Australia Organic Food and Beverages Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Australia Organic Food and Beverages Market Overview:

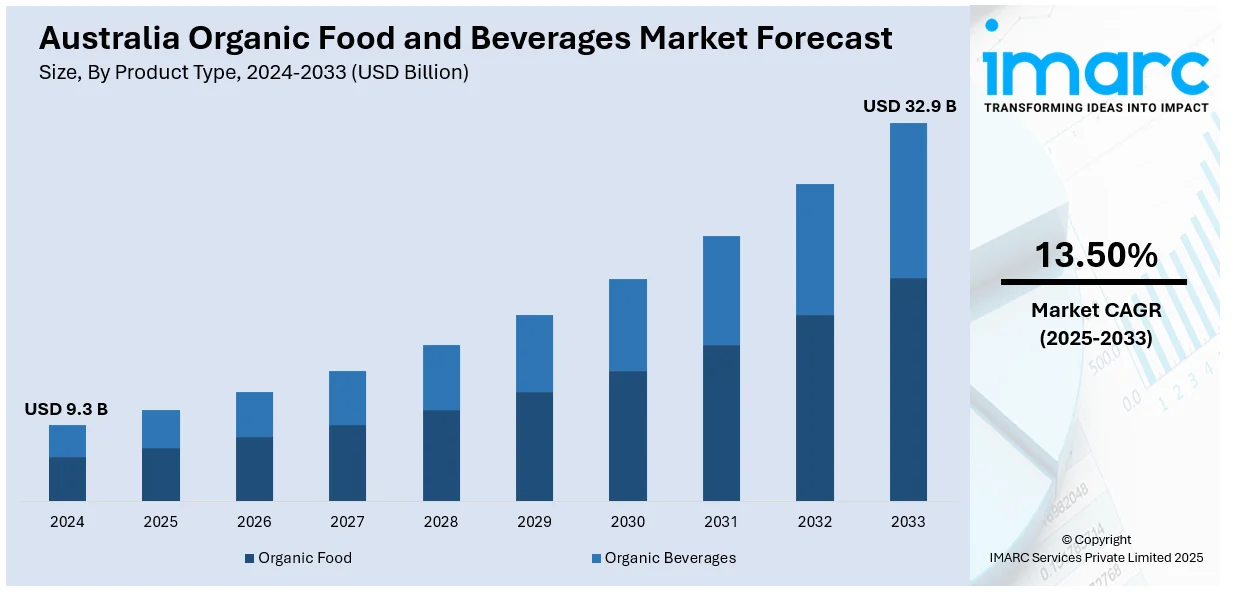

The Australia organic food and beverages market size reached USD 9.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 32.9 Billion by 2033, exhibiting a growth rate (CAGR) of 13.50% during 2025-2033. Rising health consciousness, surging clean-label demand, growing environmental concerns, increasing disposable incomes, wider retail availability, trusted certifications, government support, and innovative organic offerings are factors accelerating the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.3 Billion |

| Market Forecast in 2033 | USD 32.9 Billion |

| Market Growth Rate 2025-2033 | 13.50% |

Australia Organic Food and Beverages Market Trends:

Rising Consumer Preference for Clean-Label Products

The shifting consumer preference for clean-label products is one of the key factors boosting the Australia organic food and beverages market share. Clean-label foods, those perceived as free from artificial additives, preservatives, and synthetic chemicals, are gaining traction as consumers become more discerning about ingredient transparency and product integrity. In Australia, this shift is aligned with broader trends in mindful consumption, where buyers actively read labels and seek clarity on sourcing and production practices. The demand for simplified ingredient lists with recognizable, natural components is particularly prominent among health-conscious and younger demographics. Clean-label claims are also influencing purchasing decisions in categories such as dairy, snacks, beverages, and baby food.

To get more information on this market, Request Sample

Health Awareness and Nutrition-Driven Consumption

Increasing health awareness among consumers has led to a pronounced shift in dietary preferences, with organic food and beverages viewed as a healthier alternative to conventional options. This perception is rooted in the belief that organic products are free from harmful chemicals, genetically modified organisms, and artificial additives, thereby supporting overall wellness. In 2023, Kerry introduced SucculencePB, a clean-label taste technology for plant-based meats. This innovation enhances moisture and flavor while reducing the need for tropical oils, aligning with consumer demand for healthier, sustainable, and transparent ingredient profiles. Public health campaigns and widespread media coverage of issues related to obesity, cardiovascular diseases (CVDs), and lifestyle-related disorders have further heightened interest in nutrition-based consumption. Organic categories such as fresh produce, whole grains, plant-based beverages, and free-range meats have seen stronger uptake among individuals prioritizing immunity, digestion, and energy levels, which is propelling Australia organic food and beverages market growth.

Expanding Availability Across Retail and Online Channels

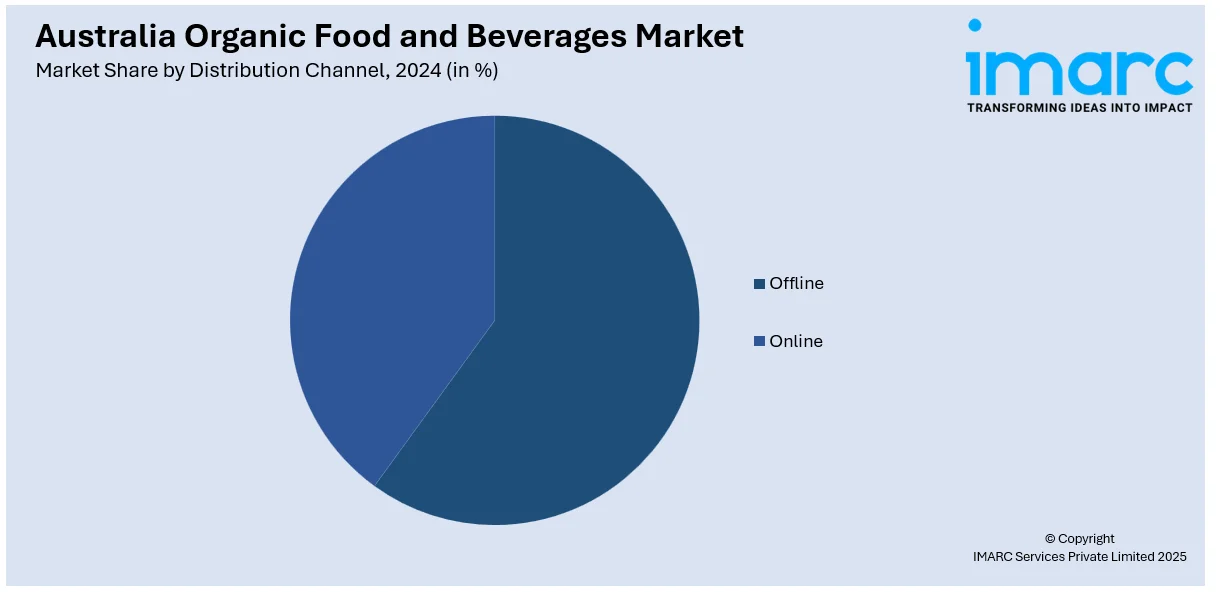

The broader distribution and increased shelf presence of organic food and beverages (F&B) across retail and e-commerce platforms have been instrumental in scaling the market in Australia. Supermarkets such as Woolworths and Coles have integrated dedicated organic sections, improving accessibility and normalizing organic products within weekly grocery baskets. In line with this, specialty health stores and organic-only outlets cater to niche demands and premium offerings. The rise of e-commerce, particularly accelerated by pandemic-induced shifts in buying behavior, has enabled brands to directly engage with consumers and offer subscription models, product bundling, and discounts for regular purchases. Online marketplaces provide detailed product information and reviews, helping consumers make informed choices and fostering brand loyalty. Furthermore, the growing retail infrastructure and seamless online experience is creating a positive Australia organic food and beverages market outlook.

Australia Organic Food and Beverages Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Organic Food

- Organic Fruit and Vegetables

- Organic Meat, Fish and Poultry

- Organic Dairy Products

- Organic Frozen and Processed Foods

- Others

- Organic Beverages

- Fruit and Vegetable Juices

- Dairy

- Coffee

- Tea

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes organic food (fruit and vegetables, meat/fish/poultry, dairy products, frozen and processed foods, and others) and organic beverages (fruit and vegetable juices, dairy, coffee, tea, and others).

Distribution Channel Insights:

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Organic Food and Beverages Market News:

- In 2023, Remedy Drinks expanded its product line by launching a USDA-certified organic energy drink range. These beverages are formulated with live cultures, contain zero sugar, and are free from artificial ingredients, aligning with the growing consumer demand for clean-label and functional organic beverages.

Australia Organic Food and Beverages Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia organic food and beverages market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia organic food and beverages market on the basis of product type?

- What is the breakup of the Australia organic food and beverages market on the basis of distribution channel?

- What is the breakup of the Australia organic food and beverages market on the basis of region?

- What are the various stages in the value chain of the Australia organic food and beverages market?

- What are the key driving factors and challenges in the Australia organic food and beverages market?

- What is the structure of the Australia organic food and beverages market and who are the key players?

- What is the degree of competition in the Australia organic food and beverages market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia organic food and beverages market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia organic food and beverages market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia organic food and beverages industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)