Australia Network Security Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, Industry Vertical, and Region, 2025-2033

Australia Network Security Market Overview:

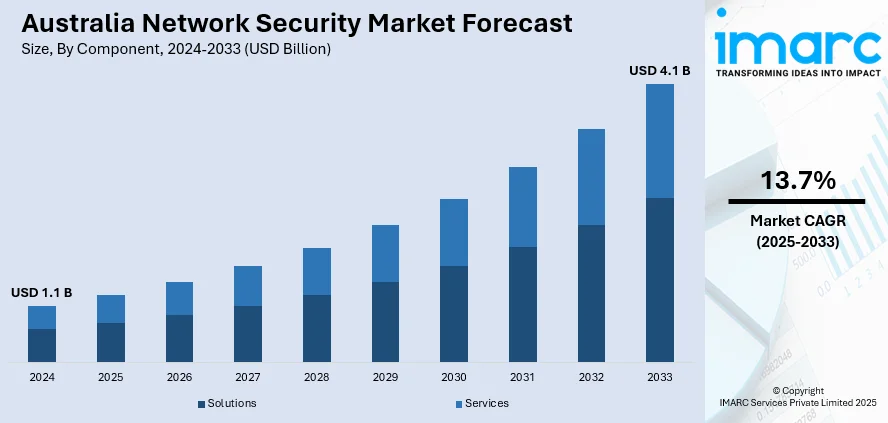

The Australia network security market size reached USD 1.1 Billion in 2024. Looking forward, the market is projected to reach USD 4.1 Billion by 2033, exhibiting a growth rate (CAGR) of 13.7% during 2025-2033. The market is driven by rising cyber threats, increased digital transformation, strict data protection regulations, cloud adoption, remote work trends, and growing investments in IT infrastructure. Demand for advanced threat detection, compliance solutions, and secure access tools is also fueling market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.1 Billion |

| Market Forecast in 2033 | USD 4.1 Billion |

| Market Growth Rate 2025-2033 | 13.7% |

Key Trends of Australia Network Security Market:

Persistent Threats Fueling Shift toward Strengthened Cyber Defenses

Ongoing digital threats in Australia are reinforcing the need for stronger protection across online systems. Despite slight fluctuations in incident volume, issues like identity fraud and financial scams remain common, highlighting weak points in existing safeguards. As a result, there’s growing attention on enhancing detection capabilities, securing user access, and improving response mechanisms. The focus is on reducing vulnerabilities that expose individuals and organizations to risk. This is driving wider adoption of protective tools, improved authentication protocols, and more coordinated efforts to manage digital risks. The environment is steadily moving toward more proactive and adaptive approaches to security, with greater emphasis on resilience and accountability across networks. According to industry reports, Australia recorded over 87,400 cybercrime reports in 2023–24, averaging one every six minutes, according to the Australian Signals Directorate’s latest Annual Cyber Threat Report. While this marks a 7% decline from the previous year, identity fraud, online shopping fraud, and online banking fraud topped the list of reported incidents, signaling persistent threats and underlining the critical importance of strengthening the country’s network security measures.

To get more information on this market, Request Sample

Growing Demand for Flexible Zero-Trust Security Solutions

Rising demand for secure, device-agnostic access is driving broader interest in zero-trust network approaches across Australia. As workforces become more distributed and reliance on third-party collaboration increases, organizations are seeking flexible tools that safeguard remote access without compromising usability. Solutions that enable granular control over who accesses what, from where, and on which device are gaining traction. There's a clear shift toward network security setups that don’t assume implicit trust, instead verifying every access request. This approach is particularly useful for managed environments, where scalability, ease of deployment, and cost efficiency are key. The focus is on integrating advanced access controls into everyday operations to protect sensitive data and systems, no matter where users or assets are located. For instance, in July 2024, SonicWall launched Cloud Secure Edge (CSE), a zero-trust network access (ZTNA) solution designed for managed service providers (MSPs). This cost-effective and flexible solution ensures secure remote and internet access, allowing organizations to connect employees and third-party users seamlessly from any device, anywhere. CSE provides enhanced control and protection for a distributed workforce.

Cloud Security Focus in Australia

The rapid adoption of cloud technology is reshaping Australia's digital landscape, leading to an increasing demand for effective cloud security measures. As organizations move applications, data, and essential operations to the cloud, ensuring the security of these platforms has become crucial. Companies are turning to cloud-native security solutions that offer scalability, real-time monitoring, and defenses against changing cyber threats. The adoption of tools that enhance visibility, data encryption, and compliance management across hybrid and multi-cloud environments is on the rise. This trend has been accelerated by the growth of remote work and digital transformation efforts, which require secure and adaptable IT environments. The ongoing shift toward cloud-centric security is expected to play a significant role in boosting the Australia network security market share.

Growth Drivers of Australia Network Security Market:

Digital Transformation Initiatives Driving Security Needs

Digital transformation is revolutionizing operations for organizations in Australia as they increasingly embrace cloud computing, IoT devices, and AI technologies. Although these advancements lead to improved efficiency and innovation, they also increase vulnerability by expanding the attack surface. To mitigate these risks, companies are channeling resources into sophisticated security tools that offer real-time monitoring, threat detection, and data protection across intricate networks. The incorporation of automation and AI within security systems is further enhancing defenses against sophisticated threats. As businesses expedite their digital transition, the need for secure infrastructures will continue to rise, directly boosting Australia network security market demand and positioning cybersecurity as a fundamental aspect of contemporary business strategies.

Government Regulations and Compliance

Stringent government regulations and compliance mandates are significantly influencing the Australia network security market. Data protection laws, privacy regulations, and cybersecurity frameworks require that businesses implement strong systems to protect sensitive data. Organizations in sectors like banking, healthcare, and critical infrastructure are subjected to increased scrutiny, leading to greater investments in advanced security solutions. Non-compliance poses substantial financial and reputational risks, prompting companies to emphasize adherence to regulations. This regulatory emphasis safeguards data and builds trust with customers and stakeholders. As compliance standards evolve, enterprises will likely enhance their network security practices, further driving adoption across various industries in Australia.

SME Security Adoption

Small and medium enterprises (SMEs) in Australia are increasingly appreciating the significance of cybersecurity for long-term resilience. Historically, SMEs dealt with budget limitations, but the rise of threats like ransomware and phishing has underscored the necessity for affordable yet efficient solutions. A growing number of SMEs are now turning to cloud-based and managed security services that offer robust protection without the need for extensive in-house expertise. This transition enables smaller businesses to protect critical data, ensure business continuity, and maintain competitiveness within the digital economy. Given that SMEs play a significant role in the country’s economic landscape, their increasing investment in cybersecurity is anticipated to substantially drive Australia network security market growth in the near future.

Government Regulations for Australia Network Security Market:

Mandatory Data Breach Notification

The Mandatory Data Breach Notification regulation requires organizations in Australia to report any significant data breaches to both regulators and affected individuals within a defined timeframe. This measure fosters transparency and prompt action to mitigate the effects of security incidents on consumers and businesses. By making breach disclosures obligatory, the law encourages companies to strengthen their data protection frameworks, implement advanced monitoring systems, and establish rapid response processes. This approach protects sensitive information and enhances consumer trust. The regulation has become a critical factor driving enterprises across various industries to invest in proactive security solutions, ultimately bolstering the resilience of the digital landscape and influencing the overall trajectory of the Australia network security market.

Critical Infrastructure Protection Laws

The Critical Infrastructure Protection Laws are fundamental to Australia’s cybersecurity framework, requiring stringent protective measures for essential sectors such as energy, finance, healthcare, and telecommunications. These industries are prime targets for cybercriminals due to their significance in national stability and public safety. Under these laws, organizations must implement advanced risk management strategies, secure digital systems, and establish continuous monitoring protocols to avert disruptions. According to Australia network security market analysis, these regulations are significantly influencing the adoption of next-generation security technologies across critical industries. The emphasis on protecting essential services safeguards the economy and ensures national security, making compliance with these laws a key driver in network security investments.

Privacy Act Compliance

The Privacy Act plays a vital role in ensuring that businesses manage, store, and process personal data responsibly in Australia. Under this regulation, companies are legally obligated to protect individuals’ personal information from unauthorized access, misuse, or disclosure. The Act enforces accountability, compelling businesses to establish transparent privacy policies and adopt robust cybersecurity measures. With the increase in digital transactions and data-centric operations, organizations are prompted to invest in encryption technologies, secure data storage, and advanced access control mechanisms. Non-compliance carries financial penalties and reputational risks, making adherence a strategic priority. The Privacy Act strengthens consumer confidence and acts as a significant driver for innovation and investment in the Australia network security market.

Opportunities of Australia Network Security Market:

Rising IoT Adoption

The swift uptake of Internet of Things (IoT) devices across various sectors in Australia is generating notable prospects in the network security arena. From intelligent home technology to industrial automation, IoT devices produce vast quantities of data and connect to essential networks, rendering them susceptible to cyber threats. This growing connectivity has paved the way for IoT-centric security solutions, encompassing device authentication, secure gateways, and real-time monitoring systems. Businesses and consumers are increasingly seeking enhanced protection to secure sensitive information and maintain operational continuity. As IoT integration becomes more entrenched in industries such as healthcare, manufacturing, and logistics, the demand for dedicated security frameworks will continue to rise, positioning IoT security as a crucial factor in driving innovation and growth within Australia’s network security market.

AI and Automation Integration

Artificial intelligence (AI) and automation are transforming network security approaches in Australia, offering new possibilities for improved threat identification and swift response abilities. AI-driven analytics can identify atypical patterns, uncover sophisticated cyberattacks, and forecast potential breaches with greater precision than conventional methods. Automation augments these abilities by facilitating instant responses without needing manual intervention, decreasing the time required to neutralize threats. This method is particularly advantageous for managing large, complex networks where human oversight alone is inadequate. As cyber threats evolve, the incorporation of AI and automation enables businesses to bolster resilience, reduce risks, and enhance operational efficiency. This trend presents significant growth prospects for companies that deliver intelligent, adaptive, and automated security solutions.

Public-Private Partnerships

Public-private partnerships are becoming essential in the Australian network security sector, as the collaboration between government bodies and private companies enhances the country's overall approach to cybersecurity. Governments are establishing frameworks and incentives to motivate businesses to adopt advanced security measures and are also collaborating with technology providers to create robust solutions. These partnerships foster knowledge exchange, innovation, and coordinated responses to cyber threats, particularly in the protection of critical infrastructure. For private companies, such collaborations present new avenues to co-develop solutions, engage in government-funded initiatives, and broaden their presence in regulated sectors. By cultivating a culture of shared responsibility, public-private cooperation enhances security resilience and accelerates the adoption of innovative cybersecurity technologies throughout the country.

Challenges of Australia Network Security Market:

Shortage of Skilled Cybersecurity Professionals

A significant issue facing the network security market in Australia is the lack of skilled cybersecurity professionals. As cyber threats grow more sophisticated, organizations need experts with specialized knowledge in areas like threat intelligence, incident response, and cloud security. Unfortunately, the available talent has not matched the increasing demand, leaving many companies vulnerable. This gap often compels businesses to engage third-party providers, which can elevate costs and reduce control. The shortage of skills also hampers the adoption of advanced security frameworks and complicates effective risk management. Without adequate expertise, even the most advanced security tools may fall short, contributing to long-term vulnerabilities within Australia's cybersecurity landscape.

High Implementation Costs

The substantial expenses associated with deploying advanced network security solutions present a considerable hurdle, particularly for small and medium enterprises (SMEs) in Australia. While larger businesses may have the budget for complex security infrastructures, smaller firms often find it challenging to allocate adequate funds. Costs linked to acquiring advanced tools, upgrading outdated systems, hiring qualified professionals, and ensuring compliance can be overwhelming. This financial obstacle forces numerous SMEs to depend on basic or outdated solutions, leaving them exposed to advancing cyber threats. In addition, the ongoing investment needed for continuous monitoring, patching, and training further intensifies the financial strain. The high implementation costs inhibit adoption and deepen the security divide between larger enterprises and resource-limited businesses in Australia.

Evolving Nature of Cyber Threats

The continually changing landscape of cyber threats represents yet another significant challenge for the network security market in Australia. Cybercriminals are perpetually devising new attack strategies, including ransomware, phishing, advanced persistent threats, and supply chain attacks. These shifting tactics complicate the ability of organizations to maintain consistent and effective defense strategies. Conventional security measures often lag behind these emerging threats, resulting in exploitable gaps. This constant evolution necessitates that companies invest heavily in adaptive and proactive security frameworks, increasing both costs and complexity. Furthermore, the unpredictability of cyberattacks escalates operational risks and threatens business continuity. Keeping pace with these threats demands ongoing innovation, but many organizations find this to be an intimidating challenge.

Australia Network Security Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, deployment mode, organization size, and industry vertical.

Component Insights:

- Solutions

- Firewalls

- Antivirus/Antimalware

- Network Access Control (NAC)

- Data Loss Prevention

- IDS/IPS

- Secure Web Gateways

- DDoS Mitigation

- Unified Threat Management

- Others

- Services

- Professional Services

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions (firewalls, antivirus/antimalware, network access control (NAC), data loss prevention, IDS/IPS, secure web gateways, DDoS mitigation, unified threat management, and others) and services (professional services and managed services).

Deployment Mode Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes cloud-based and on-premises.

Organization Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes large enterprises and small and medium-sized enterprises.

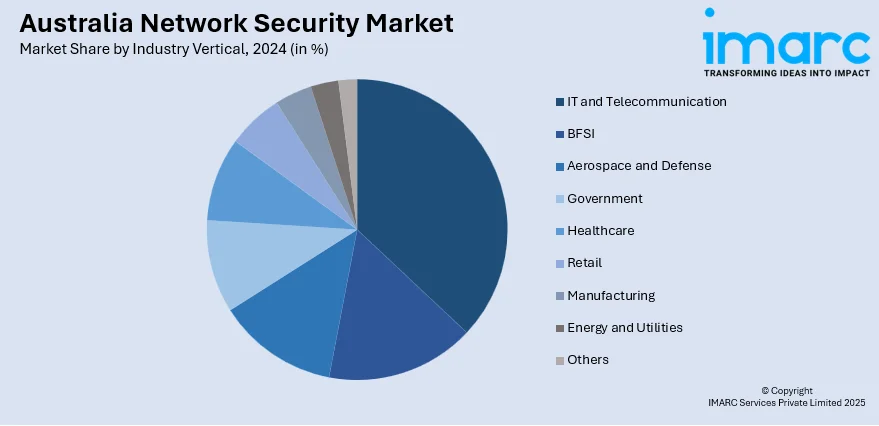

Industry Vertical Insights:

- IT and Telecommunication

- BFSI

- Aerospace and Defense

- Government

- Healthcare

- Retail

- Manufacturing

- Energy and Utilities

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes IT and telecommunication, BFSI, aerospace and defense, government, healthcare, retail, manufacturing, energy and utilities, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- CyberCX

- CyberSapiens

- Macquarie Technology Group

- NEC Australia Pty Ltd

- Netomate

- Telstra

- Thales Cyber Services ANZ

Australia Network Security Market News:

- In March 2025, ACS partnered with Cyberknowledge to introduce an AI-assisted cyber risk management platform tailored for small and medium-sized businesses (SMBs) in Australia. This platform offers services such as risk assessment, automated policy generation, and third-party risk management. Targeting sectors like financial services, healthcare, retail, and professional services, the initiative aims to support over 1,000 SMBs in its first year.

- In October 2024, Australia launched the Australian Cyber Network (ACN), a not-for-profit initiative aimed at combating the nation's escalating cybercrime issues, with over 94,000 incidents reported in the past year. Building on AustCyber's legacy, ACN focuses on advocacy, capability building, and education, particularly supporting small and medium-sized businesses. The network seeks to enhance Australia's cyber resilience and establish a leadership role in global cybersecurity standards.

Australia Network Security Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Modes Covered | Cloud-based, On-premises |

| Organization Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Industry Verticals Covered | IT and Telecommunication, BFSI, Aerospace and Defense, Government, Healthcare, Retail, Manufacturing, Energy and Utilities, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | CyberCX, CyberSapiens, Macquarie Technology Group, NEC Australia Pty Ltd, Netomate, Telstra, Thales Cyber Services ANZ, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia network security market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia network security market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia network security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The network security market in Australia was valued at USD 1.1 Billion in 2024.

The Australia network security market is projected to exhibit a compound annual growth rate (CAGR) of 13.7% during 2025-2033.

The Australia network security market is expected to reach a value of USD 4.1 Billion by 2033.

The Australia network security market is witnessing rising adoption of zero-trust frameworks, AI-driven threat detection, and cloud-native security solutions. Increasing demand for IoT protection, integration of automation, and a growing focus on public-private collaboration are also shaping the market, enhancing resilience against evolving cyber risks.

Growth in the Australia network security market is fueled by rising cyberattacks, expanding remote work, and accelerated digital transformation. Stringent data protection regulations and greater investment from SMEs in affordable security solutions further drive adoption. Additionally, protection of critical infrastructure is pushing organizations to prioritize advanced network security frameworks.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)