Australia Off-Grid Solar Power Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Australia Off-Grid Solar Power Market Overview:

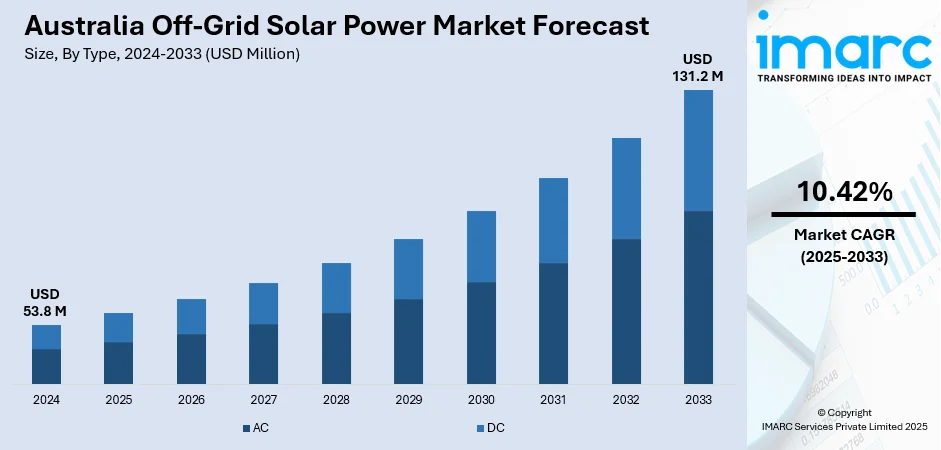

The Australia off-grid solar power market size reached USD 53.8 Million in 2024. Looking forward, the market is projected to reach USD 131.2 Million by 2033, exhibiting a growth rate (CAGR) of 10.42% during 2025-2033. The market is expanding due to rising energy needs in remote mining and industrial operations, wherein solar offers cost stability and supports environmental, social, and governance (ESG) goals. National and regional policies are further accelerating adoption through financial incentives and technical support, especially for underserved communities. As battery and microgrid technologies improve, solar systems are becoming more scalable and resilient. This combination of factors is contributing to the steady growth of the Australia off-grid solar power market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 53.8 Million |

| Market Forecast in 2033 | USD 131.2 Million |

| Market Growth Rate 2025-2033 | 10.42% |

Key Trends of Australia Off-Grid Solar Power Market:

Mining and Industrial Off-Grid Demand

Australia's robust mining industry remains influential in driving off-grid solar demand, especially in remote areas where linking to the national grid is challenging and not cost-effective. Mining activities require continuous, high-capacity energy for drilling, processing, and housing workers, functions that have traditionally relied on diesel generators. Nevertheless, increasing fuel prices, unstable supply chains, and a growing environmental responsibility are leading to a shift towards integrated solar systems with storage solutions. Off-grid solar provides enduring cost predictability, reduced maintenance, and enhanced alignment with corporate ESG objectives. Scalable design allows mining companies to customize systems according to specific site energy profiles and project timelines, enhancing operational adaptability. A notable illustration of this trend appeared in 2024, as Sungrow collaborated with Zenith Energy to create Australia’s largest off-grid hybrid renewable energy initiative at Kathleen Valley. This innovative system integrated solar, wind, battery storage, and thermal generation to satisfy the site’s mining energy needs while providing up to 80% renewable power each year. The initiative not only reduced emissions but also showcased how hybrid renewables can manage the scale and intensity of mining activities. Apart from mining, remote industrial locations, such as construction camps and supply chain centers, are also pursuing similar routes, utilizing solar as a reliable and economical option. As energy independence turns into a competitive edge in challenging settings, the transition to off-grid solar throughout the industrial sector is both a tactical move and financially prudent.

To get more information on this market, Request Sample

Policy Incentives and Sustainability Goals

The increasing effort to cut carbon emissions and enhance renewable energy access is contributing to the Australia off-grid solar power market growth, especially in isolated and underserved regions. National and state administrations are implementing a combination of grants, rebates, and feed-in tariffs aimed at reducing financial obstacles and facilitating solar adoption, particularly for indigenous communities and remote settlements. In addition to funding, policy frameworks promote technical advancements in battery storage and microgrid systems, making certain that solar installations are not only environment-friendly but also robust and expandable. These initiatives are incorporated into wider rural development and climate resilience plans. In 2025, the Albanese Government reaffirmed this dedication by enhancing the board of the Australian Renewable Energy Agency (ARENA), an essential organization aiding the nation's clean energy transition. The board’s growth aligns with the Future Made in Australia initiative, which focuses on enhancing investment in domestic renewable infrastructure. So far, ARENA has invested more than $2.9 billion in renewable energy initiatives, greatly progressing Australia's journey toward achieving net-zero emissions. This institutional support offers stability and progress for off-grid initiatives that might otherwise encounter financial or logistical obstacles. As climate-related reporting and accountability measures grow more rigorous, off-grid solar is increasingly viewed not only as a technological solution but also as a policy-driven tool for emissions reduction and equitable energy access across Australia's vast, off-grid regions.

Integration with Advanced Battery Storage

The incorporation of advanced battery storage is emerging as a pivotal trend within Australia’s off-grid solar power industry. High-capacity batteries enable households, businesses, and remote facilities to accumulate surplus solar energy produced during the day for utilization at night or in times of limited sunlight. This feature guarantees a consistent and dependable electricity supply decreasing reliance on diesel generators or the main grid. Additionally, enhanced battery performance and extended lifespans improve overall investment returns making off-grid systems more appealing to consumers. The increasing use of these storage solutions further promotes energy independence and resilience especially in remote or rural locations. This trend significantly contributes to Australia off-grid solar power market demand.

Growth Drivers of Australia Off-Grid Solar Power Market:

Energy Independence and Reliability

Energy independence serves as a crucial factor in the rise of off-grid solar power in Australia. A growing number of consumers, businesses, and remote facilities are opting for self-sufficient energy solutions to lessen their reliance on centralized grids and to mitigate disruptions from outages. Off-grid solar systems offer a steady and dependable power supply which is particularly vital for rural areas, agricultural enterprises, and mining locations where access to electricity can be inconsistent or expensive. By generating and storing their own energy users attain greater control over their consumption, boost operational resilience, and lessen their exposure to fluctuating energy prices. The emphasis on reliability and autonomy over energy resources continues to propel the widespread acceptance of off-grid solar solutions throughout the nation.

Advancements in Storage Technology

Improvements in battery storage technology are greatly enhancing the attractiveness of off-grid solar systems. Contemporary batteries deliver increased efficiency, extended lifespan, and higher storage capacity, empowering users to enjoy uninterrupted power even during prolonged periods of low sunlight. These advancements decrease the reliance on backup generators and minimize overall operational expenses. Enhanced battery performance also allows for superior energy management, enabling households, farms, and businesses to optimize their usage based on demand patterns. Such advancements have bolstered consumer and investor confidence, making off-grid solar a viable and eco-friendly option. These technological enhancements are significant contributors to market growth according to Australia off-grid solar power market analysis.

Technological Innovation

Technological progress is reshaping the off-grid solar landscape in Australia. The incorporation of smart monitoring systems enables users to observe energy production, consumption, and storage in real time, leading to improved system efficiency and maintenance. Hybrid solutions that blend solar with wind turbines or backup generators ensure a continuous electricity supply, even amid varying weather conditions. These innovations improve usability, reliability, and return on investment, making off-grid systems increasingly appealing to a broad spectrum of consumers. Furthermore, smart energy management technologies aid in optimizing battery usage and minimizing waste, further fostering cost-effectiveness. Ongoing innovation in both solar hardware and software is a key driver of adoption, ensuring that off-grid solar solutions adapt to changing consumer demands.

Government Initiatives for Australia Off-Grid Solar Power Market:

Clean Energy Transition Policies

Australia's policies for clean energy transition focus on minimizing carbon emissions and encouraging the uptake of sustainable energy solutions. These regulations create an environment that supports the use of renewable energy, including off-grid solar systems. By emphasizing clean power generation over fossil fuels, governmental initiatives indirectly promote investment in decentralized energy options, especially in rural and remote regions. These policies benefit households, farms, and small businesses seeking low-carbon solutions, making off-grid solar an appealing choice. Moreover, the emphasis on long-term sustainability and energy efficiency is in harmony with national climate goals, reinforcing the significance of renewable technologies. Consequently, these policies are key indirect motivators for the expansion of Australia's off-grid solar industry.

Research and Development Funding

Government-supported research and development (R&D) programs are crucial for the progress of off-grid solar technology in Australia. Funding initiatives encourage innovation in solar panels, inverters, battery storage, and energy management systems, leading to improvements in efficiency, reliability, and cost-effectiveness. These programs inspire manufacturers and technology innovators to create high-performance solutions tailored for remote and rural usage. By lowering expenses and boosting system longevity, R&D funding makes off-grid solar systems more attainable for a broader audience of consumers and businesses. Additionally, these initiatives drive technological progress that facilitates hybrid energy integration and smart energy management. Overall, government investment in R&D fortifies the market, ensuring the ongoing innovation and competitiveness of Australia’s off-grid solar sector.

Promotion of Hybrid Energy Solutions

The Australian government advocates for hybrid energy solutions that integrate solar power with other renewable sources or backup generators to enhance reliability in off-grid settings. Incentives for hybrid systems motivate households, businesses, and remote facilities to embrace energy solutions that ensure a continuous electricity supply, even during low sunlight periods or adverse weather. By fostering the integration of various energy sources, these initiatives enhance overall system efficiency, decrease reliance on diesel generators, and optimize energy usage. Promoting hybrid solutions also encourages the use of advanced energy management technologies and battery storage systems, making off-grid solar a more practical and sustainable option. These efforts contribute to the overall development and resilience of the Australian off-grid solar market.

Applications of Australia Off-Grid Solar Power Market:

Residential Use in Remote Areas

In Australia's rural and remote regions, off-grid solar systems are becoming a common solution for households' electricity needs. Many residences are distanced from the main electricity grid, which can render traditional connections both costly and impractical. Off-grid solar enables families to independently power lights, appliances, and heating or cooling systems. High-capacity batteries can store surplus energy produced during daylight hours, ensuring a reliable electricity supply during the night or in periods of limited sunlight. This method bolsters energy self-sufficiency, decreases dependence on diesel generators, lowers electricity expenses, and promotes environmental sustainability. Therefore, utilizing off-grid solar is a sensible choice for securing energy in isolated communities.

Agricultural Applications

Off-grid solar power is essential in Australia’s agricultural landscape, especially for farms and livestock operations in regions with restricted grid access. Solar energy efficiently operates irrigation pumps, lighting systems, and vital farm equipment. By leveraging renewable energy, farmers lessen their reliance on diesel generators, reduce operational costs, and lower carbon emissions. Battery storage systems guarantee a constant energy supply during nighttime or overcast days, ensuring seamless farm activities. Furthermore, solar technology can be coupled with water pumps and sensors to enhance irrigation management, resulting in improved productivity and sustainability. The integration of off-grid solar in agriculture plays a key role in enhancing energy efficiency, operational resilience, and environmental accountability across rural farming areas.

Telecommunication Infrastructure

Off-grid solar systems are crucial for energizing telecommunication infrastructure in Australia’s remote regions. Numerous mobile towers, base stations, and communication relay points are positioned far from grid connections, making solar power a dependable and economical option. These systems ensure the continuous operation of telecommunication networks, facilitating connectivity for remote populations, emergency services, and industries such as mining and tourism. Advanced battery storage offers backup power during periods of low sunlight, maintaining uninterrupted communication. Solar-powered telecom solutions reduce dependency on diesel generators, minimize operational expenses, and contribute to environmental sustainability. As telecommunication needs grow in rural and isolated areas, adopting off-grid solar becomes pivotal for establishing a robust, reliable, and energy-efficient network infrastructure.

Australia Off-Grid Solar Power Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- AC

- DC

The report has provided a detailed breakup and analysis of the market based on the type. This includes AC and DC.

Application Insights:

.webp)

- Non-Residential

- Residential

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes non-residential and residential.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Off-Grid Solar Power Market News:

- In March 2025, Pacific Energy announced the completion of Australia’s largest off-grid hybrid power system at the Tropicana gold mine in Western Australia. The 115 MW system includes 24 MW of solar, 24 MW of battery storage, and 4 wind turbines, significantly reducing diesel and gas use. This project supports AngloGold Ashanti’s carbon reduction goals with an expected 65,000 t/y emission cut.

- In March 2024, APA Group officially launched the 88 MW Dugald River Solar Farm in outback Queensland, now Australia's largest remote-grid solar farm. Spanning 200 hectares with 180,000 panels, it generated 240 GWh annually to power mining operations. The project supported decarbonization and offers significant cost savings for resource companies.

Australia Off-Grid Solar Power Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | AC, DC |

| Applications Covered | Non-Residential, Residential |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia off-grid solar power market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia off-grid solar power market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia off-grid solar power industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The off-grid solar power market in Australia was valued at USD 53.8 Million in 2024.

The Australia off-grid solar power market is projected to exhibit a compound annual growth rate (CAGR) of 10.42% during 2025-2033.

The Australia off-grid solar power market is expected to reach a value of USD 131.2 Million by 2033.

The key market trends include increasing adoption of hybrid solar systems combined with wind or backup generators, smart energy management solutions for real-time monitoring, and portable solar kits for temporary or emergency use. Growing interest in sustainable, off-grid solutions among rural households and small businesses is also shaping market expansion.

Rising electricity costs and limited grid access in remote regions drive off-grid solar adoption. Government incentives, technological advancements in storage and efficiency, and heightened environmental awareness are further accelerating growth. Consumers and businesses increasingly prioritize reliable, self-sufficient energy solutions to enhance sustainability and operational resilience.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)