Australia Organic and Natural Pet Food Market Size, Share, Trends and Forecast by Ingredient, Pet Type, Product Type, Packaging Type, Distribution Channel, and Region, 2026-2034

Australia Organic and Natural Pet Food Market Overview:

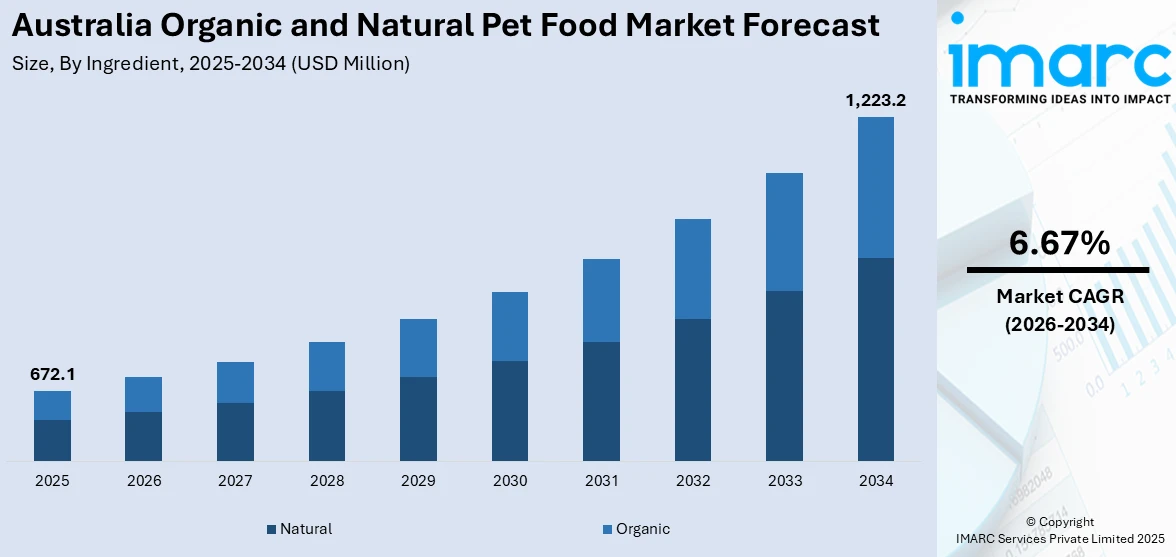

The Australia Organic and Natural Pet Food Market size reached USD 672.1 Million in 2025. Looking forward, the market is expected to reach USD 1,223.2 Million by 2034, exhibiting a growth rate (CAGR) of 6.67% during 2026-2034. The market includes growing pet humanization, increasing awareness of pet health and nutrition, and rising demand for clean-label, chemical-free products. Eco-conscious consumer values, ethical sourcing, and preference for functional ingredients also push demand, aligning pet care choices with broader wellness and sustainability trends.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 672.1 Million |

| Market Forecast in 2034 | USD 1,223.2 Million |

| Market Growth Rate 2026-2034 | 6.67% |

Key Trends of Australia Organic and Natural Pet Food Market:

Sustainability and Ethical Sourcing Becoming a Priority

Environmental and ethical issues are impacting consumer decisions in the Australia organic and natural pet food market outlook. Pet owners in Australia are increasingly becoming eco-friendly and seeking products that carry values such as sustainable agriculture, low carbon footprint, and cruelty-free sourcing. Companies that incorporate recyclable or biodegradable packaging, regenerate agriculture, or advocate low-impact protein sources such as insects or plant-based products are in the spotlight. Evaluating the ethics of sourcing and transparency along the supply chain are also top priorities. Organic, animal welfare, and sustainable fish certifications are becoming more highly regarded. Consumers are no longer selecting food solely based on nutritional needs, as they are increasingly considering the broader impact of their choices on global sustainability and animal welfare, which further contributes to the Australia organic and natural pet food market demand.

To get more information on this market Request Sample

Humanization of Pets Driving Premium Choices

Australians are increasingly treating their pets as family, leading to a significant rise in spending, with over $33 billion spent on pets in the last year, particularly on food. This emotional connection drives a demand for high-quality, human-grade pet food, with owners seeking organic, natural, and ethically sourced products further increasing the Australia organic and natural pet food market share. Pet parents are more discerning, carefully reviewing ingredient lists to avoid artificial additives, preservatives, and fillers. There’s also a growing interest in superfoods, grain-free diets, and holistic health benefits, reflecting broader wellness trends in human food. The desire for cleaner, safer, and more nutritious options encourages increased spending on premium pet food. Brands that prioritize transparency, quality sourcing, and health benefits are gaining favor with Australian consumers, as they align with values of sustainability and well-being for both pets and the planet.

Rise of Functional and Personalised Nutrition

Personalized nutrition is gaining momentum as pet owners try to address the particular health requirements of their pets with food. These range from products aimed at digestion, joint care, skin and coat, weight control, and even mental health. Natural supplements and functional components such as probiotics, omega fatty acids, and herbal combinations are being added to pet food. There's also interest in formulations based on breeds, age, and activity levels. The trend also carries over to customized meal plans and subscription services with tailored choices based on a pet's profile. With growing consciousness of pet health and longevity, customers are embracing organic and natural foods that feed more than just the body they promote vitality for the long term and prevent disease states further aiding the Australia organic and natural pet food market growth.

Growth Drivers of Australia Organic and Natural Pet Food Market:

Rise in Demand for Sustainable and Ethical Pet Products

Sustainability and ethical sourcing are emerging as key decision drivers among Australian consumers, and this move is gaining momentum in the pet food industry. Pet owners are increasingly opting for organic and natural pet food products that reflect their green and ethical concerns. Most Australians worry about the green footprint of conventional pet food production, such as massive animal farming and excessive waste from packaging. Consequently, there is increased demand for items created from sustainably harvested raw materials, free-range meats, and recyclable or biodegradable packaging. Companies that promote transparency in sourcing, green practices, and local agriculture support are winning consumers' hearts. Many consumers are also attracted to organic and natural pet food due to its low environmental impact and limited usage of chemicals, hormones, and man-made additives. This alignment with Australia's wider cultural drive toward sustainability is assisting in the development of a new generation of environmentally aware pet food consumers, driving market growth.

Expansion of Local and Boutique Pet Food Production

According to the Australia organic and natural pet food market analysis, good reputation for agricultural standards and clean food production systems underpins growth of its organic and natural pet food industry. Numerous local pet food businesses focus on using locally sourced ingredients, which resonates with health-oriented customers who prioritize traceability and Australian farm support. Boutique makers, especially those based in country regions, are reaching niche markets by providing small batches, hand-made, and species-specific recipes. These manufacturers tend to use sustainability, low processing, and ethical sourcing as major brand points of difference. Moreover, the strict regulatory framework of Australia regarding pet food safety also reinforces consumer trust in domestically produced products. The availability of a robust agricultural sector, with ready access to quality meats, fish, grains, and vegetables, ensures a reliable supply chain for organic pet food production. This environment nurtures homegrown innovation and enables businesses to move rapidly to stay ahead of changing consumer tastes, so the nation is a rich field for traditional brands and new natural pet food entrepreneurs alike.

Growing Emphasis on Pet Wellness and Preventative Healthcare

With Australian pet owners increasingly understanding the connection between nutrition and long-term wellbeing, there is increasing demand for pet foods with functional benefits in addition to traditional maintenance. These involve products made with organic superfoods, supplements, and natural ingredients that ensure digestive health, joint support, immunity, and skin and coat care. Increased veterinary expenditures are also encouraging pet owners to take a preventative approach toward animal health, with many starting from quality nutrition. More are seeking natural and organic alternatives as a means of preventing prevalent health problems associated with bad diets, including obesity, allergies, and gastrointestinal diseases. In an area where pet insurance is on the rise and wellness trends are impacting consumerism, organic pet food is being viewed as a wise long-term investment. Brands embracing holistic health philosophies, open sourcing, and science-backed nutritional positioning are optimally poised to gain from this movement toward active pet care.

Australia Organic and Natural Pet Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on ingredient, pet type, product type, packaging type, and distribution channel.

Ingredient Insights:

- Natural

- Organic

A detailed breakup and analysis of the market based on the ingredient have also been provided in the report. This includes natural and organic.

Pet Type Insights:

- Dog Food

- Cat Food

- Others

The report has provided a detailed breakup and analysis of the market based on the pet type. This includes dog food, cat foods, and others.

Product Type Insights:

- Dry Pet Food

- Wet and Canned Pet Food

- Snacks and Treats

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes dry pet food, wet and canned pet food, and snacks and treats.

Packaging Type Insights:

- Bags

- Cans

- Pouches

- Boxes

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes bags, cans, pouches, and boxes.

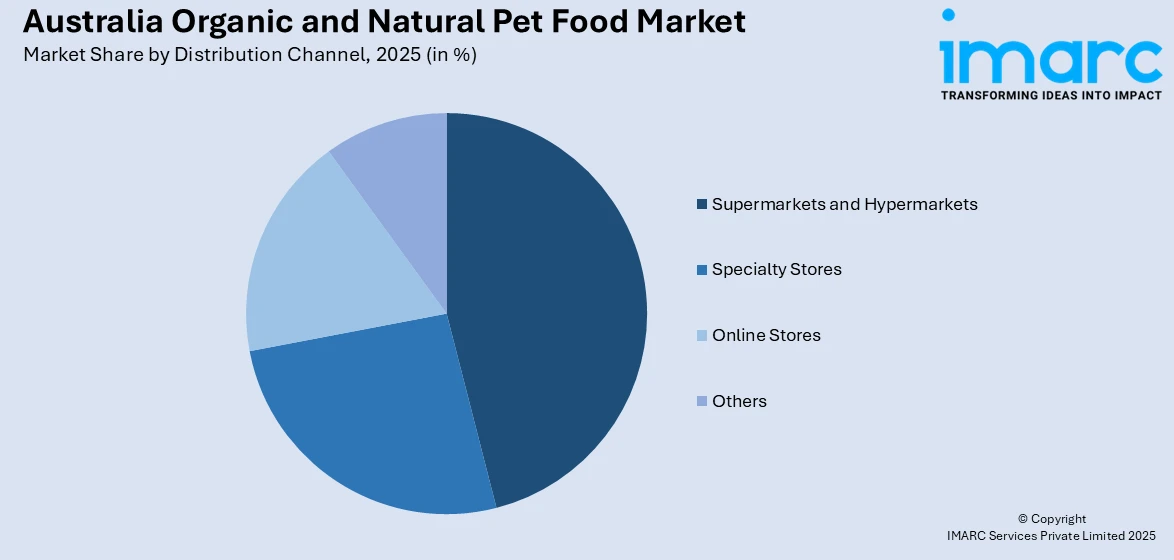

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, online stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Organic and Natural Pet Food Market News:

- In August 2024, To celebrate International Dog Day, premium Australian pet food brand Frontier Pets launched its ‘Pledge to Pets’ initiative, donating $10 worth of food for every pledge made. Known for its raw, freeze-dried organic dog and cat food, Frontier Pets uses 100% ethically sourced, preservative-free ingredients. The brand’s unique process retains full nutritional value, earning it a 4.8-star rating and praise from pet owners for quality and palatability.

- In July 2024, Real Pet Food Co. launched Australia’s first pet food using Black Soldier Fly (BSF) protein with its Billy + Margot Insect Single Protein + Superfoods range. After two years of research, the company secured the country’s first BSF meal import permit. Available exclusively at Petbarn and online, this innovation supports sustainability and showcases Real Pet Food’s commitment to eco-friendly, nutritious alternatives in pet nutrition.

Australia Organic and Natural Pet Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Ingredients Covered | Natural, Organic |

| Pet Types Covered | Dog Food, Cat Foods, Others |

| Product Types Covered | Dry Pet Food, Wet and Canned Pet Food, Snacks and Treats |

| Packaging Types Covered | Bags, Cans, Pouches, Boxes |

| Distribution Channels Covered | Supermarkets And Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia organic and natural pet food market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia organic and natural pet food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia organic and natural pet food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia organic and natural pet food market was valued at USD 672.1 Million in 2025.

The Australia organic and natural pet food market is projected to exhibit a CAGR of 6.67% during 2026-2034.

The Australia organic and natural pet food market is expected to reach a value of USD 1,223.2 Million by 2034.

Key trends in Australia organic and natural pet food market include increased demand for grain-free and allergy-friendly formulas, use of superfoods and functional ingredients, and a shift toward sustainable packaging. Consumers also prefer locally sourced, transparent brands that emphasize ethical production and align with human health and wellness values.

The Australia organic and natural pet food market is driven by rising demand for sustainable and ethically sourced products, growing awareness about pet wellness, and strong support for local, clean-label manufacturing. Pet owners also increasingly seek high-quality, natural nutrition that aligns with health trends and environmental values across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)