Australia Offshore Support Vessels Market Size, Share, Trends and Forecast by Type, Water Depth, Fuel, Service Type, Application, and Region, 2025-2033

Australia Offshore Support Vessels Market Overview:

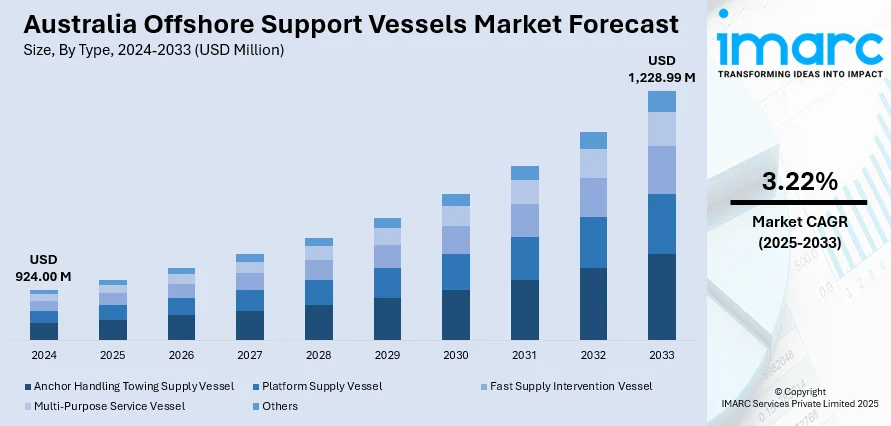

The Australia offshore support vessels market size reached USD 924.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,228.99 Million by 2033, exhibiting a growth rate (CAGR) of 3.22% during 2025-2033. The market is being driven by increased offshore oil and gas exploration, expansion of renewable energy projects like offshore wind farms, and technological advancements, such as the advent of dynamic positioning systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 924.00 Million |

| Market Forecast in 2033 | USD 1,228.99 Million |

| Market Growth Rate 2025-2033 | 3.22% |

Australia Offshore Support Vessels Market Trends:

Increased Investment in Offshore Renewable Energy Projects

As the global energy landscape shifts toward sustainability, Australia is actively embracing offshore renewable energy, particularly offshore wind power, which is boosting the demand for offshore support vessels (OSVs). These vessels play a vital role in the construction, operation, and upkeep of offshore wind energy projects. The country’s commitment is evident in the launch of a major offshore wind farm in Victoria’s Gippsland region in 2023. Looking ahead, the Australian government targets offshore wind capacity of up to 9 GW by 2040. This rapid development is fueling demand for specialized OSVs equipped for turbine installation, subsea cable laying, and long-term maintenance. As part of its broader goal to achieve net-zero emissions by 2050, the government is actively funding offshore energy initiatives, positioning Australia’s OSV market for sustained growth in support of its clean energy transition.

To get more information on this market, Request Sample

Technological Advancements in OSV Design and Capabilities

Technological advancements in offshore support vessels are playing a pivotal role in enhancing operational efficiency, safety, and sustainability in Australia’s offshore sector. The integration of dynamic positioning (DP) systems, hybrid propulsion technologies, and automation is enabling OSVs to undertake complex offshore operations such as deep-water drilling and subsea exploration with greater precision and reliability. In response to stricter environmental regulations and the national push toward sustainability, Australian operators are increasingly investing in high-performance OSVs that offer improved fuel efficiency and reduced carbon emissions. The adoption of automation and digital technologies is further transforming fleet management, with “smart” OSVs utilizing Internet of Things (IoT) systems for real-time monitoring, predictive maintenance, and optimized performance. This digital shift not only reduces operational costs and downtime but also boosts safety and productivity.

Australia Offshore Support Vessels Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, water depth, fuel, service type, and application.

Type Insights:

- Anchor Handling Towing Supply Vessel

- Platform Supply Vessel

- Fast Supply Intervention Vessel

- Multi-Purpose Service Vessel

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes anchor handling towing supply vessel, platform supply vessel, fast supply intervention vessel, multi-purpose service vessel, and others.

Water Depth Insights:

- Shallow Water

- Deepwater

A detailed breakup and analysis of the market based on the water depth have also been provided in the report. This includes shallow water and deepwater.

Fuel Insights:

- Fuel Oil

- LNG

The report has provided a detailed breakup and analysis of the market based on the fuel. This includes fuel oil and LNG.

Service Type Insights:

- Technical Services

- Inspection and Survey

- Crew Management

- Logistics and Cargo Management

- Anchor Handling and Seismic Support

- Others

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes technical services, inspection and survey, crew management, logistics and cargo management, anchor handling and seismic support, and others.

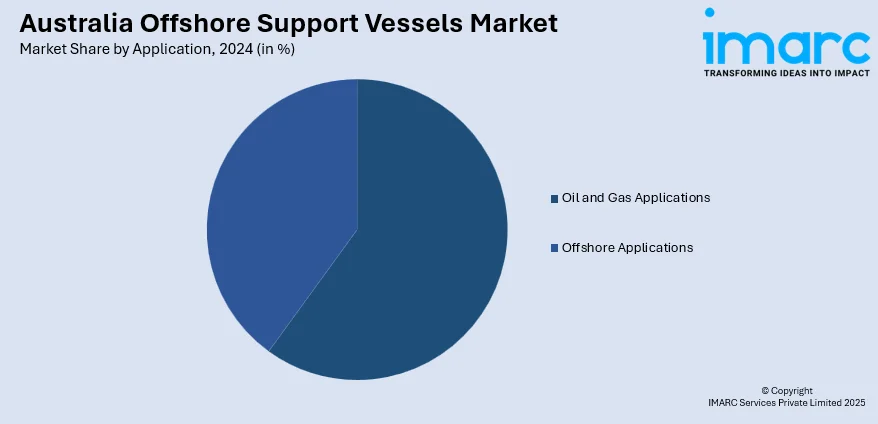

Application Insights:

- Oil and Gas Applications

- Offshore Applications

The report has provided a detailed breakup and analysis of the market based on the application. This includes oil and gas applications and offshore applications.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Offshore Support Vessels Market News:

- December 2024: Austal Australia secured an AUD 157 million contract to construct two additional Evolved Cape-class Patrol Boats for the Royal Australian Navy, increasing the total to 10 under the SEA1445-1 Project. These 58-meter vessels, built in Henderson, Western Australia, feature enhanced crew accommodations, advanced sustainment systems, and improved quality-of-life amenities.

- August 2024: Go Offshore and Qube Ports established a joint venture named SEA Energy and Renewables. This collaboration aims to provide end-to-end marine logistics services tailored to offshore energy, renewables, and decommissioning sectors across Australia and Southeast Asia.

Australia Offshore Support Vessels Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Anchor Handling Towing Supply Vessel, Platform Supply Vessel, Fast Supply Intervention Vessel, Multi-Purpose Service Vessel, Others |

| Water Depths Covered | Shallow Water, Deepwater |

| Fuels Covered | Fuel Oil, LNG |

| Service Types Covered | Technical Services, Inspection and Survey, Crew Management, Logistics and Cargo Management, Anchor Handling and Seismic Support, Others |

| Applications Covered | Oil and Gas Applications, Offshore Applications |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia offshore support vessels market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia offshore support vessels market on the basis of type?

- What is the breakup of the Australia offshore support vessels market on the basis of water depth?

- What is the breakup of the Australia offshore support vessels market on the basis of fuel?

- What is the breakup of the Australia offshore support vessels market on the basis of service type?

- What is the breakup of the Australia offshore support vessels market on the basis of application?

- What are the various stages in the value chain of the Australia offshore support vessels market?

- What are the key driving factors and challenges in the Australia offshore support vessels market?

- What is the structure of the Australia offshore support vessels market and who are the key players?

- What is the degree of competition in the Australia offshore support vessels market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia offshore support vessels market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia offshore support vessels market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia offshore support vessels industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)