Australia Nutritional Supplements Market Size, Share, Trends and Forecast by Product Type, Form, Distribution Channel, Consumer Group, and Region, 2026-2034

Australia Nutritional Supplements Market Overview:

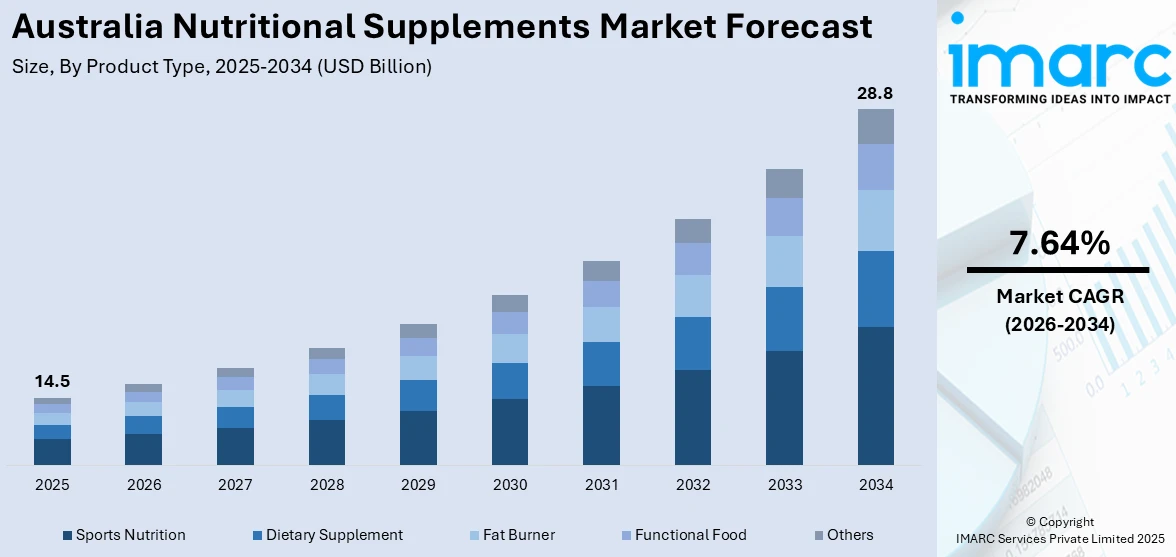

The Australia nutritional supplements market size reached USD 14.5 Billion in 2025. Looking forward, the market is expected to reach USD 28.8 Billion by 2034, exhibiting a growth rate (CAGR) of 7.64% during 2026-2034. The market is witnessing steady expansion, driven by growing consumer focus on preventive healthcare, fitness, and immunity enhancement. A shift toward plant-based and clean-label products, coupled with increased e-commerce adoption, is reshaping purchasing behavior. The market is also supported by evolving regulatory frameworks that encourage transparency and safety. This dynamic environment continues to boost Australia nutritional supplements market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 14.5 Billion |

| Market Forecast in 2034 | USD 28.8 Billion |

| Market Growth Rate 2026-2034 | 7.64% |

Key Trends of Australia Nutritional Supplements Market:

Growing Consumer Demand for Tailored Nutritional Supplements

The Market for Nutritional Supplements in Australia is growing due to a move toward personal nutrition, with consumers demanding specially formulated supplements to address personal health requirements. Improved technology and expanded understanding of the science of nutrition are allowing more personalized supplement choices, aimed at addressing deficiencies, lifestyle needs, and wellness objectives. This reflects an overarching consumer demand for preventive healthcare and active management of wellness. In addition, genetic testing and digital health platforms are enabling personalized suggestions, thus boosting market opportunities. Consequently, the market is experiencing diversified product offerings that target diverse populations, such as aging groups, athletes, and wellness-conscious individuals. This shift in consumer behavior highlights the need for innovation in product offerings and marketing strategies, representing a key feature of the Australia Nutritional Supplements Market trends.

To get more information on this market Request Sample

Regulatory Changes Shaping Sports Supplement Market

Recent regulatory reforms effective since November 30, 2023, are having a profound impact on the Australia Nutritional Supplements Market growth, especially in the sports supplement category. The Therapeutic Goods Administration (TGA) now requires that sports supplements in pill, capsule, or tablet forms should be registered as therapeutic goods. This regulatory reform is set to improve consumer protection by ensuring tougher regulation of product content and claims. These new compliance rules drive manufacturers to uphold higher quality levels, which enhances consumer trust and builds market credibility. This trend is consistent with the overall Australia Nutritional Supplements Market orientation toward safety and openness. Therefore, the regulatory transformation is likely to influence product development, marketing strategies, and industry practices in the Australian sports nutrition industry.

Rise in Demand for Plant-Based and Natural Supplements

Another trend as per the Australia nutritional supplements market analysis is the mounting consumer preference for natural and plant-based supplement products. Australians have increasingly become health-aware and look for alternatives to artificial ingredients, driven by the demand for clean-label products and environmentally friendly sourcing. This is due to increased awareness about environmental footprint, ethical appeal, and health benefits from botanical and organic compounds. Herbal extracts, natural-source vitamins, and superfoods are becoming increasingly popular across diverse consumer groups. Incorporating these products into a person's daily health regimen is one of the drivers of current the market. In response to changing consumer demand, companies are undertaking research and development to provide innovative, natural product offerings that appeal to modern wellness concerns.

Growth Drivers of Australia Nutritional Supplements Market:

Growing Health Awareness and Preventive Healthcare

One of the key growth drivers of Australia's nutrition supplements market is growing consumer awareness about health and wellness. Australians are focusing on preventive healthcare, and more people are taking proactive measures to ensure long-term well-being and prevent chronic illness. This transition is highly evident in the increased need for vitamins, minerals, herbal extracts, and functional food. The lifestyle of health, fitness, and well-being has become mainstream, especially among the young and middle-aged generations. Health-oriented media content, social media trends, and greater access to health information have influenced Australians to look at the use of nutritional supplements as part of their regular routines. The COVID-19 pandemic also increased consumer interest in immunity-supporting supplements, and the behavior has persisted post-pandemic. With increasingly informed and involved consumers taking control of their health, demand for immune-aid, stress support, and energy-related supplements remains strong.

Aging Population and Increase in Chronic Disease

The region’s ageing population is yet another major growth driver fueling the growth of the Australia nutritional supplements market demand. With increasing life expectancy and people moving into the older age group, demand for healthy ageing products as well as age-related health conditions is increasing. Older Australians are increasingly looking for supplements that enhance bone density, joint health, heart performance, mental acuity, and immune function. Additionally, the rising incidence of chronic diseases like diabetes, cardiovascular disease, and arthritis has seen many embrace supplements as an additional measure to complementary therapy. Healthcare providers also advocate for the use of nutrition in helping manage deficiencies and enhance the quality of life. The use of natural and non-invasive measures also enhances supplement consumption among aging populations. With this cohort growing, so too is the long-term demand for specialized supplements, which suit their changing health requirements, thus being a key driver of market growth.

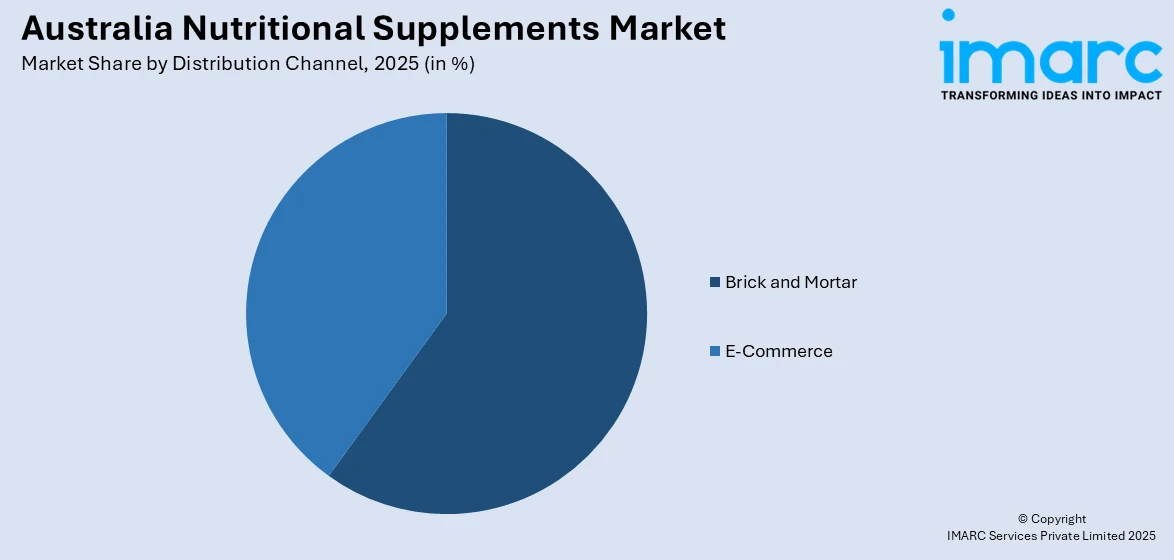

Growth in E-Commerce and Direct-to-Consumer Channels

The accelerated rise in e-commerce and direct-to-consumer (DTC) models is becoming the key driver for the Australian nutritional supplements market. With the ease of online purchase and rising penetration of mobile internet, consumers in both urban and regional markets are buying supplements online in record numbers. Australian consumers are especially sensitive to tailored product offers and subscription models, which are increasingly offered through brand-owned platforms and online health retailers. The emergence of online marketing, influencer sponsorship, and health content has helped firms more easily reach and inform their target markets regarding the advantages of different supplements. Also, the geographically distributed population of Australia has provided a compelling argument for DTC logistics and online engagement strategies, enabling brands to cater to remote regions cost-effectively. These avenues diminish reliance on conventional brick-and-mortar stores and provide more versatility in product training, packaging, and tailoring, while also driving market expansion.

Australia Nutritional Supplements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, form, distribution channel, and consumer group.

Product Type Insights:

- Sports Nutrition

- Dietary Supplement

- Fat Burner

- Functional Food

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes sports nutrition, dietary supplement, fat burner, functional food, and others.

Form Insights:

- Powder

- Tablets

- Capsules

- Liquid

- Soft Gels

- Others

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes powder, tablets, capsules, liquid, soft gels, and others.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Brick and Mortar

- E-Commerce

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes brick and mortar and e-commerce.

Consumer Group Insights:

- Infants

- Children

- Adults

- Pregnant

- Geriatric

The report has provided a detailed breakup and analysis of the market based on the consumer group. This includes infants, children, adults, pregnant, and geriatric.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Nutritional Supplements Market News:

- In January 2024, Vitadrop, established by Charlie Wood and Dan Concannon, released 11 water-based vitamin supplements by 2024, out of which four were TGA-accredited products available in big Australian retailers. The company has an estimate of \$2 million revenue by 2024 and \$50 million by 2030, with global expansion and Australian-based manufacturing plans.

- In January 2024, Jaryd Terkelsen and Ash Bisset's Beforeyouspeak Coffee expanded into the Middle East in 2024, rolling out sachets in 25 UAE supermarkets and set to enter Saudi Arabia. The health-conscious coffee brand has health-focused blends and is increasing instant and canned formats in Woolworths and convenience stores such as Ampol and Caltex.

Australia Nutritional Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sports Nutrition, Dietary Supplement, Fat Burner, Functional Food, Others |

| Forms Covered | Powder, Tablets, Capsules, Liquid, Soft Gels, Others |

| Distribution Channels Covered | Brick and Mortar, E-Commerce |

| Consumer Groups Covered | Infants, Children, Adults, Pregnant, Geriatric |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia nutritional supplements market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia nutritional supplements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia nutritional supplements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia nutritional supplements market was valued at USD 14.5 Billion in 2025.

The Australia nutritional supplements market is projected to exhibit a CAGR of 7.64% during 2026-2034.

The Australia nutritional supplements market is expected to reach a value of USD 28.8 Billion by 2034.

The Australia nutritional supplements market trends include growing demand for plant-based and organic products, personalized nutrition, and supplements targeting mental health, immunity, and aging. E-commerce growth, subscription models, and influencer-driven marketing are reshaping consumer buying habits, while sustainability and clean-label ingredients are becoming key factors in product development and branding.

The Australia nutritional supplements market is driven by rising health awareness, an aging population, and increasing focus on preventive healthcare. Growing demand for natural, immunity-boosting, and personalized supplements is fueling market growth across urban and regional areas, strengthening consumer engagement and accessibility.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)