Australia Oral Care Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2026-2034

Australia Oral Care Market Overview:

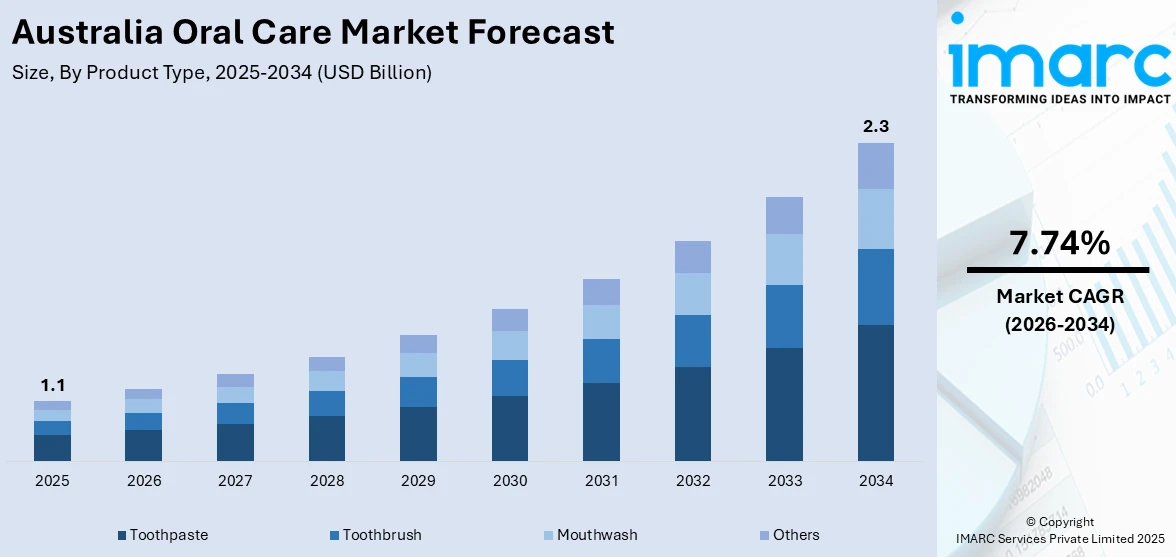

The Australia oral care market size reached USD 1.1 Billion in 2025. Looking forward, the market is expected to reach USD 2.3 Billion by 2034, exhibiting a growth rate (CAGR) of 7.74% during 2026-2034. Rising awareness about oral health and its link to overall wellness drives demand for advanced oral care products in Australia. Technological innovations, such as electric and smart toothbrushes, enhance consumer appeal. Additionally, growing preference for natural, organic, and eco-friendly oral care solutions reflects increasing health and environmental consciousness. Cosmetic dentistry trends also boost interest in whitening and specialized products. Together, these factors fuel Australia oral care market share by encouraging consumers to invest more in oral hygiene and preventive care.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.1 Billion |

| Market Forecast in 2034 | USD 2.3 Billion |

| Market Growth Rate 2026-2034 | 7.74% |

Key Trends of Australia Oral Care Market:

Technological Advancements in Oral Care Products

Technological advancement is a leading driver for the Australia's oral care market growth. Electric and smart toothbrushes with pressure sensors, timers, and connectivity through Bluetooth are becoming popular among tech-conscious buyers looking to enhance dental care habits. The products provide instant feedback, promoting user interaction and brushing techniques. The market is also witnessing trends in toothpaste formulations in the form of natural ingredients, fluoride-free variants, and sensitivity products to suit health-driven consumers. Additionally, oral care devices connected with AI-based apps help people monitor and record their oral health improvement over time. The accessibility of such cutting-edge solutions, particularly in cities and suburban locations, facilitates more regular and informed oral care habits. This increasing need for intelligent, personalized, and efficacious products is widening the market potential and stimulating ongoing innovation in product design and digital health integration, which further contributes to the growth of Australia oral care market demand.

To get more information on this market Request Sample

Rising Awareness about Oral Health and Hygiene

Heightened public awareness of oral health is reshaping Australia’s oral-care market. The Australian Institute of Health and Welfare reports more than 87,000 potentially preventable hospitalizations for dental conditions in 2022-23, stark evidence that neglect carries health and economic costs. Media coverage of these figures, plus nationwide campaigns from the Australian Dental Association and state health departments, is prompting consumers to link daily hygiene with broader well-being, including cardiovascular and diabetes risk. Consequently, they are trading up from manual brushes to electric or app-enabled models, adding floss, interdental picks and alcohol-free mouthwash to routines, and choosing whitening or re-mineralizing toothpastes for cosmetic confidence. Dentists reinforce this preventive mindset during check-ups, while retailers expand shelf space for premium, sensitive-care and natural formulations. The feedback loop between education, behavior change and product innovation is accelerating category growth, driving consistent mid-single-digit annual revenue gains, reflecting broader Australia oral care market trends.

Growing Demand for Natural and Organic Oral Care Products

In Australia, growing health and environmental awareness is driving demand for natural and organic oral products. Customers increasingly demand chemical-free toothpaste, herbal mouthwash, and biodegradable toothbrushes as part of a green lifestyle. Ethical reasons also contribute, with many choosing cruelty-free and sustainably sourced ingredients. This is in line with the larger clean beauty trend, compelling producers to restage with natural ingredients such as tea tree oil, aloe vera, and neem. This compels retailers to expand organic offerings for niche segments like vegans and sensitive consumers. The trend not only registers changing consumer values but also creates ecological sustainability in the form of less chemical use and waste. This transition is fueling innovation and reconfiguring the market environment, setting natural oral care up as a rapidly growing category with long-term potential within Australia's larger wellness and personal care economy.

Growth Drivers of Australia Oral Care Market:

Government Health Programs and Accessibility of Dental Insurance

Australia's oral health market profits immensely from the healthcare infrastructure of the country and government-sponsored dental health programs. Dental health schemes such as the Child Dental Benefits Schedule (CDBS) have contributed considerably to developing regular oral hygiene practices amongst the youth, creating increased household demand for oral care solutions. Public campaigns supported by health departments from Australian states further highlight the significance of brushing, flossing, and regular check-ups, thereby making oral care a universally accepted health concern. Notably, private health insurance policies in Australia usually have dental cover, and this economic access to routine care has resulted in a spill-over effect on the demand for preventive and maintenance-oriented oral hygiene products. Australians who are regularly seeing dentists are more apt to spend on products that align with clinical guidelines. The link between public and private healthcare providers and consumer behavior guarantees regular and repeat demand among product categories, ranging from toothbrushes to specific dental rinses.

Aging Population Impact and Cosmetic Dentistry Awareness

According to the Australia oral care market analysis, the aging population of the region is another prominent driver pushing the industry forward. As Australians age into their 50s and 60s, oral health is becoming a greater priority for cleanliness, and to maintain quality of life along with appearance. This age group is more susceptible to issues such as tooth sensitivity, dry mouth, gum recession, and dental prosthetics, all which require customized oral care therapies. It is also common to find much of this group to be extremely cosmetic-conscious, driving the demand for aesthetic dentistry and maintenance within the home. Interest in veneers, crowns, and bleaching procedures has generated subsequent demand for items associated with these, including non-abrasive toothpaste, whitening gels, and enamel-strengthening mouthwashes. Australian consumers within this segment are also brand-conscious and will spend more on premium products if they reflect their way of life or health requirements. This nexus of aging and aesthetic awareness specifically reinforces Australia's mid- to high-end oral care product segments.

Expansion of Urban Retail and Regional Accessibility Upgrade

An important yet underappreciated driver of oral care growth in Australia is the retail development across urban and regional markets. Whilst key metro markets such as Sydney, Melbourne, and Brisbane remain leaders, with modern pharmacies and supermarket chains providing comprehensive oral care aisles, regional access has increased significantly over recent years. Investment in rural retail chains and the growth of online pharmacies have provided assured access to high-quality oral care products for city residents no more. In areas such as Western Australia and Northern Territory, where dental care may lack physical accessibility, consumers are turning to increasingly over-the-counter oral care solutions as preventive options. National drugstore chains, discount department stores, and even mobile health clinics distribute oral care products to populations that were underserved in the past. Such expanded retail distribution geographically plays a pivotal part in driving product penetration and ensuring year-round demand, particularly for use daily items such as toothpaste, floss, and dental kits.

Australia Oral Care Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, application, and distribution channel.

Product Type Insights:

- Toothpaste

- Toothbrush

- Mouthwash

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes toothpaste, toothbrush, mouthwash, and others.

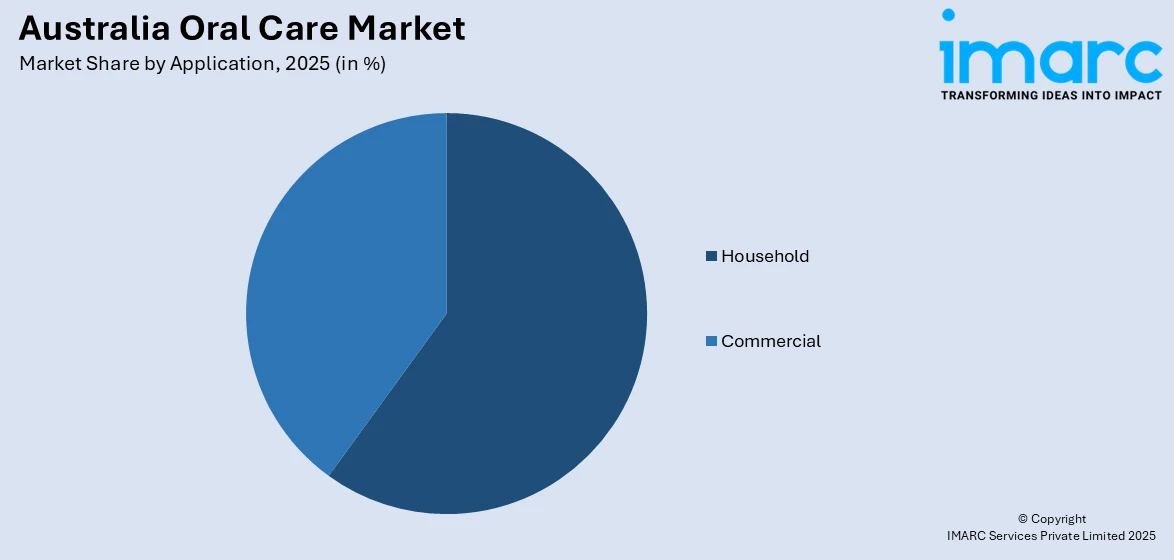

Application Insights:

Access the comprehensive market breakdown Request Sample

- Household

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes household and commercial.

Distribution Channel Insights:

- Hypermarkets and Supermarkets

- Convenience Stores

- Online Sales Channels

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes hypermarkets and supermarkets, convenience stores, online sales channels, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Oral Care Market News:

- In June 2024, Pacific Smiles Group Limited (ASX: PSQ) has signed a non-binding MoU with nib Health Funds to expand its preventative dental care offering exclusively to 117 centers for two years starting July 1, 2024. Additionally, Pacific Smiles agreed to be acquired by National Dental Care (NDC) via a scheme of arrangement for AU$1.90 per share. This acquisition aims to strengthen Pacific Smiles' dental service footprint across Australia.

Australia Oral Care Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Toothpaste, Toothbrush, Mouthwash, Others |

| Applications Covered | Household, Commercial |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Stores, Online Sales Channels, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia oral care market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia oral care market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia oral care industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia oral care market was valued at USD 1.1 Billion in 2025.

The Australia oral care market is projected to exhibit a CAGR of 7.74% during 2026-2034.

The Australia oral care market is expected to reach a value of USD 2.3 Billion by 2034.

The Australia oral care market trends include a shift toward eco-friendly packaging, natural ingredients, and multifunctional products. Consumers are embracing electric toothbrushes, teeth whitening solutions, and subscription-based oral care services, while brands are innovating with personalized dental care and expanding online presence to meet evolving preferences and digital shopping behaviors.

The Australia oral care market is driven by rising awareness about dental hygiene, increasing demand for natural and sustainable products, and regular dental visits supported by health insurance. Urban consumers prefer advanced oral solutions like electric toothbrushes and whitening products, while e-commerce growth also makes premium brands more accessible across regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)