural sweeteners. In addition, government support for healthier foods and sustainable practices are expanding the Australia natural sweeteners market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 103.60 Million |

| Market Forecast in 2033 | USD 200.02 Million |

| Market Growth Rate 2025-2033 | 6.80% |

Australia Natural Sweeteners Market Trends:

Increased Demand for Health-Conscious Products

One of the major trends shaping the market is the rising consumer demand for healthier alternatives to refined sugar. As Australians become more health-conscious, there is a growing preference for products that align with wellness goals, such as weight management and the prevention of lifestyle-related diseases. An industry study projects that by the year 2050, Australia is set to have the second-highest childhood obesity rate among high-income countries, trailing only Chile. Around one in three Australian children and teens (2.2 million) are expected to be obese. The increasing prevalence of obesity, diabetes, and other metabolic disorders linked to high sugar consumption are key drivers for the shift toward natural sweeteners. Natural sweeteners such as stevia, monk fruit, and agave nectar are being adopted as healthier alternatives owing to their reduced calorie count and negligible glycemic effect. Companies are adapting by innovating and using natural sweeteners across a variety of products, from food to baked foods, and marketing them as sugar alternatives with no additives. This trend is complemented by numerous health organizations promoting less sugar consumption, fueling consumer understanding and demand for naturally sweetened foods and beverages.

To get more information on this market, Request Sample

Rise of Clean Label and Organic Products

The increasing popularity of clean label and organic products is positively impacting the Australia natural sweeteners market growth. Moreover, Consumers are becoming more concerned about the ingredients in the food they consume, with many opting for products that are less processed and do not contain artificial additives or preservatives. This shift towards clean labeling is fostering the demand for natural sweeteners that align with these preferences. Apart from this, Australian consumers are increasingly placing value on organic certification, further underpinning the move towards naturally sourced sweeteners. Sweeteners such as organic honey, coconut sugar, and organic stevia are gaining traction due to their perceived natural origin and minimal processing. As a result, brands are aligning their product offerings with consumer expectations by opting for organic and clean-label certifications to enhance product appeal. Moreover, natural sweeteners are becoming increasingly popular in organic beverages. According to an industry report, the Australian organic food and beverage market is valued at USD 9.3 Billion in 2024 and is projected to grow significantly, reaching USD 32.9 Billion by 2033, at a compound annual growth rate (CAGR) of 13.50% between 2025 and 2033. This is stimulating the demand for natural sweeteners. As more consumers choose organic and healthier options, the natural sweetener market is gaining, with rising acceptance in a range of food and beverage applications.

Australia Natural Sweeteners Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Stevia

- Sorbitol

- Mannitol

- Xylitol

- Erythritol

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes stevia, sorbitol, mannitol, xylitol, erythritol, and others.

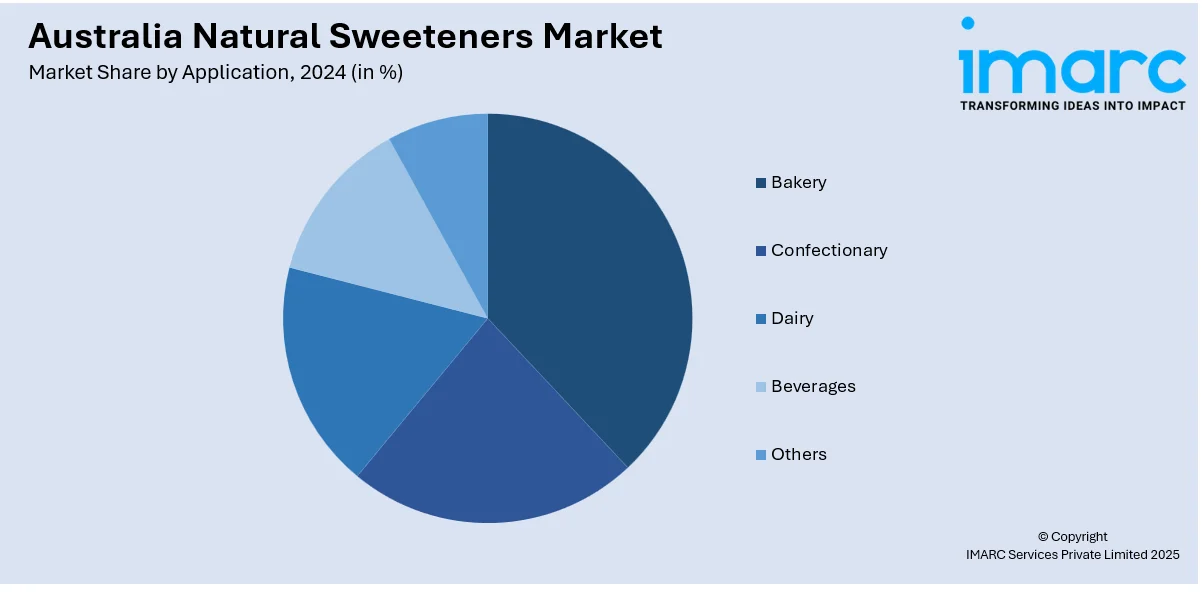

Application Insights:

- Bakery

- Confectionary

- Dairy

- Beverages

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes bakery, confectionery, dairy, beverages, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Natural Sweeteners Market News:

- On November 13, 2024, Samyang Corporation announced that it had received approval from Food Standards Australia New Zealand (FSANZ) to market allulose as a novel food ingredient, becoming the first company globally to achieve this status in both countries. This regulatory milestone allows Samyang to expand its international footprint in the low-calorie sweetener market, leveraging allulose's sugar-like taste and minimal caloric content. The approval is expected to bolster Samyang's position in the Asia-Pacific region, aligning with its strategic growth initiatives in the health-conscious food sector.

Australia Natural Sweeteners Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Stevia, Sorbitol, Mannitol, Xylitol, Erythritol, Others |

| Applications Covered | Bakery, Confectionary, Dairy, Beverages, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia natural sweeteners market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia natural sweeteners market on the basis of type?

- What is the breakup of the Australia natural sweeteners market on the basis of application?

- What is the breakup of the Australia natural sweeteners market on the basis of region?

- What are the various stages in the value chain of the Australia natural sweeteners market?

- What are the key driving factors and challenges in the Australia natural sweeteners market?

- What is the structure of the Australia natural sweeteners market and who are the key players?

- What is the degree of competition in the Australia natural sweeteners market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia natural sweeteners market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia natural sweeteners market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia natural sweeteners industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)