Australia Online Car Rental Market Size, Share, Trends and Forecast by Booking Type, Rental Length, Vehicle Type, Application, Payment Mode, Service Type, and Region, 2025-2033

Australia Online Car Rental Market Overview:

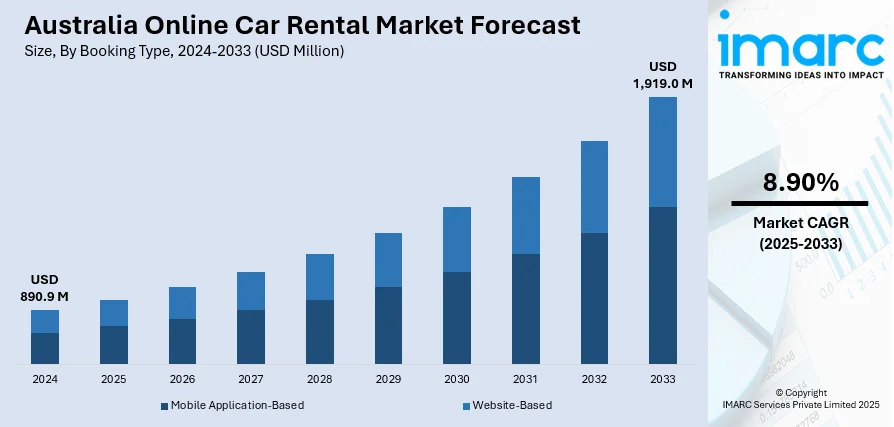

The Australia online car rental market size reached USD 890.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,919.0 Million by 2033, exhibiting a growth rate (CAGR) of 8.90% during 2025-2033. The rising popularity of flexible travel bookings as buyers are now more interested in personalized travel experiences is contributing to the market growth. Moreover, the heightened popularity of smartphones is fueling the market growth. Apart from this, the constant increase in domestic and international tourism is expanding the Australia online car rental market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 890.9 Million |

|

Market Forecast in 2033

|

USD 1,919.0 Million |

| Market Growth Rate 2025-2033 | 8.90% |

Australia Online Car Rental Market Trends:

Growing Need for Flexible Travel Arrangements

The online car rental industry in Australia is driven by the increasing popularity of flexible travel bookings. Buyers are now more interested in personalized travel experiences that can be adjusted according to their requirements, including last-minute bookings and the availability of assorted vehicle varieties. Since more individuals are moving towards personalized, on-demand transport, online channels are driving these demands by providing ample opportunities for vehicle variety and flexible rental duration. This trend is further gaining traction as domestic and international tourists are appreciating the convenience of accessing cars easily through online platforms, making the overall experience of car rentals more convenient and attractive. Moreover, the convenience of comparing prices, looking for availability, and reading reviews in real time is giving customers a better rental experience.

To get more information on this market, Request Sample

Rising Use of Smartphone Technology

The popularity of smartphones is fueling the Australia online car rental market growth. As per the information given by DataReportal, in 2025, 34.44 million cellular mobile connections were functioning in Australia. Additionally, people are using mobile websites and apps to reserve cars on rent, given the convenience and on-the-fly access that smartphones provide across a range of services. As mobile technology evolves further, car rental companies are constantly enhancing their web platforms, allowing customers to book cars, make reservations, and even unlock cars with minimal effort. The infusion of mobile payment systems, real-time information, and global positioning system (GPS) technology is improving the rental experience, making it more convenient and easier to use. As Australians increasingly welcome mobile technology, they are also opting for the convenience of car rental booking on-the-go, fueling the growth of online rental services in the country.

Increase in Domestic and International Tourism

The constant rise in domestic and international travel activities is driving the requirement for car rentals online in Australia. As more tourists look for flexible and convenient means of transport, the market is enjoying the rising number of people who prefer car rentals to the use of public means or taxi services. Australians are also taking to increased domestic travel, visiting different parts of the country, which is boosting the demand for affordable and convenient rental options. Overseas visitors are also opting for car rentals to visit the extensive areas of interest and tourist sites at their own convenience. Online travel agencies are addressing this boom by presenting improved price terms, wider car categories, and extended pick-up/drop-off services, thus rendering car rentals a convenient choice for travelers. This trend is likely to persist as the tourism sector recovers and grows in the next few years. In 2025, CarTrawler, the top B2B technology provider of car rental services to the worldwide travel sector, unveiled a new car rental collaboration with Virgin Australia. This partnership signifies another key airline collaboration for CarTrawler and is an important advancement in improving the travel experience for Virgin Australia passengers.

Australia Online Car Rental Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on booking type, rental length, vehicle type, application, payment mode, and service type.

Booking Type Insights:

- Mobile Application-Based

- Website-Based

The report has provided a detailed breakup and analysis of the market based on the booking type. This includes mobile application-based and website-based.

Rental Length Insights:

- Short Term

- Long Term

The report has provided a detailed breakup and analysis of the market based on the rental length. This includes short term and long term.

Vehicle Type Insights:

- Luxury

- Executive

- Economy

- SUVs

- Others

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes luxury, executive, economy, SUVs, and others.

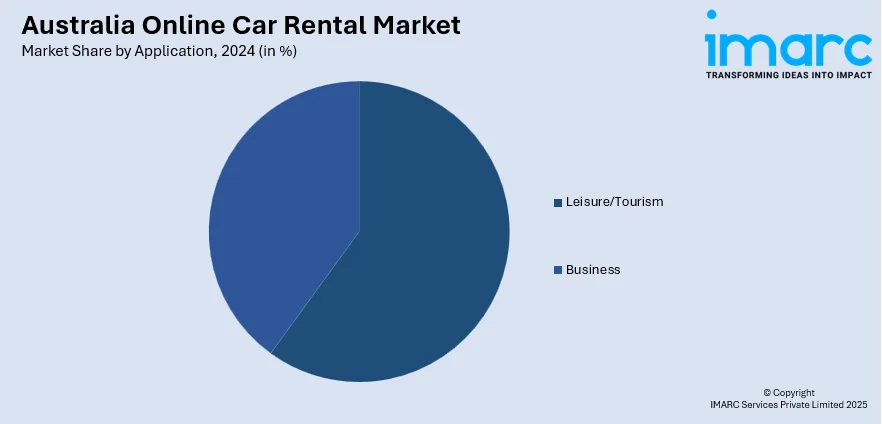

Application Insights:

- Leisure/Tourism

- Business

The report has provided a detailed breakup and analysis of the market based on the application. This includes leisure/tourism and business.

Payment Mode Insights:

- Online Payment

- Cash on Delivery

A detailed breakup and analysis of the market based on the payment mode have also been provided in the report. This includes online payment and cash on delivery.

Service Type Insights:

- Self-Driven

- Chauffeur-Driven

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes self-driven and chauffeur-driven.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Online Car Rental Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Booking Types Covered | Mobile Application-Based, Website-Based |

| Rental Lengths Covered | Short Term, Long Term |

| Vehicle Types Covered | Luxury, Executive, Economy, SUVs, Others |

| Applications Covered | Leisure/Tourism, Business |

| Payment Modes Covered | Online Payment, Cash on Delivery |

| Service Types Covered | Self-Driven, Chauffeur-Driven |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia online car rental market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia online car rental market on the basis of booking type?

- What is the breakup of the Australia online car rental market on the basis of rental length?

- What is the breakup of the Australia online car rental market on the basis of vehicle type?

- What is the breakup of the Australia online car rental market on the basis of application?

- What is the breakup of the Australia online car rental market on the basis of payment mode?

- What is the breakup of the Australia online car rental market on the basis of service type?

- What is the breakup of the Australia online car rental market on the basis of region?

- What are the various stages in the value chain of the Australia online car rental market?

- What are the key driving factors and challenges in the Australia online car rental market?

- What is the structure of the Australia online car rental market and who are the key players?

- What is the degree of competition in the Australia online car rental market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia online car rental market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia online car rental market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia online car rental industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)