Australia Online Language Learning Market Report by Learning Mode (Self-learning Apps and Applications, Tutoring), Age Group (<13 Years, 13-17 Years, 18-20 Years, 21-30 Years, 31-40 Years, >40 Years), Language (English, Spanish, French, Mandarin, German, Japanese, Italian, Arabic, Korean, and Others), End User (Individual Learners, Educational Institutes, K-12, Higher Education, Government Institutes, Corporate Learners), and Region 2025-2033

Australia Online Language Learning Market Overview:

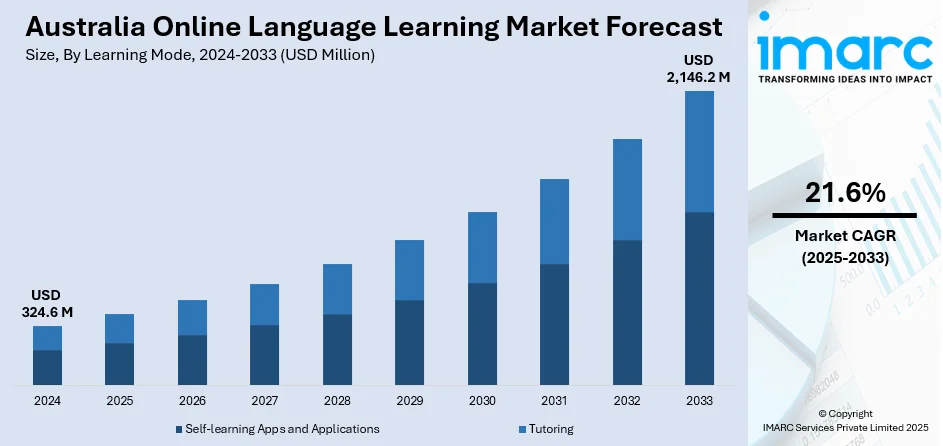

The Australia online language learning market size reached USD 324.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,146.2 Million by 2033, exhibiting a growth rate (CAGR) of 21.6% during 2025-2033. The market is driven by the rising interest in international traveling and migration and the escalating demand for online language learning, along with the increasing accessibility of smartphones and the growing integration of advanced technologies in educational tools.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 324.6 Million |

| Market Forecast in 2033 | USD 2,146.2 Million |

| Market Growth Rate (2025-2033) | 21.6% |

Australia Online Language Learning Market Trends:

Rising Trend of International Traveling and Migration

According to the latest release about overseas migration by the Australian Bureau of Statistics (ABS), overseas migration contributed a net gain of 518,000 people to Australia's population in 2023. The growing interest in international traveling and migration is driving the demand for online language learning in Australia. As people are relocating more frequently due to career opportunities, there is a rise in the demand for excellent language skills. Travelers and expatriates frequently strive to improve their language skills and promote more effective conversation and deeper cultural integration. Online language learning solutions fulfill this requirement by providing adaptable, accessible, and focused language education that may be adjusted to specific travel destinations or work settings. These systems enable users to study and practice new languages at their own speed, adapting classes to busy travel schedules or relocation plans.

To get more information on this market, Request Sample

Furthermore, as migration flows are increasing, immigrants and expatriates need language skills to effectively integrate into their new communities and work situations. Online language classes are gaining traction among the masses because they provide accessible, cost-effective, and individualized learning opportunities that can be accessed from anywhere. The increasing emphasis on cultural competence and effective communication in global relationships is positively influencing the market. There is also an increase in the demand for language learning applications and online courses that teach practical and real-world language skills, as they are helping users prepare for diverse international experiences and improve their ability to communicate with people from many cultures.

Enhancements in Mobile Accessibility

Increased mobile access represents one of the key factors propelling the growth of the market in Australia. The growing use of smartphones and tablets is changing how individuals interact with educational content, resulting in an increase in the popularity of mobile language learning apps. These apps provide users with the ease of learning while on the go, allowing them to practice language skills whenever and wherever they want, whether during commutes, breaks, or while traveling. In addition, mobile apps include gamification components, which are making the learning experience more interesting and pleasant, encouraging regular usage.

Mobile apps offer flexibility and accessibility that appeal to a wide range of audiences, including busy professionals, students, and travelers who like to study in short and manageable sessions. The continuous adoption of mobile technology is reinforcing the expansion of language learning apps, as smartphones and tablets are becoming integral tools in daily life. As per the IMARC Group’s report, the Australia smartphone market size is expected to exhibit a growth rate (CAGR) of 1.60% during 2024-2032, reflecting the increasing reliance on mobile devices.

Australia Online Language Learning Market News:

- May 2024: Language Confidence, an Australia-based artificial intelligence (AI) language firm, raised $1.5 million in a seed round led by Wavemaker Partners and Investible to enhance its spoken English teaching and testing automation. The funding will enable the company to expand its product offering and grow its customer base.

- April 2024: The Albanese Labor Government invested $15 million to enhance language education in community language schools in Australia, with funding allocated for upgrading educational equipment and strengthening online delivery.

Australia Online Language Learning Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on learning mode, age group, language, and end user.

Learning Mode Insights:

- Self-learning Apps and Applications

- Tutoring

- One-on-One Learning

- Group Learning

The report has provided a detailed breakup and analysis of the market based on the learning mode. This includes self-learning apps and applications and tutoring (one-on-one learning, and group learning).

Age Group Insights:

- <13 Years

- 13-17 Years

- 18-20 Years

- 21-30 Years

- 31-40 Years

- >40 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes <13 years, 13-17 years, 18-20 years, 21-30 years, 31-40 years, and >40 years.

Language Insights:

- English

- Spanish

- French

- Mandarin

- German

- Japanese

- Italian

- Arabic

- Korean

- Others

The report has provided a detailed breakup and analysis of the market based on the language. This includes english, spanish, french, mandarin, german, japanese, italian, arabic, korean, and others.

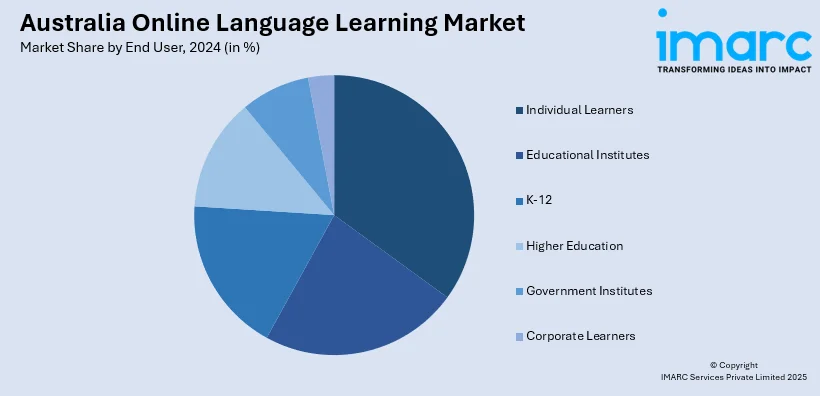

End User Insights:

- Individual Learners

- Educational Institutes

- K-12

- Higher Education

- Government Institutes

- Corporate Learners

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes individual learners, educational institutes, k-12, higher education, government institutes, and corporate learners.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Online Language Learning Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Learning Modes Covered |

|

| Age Groups Covered | <13 Years, 13-17 Years, 18-20 Years, 21-30 Years, 31-40 Years, >40 Years |

| Languages Covered | English, Spanish, French, Mandarin, German, Japanese, Italian, Arabic, Korean, Others |

| End Users Covered | Individual Learners, Educational Institutes, K-12, Higher Education, Government Institutes, Corporate Learners |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia online language learning market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Australia online language learning market?

- What is the breakup of the Australia online language learning market on the basis of learning mode?

- What is the breakup of the Australia online language learning market on the basis of age group?

- What is the breakup of the Australia online language learning market on the basis of language?

- What is the breakup of the Australia online language learning market on the basis of end user?

- What are the various stages in the value chain of the Australia online language learning market?

- What are the key driving factors and challenges in the Australia online language learning?

- What is the structure of the Australia online language learning market and who are the key players?

- What is the degree of competition in the Australia online language learning market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia online language learning market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia online language learning market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia online language learning industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)