Australia Organic Packaged Foods Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2025-2033

Australia Organic Packaged Foods Market Size and Share:

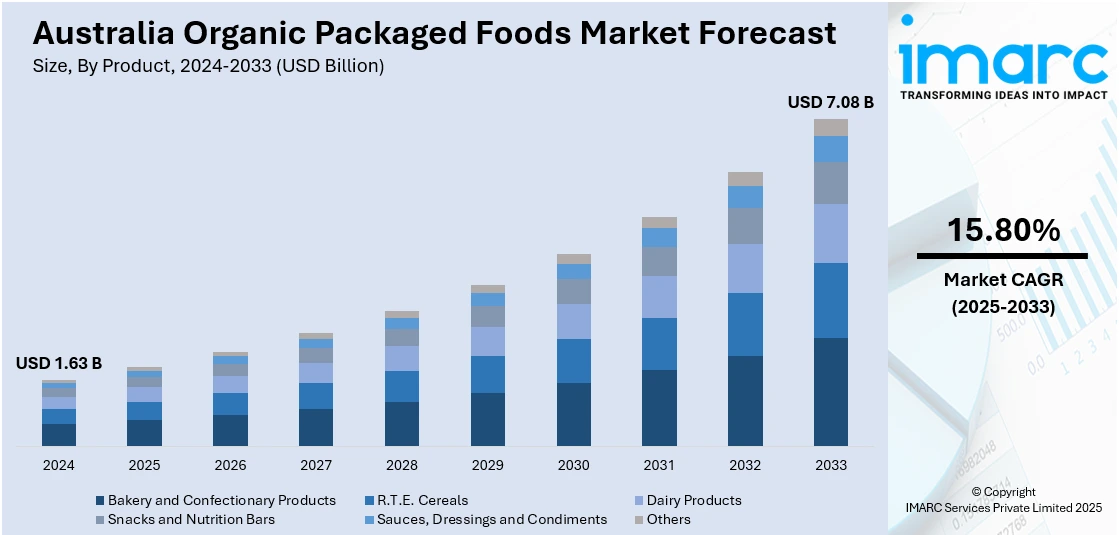

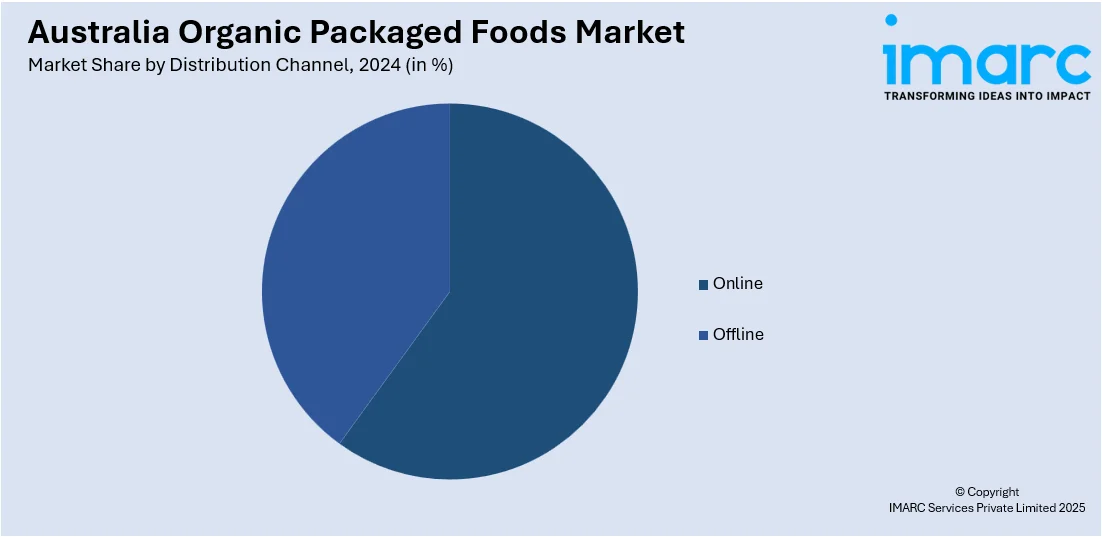

The Australia organic packaged foods market size reached USD 1.63 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.08 Billion by 2033, exhibiting a growth rate (CAGR) of 15.80% during 2025-2033. The market is witnessing constant growth as a result of consumers highly seeking clean label and minimally processed goods. This movement includes categories like dairy, snacks, ready to eat cereals, bakery, and condiments, driven by health consciousness and natural food choices. Both offline and online channels of distribution have played their part in greater accessibility and wider adoption. The use of locally sourced ingredients and eco-friendly practices is a display of changing consumer attitudes, impacting the growth of Australia organic packaged foods market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.63 Billion |

| Market Forecast in 2033 | USD 7.08 Billion |

| Market Growth Rate 2025-2033 | 15.80% |

Australia Organic Packaged Foods Market Trends:

Growing Demand for Clean Label and Transparent Ingredients

Consumer demand for clean label products with simple, transparent ingredient lists that do not contain artificial additives or preservatives drives the Australia organic packaged foods market. Consumers with health consciousness seek natural and minimally processed foods in accordance with wellness and sustainability ideals. The demand has led manufacturers to switch to clearer labeling, highlighting ingredient origins, organic certification, and ethical production practices. Transparency and trust are the most important drivers for purchase, with consumers wanting to ensure that products adhere to strict organic standards. According to the reports, in January 2025, pressure mounted for overhauling organic labeling legislation in Australia, with a draft national legal standard proposed to control organic claims and avoid deceptive packaging. Moreover, clean label trends are thus driving innovation in product development, packaging, and branding to boost consumer confidence. Such a trend is a prime driver in the Australia organic packaged foods market growth, challenging brands to differentiate themselves on the basis of authenticity and transparent communication. Overall, the trend towards cleaner, more transparent food options keeps reshaping Australian consumer expectations and the industry overall.

To get more information on this market, Request Sample

Integration of Indigenous Australian Ingredients in Organic Foods

One of the emerging Australia organic packaged food market trends is the integration of native Australian ingredients like wattleseed, finger lime, and kakadu plum. These botanicals with their high antioxidant and essential nutrient content deliver functional health benefits while representing Australia's distinctive biodiversity. Through the use of indigenous ingredients, product developers benefit from consumer desire for authentic, locally produced foods with nutritional value as well as unique flavors. The use does support local agriculture and brings sustainability as it encourages native crops with less environmental footprint to be utilized. In addition, it also parallels the larger trends in the market of innovation and appreciation of cultural heritage. The incorporation of indigenous ingredients differentiates organic packaged food in a competitive marketplace to drive Australia organic packaged foods market growth by appealing to consumers looking for wellness benefits coupled with local authenticity. This marriage of ancient knowledge and contemporary food technology continues to grow.

Expansion of Retail and Online Channels for Organic Packaged Foods

The trends in the Australia organic packaged foods market show a fast growth in distribution channels, particularly through e-commerce websites and specialist health food stores. Consumers are increasingly desiring convenient access to organic foods through online shopping, with subscription and home delivery improving the shopping experience. Such growth mirrors changing customer behavior driven by hectic lifestyles and a need for a wider range of products. Specialty retailers, which are organic and health-focused food stores, provide carefully selected items that address advanced consumer needs. This multiplication of retail venues allows organic packaged foods to penetrate a more extensive demographic base, including regional and remote consumers. Distribution networks is one of the key drivers of the Australia organic packaged foods market growth, with enhanced accessibility fueling more trial and repeat usage. More consumer interaction through online sources also aids in market expansion and long-term growth within the organic food market.

Australia Organic Packaged Foods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product and distribution channel.

Product Insights:

- Bakery and Confectionary Products

- R.T.E. Cereals

- Dairy Products

- Snacks and Nutrition Bars

- Sauces, Dressings and Condiments

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes bakery and confectionary products, R.T.E. cereals, dairy products, snacks and nutrition bars, sauces, dressings and condiments, and others.

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Organic Packaged Foods Market News:

- In May 2025, Veganz, Germany joined hands with Jindilli Beverages to launch 2D-printed Mililk® plant milk in Australia under Milkadamia, representing a landmark innovation for the Australia Organic Packaged Foods market by offering sustainable, shelf-stable dairy alternatives in response to rising consumer demand for environmentally conscious and health-driven organic offerings.

Australia Organic Packaged Foods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Bakery and Confectionary Products, R.T.E. Cereals, Dairy Products, Snacks and Nutrition Bars, Sauces, Dressings and Condiments, Others |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia organic packaged foods market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia organic packaged foods market on the basis of product?

- What is the breakup of the Australia organic packaged foods market on the basis of distribution channel?

- What is the breakup of the Australia organic packaged foods market on the basis of region?

- What are the various stages in the value chain of the Australia organic packaged foods market?

- What are the key driving factors and challenges in the Australia organic packaged foods?

- What is the structure of the Australia organic packaged foods market and who are the key players?

- What is the degree of competition in the Australia organic packaged foods market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia organic packaged foods market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia organic packaged foods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia organic packaged foods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)