Australia Online Grocery Market Report by Product Type (Vegetables and Fruits, Dairy Products, Staples and Cooking Essentials, Snacks, Meat and Seafood, and Others), Business Model (Pure Marketplace, Hybrid Marketplace, and Others), Platform (Web-Based, App-Based), Purchase Type (One-Time, Subscription), and Region 2025-2033

Australia Online Grocery Market Size and Share:

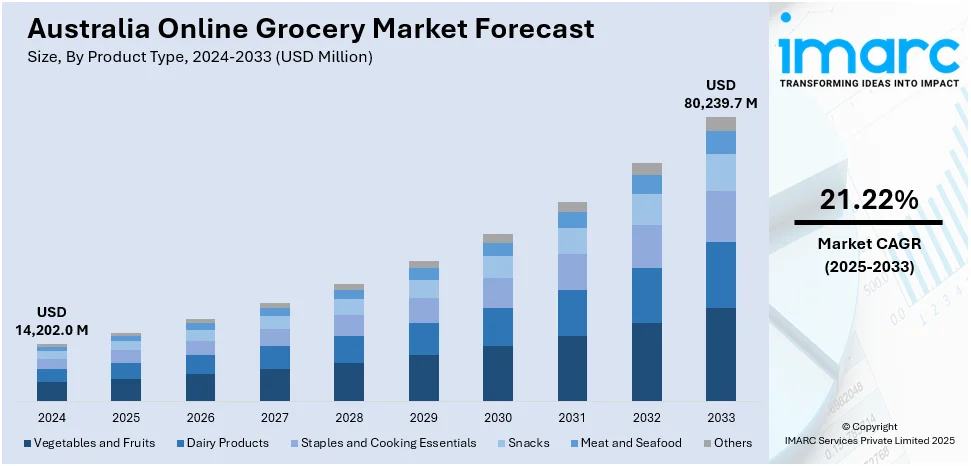

Australia online grocery market size reached USD 14,202.0 Million in 2024. The market is projected to reach USD 80,239.7 Million by 2033, exhibiting a growth rate (CAGR) of 21.22% during 2025-2033. The increasing advancements in technology, such as mobile apps and user-friendly websites, which have made online grocery shopping more accessible and user-friendly, are primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 14,202.0 Million |

|

Market Forecast in 2033

|

USD 80,239.7 Million |

| Market Growth Rate 2025-2033 | 21.22% |

Key Trends of Australia Online Grocery Market:

Growing Focus on Delivery Speed

Fast delivery has become a major battleground in Australia's online grocery market. Consumers now expect their groceries to arrive the same day, often within a few hours. To meet this demand, large retailers are overhauling their supply chains. Many are setting up micro-fulfillment centers in urban areas to cut down delivery times. These facilities allow orders to be picked and packed quickly, close to where customers live. Retailers are also teaming up with last-mile delivery startups that specialize in rapid dispatch. Some are experimenting with predictive inventory placement moving high-demand products closer to likely buyers. With speed now a deciding factor for many shoppers, delivery time is no longer just a service metric; it has become a core part of the value proposition. As a result, the competition in the market is intensifying, significantly influencing Australia online grocery market share.

To get more information on this market, Request Sample

Private Labels Gaining Ground

Private-label products are becoming a bigger part of online grocery catalogs in Australia. Supermarkets are investing in their brands to boost profitability and reduce reliance on third-party suppliers. These private labels are no longer limited to budget options they now encompass premium and organic ranges tailored to specific customer segments. Online platforms prominently feature them through curated lists and promotions, providing more visibility than traditional store layouts can offer. Retailers utilize customer data to position private-label items as alternatives to well-known brands, leveraging past purchasing behavior. The increased control over branding, pricing, and supply chain makes private labels strategically important. Their growing online presence signals a long-term shift in how supermarkets build loyalty and protect their margins.

Rise of Subscription and Auto-Replenishment Models

Recurring delivery models are gaining traction in the online grocery sector, particularly for staples such as milk, bread, coffee, baby supplies, and cleaning products. These subscriptions simplify customers' lives and create predictable demand for retailers. Many platforms now offer auto-replenishment features that learn from past purchase cycles to suggest when to restock. Subscribers often receive small discounts or perks, such as priority delivery slots, making the model attractive. This approach also reduces customer churn, as users become accustomed to a convenient, low-effort routine. For retailers, it's a way to lock in long-term revenue while better forecasting inventory needs. As consumers get more comfortable outsourcing routine shopping tasks, subscription models are becoming a key part of the online grocery market.

Growth Drivers of Australia Online Grocery Market:

Time-Saving Convenience

One of the strongest drivers of online grocery adoption in Australia is the need to save time. Many consumers, especially working professionals and parents, prefer the ease of ordering groceries from their phones or laptops rather than spending hours in-store. The ability to shop anytime early morning, late at night, or during a lunch break adds flexibility drives the Australia online grocery market demand. Repeat orders, saved shopping lists, and personalized suggestions further reduce the effort required. With tight schedules and long commutes becoming more common, convenience is no longer just a bonus it’s essential. Online grocery platforms that offer smooth navigation, fast checkout, and reliable delivery windows are winning customer loyalty simply by giving people back their time each week.

Urbanization and Population Density

Australia’s urban centers, such as Sydney, Melbourne, and Brisbane, provide the ideal conditions for efficient online grocery operations. With many residents concentrated in apartment complexes and high-density neighborhoods, retailers can fulfill multiple orders within a small delivery radius. This clustering lowers logistics costs and shortens delivery times, making the model more viable. Additionally, city dwellers often face traffic congestion, parking issues, and limited store space, which makes online shopping the more attractive option. Urban areas also tend to have higher adoption rates of digital tools, which support broader usage of grocery apps. As urbanization continues, especially in outer metro suburbs, retailers are refining their delivery zones and investing in local fulfilment hubs to serve these populations efficiently.

Expansion of Delivery Infrastructure

Retailers in Australia are investing heavily in the systems that make online grocery work. This includes regional warehouses, micro-fulfillment centers, refrigerated storage, and advanced routing software for delivery fleets. Cold chain logistics critical for items such as meat, dairy, and produce have seen significant improvements, making customers more confident in ordering perishables online. Many companies are also partnering with third-party delivery firms or using crowdsourced delivery models to boost reach and flexibility. These logistics upgrades enable faster delivery windows, increased accuracy, and reduced spoilage. As infrastructure becomes more advanced and reliable, it removes a major barrier to entry for skeptical customers, thereby strengthening the long-term growth of the online grocery segment in both metropolitan and regional areas. According to Australia online grocery market analysis, these investments in logistics infrastructure have not only improved service quality and reliability but also significantly expanded consumer adoption rates.

Australia Online Grocery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, business model, platform, and purchase type.

Product Type Insights:

- Vegetables and Fruits

- Dairy Products

- Staples and Cooking Essentials

- Snacks

- Meat and Seafood

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes vegetables and fruits, dairy products, staples and cooking essentials, snacks, meat and seafood, and others.

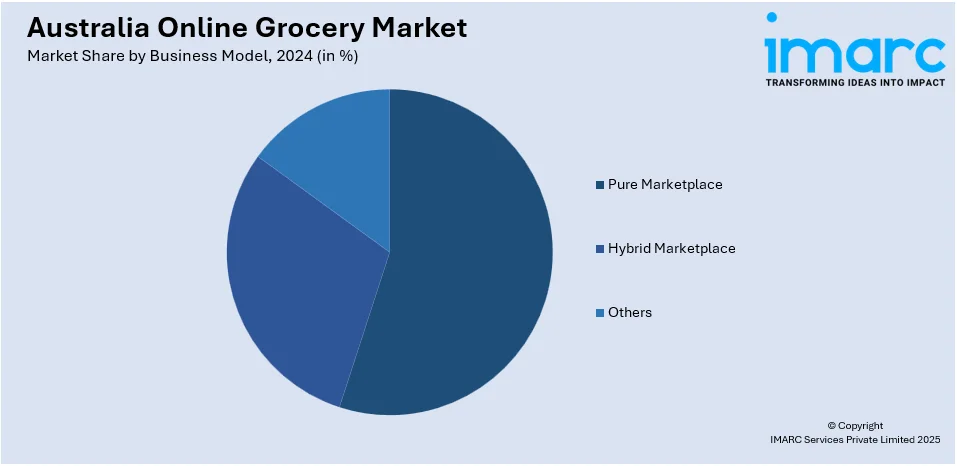

Business Model Insights:

- Pure Marketplace

- Hybrid Marketplace

- Others

A detailed breakup and analysis of the market based on the business model have also been provided in the report. This includes pure marketplace, hybrid marketplace, and others.

Platform Insights:

- Web-Based

- App-Based

The report has provided a detailed breakup and analysis of the market based on the platform. This includes web-based and app-based.

Purchase Type Insights:

- One-Time

- Subscription

A detailed breakup and analysis of the market based on the purchase type have also been provided in the report. This includes one-time and subscription.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Development:

- In September 2024, Alibaba's grocery chain Freshippo entered the Australian market in partnership with local online supermarket Ebest. Offering a selection of Chinese products via Ebest's platform, this move aims to meet the growing demand for ethnic groceries. This marks Freshippo's third international expansion following ventures in the US and Singapore.

- In September 2024, Coles launched its first Customer Fulfilment Centre (CFC) in Truganina, Victoria, marking a significant transformation in online grocery shopping in Australia. The CFC will enhance order accuracy and freshness, ensuring customers complete orders on time and receive a guaranteed minimum shelf life for perishable items, thereby providing a better shopping experience.

- In August 2024, Ocado launched two robotic customer fulfillment centers in Australia, developed in partnership with Coles. The Melbourne and Sydney warehouses, part of a 2019 agreement, aim to enhance the online grocery shopping experience. The centers are expected to enable next-day delivery by year-end despite previous construction delays.

Australia Online Grocery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Vegetables and Fruits, Dairy Products, Staples and Cooking Essentials, Snacks, Meat and Seafood, Others |

| Business Models Covered | Pure Marketplace, Hybrid Marketplace, Others |

| Platforms Covered | Web-Based, App-Based |

| Purchase Types Covered | One-Time, Subscription |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia online grocery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia online grocery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia online grocery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The online grocery market in the Australia was valued at USD 14,202.0 Million in 2024.

The Australia online grocery market is expected to reach a value of USD 80,239.7 Million by 2033.

The Australia online grocery market is projected to exhibit a compound annual growth rate (CAGR) of 21.22% during 2025-2033.

Faster delivery options, personalized shopping experiences, and mobile-first platforms are shaping the market. Subscription models, expanded product ranges, and sustainability efforts are also gaining traction. Major retailers are leveraging AI and automation to improve order accuracy, speed, and customer satisfaction.

Rising urbanization, busy lifestyles, and high internet penetration are driving demand. Improved delivery infrastructure, growing smartphone usage, and retailer-led promotions make online shopping more appealing. Consumer comfort with digital tools and the desire for convenience continue to push the market forward.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)